MARKET OVERVIEW

The Cinematographic Camera Market is a dynamic and thriving sector within the broader entertainment industry, serving as the cornerstone of filmmaking and video production. As technology continues to advance at an astounding pace, cinematographic cameras have evolved from their humble beginnings into highly sophisticated devices that push the boundaries of creativity and visual storytelling.

A cinematographic camera, in its core, is a specialized marvel, designed and constructed solely for the purpose of capturing scenes and moments that will later be meticulously edited and assembled into a motion picture. In filmmaking, these cameras are the foundation upon which cinematic experiences are built. The Cinematographic Camera market's journey has been one of constant adaptation to the changing demands of the film industry. Over the years, technological advancements have played a pivotal role in shaping the trajectory of cinematographic cameras. The transition from analog to digital cameras, for instance, was a momentous turning point.

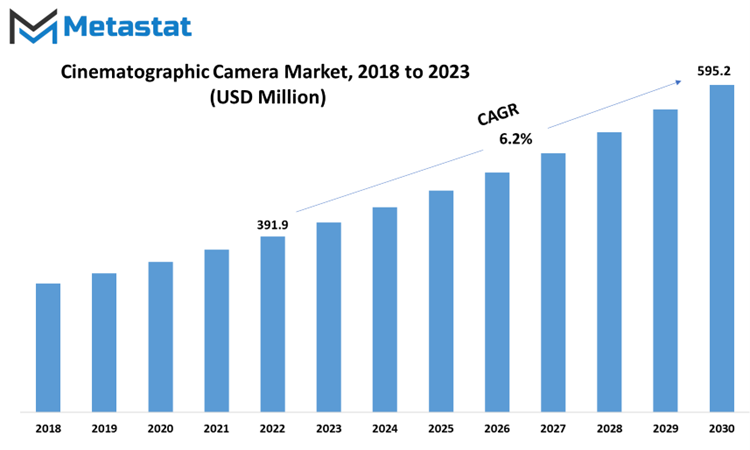

The shift towards digital cinematography has allowed for higher resolutions, improved color rendition, and greater flexibility in post-production. It is important to note that the journey of cinematographic cameras doesn't merely encompass the hardware but also the software that complements them. Post-production software, like Adobe Premiere Pro and DaVinci Resolve, has become integral to the modern filmmaking process, seamlessly integrating with the cameras to create breathtaking cinematic experiences. The Global Cinematographic Camera market, an industry essential for the very existence of cinematic wonders, has been a hotbed of innovation and transformation. In this research report, we will explore the nuances and transformations that have shaped the Global Cinematographic Camera market. The market is estimated to reach $595.2 Million by 2030; growing at a CAGR of 6.2% from 2023 to 2030.

GROWTH FACTORS

The Cinematographic Camera market is influenced by several factors. The growing demand for high-quality film and video content is being fueled by streaming services like Netflix and social media platforms such as YouTube and TikTok. These platforms have created an appetite for visually engaging content, propelling the need for advanced cameras.

Notably, the affordability of professional-grade cameras has opened up the industry to a broader audience. Technological advancements, like autofocus and image stabilization, have made it easier for aspiring filmmakers and content creators to produce high-quality visuals. The result is a more democratized cinematography landscape where talent and creativity often outweigh budget constraints.

Furthermore, ongoing technological advancements in camera technology play a pivotal role in shaping this market. Improvements in sensor technology, autofocus systems, image stabilization, codec and compression technology, color grading software, and camera design are driving innovation and intensifying competition among manufacturers.

However, there are certain constraints that affect this market. One notable challenge is the high cost of cinematographic cameras. These devices, equipped with cutting-edge features, often come with a premium price tag, limiting their accessibility to a broader audience and impacting manufacturers' profitability. This price barrier can be a significant deterrent for smaller production houses and independent filmmakers.

In addition to the cost factor, the market faces stiff competition from low-cost cameras and smartphones. Many modern smartphones come with advanced camera capabilities, and they are readily available to a vast consumer base. This competition has led to declining sales and pricing pressures in the cinematographic camera market.

Nonetheless, there are promising market opportunities that are emerging. One of these opportunities lies in the increasing use of drones for aerial videography. Drones provide a unique perspective and the ability to access challenging environments that are often difficult or dangerous for traditional camera setups. This growing demand for high-quality cinematographic cameras suitable for drones has spurred innovation among manufacturers.

To meet this demand, manufacturers are working on developing compact, lightweight, and advanced cinematographic cameras. These devices are designed to be drone-friendly, enabling stunning aerial shots that were once difficult to capture. This niche market for drone-compatible cinematographic cameras presents a promising avenue for growth and innovation within the industry.

