MARKET OVERVIEW

The Global Backtesting Tools Market; analytical frameworks made it possible to test and forecast the impact of the key effects on the Backtesting Tools Market, both positive and negative. There were several distinct phases in the development of the Backtesting Tools Market. The first phase is marked by development and online consumption supported by an economic theory that favors free access to information. The explosion in software use in the late 1990s coupled with the rapid spread of internet access meant that an increasing number of trading systems were becoming available to the investing population.

Consequently, an avalanche of potential results began running mostly against a huge number of trading ideas. Backtesting was borne to substantiate these ideas with some measure of reasoning and in a sense, whittle down the list further through an iterative process as called 'brute-force' by our kind. Market modeling and forecasting on the shoulders of backtesting gained prominence in flight by happy coincidence.

Backtesting tools evaluate the past performance of a trading strategy with the help of historical market data; these tools use a set of input trading rules or parameters and backtrack to determine how the strategies would have performed in the past. The outcome back-tested has far-reaching implications for decision-making in finance. The Backtesting Tools Market is itself a dynamic and evolving sector that has been a game-changer within the larger world of financial analysis. These provide the means to completely test and refine trading strategies that would allow more informed investment decisions to be made. The Backtesting Tools Market will continue to be a primary service to those trudging through the uncertain paths of decision-making across modern financial markets due to the constant growth of technology.

The Backtesting Tools Market is an exciting and fast-paced industry that has become a cornerstone in economic analysis. They allow for the comprehensive testing and adjustment of trading strategies, with ultimate returns being better investment decisions. With technology always marching forward, the Backtesting Tools Market would remain an invaluable ally to anyone left stranded in the sophisticated maze of modern financial markets.

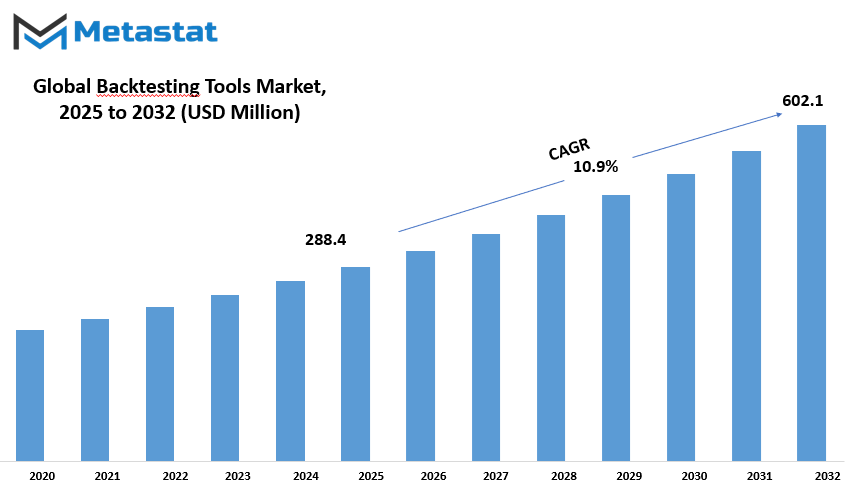

Global Backtesting Tools market is estimated to reach $602.1 Million by 2032; growing at a CAGR of 10.9% from 2025 to 2032.

GROWTH FACTORS

However, some restraints plague the Backtesting Tools market. One significant limitation is overfitting, whereby a strategy fits historical data well but fails when applied in real-time due to exorbitant tuning for past conditions. Although useful in helping to backtest reduces strategy performance, parameters adjusted too much to fit historical data patterns will actually contribute to overfitting. Hence, this leaves incubation in transforming emerge strategies into dynamic market conditions.

Backtesting Tools-The instrument finds numerous market drivers, restraints and opportunities to overtly influence the dynamism of the market. The primary market driver is Data Availability and Analysis. This thrust came about as a result of advancing technologies, which consolidated massive amounts of historical market data and made sophisticated analytical tools. These analytical tools changed how investment strategies and trading algorithms are developed, tested, and implemented. With historical data, professionals can comprehensively evaluate strategies through simulation, giving them a means to test strategy performance under various conditions and fine-tune their strategies.

