MARKET OVERVIEW

The Chargeback Management Software Market has risen to prominence as businesses across the world grapple with the complexities of chargeback disputes and seek efficient solutions to mitigate their financial losses. Chargebacks are a financial transaction reversal initiated by a customer, typically in response to a disputed or unrecognized credit card charge. Such disputes can lead to substantial financial losses for merchants, as well as increased operational costs. Therefore, the need for an effective and efficient solution to manage chargebacks has become pivotal in the world of commerce.

In response to the pivotal need for effective chargeback management, a thriving industry has emerged, centered around chargeback management software solutions. These software platforms are designed to streamline the chargeback dispute process, reducing the time, effort, and resources required to handle such cases. This has become particularly important as the volume of online transactions has surged, making manual dispute resolution impractical for many businesses.

The Global Chargeback Management Software Market is not confined to a specific geographical area; it encompasses businesses from various industries, all grappling with the challenges of chargebacks. This market is fueled by several factors, including the rapid growth of e-commerce, the increasing complexity of payment systems, and the constant evolution of fraud tactics. Consequently, businesses are investing in chargeback management solutions to maintain profitability, enhance customer relationships, and protect their reputations.

The Global Chargeback Management Software Market plays a pivotal role in helping businesses navigate the complex world of payment disputes. While it may not be a familiar term to all, its importance in maintaining profitability and customer trust is undeniable. As the business landscape continues to evolve, chargeback management software will remain a critical tool for businesses looking to protect their financial interests, build stronger customer relationships, and adapt to the ever-changing world of commerce.

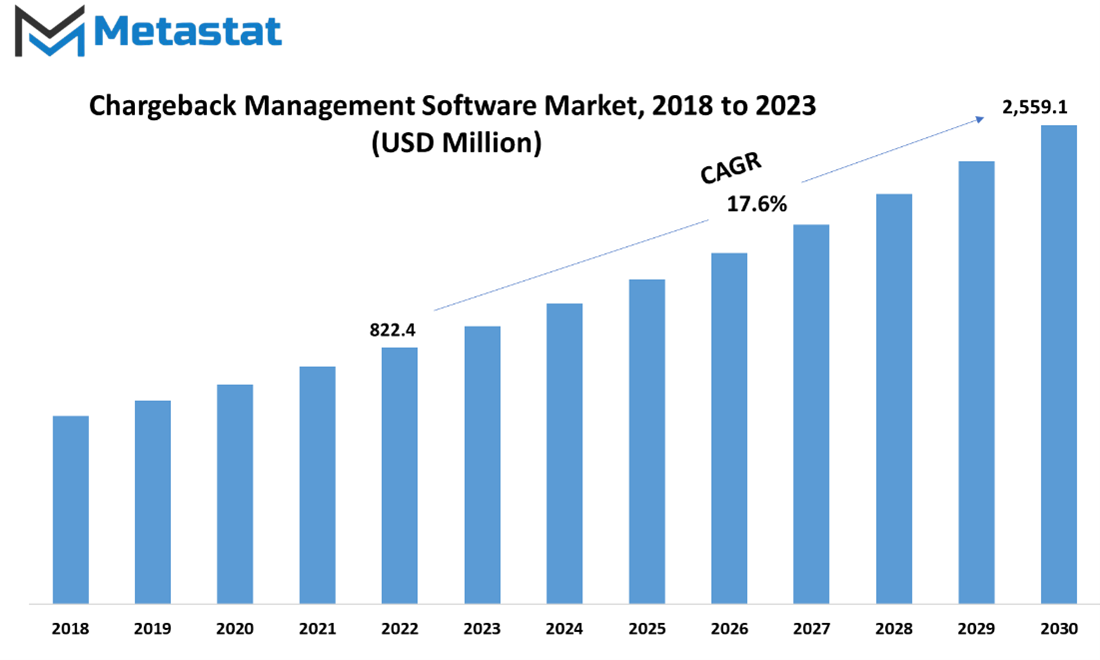

Global Chargeback Management Software market is estimated to reach $2,559.1 Million by 2030; growing at a CAGR of 17.6% from 2023 to 2030.

