MARKET OVERVIEW

The Global Blood Tubing Set market stands as a critical segment within the healthcare industry, catering to the intricate needs of patients undergoing hemodialysis. These sets, comprising various components like arterial and venous tubing, blood filters, and connectors, play a pivotal role in facilitating the process of extracorporeal blood circulation during dialysis sessions. As technology advances and healthcare standards evolve, the demand for advanced blood tubing sets is expected to surge, reshaping the landscape of this industry.

One of the primary drivers fueling the demand for blood tubing sets is the rising prevalence of end-stage renal disease (ESRD) globally. With a growing aging population and increasing incidences of chronic kidney diseases, the need for hemodialysis as a life-sustaining therapy is becoming more pronounced. Consequently, healthcare providers are actively seeking efficient and reliable blood tubing sets to ensure optimal patient outcomes.

Furthermore, technological advancements are poised to revolutionize the design and functionality of blood tubing sets. Innovations such as biocompatible materials, improved flow dynamics, and integrated monitoring systems are anticipated to enhance the safety and efficacy of hemodialysis procedures. Manufacturers are investing heavily in research and development to introduce next-generation blood tubing sets capable of meeting the evolving demands of healthcare professionals and patients alike.

The future of the Global Blood Tubing Set market also encompasses a growing emphasis on sustainability and environmental consciousness. With increasing awareness regarding the ecological impact of medical waste, there is a rising demand for eco-friendly materials and disposable options that minimize carbon footprint. Manufacturers are expected to prioritize the development of recyclable and biodegradable components, aligning with the broader sustainability goals of the healthcare sector.

Moreover, the emergence of telemedicine and remote monitoring technologies is anticipated to influence the dynamics of the blood tubing set market. As healthcare delivery models evolve to accommodate virtual care settings, there is a growing need for interoperable devices that seamlessly integrate with telehealth platforms. Blood tubing sets equipped with wireless connectivity and remote monitoring capabilities are likely to gain traction, enabling healthcare providers to deliver high-quality dialysis services outside traditional clinical settings.

The Global Blood Tubing Set market is on the cusp of significant transformation driven by technological innovation, changing healthcare demographics, and shifting environmental priorities. As demand for hemodialysis continues to rise, manufacturers will play a crucial role in developing advanced solutions that improve patient outcomes, enhance operational efficiency, and contribute to sustainable healthcare practices. By embracing innovation and sustainability, the blood tubing set industry is poised to thrive in the dynamic landscape of modern healthcare.

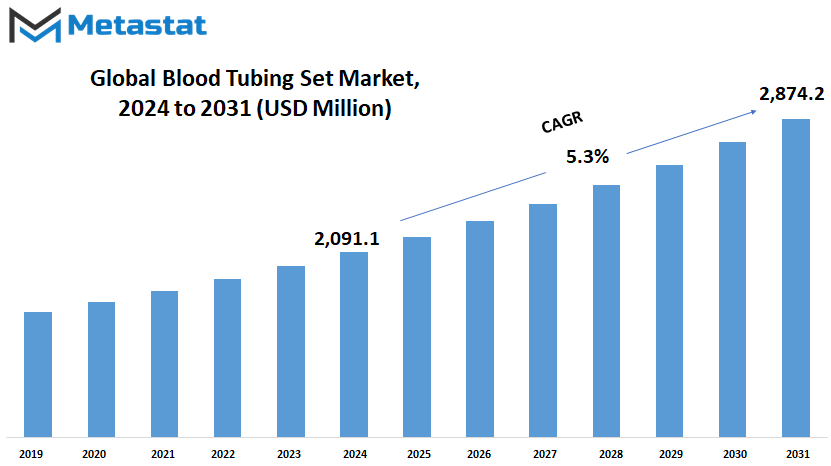

Global Blood Tubing Set market is estimated to reach $2,874.2 Million by 2031; growing at a CAGR of 5.3% from 2024 to 2031.

