Global Collaborative Robots Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global collaborative robots market has become one of the most revolutionary sectors in the automation sector, revolutionizing the human-robot interaction on factory floors, laboratories, and service settings. The idea initially started shaping up in the mid-1990s when scientists and engineers began seeking ways of enabling robots to collaborate with people. Industrial robots at that time were caged, efficiency and speed of theirs but without any feeling of being with people. The thought of a machine being able to coexist in a shared workspace was a revolution, but years of trials had to be accomplished before it could be commercially sold.

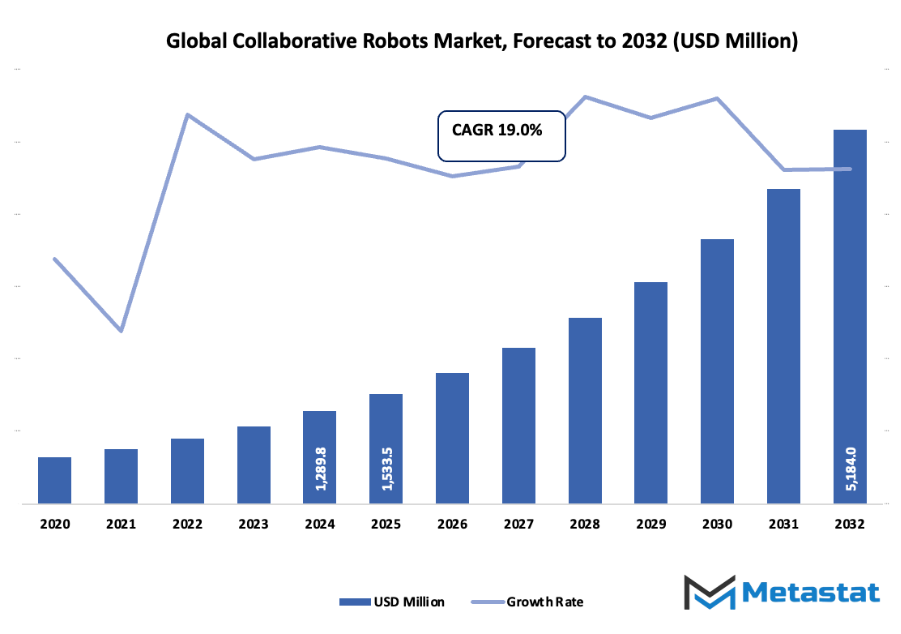

- Global collaborative robots market worth around USD 1533.5 million in 2025, at a CAGR of about 19.0% during 2032, and having strong potential to reach more than USD 5184 million.

- Having up to 5kg market share of close to 57.8%, it is leading innovation and broadening applications with rigorous research.

- Growth drivers: Rise in Adoption of Automation in Manufacturing Sectors, Development in Robotics and Artificial Intelligence Technologies

- Opportunities: Small and Medium-sized Enterprises (SMEs) Adoption of Cobots

- Key insight: The market is poised to expand exponentially in value through the decade to come, announcing vast potential for expansion.

By the early 2000s, certain vision-forming businesses started to showcase practical uses for lighter, sensor-based robotic arms that could coexist with human beings. Early versions formed the foundation for what eventually became the global collaborative robots market. The advent of force sensors, vision systems, and user-friendly program interfaces enabled these robots to be easily repurposed to many different applications toe-tapping assembly operations all the way up to complex material handling processes.

Improved safety standards and regulatory bodies formulating more detailed guidelines for human-robot interaction prompted people to trust these technologies increasingly. The growth of this market hastened after 2010, when small producers became aware that Collaborative Robots could serve to mitigate deficiencies of labor while still being flexible at a fraction of the cost of heavy infrastructure. Consumer demand for more individualized and quick-to-make goods during this time was changing production cycles, and cobots provided an expandable solution.

Artificial intelligence and machine learning technology will continue to enhance the way these robots interpret what is happening around them and react to it, enabling them to operate with more precision and independence. In the coming few years, the global market for Collaborative Robots will persist in transforming industrial operations through further inroads into digital infrastructure, real-time analytics, and adaptive learning ability. What is today a hesitant pilot of co-operative automation will be the pillar of modern manufacturing, balancing human innovation with robot reliability in previously imagined impossible manners.

Market Segments

The global collaborative robots market is mainly classified based on Payload Capacity, Application, Vertical.

By Payload Capacity is further segmented into:

- Up to 5kg: These payload-capable Collaborative Robots up to 5kg will execute tasks that entail light handling and delicate movements. The robots will be appropriate for assembly of small components, light pick and place, and light packaging, with the ability to operate in confined production environments.

- Up to 10kg: Pay-load Collaborative Robots with 10kg payload capacity will carry moderately heavy parts and material. These robots will be suitable for assembly operations requiring additional strength, moderate handling, and packaging operations where standard automation cannot tackle different weights effectively.