GROWTH FACTORS

The Chargeback Management Software market is experiencing notable growth, driven by several key factors. The increasing prevalence of E-commerce transactions has become a significant driver. The rise of online shopping, coupled with the vast selection of products and the global reach of the internet, has contributed to this trend. With the uptick in E-commerce activities, an inevitable consequence has been the surge in chargebacks, wherein customers dispute transactions.

To address this challenge, businesses are increasingly turning to Chargeback Management Software. This software offers a streamlined process for managing disputes efficiently, preventing fraud, and reducing financial losses. It operates by monitoring transactions in real-time, providing dispute resolution workflows, and supplying valuable analytics to identify patterns. As E-commerce continues to expand, businesses are proactively investing in these solutions to safeguard their revenue, preserve their reputation, and maintain strong customer relationships.

Moreover, stringent regulatory compliance requirements have emerged as another influential driver. Regulatory authorities are imposing strict guidelines across various industries, including finance, retail, and E-commerce. These regulations primarily revolve around ensuring transparency, security, and fair practices in financial transactions, particularly in chargebacks. Non-compliance can result in fines and penalties. Chargeback Management Software plays a crucial role in helping businesses meet these regulatory demands. It accomplishes this by automating and streamlining the chargeback resolution process, ensuring adherence to evolving regulations, and thereby helping businesses address regulatory concerns proactively and maintain trustworthiness.

However, this market is not without its challenges. One notable restraint is the complexity of integrating Chargeback Management Software into existing business systems. These solutions must seamlessly integrate with a range of systems, including payment processing systems, customer databases, and financial management software. The challenge lies in the diversity of IT environments within businesses, often comprising legacy systems, third-party software, and custom-built applications. This intricacy can lead to implementation delays, increased costs, and can be particularly discouraging for smaller businesses.

Another restraint worth noting is the cost of implementation. The initial investment required to implement Chargeback Management Software can be substantial. This encompasses licensing fees, customization expenses, training costs, and ongoing maintenance. For smaller businesses or startups operating on limited budgets, this cost can serve as a significant barrier. Additionally, the need for hardware infrastructure upgrades or integration with existing systems can further inflate expenses. While some vendors offer flexible pricing models to mitigate this restraint, it remains vital for businesses to thoroughly evaluate the long-term benefits.

Amidst these challenges, significant opportunities are also emerging in the Chargeback Management Software market. One such opportunity is the integration of AI-powered analytics. This represents a compelling avenue for the sector's future growth. AI-driven analytics offer an enhanced and more effective approach to detecting and responding to transaction disputes.

Machine learning algorithms are capable of analyzing transaction data in real-time, identifying anomalies, and even predicting fraudulent activities. This proactive approach substantially reduces the financial impact of chargebacks while simultaneously enhancing the overall customer experience. AI can also automate dispute resolution processes, intelligently categorize disputes, and adapt to evolving regulatory requirements, thus ensuring compliance.

In essence, AI-powered analytics are poised to revolutionize the Chargeback Management Software market by offering a proactive and data-driven method for managing chargebacks effectively. This innovation promises to shape the future of the industry, further emphasizing the importance of this technology in safeguarding the financial interests and reputations of businesses while delivering a seamless experience for customers.

