MARKET OVERVIEW

The Global Automotive Wheels market stands as a cornerstone within the automotive industry, an integral component that ensures the smooth functionality and aesthetic appeal of vehicles worldwide. This market encompasses a wide array of wheels designed to cater to diverse vehicle types, from passenger cars to commercial vehicles, and even specialty vehicles like off-road trucks and high-performance sports cars.

As technology continues to advance, the automotive wheels market is poised for significant transformation. Manufacturers are increasingly leveraging innovative materials and manufacturing techniques to produce wheels that are not only lighter and stronger but also more visually striking. Carbon fiber, aluminum alloys, and even advanced composite materials are gaining traction, offering benefits such as enhanced fuel efficiency, improved performance, and greater durability.

Moreover, the advent of electric vehicles (EVs) is reshaping the landscape of the automotive industry, including the wheels market. With the growing demand for EVs, manufacturers are designing wheels specifically tailored to meet the unique requirements of electric propulsion systems. These wheels often prioritize efficiency and aerodynamics, contributing to extended range and optimized performance.

In addition to material advancements, the automotive wheels market is witnessing innovations in design and customization. Consumers are increasingly seeking wheels that not only complement the overall aesthetics of their vehicles but also reflect their individual style preferences. As a result, manufacturers are offering a wide range of designs, finishes, and sizes, allowing customers to personalize their vehicles to a greater extent.

Furthermore, the global automotive wheels market is experiencing a shift towards sustainability and eco-friendliness. With increasing concerns about environmental impact, manufacturers are exploring eco-conscious materials and manufacturing processes to reduce carbon footprint. Recycled aluminum, for instance, is gaining popularity as a sustainable alternative to traditional materials, offering both environmental benefits and performance advantages.

The rise of autonomous vehicles represents another significant trend shaping the future of the automotive wheels market. As autonomous technology advances, vehicle designs are evolving to accommodate new functionalities and requirements. This includes the development of wheels optimized for autonomous driving, with features such as integrated sensors and advanced connectivity capabilities.

Looking ahead, the global automotive wheels market is poised for continued growth and innovation. Advancements in materials, design, and technology will drive the evolution of wheels, catering to the changing needs and preferences of consumers. From lightweight and aerodynamic wheels for EVs to customizable designs for personalization enthusiasts, the market will continue to diversify and adapt to meet the demands of an ever-evolving automotive industry.

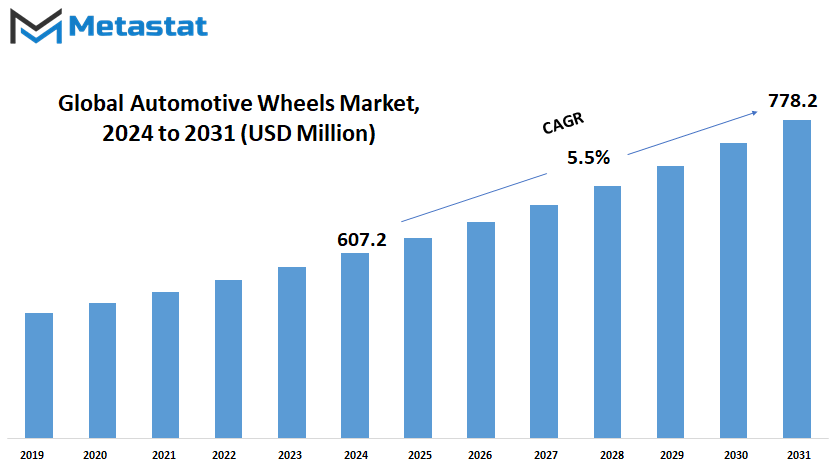

Global Automotive Wheels market is estimated to reach $778.2 Million by 2031; growing at a CAGR of 5.5% from 2024 to 2031.

GROWTH FACTORS

In the ever-changing landscape of the automotive industry, the Global Automotive Wheels market is poised for significant growth in the foreseeable future. Several key factors will shape the trajectory of this market, influencing both its expansion and potential constraints.

One of the primary drivers propelling the growth of the Global Automotive Wheels market is the escalating demand for lightweight and fuel-efficient vehicles. As consumers increasingly prioritize environmental sustainability and fuel economy, automakers are compelled to develop vehicles that are not only efficient but also lighter in weight. This shift in consumer preferences towards eco-friendly options will undoubtedly fuel the demand for automotive wheels that are both durable and lightweight.

Moreover, the continuous growth in automotive production and sales on a global scale will further contribute to the expansion of the market. As emerging markets continue to witness a rise in disposable income and urbanization, the demand for automobiles is expected to soar. This surge in demand will consequently lead to an increased need for automotive wheels, thereby driving market growth.

