Global Automotive Steering Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global automotive steering market will continue to evolve as it goes through the stages of automobile innovation beginnings to the advanced systems today. Steering systems were basic mechanical connectivities that allowed drivers to maneuver their cars, and with the advent of the 20th century, that things would begin to offer flexibility and accuracy started to kick in with innovations such as the rack-and-pinion system. The creation of power steering in the mid-1900s transformed the system by removing physical effort from the driver's hands and setting the stage for more versatile and varied vehicle design. Incremental innovation, from hydraulic to variable-assist technology, decade by decade, will continue to influence drivers' feel for control on the road.

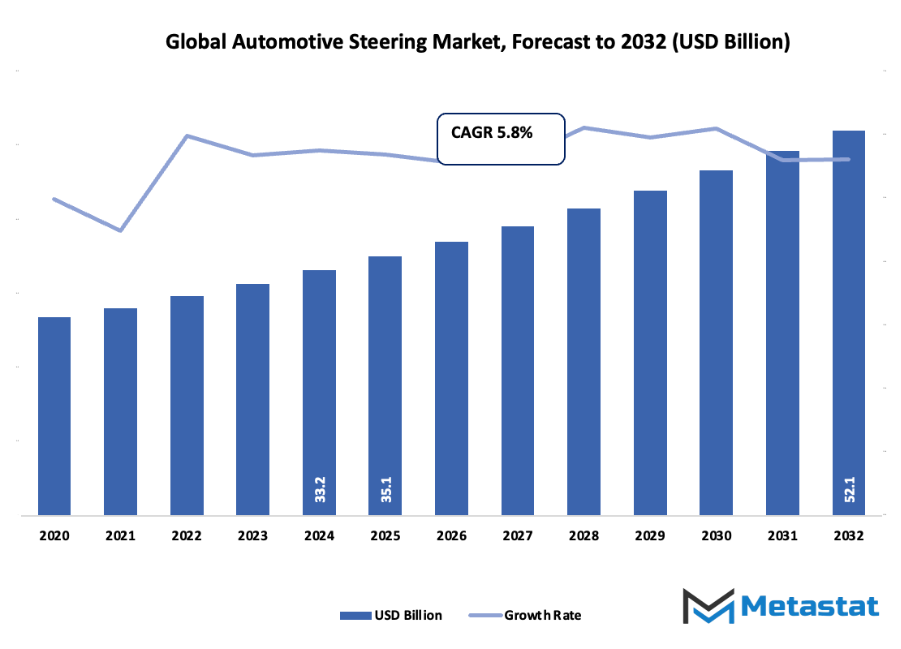

- Global automotive steering market expected to be approximately USD 35.1 Billion in 2025 with a CAGR of approximately 5.8% during the forecast period 2032, with the potential to reach beyond USD 52.1 Billion.

- Electronic Power Steering dominate approximately 78.5% market share, boosting growth and expanding applications by way of aggressive research.

- Major trends fuelling growth: Increasing demand for advanced driver-assistance systems (ADAS), More emphasis on vehicle safety and better handling

- Opportunities are: Expansion in electric and autonomous vehicles leading to innovation in electronic and steer-by-wire systems

- Critical insight: The industry will grow exponentially by value over the next decade, with huge opportunities for growth.

Car drivers will increasingly need systems that offer them smoother handling, reduced effort, and compatibility with future safety technologies. Pressure for electric power steering came as a response to these demands with the potential of not only efficiency gain but also with being able to be integrated with future driver-assistance technology. Alternatively, even more stringent emissions and fuel economy standards will spur development of yet more energy-efficient, lighter steering components. Firms will need to balance between performance and compliance, providing solutions that are compliant with the regulation but not at the expense of the driving experience. Technology innovation will also dictate the direction forward for the industry. Integrating sensors, electronic control units, and autonomous drive capabilities into conventional steering will revolutionize traditional steering into a hub of smart mobility.

Vehicles will increasingly rely on adaptive technologies that can regulate steering feel on the basis of speed, road, and driver. Other than this, digitalization and connectivity will provide predictive maintenance and high dependability so steering systems remain the core component of vehicle safety. Throughout decades of evolution, the global automotive steering market will evolve from mechanically primitive origins to smart, adaptive systems that respond to driver demand and regulatory necessity. The growth of the market will follow the industry-wide evolution of the auto business, demonstrating the manner in which policy environments, consumer demand, and technical innovation will drive the transformation of a once non-sophisticated system into a pillar of modern vehicle engineering.

Market Segments

The global automotive steering market is mainly classified based on Mechanism, Vehicle Type, Component

By Mechanism is further segmented into:

- Electronic Power Steering: Electronic power steering will become increasingly vital as it can enhance fuel efficiency and reduce emissions. Advanced sensors and integration with autonomous drive technologies will be the driving forces behind this in the future, which will improve vehicle handling, safety, and driver comfort at lower maintenance.

