MARKET OVERVIEW

The Global Brick Market comprises an integral segment of the value chain of the construction materials industry; it lies at the confluence of classic artisanship and modern engineering. Bricks, by their very nature, have taken on a significant role in building structures for centuries and remain an essential element of architectural landscapes worldwide. This enduring eminence has developed due to certain features intrinsic to bricks—features of strength, wide applicability, and aesthetic appeal that make them an important necessity in most building projects.

Basically, bricks are made from clay, which is formed into various sizes and shapes and then burnt at high temperatures to gain strength and resilience. The combination of time-tested traditional practices and modern technological practices is done with intricate dexterity to ensure coherence in quality and yet allows scope for innovative designing. Very broadly, the world market for bricks is driven by the directions of the construction sectors that are desperate for both robust and sustainable building materials that can provide assured structural integrity and appeal.

The future of the global brick market encompasses a host of emerging trends. One of them sees sustainability become the number one issue to drive the industry toward eco-friendly practices and materials. Alternatives in raw material sourcing and energy-efficient production practices are two areas drawing the attention of manufacturers to have minimal impact on the environment. Digital and automation tools allowing innovations in brick design and construction methods are going to revolutionize this sector, improving efficiency and precision in building projects.

Moreover, even more customization and aesthetics are pushed into the market, with architects and designers going full out on the different textures, colours, and finishes that current brick makers produce, in the bidding to create unique facades and interiors. This scenario of building solutions with personalization fits into the changed preferences of property developers and homeowners for unique though durable building materials.

There is a difference in dynamics on the global brick market from one country to another. Infrastructure renewal and urban renewal in developed economies sustain the demand for high-quality bricks, which must strictly meet regulatory standards. However, the industrial brick-manufacturing industries in the major emerging markets depicted in rapid urbanization as an imperative are also experiencing a continuous surge in residential and commercial construction activities.

The evolving consumer preferences and regulatory frameworks are also indicative of future landscapes that may take place within the global brick market. With sustainable construction practices coming under the limelight for policy-making at global levels, the market will see an increasing share of bricks harnessed with recycled materials or using energy-saving technologies. Additionally, efforts directed toward establishing a new generation of energy-efficient buildings with low carbon footprints have aggressively pushed market dynamics, thereby impressing upon the need for manufacturers to rethink strategies and offer innovative responses while conforming to stringent environmental norms.

The global brick market remains an integral part within the structure of the construction industry, providing sustainable solutions that blend both tradition and innovation. In the very dynamic and increasingly eco-conscious world, the reshaping of landscapes due to technological advancement and imperatives to become sustainable bodes continued evolution of bricks as one of the major aspects of modern architecture, embodying durability, versatility, and a timeless appeal to building design and construction. Of course, that evolution marks all the more the resilience and adaptability true to this market and its relevance in a very dynamic and increasingly eco-conscious world.

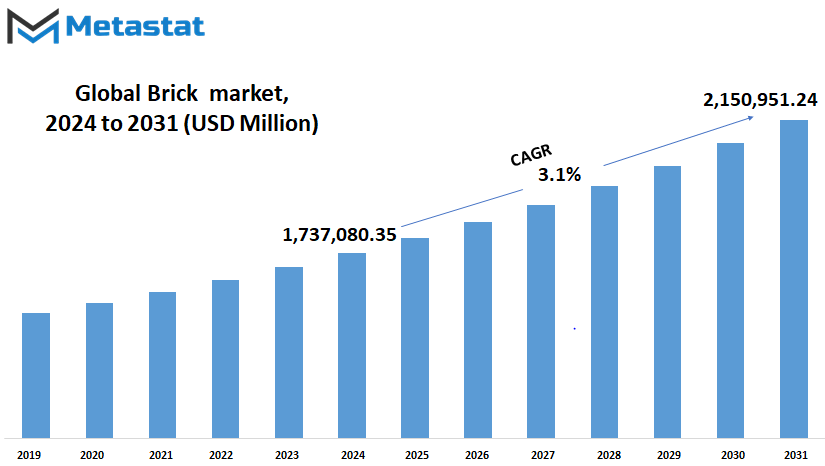

Global Brick market is estimated to reach $2,150,951.24 Million by 2031; growing at a CAGR of 3.1% from 2024 to 2031.