However, despite the promising outlook, the market is not without its challenges. Fluctuating raw material prices, particularly those of steel and aluminum, present a significant hurdle for wheel manufacturers. The volatility in raw material costs can directly impact production costs, thereby affecting profit margins and pricing strategies. Additionally, the intense competition among wheel manufacturers exerts pressure on prices, potentially restraining market growth.

Nevertheless, amidst these challenges lie opportunities for innovation and advancement. The adoption of advanced manufacturing technologies, such as 3D printing, presents a promising avenue for the market. By leveraging these technologies, manufacturers can produce customized and lightweight wheels more efficiently, catering to the evolving needs of consumers. This technological advancement not only enhances product quality but also opens up new avenues for revenue generation in the market.

The Global Automotive Wheels market is poised for growth, driven by factors such as the increasing demand for lightweight and fuel-efficient vehicles and the continuous expansion of automotive production and sales globally. However, challenges such as fluctuating raw material prices and intense competition pose potential constraints. Nevertheless, the adoption of advanced manufacturing technologies presents lucrative opportunities for market players, promising a dynamic and prosperous future for the automotive wheels market.

MARKET SEGMENTATION

By Rim Size

The automotive industry is an ever-changing landscape, continuously adapting to new technologies, consumer preferences, and market dynamics. One of the key components of a vehicle, the wheels, plays a crucial role not only in its aesthetics but also in its performance and safety. As the global automotive market continues to expand, the demand for wheels of various sizes is also on the rise.

The Global Automotive Wheels market, categorized by rim size, encompasses a wide range of options to cater to the diverse needs of consumers. Rim sizes are further segmented into 13-15 inches, 16-18 inches, 19-21 inches, and more than 21 inches. Each segment caters to different types of vehicles, from compact cars to SUVs and trucks, offering manufacturers the flexibility to design and produce wheels that suit various vehicle types and applications.

The choice of rim size not only affects the appearance of a vehicle but also its performance characteristics. Smaller rim sizes are often preferred for compact cars and city driving due to their lighter weight, which can improve fuel efficiency and handling. On the other hand, larger rim sizes are favored for performance vehicles and SUVs, as they can accommodate larger brake systems and provide better traction and stability, especially at higher speeds.

In the coming years, several factors will influence the growth and direction of the Global Automotive Wheels market. Technological advancements, such as the development of lightweight materials and advanced manufacturing techniques, will enable manufacturers to produce wheels that are not only stronger and more durable but also more fuel-efficient. Additionally, the growing popularity of electric vehicles (EVs) will create new opportunities for wheel manufacturers, as EVs often require specialized wheels to accommodate their unique powertrains and weight distribution.

Moreover, changing consumer preferences and lifestyle trends will also play a significant role in shaping the future of the automotive wheels market. As consumers become more conscious of environmental issues and seek vehicles with lower carbon footprints, there will be a growing demand for eco-friendly materials and sustainable manufacturing practices in the production of automotive wheels. Furthermore, the rise of autonomous vehicles and shared mobility services will create new challenges and opportunities for wheel manufacturers, as these vehicles may have different design requirements and usage patterns compared to traditional passenger cars.

The Global Automotive Wheels market is poised for continued growth and innovation in the coming years. With advancements in technology, changes in consumer preferences, and the emergence of new trends in the automotive industry, manufacturers will need to adapt and evolve to meet the evolving needs of the market. By staying ahead of these trends and embracing new opportunities, the automotive wheels market will continue to thrive in the future.

By Material Type

In the landscape of the automotive industry, the market for wheels plays a pivotal role. Wheels, those circular components that facilitate the movement of vehicles, have evolved significantly over time, both in terms of materials used and design. As we peer into the future, it becomes evident that several factors will shape the trajectory of the global automotive wheels market.

