MARKET OVERVIEW

The global autosar middleware market is leading the transformation of the auto industry by transforming how software elements are integrated into new automobiles. AUTOSAR, or Automotive Open System Architecture, has been the foundation for a deep transformation of how automotive software is developed, deployed, and serviced. The following essay explores the key facets of the global autosar middleware market, and its contribution to the auto industry.

AUTOSAR Middleware, being a vital issue of car software programs, is a standard framework that permits automakers to integrate software components across special providers in a continuing manner. The framework allows automakers to create software systems that can be customized without problems for use in numerous automobile fashions, promoting more performance, flexibility, and interoperability. It's well worth citing that this recreation-converting middleware is not just for passenger cars; it branches out into commercial, business, and even nascent electric and self-sufficient vehicle segments.

The global autosar middleware market is an open ecosystem that brings collectively software program providers, automakers, and Tier 1 providers to coordinate their software program additives. Unlike the conventional closed automobile software development, which tended to be inflexible, AUTOSAR Middleware promotes a collaborative technique. This has resulted in saving lots of prices in development, improving software pleasant, and, most importantly, shorter time-to-marketplace.

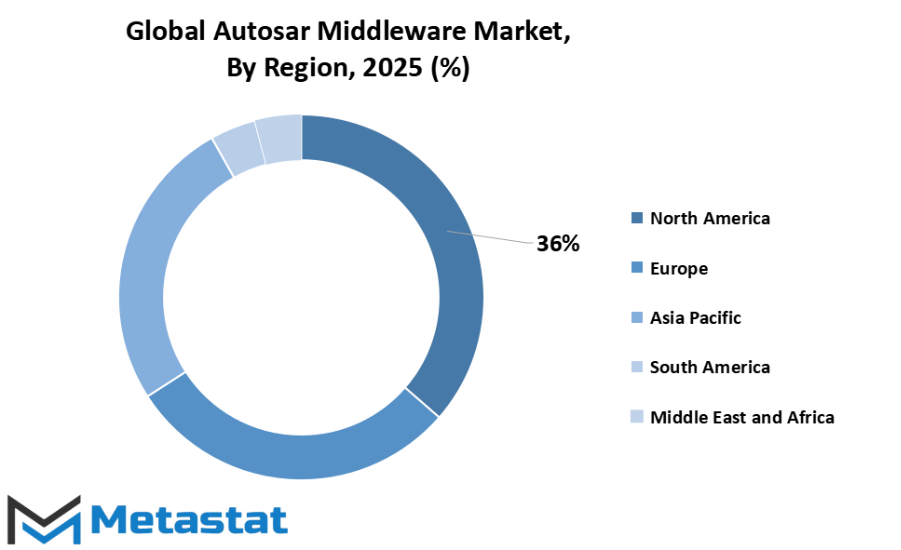

AUTOSAR Middleware is not constrained to at least one geographical location; it reaches throughout borders, representing a globally dispersed presence. Established car markets like North America, Europe, and Asia have embraced this revolution, and the marketplace keeps to grow in areas in which automobile industries are converting.

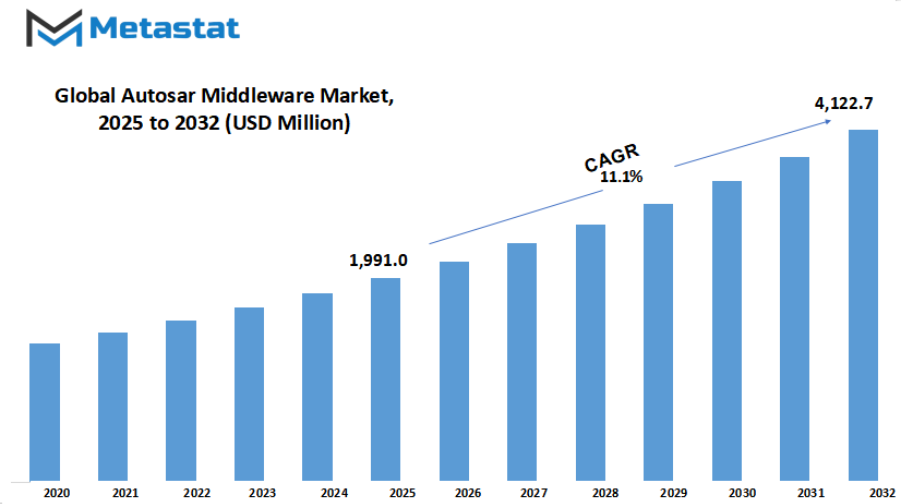

Global autosar middleware market is estimated to reach $4,122.7 Million by 2032; growing at a CAGR of 11.1% from 2025 to 2032.