MARKET SEGMENTATION

By Video resolution

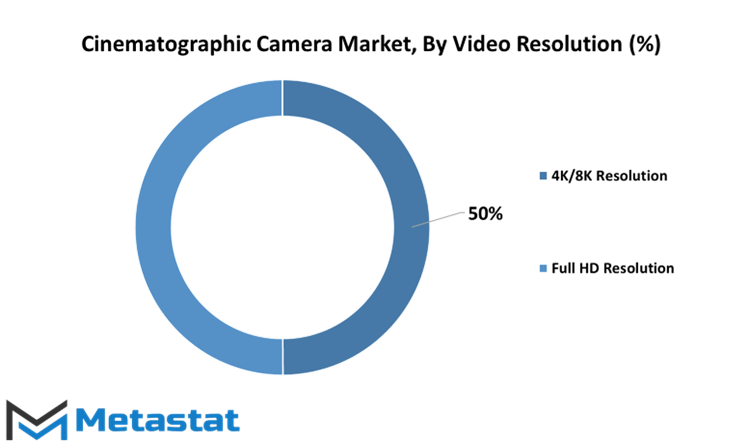

The Cinematographic Camera market offers a diverse range of products, with video resolution being a crucial aspect. In this market, the video resolution is further segmented into two key categories: 4K/8K Resolution and Full HD Resolution. These segments play a significant role in shaping the market dynamics.

The 4K/8K Resolution segment, which was valued at 184.8 USD Million in 2022, is a prominent player in the Cinematographic Camera market. This segment is characterized by cameras that can capture video in either 4K or 8K resolution. The significance of this segment lies in its ability to provide exceptionally high-quality video footage. The 4K/8K resolution offers superior clarity and detail, making it a preferred choice for professionals and enthusiasts who demand top-tier video quality. It is commonly used in applications where precision and sharpness are paramount, such as filmmaking, documentaries, and high-end video production. The market value attached to this segment underlines the growing demand for high-resolution video capabilities in the industry.

On the other hand, the Full HD Resolution segment, valued at 186.7 USD Million in 2022, has its own vital place in the Cinematographic Camera market. Full HD, also known as 1080p, offers excellent video quality that is more than sufficient for various applications. This segment appeals to a broader audience, including content creators, vloggers, and those engaged in general video production. Full HD provides a balance between video quality and data storage, making it a practical choice for a wide range of uses. It's often the go-to resolution for many due to its versatility and efficiency in delivering good video quality without overwhelming storage requirements.

Both the 4K/8K Resolution and Full HD Resolution segments cater to different needs within the Cinematographic Camera market. While 4K/8K Resolution excels in delivering the highest video quality, Full HD Resolution offers a more balanced and practical solution. The market values associated with these segments underscore the industry's recognition of their importance and the diversity of demands from consumers.

The Cinematographic Camera market's segmentation based on video resolution into 4K/8K Resolution and Full HD Resolution reflects the dynamic nature of the industry. It acknowledges the varying requirements of users, from those who demand the pinnacle of video quality to those who seek a more pragmatic balance between quality and storage efficiency. The values attributed to these segments in 2022 demonstrate their significance in shaping the market landscape and their roles in meeting the evolving needs of video content creators and professionals.

By Lens Type

The Cinematographic Camera market comprises various segments, each contributing to the diverse landscape of this industry. One of the key segments within this market pertains to the types of lenses used in these cameras.

The Cinematographic Camera market features a Lens Type categorization, which classifies cameras based on the type of lens they use. This classification is crucial in understanding the market's dynamics and consumer preferences.

One prominent segment within this classification is the EF Mount. In the year 2022, the EF Mount segment was valued at 252.3 USD Million. This indicates a significant market share, highlighting the popularity of EF Mount lenses among consumers. EF Mount lenses are known for their versatility, making them suitable for a wide range of cinematographic applications. This adaptability has led to their widespread adoption in the industry.

Another notable segment is the PI Mount. In 2022, the PI Mount segment had a market value of 119.2 USD Million. While this value is slightly lower than that of EF Mount, it still represents a substantial portion of the market. PI Mount lenses have their own set of advantages, and they cater to a specific audience within the cinematography community. These lenses are valued for their unique features and are often favored for applications.

The difference in market values between these two segments signifies the varying preferences and requirements of cinematographers and production houses. Some may prioritize the adaptability of EF Mount lenses, while others may find the distinctive features of PI Mount lenses more suitable for their projects. This diversity in consumer choices underscores the importance of offering a range of lens types in the Cinematographic Camera market to cater to the needs of a broad and discerning customer base.

The lens type segment within the Cinematographic Camera market plays a vital role in shaping the industry. It reflects the dynamic and evolving preferences of cinematographers and production professionals. The substantial market values of both EF Mount and PI Mount lenses highlight the significance of providing a diverse range of options to meet the diverse demands of the cinematography community. This, in turn, contributes to the vibrancy and competitiveness of the Cinematographic Camera market.

By Sensor Type

The Cinematographic Camera market is divided by sensor type into several segments. One of these segments is Complementary Metal-oxide-semiconductor (CMOS), which was valued at 76.9 USD Million in 2022. Another segment is Full Frame, with a value of 151.9 USD Million in the same year. Super 35mm is yet another segment, and it held a value of 40.6 USD Million in 2022. The final segment is Charge-Coupled Device (CCD), which was valued at 61.9 USD Million in 2022.