MARKET SEGMENTATION/REPORT SCOPE

By Type

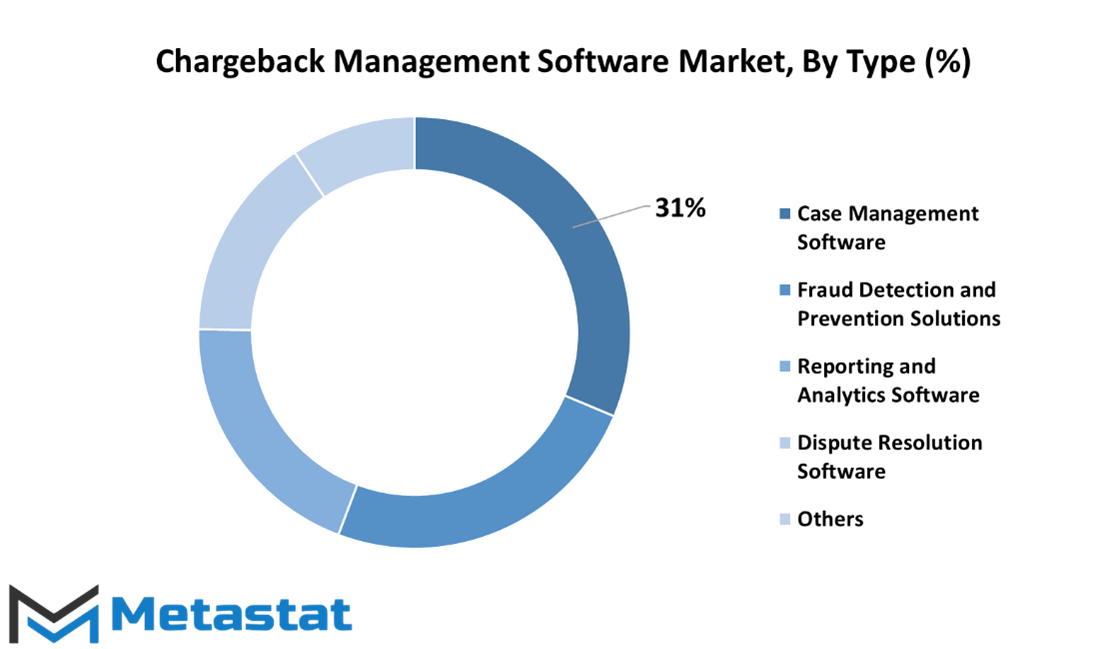

The Chargeback Management Software Market is a dynamic landscape. It's not a one-size-fits-all scenario; it's diversified. This market, in all its diversity, can be categorized into several types.

One significant category is Case Management Software. In 2022, the Case Management Software segment alone accounted for a substantial 218 USD Million. It's a vital component in the chargeback management ecosystem, allowing for efficient handling of cases and disputes.

Fraud Detection and Prevention Solutions, another segment of this market, held its ground impressively. Valued at 170.2 USD Million in 2022, it showcases the increasing need for robust fraud prevention tools in the world of chargebacks.

The chargebacks also include the Reporting and Analytics Software segment, valued at 136.3 USD Million in 2022. This segment helps organizations gain insights and make data-driven decisions, crucial in managing chargebacks effectively.

Dispute Resolution Software, with a valuation of 107.8 USD Million in 2022, plays a pivotal role in mediating and resolving disputes, a common occurrence in chargeback scenarios.

There's the others category, which might not be as prominent but is still significant in its own right. It was valued at 65.2 USD Million in 2022.

These segments highlight the diversity and importance of the chargeback management software market. They underscore the need for a multi-faceted approach to address the various challenges and needs in this ever-evolving industry.

By Application

The Chargeback Management Software Market, like many others, is not a one-size-fits-all arena. It is diversified by application, catering to different segments within the business landscape.

One substantial segment within this market is Large Enterprises. In 2022, the Large Enterprises segment made its mark, with a valuation of 417.8 USD Million. Large enterprises, with their extensive operations and intricate financial processes, often require robust and comprehensive chargeback management solutions. These solutions are tailored to address the specific needs of these corporate giants.

In parallel, we have the SMEs segment. In 2022, it was valued at 279.8 USD Million. Small and Medium-sized Enterprises, while not as expensive as their larger counterparts, have their unique set of requirements. Their operations may be more streamlined, but they too need effective chargeback management to navigate the financial complexities that come their way.

Now, let's dissect these segments a bit further. Large Enterprises, with their substantial financial transactions, need chargeback management software that can handle a high volume of data. They require solutions that offer scalability and robust reporting features. In essence, their software must match the scale and intricacy of their financial operations.