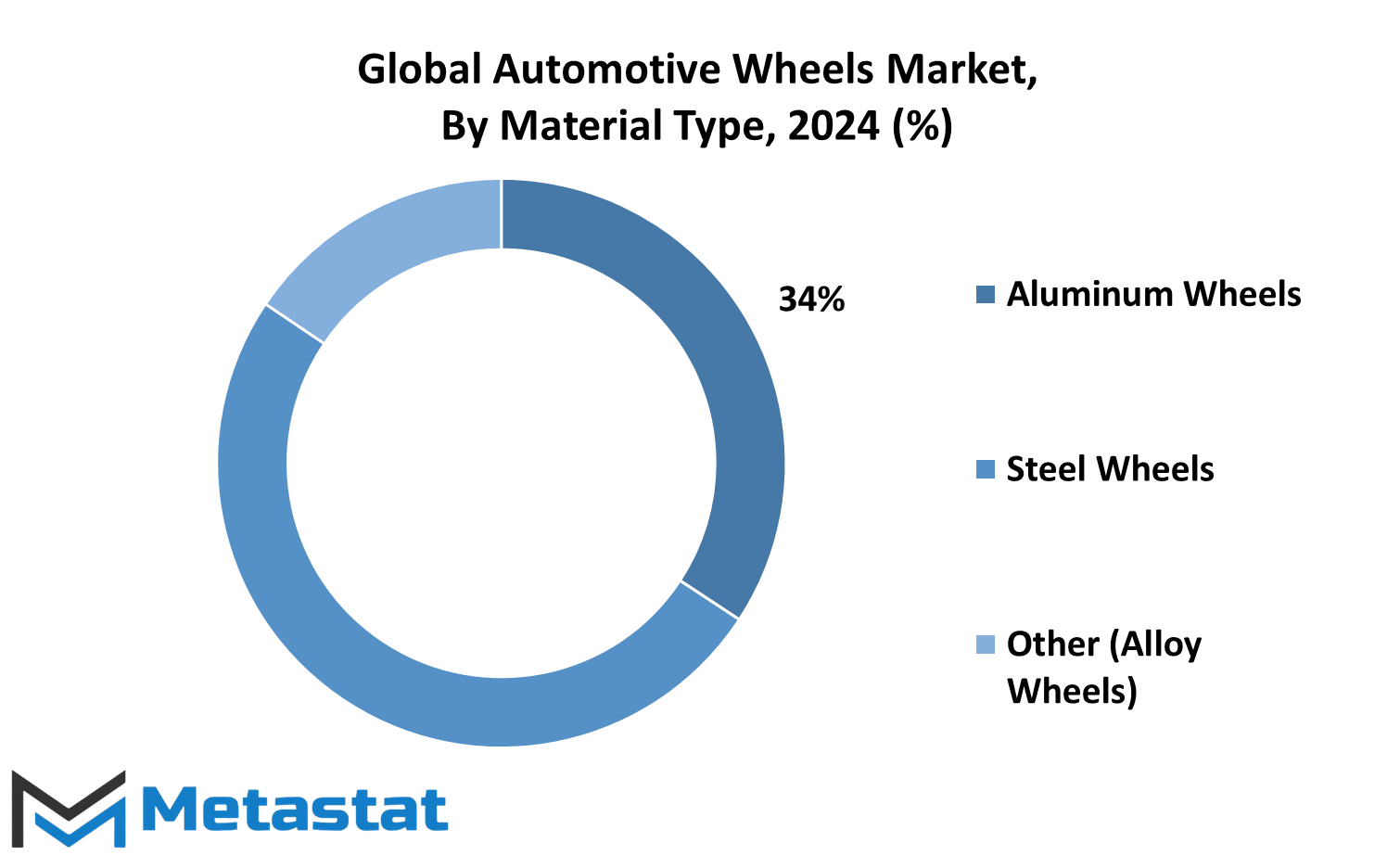

One of the primary factors influencing this market is the material used in wheel manufacturing. Currently, the market is segmented based on material type, with steel, alloy, and others being the primary categories. Steel wheels have long been a staple in the industry, known for their durability and affordability. However, with advancements in technology and consumer preferences shifting towards lighter and more aesthetically pleasing options, alloy wheels have gained considerable traction. Their lightweight nature not only enhances vehicle performance but also improves fuel efficiency, a crucial factor in an era where sustainability is paramount.

Looking ahead, it is anticipated that alloy wheels will continue to dominate the market, fueled by ongoing innovations in material science and manufacturing processes. The demand for alloy wheels will be further propelled by their ability to enhance the overall aesthetics of vehicles, appealing to a broader range of consumers.

However, it's essential to recognize that other materials, categorized under 'Others,' will also play a role in shaping the market landscape. These materials may include carbon fiber, magnesium, or even emerging materials yet to be fully explored. While they may currently represent a smaller segment of the market, advancements in technology and a growing emphasis on performance and sustainability may lead to their increased adoption in the future.

By Vehicle Type

The global automotive wheels market is a dynamic arena, influenced by various factors that shape its growth trajectory. One crucial determinant of its future trajectory is the segmentation based on vehicle types, which includes heavy commercial vehicles, light commercial vehicles, and passenger vehicles.