These segments represent the diverse range of sensor types used in cinematographic cameras, each with its unique characteristics and applications. The Complementary Metal-oxide-semiconductor (CMOS) sensor type, for instance, is known for its energy efficiency and low noise performance. It's a popular choice for many cinematographers due to its ability to capture high-quality images while consuming minimal power.

On the other hand, the Full Frame sensor type is valued for its ability to capture a wider field of view, making it ideal for shooting landscapes and scenes where expansive visuals are essential. It provides a level of detail and clarity that appeals to many filmmakers.

The Super 35mm sensor type strikes a balance between the CMOS and Full Frame sensors. It's favored for its versatility and suitability for a wide range of shooting scenarios. Filmmakers often turn to Super 35mm when they require a flexible sensor that can adapt to different conditions and deliver excellent image quality.

Moreover, the Charge-Coupled Device (CCD) sensor type offers its advantages, including high-quality color reproduction and low noise levels. It's a go-to choice for some cinematographers who prioritize color accuracy and image fidelity.

The values associated with each of these segments in 2022 highlight the market's diversification. It's a clear reflection of how filmmakers and production companies have varied needs and preferences when it comes to sensor types in cinematographic cameras. This diversity in the market allows professionals to choose the sensor type that aligns best with their specific projects and creative visions.

REGIONAL ANALYSIS

The Cinematographic Camera market is a dynamic one with a global presence. To gain a comprehensive view of this market, it's essential to consider it from a regional perspective. By dividing the market into regions, we can observe distinct trends and patterns in the industry's growth and development.

One of the significant regions in the Cinematographic Camera market is Europe. In 2018, the market in Europe was estimated to be valued at 96.9 USD Million. This value reflects the substantial presence and demand for cinematographic cameras in the region. What's even more noteworthy is the projection for the European market. Over the forecast period, it's expected to expand at a Compound Annual Growth Rate (CAGR) of 6.25%. This growth rate signifies a healthy and progressive market, indicating a steady rise in the use and demand for cinematographic cameras in Europe.

Moving across the globe to the Asia Pacific region, we find another essential market segment. In 2018, the Asia Pacific Cinematographic Camera market was estimated to be valued at 84 USD Million. This indicates that the market in the Asia Pacific region is no less significant than its European counterpart. With this level of valuation, it's evident that cinematographic cameras are in demand in Asia Pacific as well. The market here is vibrant and thriving, suggesting a substantial presence of filmmaking and videography activities.

These regional insights shed light on the diverse landscape of the Cinematographic Camera market. While Europe and Asia Pacific represent substantial market segments, there are many other regions worldwide, each with its unique characteristics and demands. Understanding the market from a regional perspective allows stakeholders to make informed decisions and adapt to the specific needs and trends of each area, ultimately contributing to the continued growth and development of the cinematographic camera industry on a global scale

COMPETITIVE PLAYERS

The Cinematographic Camera market is home to several key players, and two prominent names in this industry are ARRI and Aaton Digital. These companies play pivotal roles in shaping the market, offering innovative solutions and technologies that cater to the diverse needs of filmmakers and content creators. ARRI, a well-established leader in the cinematographic camera field, has a rich history of providing high-quality cameras and equipment to the film and television industry. Their products are renowned for their exceptional image quality and reliability. ARRI's commitment to innovation has earned them a solid reputation, making their cameras a top choice for professionals in the film industry.

Aaton Digital is another noteworthy player in the cinematographic camera market. This company is known for its dedication to developing cutting-edge digital cinematography solutions. Aaton Digital's cameras are designed with the filmmaker in mind, offering flexibility and functionality. They have gained recognition for their ergonomic designs and user-friendly features, making them popular among filmmakers seeking efficiency and creative freedom.

Both ARRI and Aaton Digital are instrumental in driving advancements in cinematographic camera technology. They understand the evolving needs of the film industry and strive to deliver products that cater to those demands. Their cameras are utilized in various cinematic projects, from large-scale productions to independent films, showcasing their versatility and adaptability.

In the competitive landscape of the cinematographic camera market, ARRI and Aaton Digital stand out as influential players, continuously pushing the boundaries of what is achievable in cinematography. Their commitment to quality, innovation, and user-friendliness ensures that filmmakers have access to the tools they need to bring their creative visions to life on the silver screen.

Cinematographic Camera Market Key Segments:

By Video resolution

- 4K/8K Resolution

- Full HD Resolution

By Lens Type

- EF Mount

- PI Mount

By Sensor Type

- Complementary Metal-oxide-semiconductor (CMOS)

- Full Frame

- Dual Pixel

- Super 35mm

- Charge-Coupled Device (CCD)

Key Global Cinematographic Camera Industry Players

- ARRI

- Aaton Digital

- Blackmagic Design

- Canon

- Fujifilm

- Grass Valley

- JVCKENWOOD

- Panasonic

- Panavision

- RED Digital Cinema

- Silicon Imaging

- Sony

- Vision Research

- Eastman Kodak

- Bolex

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383