GROWTH FACTORS

Some of the growth factors for the brick market include the fact that an almost indispensable use in construction across regions, if not the globe, is noticed, owing to its durability and versatility. One of the driving factors for using brick is its capacity to sustain harsh weather conditions and provide high structural efficiencies. Besides, an attractive aesthetic appearance is appreciated by all, right from residential structures to commercial ones.

Enhancements in brick manufacturing processes and material make it possible for companies to reach new market opportunities. With increased regard for sustainability around the world, developments in technology have resulted in the ability to produce bricks in an eco-friendly manner. Such bricks are generally made from recycled materials or produced by energy-efficient means and, thus, are more attractive to green consumers and regulatory institutions.

Growth in population and urbanization represent important drivers for the brick market. Increasing population propels further urbanization, which supports the need for affordable housing and infrastructure. Bricks, being a low-cost and durable construction material, stand best to meet this demand. New zones require numerous new constructions where urbanization demands renewal and redevelopment with increasing bricks application in these areas.

However, the growth of this market is difficult as a result of the irregular cost of raw materials and strict environmental rules. The fluctuation in the cost and availability of clay and shale as raw materials is expected to impact the cost of production of bricks. Economic volatility or other geopolitical factors can exacerbate the foregoing challenges and impact market dynamics in an unpredictable way.

Ahead, technological progress should continue to edge the market for bricks in positive directions, with innovation touching upon digital manufacturing and smart bricks that could have embedded sensors to monitor the bricks' structural integrity or energy use. Such integration would maintain not only the functionality of bricks but also help the cause toward broader trends leading to smart infrastructure and practices in sustainable construction.

The brick market presents a lot of promise with the emergence of economies that are rapidly industrializing and developing the necessary infrastructure. Therefore, the schemes on affordable housing and other urban infrastructural projects with major investments are the factors that will spur demand to a large extent in the near future. What is more, increasing advanced building technologies and construction methods are likely to further augment the growth of the market in due consideration.

Naturally, if weaknesses are found, it is the strengths and innovations within the market that drive growth in the brick market. The success of the brick sector in adapting to new technologies and market requirements will be the determinant factor for its course toward development in the long run. Bricks are thus placed as a requisite in the global construction arena with the continual rise in urbanization amid growing concern for sustainability.

MARKET SEGMENTATION

By Type

In the dynamic flow of global construction materials, bricks emerge at the core because of their durability, versatility, and sustainability. Bricks form a greatly diversified market globally, with different types meeting special construction needs. Clay bricks, sand lime bricks, fly-ash clay bricks, and many such specialized variants fulfill various conditions of the environment and architectural needs.

The most traditional and widely used all over the world are clay bricks made from natural clay and shale. This product has stayed on top in the market due to its strengths and high thermal properties, hence it's suitable for residential and commercial building purposes. Sand lime bricks, which have incorporation of lime and sand, enhance durability and preferably used in locations demanding strength against moisture and chemicals.

This includes fly ash clay bricks, made from industrial waste products like fly ash, which not only reuses waste but also imparts superb strength and integrity to the structure. In effect, these bricks easily become favored in sustainable construction methods, hence serving to achieve the global goal of low ecological footprint. Other brick innovations include interlocking designs for more rapid assembly and lighter types for seismic regions attributed to improving overall structural performance.

The segmentation of the global brick market, by type, mirrors the ongoing progress in construction technology and the set targets of being 'green'. Regarding the rise in urbanization across the world, demands for fast construction materials continue to move upward. Governments and developers press towards energy-efficient construction methods and, therefore, increase demand for bricks with higher insulation and lower carbon emission.