- Above 10kg: Robots with payloads above 10kg will carry heavy-duty loads and large-sized parts. They will assist processes such as heavy assembly, machine tending, and material handling with high strength and stability, bringing efficiency to processes where more force is needed in industry.

By Application the market is divided into:

- Assembly: Robotic assembly robots will perform precise and repetitive movements, allowing for quicker production cycles. They will reduce human mistakes, increase consistency, and help construct pieces in those sectors where speed and accuracy are necessary.

- Pick & Place: Applications of pick and place will include transferring components from point to point effectively. These robots will boost working speed, minimize labour, and find applications in the industries where immediate and repeated positioning of parts is a primary necessity.

- Handling: Handling robots will take care of transporting, storing, and setting products. They will provide safer operation with heavy loads or delicate loads, and streamline handling processes with repeated loading.

- Packaging: Packaging robots will take care of wrapping, boxing, and labeling products. They will enhance throughputs, quality standards, and enable manufacturers to keep up with changing product sizes and packaging specifications.

- Quality Inspection: Robots involved in quality inspection will check and test products for faults. They will have uniform standards, increase the accuracy of fault detection, and reduce manual inspection usage, producing overall better quality products.

- Machine Tending: Machine tending robots will load and unload machines like CNCs or presses. They will enhance machine usage, decrease downtime, and offer constant work without fatigue, increasing overall productivity.

- Gluing & Welding: Gluing and welding robots will perform tasks with precision- and consistency-related requirements. They will ensure robust welds and bonds and reduce waste while maintaining high safety standards for repetitive tasks.

- Others: These are the robots performing special or new uses. These robots will facilitate special production requirements, flexibility to new uses, and adaptability for companies venturing into automation for new activities outside the regular routine.

By Vertical the market is further divided into:

- Automotive: Collaborative Robots in the automotive sector will assist in assembly, welding, and handling heavy components. They will improve production speed, reduce workplace injuries, and maintain consistent product quality.

- Food & Beverage: Robots in food and beverage operations will handle packaging, quality checks, and material handling. They will support hygiene standards, reduce contamination risks, and improve efficiency in high-volume production environments.

- Furniture & Equipment: In furniture and equipment manufacturing, robots will assist in assembly, handling, and packaging. They will provide precision in joining components, reduce manual labor, and support timely production.

- Plastic & Chemical: Robots in the plastic and chemical industry will handle materials safely and efficiently. They will manage hazardous substances, improve production speed, and reduce the risk of human exposure to dangerous processes.

- Metal Processing: Robots in metal processing will handle heavy components, welding, and machining support. They will improve safety, increase accuracy, and maintain efficiency in repetitive or labor-intensive metal operations.

- Electronics/Semiconductors: Collaborative Robots in electronics and semiconductor production will handle assembly, testing, and packaging of delicate components. They will reduce errors, maintain high precision, and improve throughput in industries requiring meticulous work.

- Pharma: Robots in the pharmaceutical industry will assist in packaging, testing, and handling sensitive products. They will ensure compliance with strict regulations, maintain hygiene, and improve operational speed and accuracy.

- Others: This segment covers industries beyond the main verticals. Robots will adapt to specific tasks, support emerging sectors, and provide automation solutions where traditional methods are less effective, ensuring flexibility and efficiency.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1533.5 Million |

|

Market Size by 2032 |

$5184 Million |

|

Growth Rate from 2025 to 2032 |

19.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

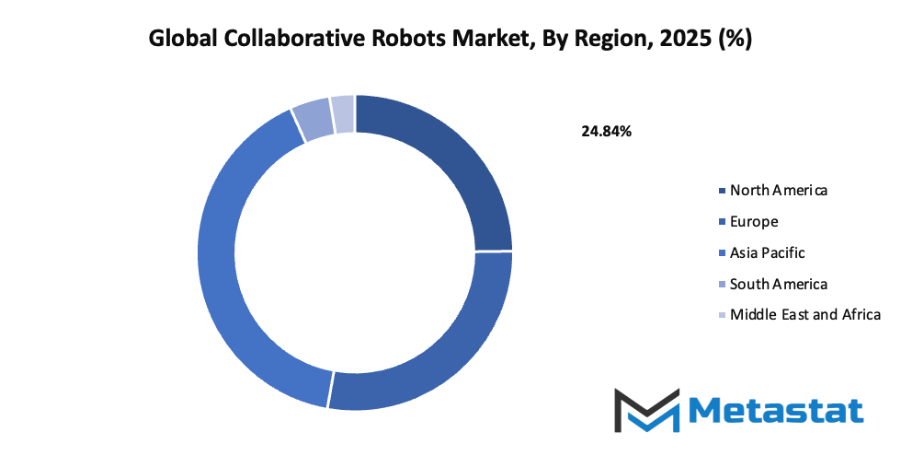

By Region:

- Based on geography, the global collaborative robots market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing Adoption of Automation in Manufacturing Industries: The global collaborative robots market will benefit from the growing trend of automation in manufacturing. Factories are increasingly implementing automated systems to speed up production and maintain consistent quality. Collaborative Robots offer flexibility and can adapt to multiple tasks, making them attractive for industries aiming to optimize workflow and reduce operational delays.