Each segment plays a distinct role in driving the market forward. Heavy commercial vehicles, characterized by their robust build and capacity for carrying heavy loads, will continue to be a significant contributor to market expansion. As global trade and industrial activities surge, the demand for heavy commercial vehicles will rise in tandem, bolstering the demand for automotive wheels tailored to withstand heavy-duty usage.

Light commercial vehicles, on the other hand, cater to a diverse range of applications, from urban logistics to last-mile delivery services. With the burgeoning e-commerce sector and increasing urbanization, the need for efficient transportation solutions will amplify, propelling the demand for light commercial vehicles and consequently, automotive wheels designed for agility and durability.

Passenger vehicles, comprising cars, SUVs, and other personal transportation vehicles, represent the largest segment in terms of volume. The proliferation of urbanization, rising disposable incomes, and improving road infrastructure across emerging economies will fuel the demand for passenger vehicles. Consequently, the automotive wheels market will witness a surge in demand for wheels that offer not only aesthetic appeal but also enhanced performance and safety features.

However, while these factors indicate a promising growth trajectory for the global automotive wheels market, several challenges loom on the horizon that could potentially restrain its expansion. One such challenge is the volatility in raw material prices, particularly steel and aluminum, which are essential constituents of automotive wheels. Fluctuations in raw material costs can directly impact production costs, thereby affecting market dynamics.

Moreover, stringent regulatory frameworks aimed at curbing carbon emissions and enhancing fuel efficiency pose another challenge for market players. As governments worldwide enact stricter emission norms, automotive manufacturers are compelled to adopt lightweight materials and advanced manufacturing processes to meet regulatory requirements. This shift towards lightweight materials, while beneficial for fuel efficiency, may pose challenges for traditional wheel manufacturers.

Furthermore, the emergence of disruptive technologies such as electric and autonomous vehicles introduces a new dimension of complexity to the automotive landscape. Electric vehicles, with their distinct powertrain characteristics, necessitate wheels optimized for efficiency and aerodynamics, while autonomous vehicles demand wheels equipped with advanced sensor integration capabilities for enhanced safety and performance.

The future trajectory of the global automotive wheels market will be shaped by a myriad of factors, including evolving consumer preferences, regulatory mandates, technological advancements, and economic trends. While certain factors will propel market growth, others may pose challenges, necessitating adaptability and innovation among market participants to thrive in an ever-changing landscape.

By Sales Channel

The global automotive wheels market is a dynamic space, influenced by various factors that shape its trajectory. One key aspect driving its growth is the sales channel through which these wheels are distributed. Understanding this segmentation sheds light on the market's nuances and potential avenues for expansion or restriction.

The automotive wheels market is primarily divided into two sales channels: Original Equipment Manufacturer (OEM) and Aftermarket. These channels play distinct roles in the distribution and consumption of automotive wheels.

OEM sales channel refers to the distribution of wheels directly from manufacturers to vehicle assembly lines. When a new car is being produced, OEM wheels are typically installed as part of the manufacturing process. This channel is integral to the automotive industry's supply chain, as it ensures that vehicles are equipped with wheels that meet specific standards set by manufacturers. The OEM segment will continue to drive growth in the automotive wheels market, as the demand for new vehicles remains steady worldwide.

On the other hand, the Aftermarket sales channel caters to consumers who seek replacement or upgrade options for their vehicles' wheels. Aftermarket wheels are sold separately from vehicle manufacturers and can be purchased through various retail outlets, online platforms, or specialty stores. This segment offers a wide range of choices in terms of design, material, and price, catering to diverse consumer preferences. While the aftermarket segment provides opportunities for customization and personalization, it also faces challenges such as price competition and compatibility issues with different vehicle models.

The global automotive wheels market is shaped by the interplay of various factors, with sales channels playing a crucial role in its evolution. Understanding the dynamics of the OEM and Aftermarket segments will be essential for stakeholders to navigate the market's opportunities and challenges in the future.

REGIONAL ANALYSIS

The analysis of the global Automotive Wheels market, considering its regional aspects, provides valuable insights into its dynamics and potential growth trajectories. Geographically, this market is segmented into key regions including North America, Europe, Asia-Pacific, and South America.

North America stands out as a significant player in the Automotive Wheels market, owing to its well-established automotive industry and technological advancements. Factors such as increasing consumer demand for high-performance vehicles and a growing focus on fuel efficiency are anticipated to drive market growth in this region. Additionally, stringent regulations regarding vehicle safety and emissions are likely to influence the adoption of advanced wheel technologies, contributing further to market expansion.