Further Innovation of the Brick Industry: Young research into new materials and new manufacturing techniques strives to bring out better performance with reduced environmental impacts. Digital modeling and automated production are making a leap in the brick manufacturing process, improving quality control and cost efficiency.

By Size

Bricks are one of the most important building materials in the global market and hold an essential place for construction in every sector. They fall under three categories of sizes in the market: Standard, Modular, and Jumbo, each finding different uses in construction works across the globe.

Standard bricks are the most used and versatile in construction. They are usually dimensioned 3⅝ x 2¼ inches in height and thickness, respectively, and used for a wide range of building projects. From residential houses to big commercial buildings, these bricks have proven to strike a balance between ease of use and inferring the structural need. The size is uniform, thus ensuring consistency in building that helps in efficient building practices.

Generally, modular bricks are used, which are a little larger than the standard ones, for ease in construction. The dimensions of these bricks measure 3⅝ inches high, 2¾ inches deep, and 7⅝ inches long. They decrease the use of mortar and increase construction speed. Modular bricks are heavily used in extensive work where time and cost-to-benefit ratios matter the most. Because of the size of these bricks, it gives greater speed in installation and helps complete timely construction without any compromise on the quality of construction.

The largest category in this regard is jumbo bricks, designed to achieve larger coverage per unit. Such bricks, usually 3⅝ inches high by 3⅝ inches deep by 11⅝ inches long, would find their place in projects where the number of joints is to be reduced and, at the same time, a finer and more troweled finish is desired on elevations. Therefore, jumbo bricks have a utility where fast construction progress and superior aesthetics are required in building purposes—like high-rise buildings or large commercial complexes.

By Application

The global brick market plays a major role in construction worldwide. Bricks are used to build a sustainable structure that provides not only functionality but creates an effect on the architecture of any building. Consequently, bricks find applications in the residential, commercial, and industrial building sectors.

Basically, bricks are used for building construction. They impinge on the structuring and durability of a building structure, equipped to sustain all weather conditions, therefore assuring its long life. The building industry is the largest consumer of bricks worldwide due to the extensive share of brick masonry work used in walls, front elevations, and partitions. This application is vital in both the urban and rural areas where bricks are most preferred due to their strength and thermal insulation.

The other major application of bricks is in the formation of paths and pavements. Whether in gardens or parks, or even in urbanwalkways, bricks provide a hardwearing surface for pedestrian traffic. They bring outdoor spaces into their own with a touch of elegance to the visible surroundings, thereby wedding utility with beauty. In the case of this market segment, the needs of landscape architects and committee works will prove to be a driver of brick demand.

Bricks are also used in constructing ornamental designs at one's garden or public places called parterres. Artistic designs are added to landscapes, therefore bringing out the other dimension of the bricks apart from their traditional construction use, in a very unique way. The parterre application puts forth the decorative aspect of bricks, hence influencing architectural and landscaping trends.

These main application areas for bricks are complemented by several other small-scoped usages in various industries. Their adaptability runs from industrial applications—kiln linings—to all sorts of decorative elements within interior design. Improvements made to the different methods and materials for producing bricks widen their potential application area even further, so as to remain relevant under changing construction scenarios.

The global brick market is expected to grow at the back of urbanization, infrastructure development, and growing emphasis on sustainable construction material. Any improvement in brick production technology pertains to increased efficiency and lower environmental impact, hence sustainability goals globally. These developments are likely to define the future of the brick industry in a number of ways and affect how bricks will be used and viewed in construction and design..

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$1,737,080.35 million |

|

Market Size by 2031 |

$2,150,951.24 Million |

|

Growth Rate from 2024 to 2031 |

3.1% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global brick market is analyzed based on its geographical distribution into several key regions: North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America comprises the United States, Canada, and Mexico. Meanwhile, the European region includes the UK, Germany, France, Italy, and the rest. In the forecast period, Asia-Pacific includes India, China, Japan, South Korea, and rest of Asia-Pacific major economies. In South America, it covers the market in Brazil, Argentina, and the rest of South America.

