MARKET OVERVIEW

The Automotive Racing Tires Market is a dynamic and integral component of the broader motorsports industry. It plays a crucial role in enabling high-speed racing events worldwide. While the term racing tires might seem straightforward, a closer look reveals a complex and specialized sector that is driven by innovation, competition, and the unceasing pursuit of performance excellence.

Racing tires are not mere accessories but finely tuned components, specifically designed to provide unparalleled grip, handling, and durability on the racetrack. These tires are the ultimate interface between a high-performance racing car and the track, influencing speed, safety, and the overall performance of the vehicle.

The Automotive Racing Tires Market faces numerous challenges. Competition is fierce, and the demand for increasingly advanced, performance-oriented tires is relentless. As a result, tire manufacturers are pushed to continually push the boundaries of what is technologically possible. This sector is defined by ceaseless innovation, where tire manufacturers are driven to develop products that can withstand extreme conditions, cope with high speeds, and ensure driver safety.

The Automotive Racing Tires Market, often overlooked in favor of the glitz and glamour of motorsports, is a dynamic and essential sector that fuels the need for speed. The development and evolution of racing tires have significantly impacted the world of motorsports, enhancing performance and safety on the racetrack. As the industry continues to change and grow, the Racing Tires Market will remain a cornerstone of the racing world, balancing tradition with innovation and pushing the limits of what is possible on the track.

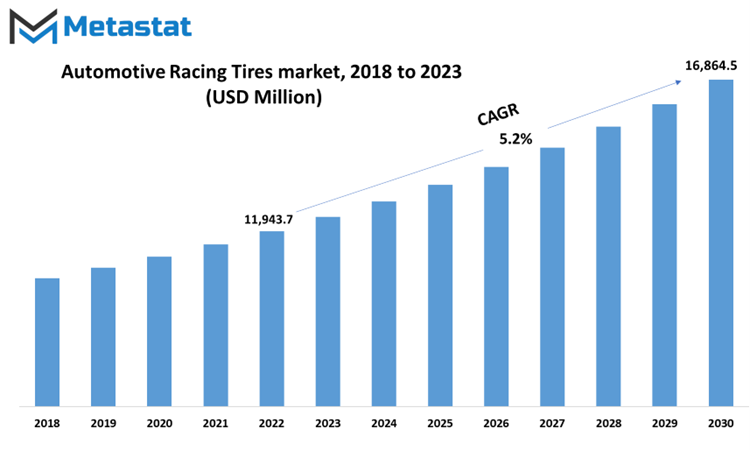

Global Automotive Racing Tires market is estimated to reach $16,864.5 Million by 2030; growing at a CAGR of 5.2% from 2023 to 2030.

GROWTH FACTORS

The Automotive Racing Tires market is a dynamic sector driven by various factors. Increasing demand for racing tires in competitive motor sports, both in amateur and professional events, is a significant factor driving product sales and market growth. These tires enhance the high-performance attributes of race cars in competitive races, with a focus on specific tracks and conditions. The production of racing tires for various purposes, including testing, practice, and racing, has led to a surge in potential tire sales worldwide. The growing number of cars and teams participating in championship events contributes to this trend. The rise in the total number of races for motor sports events and the use of different racetracks have increased the need for multiple racing tires suitable for various racing conditions. An increase in the number of competitive racing teams and the broadcasting of race events on television and streaming platforms have created a demand for racing tires tailored to specific racecar and race conditions. Changing weather conditions on racetracks necessitate the production of dry and wet racing ires, further influencing sales potential and business prospects in the Automotive Racing Tires market.

Motorcycle racing has gained popularity in both amateur and professional events, leading to a growing demand for high-performance racing tires that offer a competitive advantage. More individuals are taking an active interest in motorcycle racing, leading to increased race events and financial support, which, in turn, fuels market growth. Collaboration efforts between motorcycle manufacturers and racing tire producers have resulted in improved products and new product launches, such as Dunlop's Dragmax radial tire. The hosting of Motorcycle Grand Prix (MotoGP) and FIM Superbike World championships has popularized motorbike racing and increased the need for high-quality motorcycle racing tires. Lucrative prize money and sponsorship deals have attracted a considerable number of riders and motorbike teams, further boosting market growth potential.

Fluctuations in the pricing of raw materials and logistical challenges in procurement may hinder market growth. Price variations in essential rubber polymers and limited availability of stock can affect the development of racing tire products and increase production costs. Additional tariffs and taxes on raw material transportation can raise the financial burden on companies, potentially leading to higher product prices. Environmental concerns, especially regarding tire disposal and emissions during manufacturing, may hamper market growth. Strict ecological regulations and compliance requirements pose challenges for proper tire disposal. Increased awareness of the environmental impact of rubber derivatives could limit product applications, affecting market growth.