GROWTH FACTORS

The Global Blood Tubing Set market is witnessing notable growth, primarily due to two significant factors: the increasing prevalence of chronic kidney diseases necessitating dialysis treatment and the continuous technological advancements leading to the development of safer and more efficient blood tubing sets. This upward trend is expected to continue in the foreseeable future.

Chronic kidney diseases, which often require dialysis treatment, are becoming more prevalent worldwide. As the population ages and lifestyles change, the incidence of these diseases is projected to rise. Consequently, the demand for dialysis equipment, including blood tubing sets, will see a corresponding increase. This rise in demand is a significant driver propelling the growth of the Global Blood Tubing Set market.

Moreover, technological advancements in the field of dialysis equipment have been instrumental in enhancing the safety and efficiency of blood tubing sets. Manufacturers are continually investing in research and development to create innovative solutions that address the specific needs of patients and healthcare providers. These advancements not only improve patient outcomes but also contribute to the overall growth of the market.

However, despite the promising outlook, there are challenges that could impede the market's growth trajectory. Stringent regulatory requirements and standards for manufacturing and safety pose hurdles for companies operating in this space. Compliance with these regulations requires substantial investments in quality control and assurance measures, which may deter some manufacturers from entering the market or expanding their product offerings.

Additionally, limited reimbursement for dialysis treatments presents a barrier to market growth and adoption. The high cost of dialysis treatment, coupled with inadequate reimbursement policies, may restrict access to these life-saving therapies for some patients. As a result, the market may face challenges in achieving widespread adoption, particularly in regions with limited healthcare resources.

Despite these challenges, the market holds promising opportunities for growth, especially with the expansion of home-based dialysis therapies. As more patients opt for home-based treatments, there will be a growing demand for user-friendly and portable blood tubing sets. Manufacturers that can innovate and develop products tailored to meet the needs of home-based dialysis patients will be well-positioned to capitalize on this emerging market segment.

While the Global Blood Tubing Set market faces challenges such as regulatory requirements and limited reimbursement, technological advancements and the expansion of home-based dialysis therapies will drive growth in the coming years. With a focus on innovation and addressing the evolving needs of patients and healthcare providers, the market is poised for continued expansion and development.

MARKET SEGMENTATION

By Type

The world of medical equipment is constantly changing, with advancements being made all the time. One such area that is seeing significant development is the Global Blood Tubing Set market. These sets play a crucial role in medical procedures involving blood transfusions and dialysis.

When we look at the Global Blood Tubing Set market by type, we see that it's divided into Single-Lumen, Double-Lumen, and Triple-Lumen Blood Tubing Sets. Each type serves a specific purpose and is designed to meet the needs of different medical procedures.

Single-Lumen Blood Tubing Sets are typically used for basic blood transfusions and simple dialysis procedures. They consist of a single tube that allows blood to flow from the patient to the machine and back again.

Double-Lumen Blood Tubing Sets are more advanced and versatile. They feature two separate tubes, allowing for more complex procedures such as hemodialysis and apheresis. With two tubes, these sets can accommodate simultaneous blood withdrawal and return, making them ideal for a wide range of medical applications.

Triple-Lumen Blood Tubing Sets represent the pinnacle of technology in this field. With three separate tubes, they offer even greater flexibility and functionality. These sets are often used in specialized procedures where precise control over blood flow is essential, such as plasmapheresis and continuous renal replacement therapy.

As medical technology continues to advance, we can expect further innovations in the design and functionality of Blood Tubing Sets. New materials, improved manufacturing techniques, and enhanced features will enable healthcare professionals to perform a wider range of procedures more safely and effectively than ever before.

