Global Avermectin Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global avermectin market experienced and its industry got this due to a scientific discovery that revolutionized the control of agricultural pests and parasites. The saga started in the 70s when the researchers were able to get the natural compounds from the soil bacterium found in Japan. Eventually, they were even able to use these compounds to control parasites without damaging the environment, the main drawback of the toxic chemicals. The loudest signal, among many, the discovery set off years of trials, thus leading to the development of products based on the new, chemical-free, and environmentally safe compounds that came to be popularly known as, 'avermectin.' The products that got the go-ahead for commercial use was a great relief to the farmers and veterinarians who were now equipped with a tool that worked effectively in controlling obstinate pests and parasites with the application being only minimal.

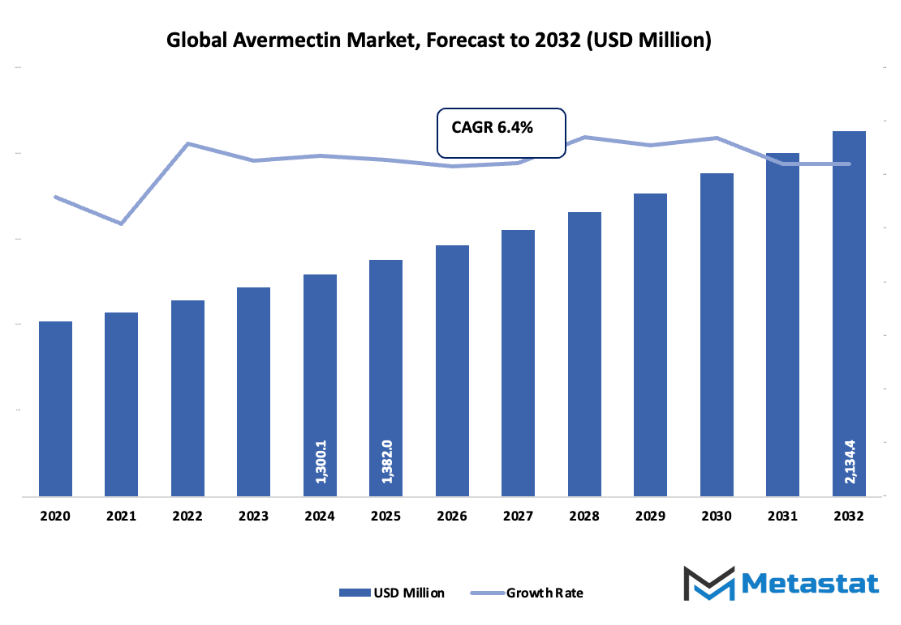

- The global avermectin market is projected to be valued at around USD 1,382 million in 2025, growing at a compound annual growth rate (CAGR) of about 6.4% through 2032, with a possibility of exceeding USD 2,134.4 million.

- Abamectin’s market share is around 37.2%, which is helping to push the innovation along with the expansion of the applications through the intense research.

- The major trends that led to growth were the increased demand for avermectin-based insecticides and antiparasitic drugs in both livestock and crops protection, as well as the rise in awareness regarding animal health and vector-borne disease control in certain developing areas.

- The opportunities comprise the rising production of bio-based and eco-friendly avermectin derivatives for sustainable pest management.

- Market Insight: The market is projected to experience a ten-fold increase in value over the next decade, thus marking the significant growth potential.

Demand instantly shot up, as soon as pretty much all the extensive farming areas started the transition to treatments that gave high results with low residue. Temporarily, the pest control methods caused contamination of the soil, thus introducing long-term damage, and hence users began to search for something that could cut down soil contamination to a minimum. Avermectin was the solution. The companies invested a considerable amount of money in improving the quality of the product and the patents that were deposited formed the first industrial zoe. The slaughter of the industry included the approval of avermectin for veterinary medicine followed by its use in crops, which led to the opening of the worldwide market.

Eventually, the changing expectations forced the market to innovate advanced. The farmers wanted products that could seamlessly integrate with the modern irrigation systems and precision farming tools. The manufacturers came up with the following: the products are more easily dissolved, stable during transportation, and precise application using spray technology sources. On the other hand, more and more attention to food safety persuaded the authorities to set strict limits on residues and to enforce rules for handling. The regulations didn't impact the industry negatively; instead, they helped to build trust and they also compelled the producers to improve their testing standards.

The global avermectin market is still advancing towards efficiency and transparency. The companies will pay attention to synthesis methods that are more environmentally friendly and to packaging that is aimed at waste reduction. As digital monitoring becomes more common in agriculture, users will rely on data to determine the optimal timing and dosage. Research teams will search for variants that are stronger but still safe and which will be effective against insects that have developed a resistance. The route from a single soil sample taken in a Japanese field to a widely accepted agricultural solution is indicative of how science, customer needs, and regulations can influence the entire industry.

Market Segments

The global avermectin market is mainly classified based on Product Type, Formulation, Application, Distribution Channel.