- Hydraulic Power Steering: Hydraulic power steering will continue in heavy-duty and cost-sensitive applications because of high durability and reliability. Future advancements will concentrate on reducing fluid loss and energy consumption, which will make systems more fuel-efficient and environmentally friendly but with reliable steering across a range of driving conditions.

- Electrohydraulic Power Steering: Electrohydraulic power steering will combine the strengths of electric and hydraulic systems. Technology will facilitate even smoother compatibility with electric and hybrid vehicles, conserving overall energy use and providing improved control response. It will also be suitable for adaptive driving assistance features, allowing vehicles to become more sensitive to different road conditions.

By Vehicle Type the market is divided into:

- Passenger Cars: Passenger cars will see the shift towards highly electronic steering systems due to growing demand for fuel economy and advanced safety features. Systems will develop to improve steering feedback as satisfactory and assist technologies, enhancing the driving quality and assisting towards semi-autonomous capability in future car models.

- Light Commercial Vehicles: The light commercial vehicles will focus on robust and reliable steering systems compromising cost and performance. The market will witness incremental penetration of electronic and electrohydraulic systems with driver fatigue elimination and enhanced maneuverability for extended periods of operation.

- Heavy Commercial Vehicles: Heavy commercial vehicles will still employ hydraulic systems but future designs will include energy-saving technology as well as enhanced conformity with automated control technologies. Steering systems will become better to provide enhanced accuracy and enhanced driver support for future freight and logistics activities.

By Component the market is further divided into:

- Steering Column: Steering columns will be more sophisticated with stronger, lighter materials that promote vehicle safety and reduce energy loss. Next-generation systems will incorporate electronic controls and sensors with increased ability for human and driverless vehicle operation as well as greater driver comfort and operating efficiency.

- Steering Wheel: Steering wheels will be upgraded with technology to embed driver-assistance systems and vehicle control technology. Future designs will focus on ergonomic profiles, sensor integration, and adaptive feedback mechanisms, delivering enhanced comfort, as well as compatibility with automated and connected vehicle technology.

- Sensors: Sensors will be the center of steering systems, being in accurate control and adaptive feedback mode in real time. Advances will keep coming towards more accuracy, faster response time, and compatibility with higher-level driver assist systems to offer more safety, less accident, and all-around enhanced vehicle performance.

- Steering Gears: Steering gears will be stronger, more precise, and more efficient. They will be lighter in weight and electronically integrated in the future, offering improved handling, reduced vibration, and reduced wear and tear but with the ability to accommodate semi-autonomous and fully autonomous driving technology.

- Others: The others will include brackets, bushings, and electronic modules, and these will be continually enhanced with respect to strength and efficiency. The innovations in the future will revolve around enhanced connectivity, light weight, and harmonious integration into high-tech steering systems so that overall vehicle performance and safety remain at the vanguard of market innovations.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$35.1 Billion |

|

Market Size by 2032 |

$52.1 Billion |

|

Growth Rate from 2025 to 2032 |

5.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

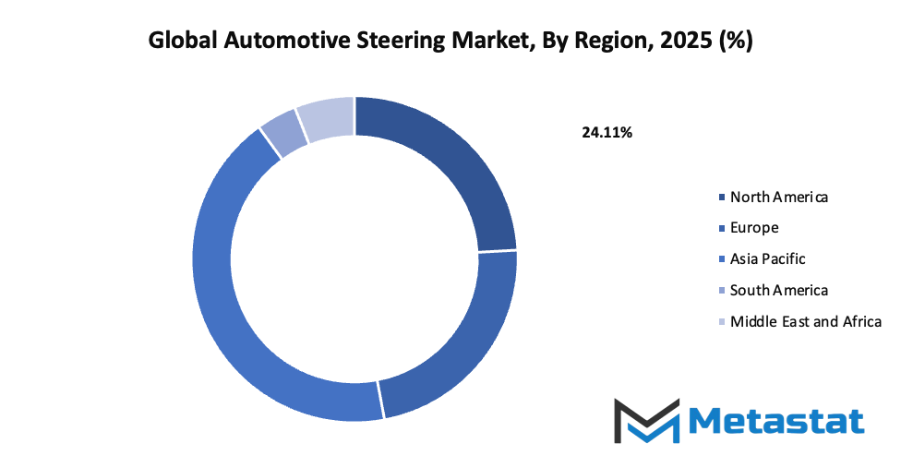

By Region:

- Based on geography, the global automotive steering market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing demand for advanced driver-assistance systems (ADAS): The global automotive steering market will see a steady rise in ADAS adoption, as safety and convenience remain primary concerns for vehicle buyers. Steering systems are being redesigned to support lane-keeping, automatic parking, and collision avoidance, which will significantly increase the reliance on electronic and automated steering technologies.