By Product Type

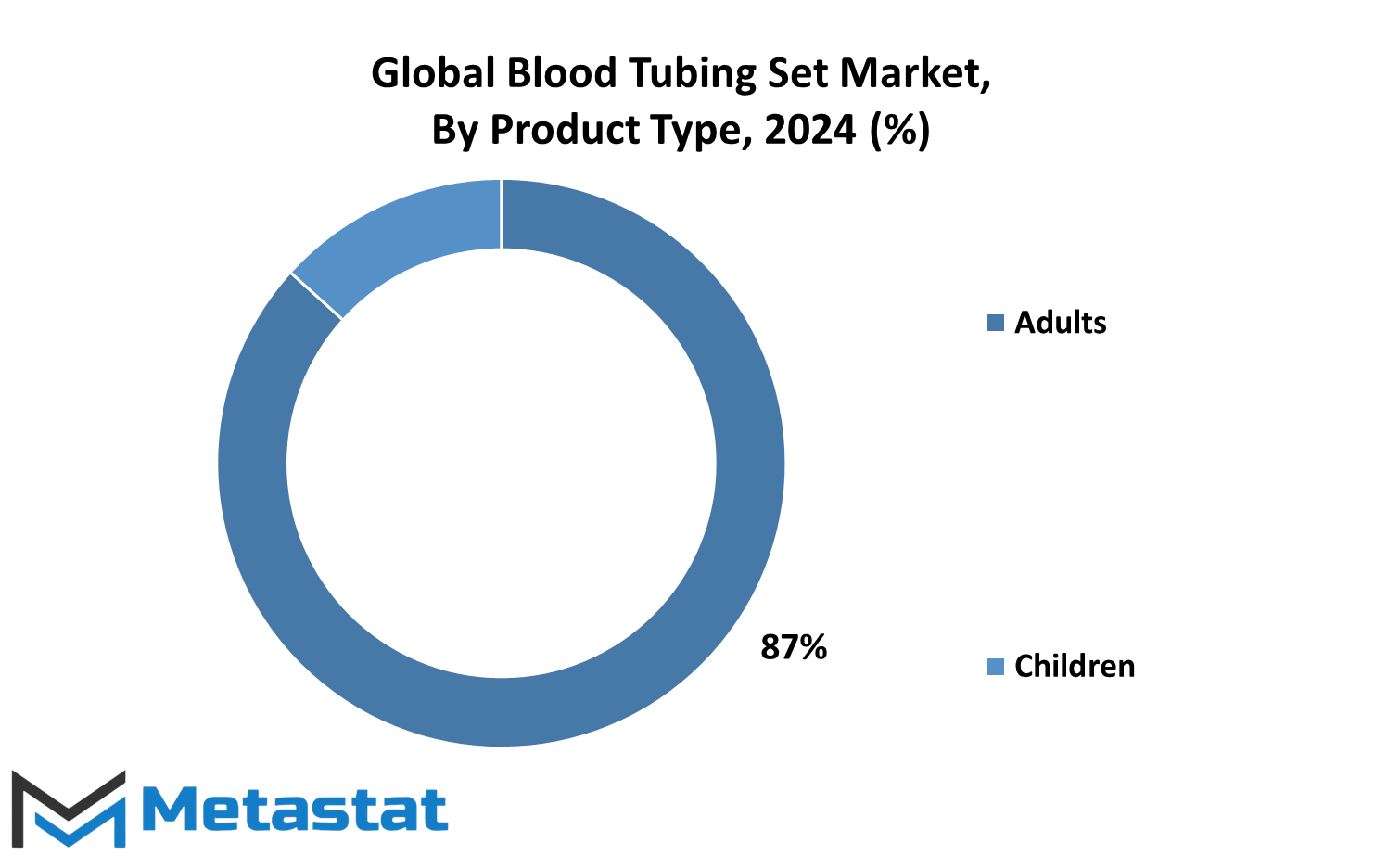

In the future, the Global Blood Tubing Set market will see segmentation based on product types such as Adults and Children. This division will cater to varying needs across different age groups, ensuring more precise and effective medical treatments. The market will witness a surge in demand for specialized tubing sets designed specifically for adults and children, reflecting the growing focus on personalized healthcare solutions.

Moreover, advancements in technology will lead to the development of innovative blood tubing sets with enhanced features to improve patient comfort and treatment outcomes. These sets will incorporate materials and designs aimed at reducing the risk of infection and enhancing compatibility with medical devices. Manufacturers will invest in research and development to create more efficient and user-friendly blood tubing sets, driving market growth.