Conversely, SMEs, with their relatively smaller operations, seek chargeback management software that is cost-effective and easy to implement. They may not need the same level of complexity as large enterprises, but the software should still provide essential features to manage chargebacks efficiently.

The key takeaway here is that the chargeback management software market recognizes the diversity of its users. It acknowledges that one size does not fit all. Instead, it tailors solutions to meet the varying needs of both large enterprises and SMEs. This flexibility allows businesses of all sizes to navigate the complex world of chargebacks effectively, ensuring that they can recoup lost funds and maintain healthy financial operations. So, whether you're a corporate giant or a smaller player in the business world, there's a piece of the chargeback management software pie designed just for you.

REGIONAL ANALYSIS

The management of chargebacks is a critical concern for businesses operating in the modern commercial landscape. These financial transactions, initiated by customers to dispute charges, necessitate efficient handling. Chargeback management software has emerged as a valuable solution in this regard. This software plays a pivotal role in simplifying and streamlining the process of addressing chargeback claims. It provides businesses with the necessary tools and resources to effectively manage these disputes, ultimately reducing financial losses and safeguarding revenue. The global market for chargeback management software is not uniform. Instead, it varies significantly based on geographical regions. Two key regions that shape the dynamics of this market are North America and Europe.

North America, as a major player in the chargeback management software market, boasts a robust and well-established e-commerce industry. The United States is home to many online businesses, making it a fertile ground for the adoption of chargeback management solutions. The sophisticated financial infrastructure and the prevalence of credit card usage further contribute to the demand for these software systems.

Europe, on the other hand, represents a diverse landscape for chargeback management software. The European market is composed of a multitude of countries, each with its own unique financial regulations and consumer behaviors. While some nations exhibit similarities to the North American market in terms of e-commerce and credit card usage, others have distinct preferences and practices. This diversity underscores the importance of tailored chargeback management solutions to address the specific needs of each European country.

In conclusion, the global chargeback management software market is not a monolithic entity but rather a collection of regional markets, each shaped by its own unique characteristics. North America, with its thriving e-commerce sector and credit card prevalence, has distinct requirements. Meanwhile, Europe, with its diversity of nations and financial regulations, needs adaptable solutions. Recognizing these geographical distinctions is vital for businesses seeking to effectively navigate the chargeback management landscape.

COMPETITIVE PLAYERS

The Chargeback Management Software Market is a dynamic arena, with various key players driving its growth. Notably, Riskified Inc. and SEON Technologies Ltd. are prominent companies in this industry, providing essential solutions for businesses dealing with chargebacks.

Riskified Inc. has carved a niche for itself by offering a comprehensive suite of services for chargeback management. Their software is designed to help businesses prevent chargebacks and reduce false positives, thereby safeguarding revenues. Riskified employs advanced machine learning algorithms to detect fraudulent activities and minimize risks effectively. They cater to a wide range of industries, including e-commerce, travel, and financial services.

SEON Technologies Ltd. is another major player in this market. Their chargeback management software is built with a focus on fraud prevention and identity verification. SEON's solutions are versatile, addressing the needs of various sectors such as e-commerce, gaming, and financial services. Their technology allows businesses to verify user identities, detect suspicious activities, and reduce chargebacks, enhancing overall operational efficiency.

These key players are at the forefront of the Chargeback Management Software Market, offering innovative solutions that help businesses protect their revenues, enhance security, and streamline operations. Their presence and contributions are instrumental in shaping the landscape of chargeback management, serving the needs of businesses across diverse industries.

Chargeback Management Software Market Key Segments:

By Type

- Case Management Software

- Fraud Detection and Prevention Solutions

- Reporting and Analytics Software

- Dispute Resolution Software

- Others

By Application

- Large Enterprises

- SMEs

Key Global Chargeback Management Software Industry Players

- Riskified Inc.

- SEON Technologies Ltd.

- Equifax Inc.

- Chargeback Gurus

- MidMetrics

- Chargebacks911

- ChargebackHelp

- iNymbus

- Sift Science, Inc.

- Signifyd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383