- Advancements in Robotics and Artificial Intelligence Technologies: Continuous improvements in robotics and AI technologies will drive the global collaborative robots market forward. Enhanced machine learning and sensor systems allow robots to perform more complex tasks safely and efficiently. These innovations increase the capability of Collaborative Robots to handle repetitive and precise operations, contributing to smarter and more productive manufacturing environments.

Challenges and Opportunities

- Initial High Cost of Investment: The global collaborative robots market encounters barriers due to the high initial investment required. Small and medium-sized enterprises may struggle with upfront expenses for purchasing and integrating Collaborative Robots. Although the long-term benefits are substantial, the significant initial cost can delay adoption and limit immediate expansion across different industries.

- Concerns About Job Displacement and Workforce Resistance: The global collaborative robots market will face challenges from workforce concerns. Employees may worry that Collaborative Robots will replace human labor, leading to resistance in implementation. Educating workers about how robots can assist rather than replace them and demonstrating efficiency improvements will be essential for smooth integration and acceptance in workplaces.

Opportunities

- Integration of Cobots in Small and Medium-sized Enterprises (SMEs): The global collaborative robots market will find significant opportunities in SMEs. Smaller businesses can benefit from Collaborative Robots to enhance production without major infrastructure changes. Cobots are scalable and cost-effective solutions that allow SMEs to increase efficiency, reduce labour challenges, and compete with larger manufacturers by adopting advanced technology.

Competitive Landscape & Strategic Insights

The global collaborative robots market is positioned for significant growth as industries continue to seek automation solutions that improve efficiency and flexibility. This market is a mix of both international industry leaders and emerging regional competitors. Important competitors include Universal Robots, ABB Ltd., FANUC America Corporation, KUKA Robotics Corporation, Yaskawa America, Inc., 6 River Systems, Inc., Kawasaki Robotics (USA), Inc., Denso Robotics, Nachi Robotic Systems, Inc., AUBO Robotics, Robotiq Inc., Comau LLC, Doosan Robotics, and Productive Robotics, Inc. These companies are developing advanced Collaborative Robots that are capable of working safely alongside humans in a variety of environments, including manufacturing, warehousing, and logistics.

Looking toward the future, the market will see new technological innovations that expand the range of applications for Collaborative Robots. Enhanced sensors, improved machine learning algorithms, and more intuitive interfaces will allow these robots to handle more complex tasks with higher precision and safety. Emerging regional competitors will continue to challenge established leaders by offering more specialized or cost-effective solutions, creating a dynamic environment where innovation and adaptability will drive success. Companies that focus on customization and integration with existing workflows will be able to address specific industrial needs, making Collaborative Robots more accessible to small and medium enterprises worldwide.

Investment in research and development will remain a key factor in shaping the market. Leaders in the industry will continue to push boundaries by exploring new designs, advanced robotics software, and the integration of artificial intelligence for predictive maintenance and optimization. Regional competitors will adopt these innovations and tailor them to local demands, leading to increased competition and faster adoption of Collaborative Robots across diverse sectors. The interplay between established multinational companies and emerging local players will fuel growth, ensuring that Collaborative Robots become an integral part of the automated workplaces of tomorrow.

Market size is forecast to rise from USD 1533.5 million in 2025 to over USD 5184 million by 2032. Collaborative Robots will maintain dominance but face growing competition from emerging formats.

The global collaborative robots market will not only focus on efficiency but also on sustainability and worker safety. Companies are developing robots that reduce energy consumption and can work alongside humans without compromising safety. This focus will make Collaborative Robots a cornerstone in the shift toward intelligent, adaptable, and sustainable manufacturing and logistics systems. With continuous advancements, the market will see a convergence of technological sophistication and practical application, ensuring that Collaborative Robots play an essential role in shaping future industrial landscapes.

Report Coverage

This research report categorizes the global collaborative robots market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global collaborative robots market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global collaborative robots market.

Collaborative Robots Market Key Segments:

By Payload Capacity

- Up to 5kg

- Up to 10kg

- Above 10kg

By Application

- Assembly

- Pick & Place

- Handling

- Packaging

- Quality Testing

- Machine Tending

- Gluing & Welding

- Others

By Vertical

- Automotive

- Food & Beverage

- Furniture & Equipment

- Plastic & Chemical

- Metal Processing

- Electronics/Semiconductors

- Pharma

- Others

Key Global Collaborative Robots Industry Players

- Universal Robots

- ABB Ltd.

- FANUC America Corporation

- KUKA Robotics Corporation

- Yaskawa America, Inc.

- 6 River Systems, Inc.

- Kawasaki Robotics (USA), Inc.

- Denso Robotics

- Nachi Robotic Systems, Inc.

- AUBO Robotics

- Robotiq Inc.

- Comau LLC

- Doosan Robotics

- Productive Robotics, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252