Furthermore, increased awareness about the importance of blood transfusions and dialysis procedures will contribute to the expansion of the Global Blood Tubing Set market. Governments and healthcare organizations will prioritize investments in healthcare infrastructure, including the procurement of high-quality medical equipment like blood tubing sets, to meet the rising demand for healthcare services.

The future of the Global Blood Tubing Set market will be characterized by segmentation based on product types tailored for adults and children, alongside technological advancements and growing awareness driving market growth and innovation.

By Material

The market for Blood Tubing Sets is on a trajectory of expansion, with various materials shaping its course. These sets, vital in medical procedures like dialysis, find themselves in a realm of constant innovation. One key factor steering this evolution is the material used in their construction.

Diving into the materials that constitute these sets, we encounter a spectrum of options. The Global Blood Tubing Set market delineates its landscape into categories such as Polyvinyl Chloride (PVC), Polyethylene, Polyurethane, and Others. Each material brings its own set of characteristics and applications to the table.

Polyvinyl Chloride (PVC) is a stalwart in the medical industry. Known for its durability and affordability, PVC tubing sets have been a mainstay in medical facilities worldwide. However, concerns regarding its environmental impact and potential health risks have prompted the exploration of alternatives.

Polyethylene emerges as a contender in this arena. Its flexibility and biocompatibility make it an attractive choice for blood tubing sets. Moreover, its low cost and resistance to chemicals further bolster its appeal.

Polyurethane, with its robustness and biostability, is another material vying for a slice of the market pie. Its ability to withstand repeated sterilization cycles and maintain its structural integrity makes it a favored option, particularly in settings where durability is paramount.

The category of Others encompasses a diverse array of materials, each with its own unique properties. These may include silicone, rubber, or even hybrid materials developed through advanced manufacturing processes. While less prevalent than PVC, Polyethylene, and Polyurethane, these materials offer niche solutions tailored to specific requirements.

As the demand for blood tubing sets continues to surge, driven by factors such as the rising incidence of chronic kidney disease and an aging population, the market will witness a proliferation of material options. Manufacturers will invest in research and development to enhance the performance and safety of these sets, ensuring they meet the stringent standards of the medical industry.

In this ever-evolving landscape, the choice of material will play a pivotal role in determining the success of blood tubing sets in the market. Factors such as cost-effectiveness, biocompatibility, and environmental sustainability will guide decision-making processes. Ultimately, it is the material that strikes the optimal balance between these factors that will emerge as the frontrunner in shaping the future of blood tubing sets.

By End User

The market for blood tubing sets is a crucial aspect of healthcare infrastructure, providing essential equipment for various medical procedures. This market is segmented based on end users, primarily hospitals, dialysis centers, and homecare settings.

Hospitals, being the primary centers for medical care, will continue to drive significant demand for blood tubing sets. As medical technologies advance, hospitals will increasingly adopt sophisticated equipment, including advanced blood tubing sets, to enhance patient care and treatment outcomes. The need for efficient blood management systems in hospitals will remain paramount, ensuring the safe and effective delivery of blood products during surgeries, transfusions, and other medical procedures.

Dialysis centers, specialized facilities for patients with kidney-related issues, will also play a crucial role in the demand for blood tubing sets. With the rising prevalence of chronic kidney diseases globally, the demand for dialysis services is expected to increase. As a result, dialysis centers will require a steady supply of blood tubing sets to facilitate hemodialysis treatments for patients with kidney failure. Advancements in dialysis technology will further drive the adoption of innovative blood tubing sets that offer improved performance and patient comfort.

The growing trend of home-based healthcare will also impact the demand for blood tubing sets, particularly in homecare settings. As more patients opt for home-based dialysis and other medical treatments, there will be a need for portable and user-friendly blood tubing sets that can be easily operated outside traditional medical facilities. Manufacturers will need to focus on developing compact and easy-to-use blood tubing sets tailored for homecare settings, ensuring patients can receive necessary treatments comfortably in their own homes.