By Product Type is further segmented into:

- Abamectin: Abamectin's steady position is backed by the needs of agriculture and pest control in the global avermectin market. Abamectin is very effective against insects and mites, assisting the agricultural community in safeguarding crops and getting higher returns. Continuous application fosters expansion as several areas look for reliable products that not only ensure the safety of crops but also minimize losses caused by pest infestation.

- Ivermectin: Ivermectin is a product of great value because of its broad use in different health-related areas. The frequent demand is from the parasite control products that are used in medical applications and animal care. The high acceptance is the cause of the steady increase in sales as more areas take up the use of parasite control treatments. The product still continues to receive support from organizations that are looking for effective and reliable solutions.

- Emamectin Benzoate: Emamectin Benzoate has an excellent performance in controlling harmful insects in agriculture. Its long-lasting protection and reliable performance make it the choice of many crop manager. The high demand is coming from the fruit and vegetable fields where the strong pest activity is capable of reducing the output. Continuous usage not only reduces the total damage but also supports healthier production and thus good yield.

- Doramectin: Being a strong demand among veterinarians, Doramectin is extensively used in animal health care and parasite control. The quickly that comes from farms and veterinarians’ livestock wellness support is what makes them depend on the product. The parasite control the product has a reliable action leads to the steady presence of the product in the professional care setting. The use of Doramectin maintains the herds' health, which in turn supports the farmers’ stronger output.

- Others (Selamectin, Eprinomectin): Selamectin and Eprinomectin support specialized uses in animal care. These products target specific parasite problems and are often preferred for pets or dairy animals where clean and safe treatment is required. Growing attention to pet wellness and farm productivity leads to continued interest in these focused product options.

By Formulation the market is divided into:

- Injectables: The fast delivery of injectable formulations and the reliable results they provide at controlled doses are the main factors that make them popular in professional environments which require steady performance. Not only does controlled dosing minimize waste, but it also assists in better management systems. The frequent use of injectables in animals is one of the key factors contributing to the growth of this formulation segment.

- Oral Tablets: Oral tablets are the simplest form of medication together with their dosing being the easiest and transport being the easiest as well. Accurate treatment is allowed through clear measurements and at the same time it is supported the steady use of drug in both medical and animal care settings. The involvement of convenience in this case is a further push in promoting the use of these drugs in areas that lack proper medical equipment, making tablets valuable to routine programs that are aimed at supporting health and diminishing parasite impacts.

- Topical Preparations: Targeted areas receive direct contact action from topical preparations. The use of topical products frequently prevents stress and allows treatment without the need for swallowing or injections. The simple application of these products helps to encourage the supporting care routines especially in places where gentle handling is needed. Many caregiver support groups value products that simplify the process and provide direct surface treatment.

- Oral Solutions: Oral solutions are the most flexible and easy-to-adjust forms of medication as far as dosing is concerned. The liquid form supports fast absorption and also helps the providers to manage the treatment of wider groups. This option is suitable for large-scale programs where time and accuracy are crucial. Consistency in performance leads to steady demand for this format.

By Application the market is further divided into:

- Agriculture: Agriculture groups rely on these products to protect crops from insects and reduce harvest loss. Reliable pest control supports stronger yields and reduces pressure on farming resources. Consistent usage helps manage harmful activity across large farming areas and encourages stable food production cycles.

- Veterinary: Veterinary usage focuses on parasite control in livestock and companion animals. Added value comes from healthier animals and improved productivity on farms. Dependable treatment helps reduce disease spread and improves overall care standards within farms and clinics, supporting strong adoption of these solutions.

- Pharmaceuticals: Pharmaceutical usage centers on parasite control and related health treatments. Research groups continue to study improved applications and safer dosing systems. Controlled treatment supports public health goals and encourages responsible treatment programs used by medical facilities around the world.

- Others: Other uses include specialty fields that require focused pest or parasite management. These needs can appear in research centers, wildlife care, or niche farming activities. Flexibility in product selection allows tailored treatment programs, supporting steady interest across smaller but meaningful user groups.

By Distribution Channel the global avermectin market is divided as:

- Direct Sales: Direct sales support stronger price control and clear communication. Producers present product details, give technical support, and secure steady demand from farms or agro-based firms. Faster feedback encourages better planning for stock and production. Direct interaction also reduces extra costs from multiple middle steps, helping buyers receive fresh supply with dependable delivery windows.

- Distributors: Distributors act as regional connectors, moving supply toward wider geographic zones. A distributor builds storage hubs, manages transport, and works with farming supply shops. This method reduces workload for producers and offers consistent product access even in remote farming areas. Strong distributor networks strengthen long-term market presence and stable sales flow.

- Online Retail: Online retail gives easy ordering and wider price comparison through digital platforms. Order placement, secure payment, and delivery tracking happen without travel. Digital stores allow smaller farms to buy needed quantity without bulk commitments. Online channels also raise visibility by listing product details, reviews, and safety information, helping buyers feel confident during selection.