Algo-trading represents the other main driving force behind market growth for Backtesting Tools. The use of advanced computation for the fast and accurate execution of trades is called algorithm trading or algo-trading. As this discipline continues to evolve, the need for advanced backtesting tools continues to increase. These tools are instrumental in assessing the historical performance of algorithmic trading strategies, pinpointing their weaknesses, and refining strategies to produce steady and profitable results.

Another constraint relates to the model assumptions employed in backtesting. Strategy backtesting employs historical performance data for evaluation, but the performance results obtained are only pertinent if the underlying assumptions for the building and testing of the strategies bear through. Any assumptions not borne in reality would inject bias and inaccuracies that mislead performance projections.

Despite these impediments, market opportunities are worth pursuing. One promising opportunity lies in integrating machine learning techniques into backtesting tools. Machine learning is capable of observing the intricacy of patterns and outliers on data that can be employed for better adaptability and performance of trading strategies. Machine learning-based strategies may thus utilize real-time information to alter their parameters and discern prediction insights, thus raising their precision and consistency to provide persistent returns across diverse market settings. However, the integration comes with its challenges, and cooperation among domain experts, quants, and data scientists will be required. The Backtesting Tools market is driven by the data availability, the growth of algorithmic trading, and restrained by overfitting and model assumptions.

MARKET SEGMENTATION

By Type

In financial analyses and investment procedures, Backtesting Tools are considered crucial. They help in assessing how well trading strategies and investment decisions can potentially work out. Looking into these market segmentations clarifies users' evolving trends and preferences.

By and large, Backtesting Tools permit investors and financial professionals to evaluate how well any particular strategy or model would have performed, had it been applied to historical data. Such a functionality is very vital in taking decisions since it helps to understand the relative strengths and weaknesses of different strategies.

The method of segmentation is paramount in all market studies. In the case of Backtesting Tools, we can identify two main categories: those used On-Premises and those offered Cloud-Based.

On-Premises Backtesting is defined as tools installed and working from a user's physical location with a market value of 142.7 million USD in 2025. A strong feeling of control and security arises since data and operations are managed in-house. Therefore, many users have preferred such a choice when data privacy is very important and when they want to customize the tool according to their own needs.

Contrastingly, the Cloud-Based segment was valued at 80.4 million USD in 2025. Web-based Backtesting Tools work with cloud infrastructure. Such tools can be accessed from anywhere via an Internet connection. They can accommodate data of ever-growing volume by scaling up or down. This flexibility has made these tools very popular among users who desire convenience and mobility.

The choice between the two segments transcends a proceeding of preference. Rather, it greatly depends on the set requirements of the user and his or her line of financial undertakings. Those who require direct control, having uncompromising standards on data security, generally favor On-premises tools. Meanwhile, those valuing flexibility and accessibility would likely find opportunities in Cloud-Based tools.

The segmentation of the Backtesting Tools market into On-premises and Cloud-Based tools emphasizes the varied requirements and priorities arising for users in the finance industry. As technology systems upscale, we can thus expect the further evolution of these segments to embrace novel trends and new demands in this ever-changing arena of financial analysis and investment strategies.

By Application

The Backtesting Tools Market is fast-changing and dynamic, depending on the varying needs and resources of different players. It is worthy of study by classifying users of backtesting tools into the two heads: Large Enterprises and Small and Medium Enterprises (SMEs).

Backtesting Tools Market has heavyweight players defining the segment called Large Enterprises. These are companies with huge resources and extensive operations, in a broader context- as they fall in this segment. In 2025, the Large Enterprises segment amounted to 152.2 USD Million. The above types of organizations usually apply complex financial analysis and strategy testing using backtesting tools.