GROWTH FACTORS

The global autosar middleware market is seeing expanded complexity bobbing up from the increase of electrical and self-reliant cars, which calls for sophisticated software program structure to address communication, manage, and protection. To meet this, a software general framework, like Autosar middleware, is important. Such an era permits scalable, reusable, and interoperable software components to be created, which makes integration across specific car systems less complicated.

Autosar middleware plays the key position inside the implementation of functionalities together with advanced driver assistance structures, infotainment, and powertrain controls, addressing the industry's necessities of performance, price financial savings, and protection improvements. The boom of global autosar middleware market is prompted by means of the growing demand for independent and related cars. Such vehicles need complex software systems for real-time communication, data handling, and decision-making. Autosar middleware contributes importantly to making these possible, offering an industry-standard framework for their development and integration in vehicles.

Nevertheless, though it has advantages, its growth is hindered by challenges. Development expenses are high and the integration of Autosar middleware into current automotive systems comes with great difficulties. It demands huge changes in software, hardware, and system architecture, which increase product prices and add technical complexities for auto manufacturers to handle.

Another issue is achieving backward compatibility and consistency across various software versions and components. With the lifecycle of vehicles being longer, maintaining compatibility with earlier software and hardware versions becomes complicated and expensive. Maintaining consistency between various software versions and components poses additional issues, affecting performance and reliability.

In spite of these limitations, there are opportunities in the growing demand for electric vehicles and advanced driver assistance systems, driving the demand for Autosar middleware. With the future of the industry moving towards electric vehicles and ADAS, implementation of standardized software frameworks becomes more and more vital for development, promising opportunities for the growth of the global autosar middleware market.

MARKET SEGMENTATION

By Type

The global autosar middleware market is a diverse landscape with different segments, each adding to the big picture. One of them is segmentation on the basis of Autosar Middleware component types. Here, the two main segments are Autosar CP and Autosar AP.

Autosar CP, or Autosar Classic Platform, occupied a large market value of 1,107.6 USD Million in 2025. It's a mature and established solution to Autosar Middleware, providing a number of standardized software building blocks for automotive use. It's stable and reliable, so it's the go-to choice for most in the auto sector.

However, Autosar AP, referring to Autosar Adaptive Platform, was valued at 883.4 USD Million in 2025. This segment is a more flexible and responsive way of Autosar Middleware. It is specifically tailored to fulfill the needs of today's highly complex automotive systems. Autosar AP provides more customization scope and is ideally suited for applications requiring a higher level of flexibility and scalability.

Autosar CP and Autosar AP both fulfill crucial functions in the global autosar middleware market. Autosar CP offers a robust platform upon which most conventional automotive systems are built, providing guarantees of reliability and efficiency in their operation. Autosar AP, on the other hand, responds to the continuously increasing need for more versatile and advanced automotive solutions, particularly in light of upcoming technologies such as autonomous driving and high-level driver assistance systems.

The values of these segments in 2025 are representative of the Automotive industry's varied requirements. While Autosar CP continues to be relevant in legacy automotive systems, Autosar AP is increasingly growing as a result of the Automotive industry's requirement for innovation and responsiveness towards emerging technology advancements. With the Automotive industry further changing, these segments are likely to continue to adapt and grow to address the needs of the future.

By Application

The global autosar middleware market is approximately the usage of its era, and two most important segments under it are the Passenger Vehicle and Commercial Vehicle segments. In 2025, the valuation for the Passenger Vehicle phase changed into 1,196.6 USD Million, while the Commercial Vehicle section was worth 794.4 USD Million.

The Passenger Vehicle phase is a major contributor to the global autosar middleware market. It spans a wide style of vehicles supposed for non-public use. Examples of such vehicles encompass sedans, hatchbacks, SUVs, and sports vehicles. However, the Commercial Vehicle phase also contributes in its own way. This segment covers business motors like vehicles, buses, vans, and one of a kind heavy-duty carriers.

Both Passenger Vehicle and Commercial Vehicle segments have a vital position to play in defining the global autosar middleware market. They affect the discovery and utilization of Autosar Middleware technology primarily based on their particular necessities and needs. The Passenger Vehicle section pursuits to improve the patron level in and safety components, while the Commercial Vehicle segment emphasizes efficiency, logistics, and adherence to industry requirements.

The dynamics of the marketplace are pushed via the unique needs and tastes of these segments. As generation evolves, both segments are expected to in addition include Autosar Middleware solutions into their motors in an effort to address changing client and industry requirements.