Under Middle East & Africa, this report covers GCC Countries, Egypt, South Africa, and other countries in the region. Regional segmentation in the brick market is important to understand the global dynamics. Every region has its own identity and factors that drive demand and supply. For example, North America and Europe have mature markets with well-developed infrastructure and construction practices that generate a constant demand for bricks. On the other hand, compared to other regions, Asia-Pacific is urbanizing and industrializing rapidly and thus has rapid construction activities and growth in the brick market.

Growth patterns in the South American and Middle East & African regions differ, driven by underlying factors currently caught between economic development, urban expansion, and government investment in infrastructure. This is ultimately impacting, through changing construction practices and preferred building materials, demand for bricks in these countries.

The global brick market will further evolve as construction technologies and sustainable building practices are invented. Increasing sensitivity towards the environment is going to stay in the trend and hence spur innovation within brick manufacturing processes in order to trim carbon footprint and improve energy efficiency. Also, regional regulatory policies and building codes will significantly contribute towards changing the market scenario and encouraging the adoption of green building materials such as bricks.

Geographical analysis of the global brick market shows different regional dynamics driven by economic, regulatory, and environmental factors. Understanding regional nuances hence becomes very important for all stakeholders in the value chain of construction industries—manufacturers, distributors, construction firms—who are to sail through the challenges and opportunities of the market in coming years.

COMPETITIVE PLAYERS

The brick industry has always stood at par in the global market today as a cornerstone in construction, poised with durability and versatility across any building project. Some of these important movers and shakers arebusinesses like Acme Brick Company, Bigbloc Construction Ltd., and Wienerberger AG.

Bricks are strong, aesthetically pleasing, and justifiably timeless in construction, with their sterling performance shared across all global climates and architectural styles—basically required elements for residential and commercial building assignments.

Acme Brick Company represents the best in the industry. The entire sector is devoted to quality and innovations. The environmental standards are complied with, and durability, sustainability—until now, its products prove continuous change in production methods that meet today's market requirement and future trends in construction.

Another key player and leader in Europe is Wienerberger AG, which offers an overall portfolio ranging from clay blocks to facing bricks. It also invests heavily in research and development to enhance the efficiency and world-environmental performance of its products. In light of this strategy, the firm is well-positioned against growing competition in the global arena.

This brick industry is embedded with all sorts of competitors, continuously showcasing milestones of companies that have other kinds of strengths and bring forth different innovations. From Bigbloc Construction Ltd. in North America to the Brampton Brick in Europe, all these substantial contributors have been major components in the technological advancement and market expansion alike.

In this regard, technological development became the main and simultaneously the capstone force in the historical process of brick making. Automated production lines and ecological ways of production reshaped the character of this industry. Developments such as these do not only give rise to easier ways of producing but reduce environmental harm by focusing on global sustainability goals.

The brick market is expected to achieve substantial growth in the future with increasing demand from rapid urbanization and related infrastructure building processes. The consumptions are substantially expected to surge up in the emerging economies, which are investing in housing and infrastructure projects.

The global brick industry is extremely competitive but innovative, committed to delivering products while being concerned for sustainability in this industry. Quality and technology advancements in this field are injected by principal companies, such as Acme Brick Company and Wienerberger AG. Against this backdrop, these principals will steer the future course of the industry to rapidly meet the rapidly growing global demand in an environmentally friendly manner.

Brick Market Key Segments:

By Type

- Clay Bricks

- Sand Lime

- Fly-ash Clay

- Others

By Size

- Standard

- Modular

- Jumbo

By Application

- Building

- Path

- Parterre

- Other

Key Global Brick Industry Players

- Acme Brick Company

- Bigbloc Construction Ltd.

- Bowerston Shale

- Brampton Brick

- Brickworks

- Columbus Brick

- GENERAL SHALE, INC.

- Jindal Mechno Bricks

- Lignacite Ltd

- Oldcastle APG

- Palmetto Brick Company

- Supreme Concrete

- Triangle Brick Co.

- Wienerberger AG

- Boral Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252