The other one goes by the name of SMEs- that is Small and Medium Enterprises. These are agile and resourceful players, quickly adapting and changing with the market. The worth of SMEs in 2025 stood at 70.8 USD Million. SMEs employ backtesting tools on a smaller scale to study their strategies, manage risks, and improve the quality of decisions made.

Whether it is a Large Enterprise or an SME using backtesting tools, it depends on the particular requirements and capabilities of the business. It shows how flexible these tools can be to cover the most recent specific market needs.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$288.4 million |

|

Market Size by 2032 |

$602.1 Million |

|

Growth Rate from 2025 to 2032 |

10.9% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

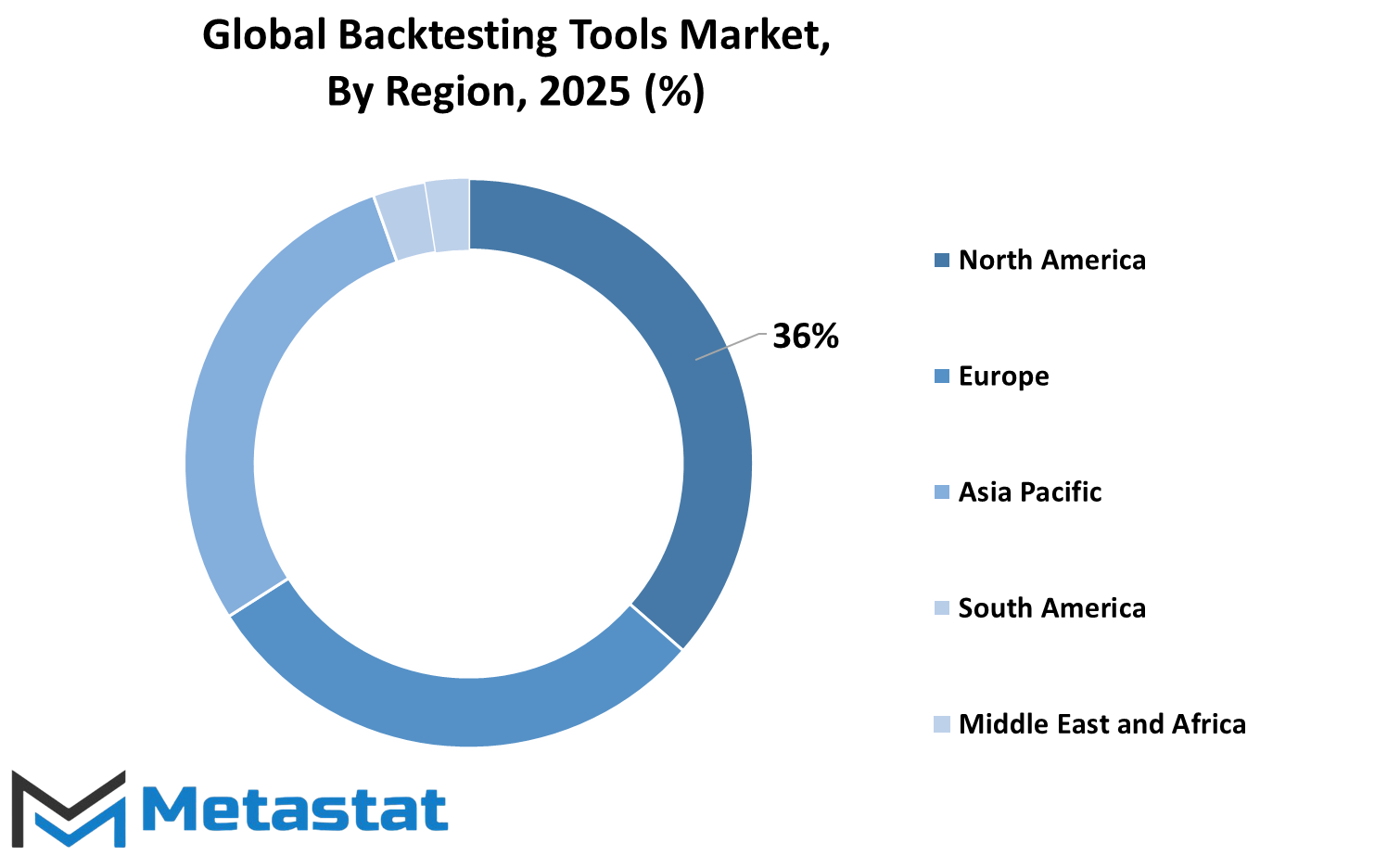

REGIONAL ANALYSIS

The global Backtesting Tools Market is an international bazaar, with North America and Europe being such important geographical section. The regions exude significant influence on market dynamics.

North America, including both US and Canada lies in very core part of Backtesting Tools Market. The area is so much booming with finance-from financial institutions through hedge funds and trading firms; thus, it's no surprise that this demand fuels needing backtesting tools. One also needs to develop their strategies and risk assessment, as well as make better decision-making. Regulatory frameworks in the region strengthen up the provision for such tools as well.

As economically strong regions, therefore, North America joins Europe, having the UK, Germany, and France, in saving a significant share in the Backtesting Tools Market. The size of the European financial sector continuously necessitated consumption for such tools. One would need such tools if one were in the very complicated and competitive nature of the European financial landscape.

North America and Europe are among dominant players in this global Backtesting Tools Market. The simple size and complexity of their financial sectors contribute to driving demand for these tools, attesting to their importance in the current processes of financial decision-making.

COMPETITIVE PLAYERS

The Backtesting Tools market is a dynamic and competitive landscape. Key players in the industry like Wyden AG and Allocate Smartly play a pivotal role in actually shaping its course. These players are not simply bodies; they are actual drivers of innovation and change in the market.