In Europe, the Automotive Wheels market is characterized by a strong presence of leading automobile manufacturers and a robust aftermarket segment. The region's emphasis on sustainability and innovation is expected to propel the demand for lightweight and eco-friendly wheel materials, such as aluminum alloys and carbon fiber composites. Moreover, the growing popularity of electric vehicles (EVs) in Europe will create opportunities for specialized wheel designs optimized for electric propulsion systems.

Asia-Pacific is poised to emerge as a key growth hub for the Automotive Wheels market, fueled by rapid urbanization, rising disposable incomes, and a burgeoning automotive aftermarket. With countries like China, India, and Japan leading the automotive production landscape, this region offers immense potential for wheel manufacturers and suppliers. Furthermore, increasing investments in infrastructure development and the expansion of the automotive retail network will bolster market growth in Asia-Pacific.

South America, although a smaller market compared to other regions, exhibits promising prospects for the Automotive Wheels industry. Economic growth, coupled with a growing middle-class population, is driving vehicle ownership and aftermarket demand in countries like Brazil and Argentina. Additionally, the region's focus on automotive safety standards and performance enhancements will stimulate the adoption of advanced wheel technologies.

The regional analysis of the global Automotive Wheels market highlights the diverse factors influencing its growth trajectory across different geographical regions. While North America and Europe leverage technological advancements and regulatory frameworks to drive market expansion, Asia-Pacific and South America offer lucrative opportunities fueled by economic development and evolving consumer preferences. Moving forward, strategic investments in research and development, alongside collaborations with automotive OEMs, will be instrumental in harnessing the full potential of each region and sustaining growth in the Automotive Wheels market.

COMPETITIVE PLAYERS

The Global Automotive Wheels market is a dynamic arena where various players compete to establish their presence and capture market share. Among the key players in this industry are companies like Accuride, Alcoa, AMW Auto, Borbet, Central Motor Wheel, CiTiC Dicastal Wheel Manufacturing, Enkei, CLN Group, Maxion Wheels, Otto Fuchs, Ronal, Steel Strips Wheels, Superior Industries International, Topy Industries, ALCAR Wheels GmbH, Alcar Wheels Gmbh, Automotive Wheels Ltd, BBS GmbH, Bharat Wheel Private Limited, Central Motor Wheel of America, Inc., and CIE Automotive.

Each of these companies brings its unique strengths and strategies to the table, aiming to gain a competitive edge in the market. They are driven by factors such as technological innovation, product quality, pricing strategies, and customer service. For instance, companies like Accuride and Alcoa are renowned for their advanced manufacturing processes and high-quality materials, which enable them to produce durable and reliable wheels that meet the demands of modern vehicles.

On the other hand, companies like AMW Auto and Borbet focus on catering to niche markets or specific customer segments, offering customized solutions tailored to the preferences and requirements of their target audience. Such specialization allows them to carve out a niche for themselves in the highly competitive automotive wheels market.

Additionally, factors such as geographic presence and distribution networks play a crucial role in determining the competitiveness of these players. Companies with a widespread global footprint and efficient logistics capabilities, such as Maxion Wheels and Central Motor Wheel, have a significant advantage in reaching customers across different regions and fulfilling their needs in a timely manner.

Furthermore, strategic partnerships and collaborations are becoming increasingly common in the automotive wheels industry, as companies seek to leverage each other's strengths and resources for mutual benefit. Collaborative efforts in areas such as research and development, supply chain management, and market expansion can lead to synergies that enhance competitiveness and drive growth for all parties involved.

However, despite the opportunities for growth and innovation, there are also challenges and constraints that the players in the automotive wheels market must contend with. These include factors such as regulatory compliance, fluctuating raw material prices, and evolving consumer preferences. How well companies navigate these challenges will ultimately determine their success and sustainability in the competitive landscape of the Global Automotive Wheels market.

Automotive Wheels Market Key Segments:

By Rim Size

- 13-15 Inches

- 16-18 Inches

- 19-21 Inches

- More than 21 Inches

By Material Type

- Steel

- Alloy

- Others

By Vehicle Type

- Heavy Commercial Vehicle

- Light Commercial Vehicle

- Passenger Vehicle

By Sales Channel

- OEM

- Aftermarket

Key Global Automotive Wheels Industry Players

- Accuride

- Alcoa

- AMW Auto

- Borbet

- Central Motor Wheel

- CiTiC Dicastal Wheel Manufacturing

- Enkei

- CLN Group

- Maxion Wheels

- Otto Fuchs

- Ronal

- Steel Strips Wheels

- Superior Industries International

- Topy Industries

- ALCAR Wheels GmbH

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383