The global market for blood tubing sets will continue to expand as healthcare providers strive to meet the evolving needs of patients across various settings. Hospitals, dialysis centers, and homecare settings will remain key drivers of demand, with each segment presenting unique opportunities for manufacturers to innovate and deliver high-quality products that enhance patient care and treatment outcomes.

REGIONAL ANALYSIS

In today's interconnected world, the market for Blood Tubing Sets is experiencing significant growth and expansion. This growth is driven by various factors, including technological advancements, increasing prevalence of chronic diseases, and rising healthcare expenditures.

Looking ahead, the global Blood Tubing Set market is poised for continued growth. As technology continues to advance, we can expect to see further innovations in Blood Tubing Sets, leading to improved performance and patient outcomes. Additionally, the increasing prevalence of chronic diseases such as kidney disease will continue to drive demand for Blood Tubing Sets, as these devices are essential for the treatment of such conditions.

Furthermore, the geographic distribution of the global Blood Tubing Set market is worth noting. North America, comprising the United States, Canada, and Mexico, holds a significant share of the market. This can be attributed to factors such as well-established healthcare infrastructure, high healthcare expenditure, and a large patient population.

In the United States, for example, the prevalence of chronic kidney disease is on the rise, driving demand for Blood Tubing Sets used in dialysis procedures. Similarly, Canada and Mexico are also witnessing an increase in the prevalence of chronic diseases, contributing to the growth of the Blood Tubing Set market in these regions.

Looking ahead, emerging markets in Asia-Pacific, Latin America, and Africa are expected to present lucrative opportunities for players in the Blood Tubing Set market. As healthcare infrastructure improves and awareness about chronic diseases increases in these regions, the demand for Blood Tubing Sets is likely to rise significantly.

The global Blood Tubing Set market is on a trajectory of growth and expansion. Technological advancements, increasing prevalence of chronic diseases, and geographic factors all play a role in driving this growth. As we look to the future, it is clear that the demand for Blood Tubing Sets will continue to rise, presenting opportunities for innovation and investment in this vital healthcare segment.

COMPETITIVE PLAYERS

The Blood Tubing Set market is fiercely competitive, with several key players vying for market share. Companies such as Fresenius, Baxter, Nipro, Asahi Kasei, Bain Medical, JMS, Weigao, Tianyi Medical, NxStage Medical, Nikkiso Co., Ltd., Sansin, Advanced Dialysis Methods GmbH, CytoSorbents Corporation, HemoCleanse, Inc., and Infomed SA are at the forefront of this competition. These companies are continually innovating and improving their products to meet the evolving needs of the market.

In the future, we can expect this competition to intensify further as new players enter the market and existing players expand their offerings. Advancements in technology and changes in consumer preferences will drive this competition, pushing companies to differentiate themselves through product quality, reliability, and affordability.

Additionally, regulatory changes and shifts in healthcare policies will also shape the competitive landscape of the Blood Tubing Set market. Companies that can adapt quickly to these changes and anticipate future trends will have a competitive edge in the industry.

Overall, the Blood Tubing Set market will continue to be highly competitive, with key players constantly striving to innovate and stay ahead of the curve. This competition will ultimately benefit consumers by driving improvements in product quality and accessibility.

Blood Tubing Set Market Key Segments:

By Type

- Single-Lumen Blood Tubing Sets

- Double-Lumen Blood Tubing Sets

- Triple-Lumen Blood Tubing Sets

By Product Type

- Adults

- Children

By Material

- Polyvinyl Chloride (PVC)

- Polyethylene

- Polyurethane

- Others

By End User

- Hospitals

- Dialysis Centers

- Homecare Settings

Key Global Blood Tubing Set Industry Players

- Fresenius

- Baxter

- Nipro

- Asahi Kasei

- Bain Medical

- JMS

- Weigao

- Tianyi Medical

- NxStage Medical

- Nikkiso Co., Ltd.

- Sansin

- Advanced Dialysis Methods GmbH

- CytoSorbents Corporation

- HemoCleanse, Inc.

- Infomed SA

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252