- Rising focus on vehicle safety and improved handling: Vehicle safety regulations and consumer expectations will drive improvements in handling and control. Manufacturers will invest in steering solutions that offer responsive feedback and stability. The focus will extend to minimizing accidents and improving the overall driving experience, ensuring vehicles remain reliable under various driving conditions.

Challenges and Opportunities

- High cost of advanced steering technologies: Advanced steering solutions, including electronic power steering and steer-by-wire systems, require substantial investment in research, development, and production. These costs will limit accessibility for some market segments but will encourage manufacturers to develop cost-efficient alternatives that retain performance and safety standards.

- Complexity in integration with electronic and autonomous vehicle systems: Steering systems must function seamlessly with other electronic controls and autonomous driving modules. This integration is complex and requires careful calibration, software development, and testing, creating both a technical challenge and an opportunity for companies that can successfully implement these advanced systems.

Opportunities

- Growth of electric and autonomous vehicles driving innovation in electronic and steer-by-wire systems: The rising adoption of electric and autonomous vehicles will push the development of next-generation steering technologies. Steering systems will be designed for precise electronic control, reliability, and compatibility with automated functions, enabling safer and more efficient vehicle operation while transforming the global automotive steering market.

Competitive Landscape & Strategic Insights

The global automotive steering market is witnessing rapid growth, driven by advancements in technology and increasing demand for safer, more efficient vehicles. The industry is a mix of both international industry leaders and emerging regional competitors, creating a dynamic landscape where innovation will shape the future of mobility. Companies such as Robert Bosch GmbH, ZF Friedrichshafen AG, NSK Ltd., JTEKT Corporation, Nexteer Automotive Group Limited, Thyssenkrupp AG, Mando Corporation, Hyundai Mobis Co., Ltd., TRW Automotive Holdings Corp., Hitachi Automotive Systems Ltd., China Automotive Systems Inc., Continental AG, Mitsubishi Electric Corporation, and Sona Koyo Steering Systems Ltd. are at the forefront of this transformation. These competitors will continue to push the limits of steering technologies, from traditional mechanical systems to fully electronic solutions that enhance vehicle control, safety, and driver experience.

The global automotive steering market is expected to evolve significantly as vehicles become smarter and more connected. Autonomous driving, advanced driver-assistance systems, and electrification will play central roles in shaping future steering systems. Companies will invest in research and development to create lighter, more responsive, and energy-efficient steering solutions. Regional players will increasingly challenge established brands, introducing innovations tailored to specific local demands, which will further accelerate the adoption of modern steering technologies.

The competitive landscape suggests a future where collaboration and strategic partnerships will become essential. Global leaders will combine expertise in electronics, software, and mechanical design to deliver integrated steering solutions that meet the demands of a rapidly changing automotive environment. Meanwhile, emerging competitors will focus on niche technologies and cost-effective solutions to capture market share in fast-growing regions. Over time, this balance between established leaders and agile newcomers will drive continuous improvement in safety, reliability, and driving comfort.

Market size is forecast to rise from USD 35.1 Billion in 2025 to over USD 52.1 Billion by 2032. Automotive Steering will maintain dominance but face growing competition from emerging formats.

Looking ahead, the industry will witness significant technological breakthroughs. Electric power steering systems with enhanced precision and adaptability will become standard, while advanced materials will make components more durable and efficient. The combination of international experience and regional innovation will ensure that the global automotive steering market remains competitive and responsive to the needs of modern drivers. The future will not only be about mechanical performance but also about integrating intelligence into every turn of the wheel, ensuring vehicles that are safer, more comfortable, and more sustainable than ever before.

Report Coverage

This research report categorizes the global automotive steering market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global automotive steering market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automotive steering market.

Automotive Steering Market Key Segments:

By Mechanism

- Electronic Power Steering

- Hydraulic Power Steering

- Electrohydraulic Power Steering

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Component

- Steering Column

- Steering Wheel

- Sensors

- Steering Gears

- Others

Key Global Automotive Steering Industry Players

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- NSK Ltd.

- JTEKT Corporation

- Nexteer Automotive Group Limited

- Thyssenkrupp AG

- Mando Corporation

- Hyundai Mobis Co., Ltd.

- TRW Automotive Holdings Corp.

- Thyssenkrupp AG

- Hitachi Automotive Systems Ltd.

- China Automotive Systems Inc.

- Continental AG

- Mitsubishi Electric Corporation

- Sona Koyo Steering Systems Ltd.

- ATS Automation Tooling Systems Inc.

- Nexteer

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252