- Others: Other sales routes include farm cooperatives, agricultural fairs, and trade events. Cooperatives collect orders from multiple small buyers, forming stronger negotiation strength. Trade events create direct interaction between product experts and buyers, supporting awareness of product benefits. These additional routes strengthen overall access and help maintain steady product movement across regions.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1382 Million |

|

Market Size by 2032 |

$2134.4 Million |

|

Growth Rate from 2025 to 2032 |

6.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

- Based on geography, the global avermectin market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising demand for avermectin-based insecticides and antiparasitic drugs in livestock and crop protection:

Higher use of avermectin-based insecticides and antiparasitic drugs supports healthier harvests and stronger livestock productivity. Many farmers focus on solutions that lower pest pressure while supporting steady crop output. Continuous buying activity creates steady progress for the global avermectin market, encouraging better product availability and consistent commercial interest.

- Increasing awareness of animal health and vector-borne disease control in developing regions:

Greater attention toward animal wellness and disease prevention encourages regular use of treatments that block parasite spread. Communities in developing regions adopt structured management plans for farms and grazing areas. Stronger education around pest control encourages constant demand for avermectin-based applications, supporting healthier food supply systems.

Challenges and Opportunities

- Regulatory limitations on chemical pesticide use in some agricultural markets:

Legal restrictions on chemical pesticide usage guide producers toward stricter safety requirements. Agricultural markets follow controlled application standards to protect soil quality, water sources, and consumer safety. Such regulations slow product expansion, yet also motivate manufacturers to refine formulas to satisfy compliance expectations and remain active in competitive agriculture spaces.

- Emergence of pest resistance reducing long-term efficacy of avermectin formulations:

Repeated use of identical formulations increases the chance of reduced product strength. Certain pest groups adjust over time, lowering the effectiveness of treatments. Reduced performance generates uncertainty for agricultural investments and demands fresh research to maintain strong pest control outcomes across different regions and farming systems.

Opportunities

Growing development of bio-based and environmentally safe avermectin derivatives for sustainable pest management:

Research groups and producers explore alternatives that support soil health and ecological balance. Bio-based variations encourage safer farming practices and reduce harmful residue. Environmentally considerate solutions appeal to growers seeking reliable pest control while maintaining natural diversity, guiding market progress toward cleaner commercial production strategies.

Competitive Landscape & Strategic Insights

The global avermectin market includes a combination of long-established multinational corporations and newly emerging regional players. This structure creates a competitive environment where both experience and innovation influence growth. International companies bring decades of research, advanced technology, and well-established distribution networks, allowing them to maintain a strong presence in several countries. At the same time, regional producers contribute through cost-efficient production and specialized products designed for local agricultural conditions. Together, these forces shape the continuous expansion and diversification of the market.

Major participants include Syngenta AG, Sumitomo Chemical Co., Ltd., FMC Corporation, Nufarm Limited, Zhejiang Hisun Chemical Co., Ltd., Hebei Veyong Bio-Chemical Co., Ltd., Shandong Qilu King-Phar Pharmaceutical Co., Ltd., Merck & Co., Inc., Shandong Sino-Agri United Biotechnology Co., Ltd., Hailir Pesticides and Chemicals Group Co., Ltd., Rotam CropSciences Ltd., and Hangzhou Tianlong Biotechnology Co., Ltd. Each of these organizations contributes differently to market development. Some concentrate on developing more effective and environmentally safe formulations, while others invest in expanding production capacity and improving supply chain efficiency. This combination of strategies supports a balance between innovation and accessibility.

Market size is forecast to rise from USD 1382 million in 2025 to over USD 2134.4 million by 2032. Avermectin will maintain dominance but face growing competition from emerging formats.

The global demand for Avermectin continues to increase due to the need for effective pest control solutions that support higher agricultural productivity. Advances in biotechnology, along with stricter environmental regulations, encourage producers to create safer and more sustainable products. Market expansion in regions such as Asia-Pacific and Latin America shows growing agricultural activity and rising awareness of crop protection benefits. Continuous collaboration between global and local enterprises strengthens the overall structure of the market, ensuring that both quality and availability meet international standards. As competition remains strong, the focus on product improvement, sustainable manufacturing, and strategic partnerships will guide the future direction of the Avermectin industry.

Report Coverage

This research report categorizes the global avermectin market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global avermectin market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global avermectin market.

Avermectin Market Key Segments:

By Product Type

- Abamectin

- Ivermectin

- Emamectin Benzoate

- Doramectin

- Others (Selamectin, Eprinomectin)

By Formulation

- Injectables

- Oral Tablets

- Topical Preparations

- Oral Solutions

By Application

- Agriculture

- Veterinary

- Pharmaceuticals

- Others

By Distribution Channel

- Direct Sales

- Distributors

- Online Retail

- Others

Key Global Avermectin Industry Players

- Syngenta AG

- Sumitomo Chemical Co., Ltd.

- FMC Corporation

- Nufarm Limited

- Zhejiang Hisun Chemical Co., Ltd.

- Hebei Veyong Bio-Chemical Co., Ltd.

- Shandong Qilu King-Phar Pharmaceutical Co., Ltd.

- Merck & Co., Inc.

- Shandong Sino-Agri United Biotechnology Co., Ltd.

- Hailir Pesticides and Chemicals Group Co.Ltd

- Rotam CropSciences Ltd.

- Hangzhou Tianlong Biotechnology Co., Ltd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252