The global autosar middleware market is differentiated into the Passenger Vehicle and Commercial Vehicle segments. These segments, with their respective demands and packages, play a critical function within the ordinary boom and improvement of the market. With continuous technological advancements, their significance in figuring out the destiny of the global autosar middleware market can best increase.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,991.0 million |

|

Market Size by 2032 |

$4,122.7 Million |

|

Growth Rate from 2025 to 2032 |

11.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global autosar middleware market has gained importance as industries more and more rely upon software-pushed structures for motors. This middleware acts because the spine for automotive packages, making sure compatibility and easy conversation between hardware and software additives. With the increase of advanced driving force help systems, electric cars, and linked car technologies, the call for standardized software program systems will best maintain to increase. Automakers and era providers are turning to Autosar Middleware as a basis for more secure, smarter, and extra green cars.

Based on geography, the market spreads across special areas, each contributing to its growth in particular ways. North America, with the U.S., Canada, and Mexico, has been a strong participant due to its early adoption of advanced automobile technology and the presence of main car manufacturers. Europe, which includes international locations including the UK, Germany, France, and Italy, has long been a hub for innovation in automobile protection and sustainability. Strong regulatory frameworks inside the vicinity will encourage wider adoption of Autosar requirements, growing opportunities for collaboration among automakers and software program builders.

In Asia-Pacific, markets together with India, China, Japan, and South Korea are witnessing speedy transformation inside the automobile zone. Rising investments in electric mobility, sturdy government assist, and a developing urge for food for linked vehicles are fueling the call for middleware solutions. This location is predicted to play a huge position in shaping the marketplace’s destiny, as each set up automakers and rising groups work in the direction of introducing cost-effective yet technologically advanced cars. South America, led through Brazil and Argentina, is gradually embracing the shift, with automakers exploring Autosar adoption to stay competitive and aligned with international tendencies.

The Middle East & Africa, with countries inclusive of the ones in the GCC, Egypt, and South Africa, is also starting to show progress in adopting these systems. While the vicinity continues to be in its early degrees of deployment, the increasing push closer to smarter infrastructure and modern mobility will encourage regular growth. Each of those geographic areas has its personal demanding situations and opportunities, however collectively they shape the muse for a market so one can keep increasing as motors turn out to be extra software program-defined and interconnected.

COMPETITIVE PLAYERS

The global autosar middleware market is a fast-evolving and dynamic market in the automotive sector. Autosar Middleware acts as a linchpin for the operation of contemporary cars, allowing multiple electronic control units (ECUs) to exchange information and coordinate successfully. The essay discusses major players in the global autosar middleware market, highlighting the importance and influence of such players. Autosar stands for Automotive Open System Architecture, and it is a standard software framework that makes developing ECUs within cars easier. It offers an open platform where automakers and suppliers can collaborate, eliminating the heterogeneities that come with varied hardware and software environments. Here, important players in the Autosar Middleware industry such as Vector Informatik GmbH and ETA are notable contributors to the establishment and implementation of Autosar standards. Vector Informatik GmbH is a leading brand in automotive electronics and software. They focus on creating software components and tools for Autosar. Automakers and suppliers use their products extensively to design, develop, and test ECUs. Vector Informatik's Autosar Middleware expertise makes it very easy to integrate software components in vehicles for optimal performance and reliability.

ETA, another prominent contributor, provides software solutions specifically developed to support the Autosar standard. Their software is specifically designed to make software development and ECUs implementation compatible with Autosar specifications. ETA's efforts provide effortless integration of software in various vehicle systems, with the aim of ensuring compatibility and performance.

The work of these influential players involves more than making software solutions available. They become pro-active players in forging the Autosar standards' future, contributing to joint ventures aimed at developing and perfecting the framework. Such cooperation is critical in a field where compatibility and interoperability become the defining factors.

The importance of these industry leaders in the global autosar middleware market cannot be understated. Their efforts make it easier to develop and apply Autosar standards, spurring innovation and streamlining the auto industry. As the market matures, their knowledge and dedication to quality will continue to be needed to advance the market and keep Autosar Middleware thriving.

Autosar Middleware Market Key Segments:

By Type

- Autorsar CP

- Autorsar AP

By Application

- Passenger Vehicle

- Commercial Vehicle

Key Global Autosar Middleware Industry Players

- Vector Informatik GmbH

- ETAS

- Elektrobit Automotive GmbH

- Neusoft Reach Automotive Technology (Shanghai) Co., Ltd.

- Green Hills Software LLC

- Embitel Technologies (I) Pvt. Ltd.

- KPIT Technologies Ltd.

- Siemens Digital Industries Software

- Validas AG

- Acsia Technologies

- Avelabs LLC

- BASICWORX ENGINEERING GmbH

- easycore GmbH

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252