Wyden AG, for example, has gained prominence for its advanced-level backtesting solutions. With these backtesting tools, traders and financial professionals are able to simulate trading strategies and evaluate their historical performance. In empowering this method of evaluation, Wyden AG allows market participants to make informed decisions and improve their strategies further.

Allocate Smartly, on the other hand, is the second prominent player due to its data-oriented strategy. Its tools utilize historical market information to assess and optimize portfolio allocations. In addressing this very need, Allocate Smartly enables the investors to make sense of the financial market complexities.

These key players do not restrict themselves to providing backtesting tools; they foster growth in a domain where accuracy and reliability play major roles. Their contributions are geared toward standing in the way of strategy and decisions made by traders, investors, and financial institutions.

With advances in technology, the role of key players in the Backtesting Tools market becomes more and more crucial. They are the driving force behind the creation of new innovative solutions that are enhancing backtesting accuracy and efficiency, thus affecting the profitability and risk management of all those participating in financial markets.

In this ever-evolving environment, having organizations such as Wyden AG and Allocate Smartly only demonstrates their dedication to excellence and importance in determining the future of backtesting and its consequences on financial markets. Their tool is not a mere product; their tool is a catalyst for change, assisting individual and corporate transformation in response to the requirements of the financial industry.

Backtesting Tools Market Key Segments:

By Type

- On-premises

- Cloud Based

By Application

- Large Enterprises

- SMEs

Key Global Backtesting Tools Industry Players

- Wyden AG

- Allocate Smartly

- Alpha Architect

- AmiBroker.com

- Qontigo (AXIOMA)

- Build Alpha

- Central Limit Technologies

- Deltix

- Equities Lab, LLC

- Interactive Data Corporation (eSignal)

- Factor Research Limited

- FINVIZ.com

- FOREX CAPITAL MARKETS LIMITED

- Atreidian LLC

- MCT LIMITED

- NinjaTrader

- Portfolio123

- Price Action Lab

- Quant Connect

- SmartQuant

- StrategyQuant

- Tickblaze LLC.

- TradeStation Group

- Trading Blox

- Quantacula, LLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383