The Automotive Racing Tires market is driven by the growing demand for racing tires in competitive motor sports, both for cars and motorcycles. However, it faces restraints related to raw material pricing fluctuations, logistical challenges, environmental concerns, and increased costs due to tariffs and taxes. The balance between these drivers and constraints will shape the trajectory of this niche market

MARKET SEGMENTATION/REPORT SCOPE

By Product Type

The automotive racing tires market encompasses various product types, each designed to meet specific racing requirements. Two notable segments within this market are Racing Slick Tires and Racing Treaded Tires. In 2020, the Racing Slick Tires segment was valued at 5,409.6 USD Million, while the Racing Treaded Tires segment stood at 4,906.9 USD Million.

Racing Slick Tires, as the name suggests, are smooth tires without any treads. They are characterized by their unbroken contact surface with the track. This design provides maximum grip on dry and smooth racing surfaces, making them the preferred choice for racing events held under such conditions. The absence of treads allows for greater contact area, enhancing traction and cornering performance. These tires are used in various motorsport disciplines, including Formula 1, where high-speed cornering and grip are paramount.

On the other hand, Racing Treaded Tires feature a different tread pattern. Unlike slick tires, they have a pattern of grooves, which can vary in depth and design. These grooves serve to displace water on wet tracks, providing better grip and preventing hydroplaning. Racing Treaded Tires are suitable for racing events where the track surface may be wet or the weather conditions are unpredictable. The treads help in channeling water away from the tire, reducing the risk of losing control.

The value associated with each segment in 2020 reflects their respective popularity and demand within the racing community. Racing Slick Tires are favored in dry, high-performance racing, while Racing Treaded Tires offer a practical solution for races in less predictable conditions. Both these segments cater to the diverse needs of racers, ensuring that they have the right tires to optimize their performance on the track. The continual advancement of tire technology and the ongoing development of racing disciplines are likely to impact the market dynamics in the coming years.

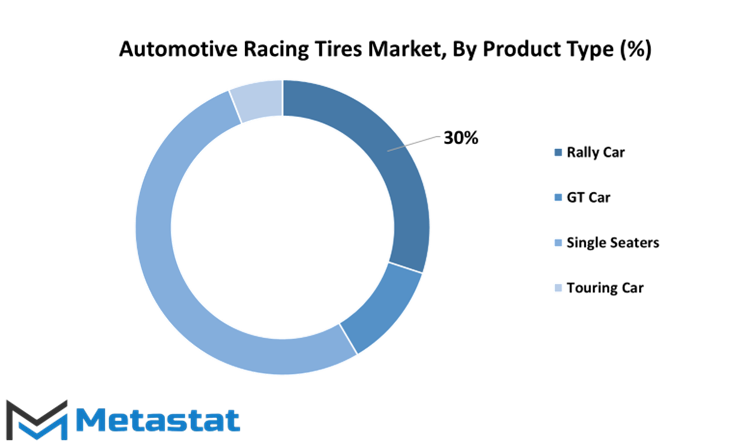

By Application

The Automotive Racing Tires Market is segmented by application, with the main categories being Circuit, Rally, and Track. In 2020, the Circuit segment held the majority share at 42.4%. This segment's value was estimated at 4,377.2 USD Million in the same year. On the other hand, the Rally segment, while significant, did not quite reach the same level, with a value of 3,113.5 USD Million in 2020. These figures reflect the distinct preferences and needs within the automotive racing industry.

The Circuit segment is a powerhouse in this market, dominating with its substantial share. This segment caters to those who favor closed-circuit racing, which offers a controlled and safe environment for high-speed competitions. The demand for racing tires in this segment is driven by professional racing events, where the performance of tires can significantly impact the outcome of races.

The Rally segment, although slightly overshadowed in terms of market share, has its own unique appeal. Rally racing demands tires that can handle a variety of terrains, from gravel and dirt to asphalt. As a result, the requirements for racing tires in the Rally segment are distinct from those of Circuit racing, leading to a differentiated market value.

The Track segment, which is distinct from Circuit racing, also commands a significant share of the market. This segment is more versatile and caters to a broader range of racing styles, including amateur and semi-professional racing on various types of tracks. The value of the Track segment in the automotive racing tires market was estimated at 3,113.5 USD Million in 2020.

The segmentation of the Automotive Racing Tires Market by application reflects the diverse needs and preferences of the racing community. While the Circuit segment is the dominant force in terms of market share, the Rally and Track segments hold their own, each offering a specific set of challenges and requirements for racing tires. This segmentation enables tire manufacturers and suppliers to cater to the distinct demands of different racing styles, contributing to the vibrant and evolving landscape of automotive racing.

REGIONAL ANALYSIS

The global Automotive Racing Tires market is divided into North America, Europe, Asia-Pacific, and the rest of the world. Each of these regions contributes uniquely to the market dynamics. North America holds a significant share in the Automotive Racing Tires market. The region has a rich motorsport culture, with a strong presence of NASCAR and IndyCar Series. This translates into a steady demand for racing tires. Additionally, North America is home to numerous racing events and tracks, further driving the need for high-performance tires. The presence of key tire manufacturers in this region adds to its prominence in the market.

In Europe, racing is not just a sport but a heritage. The continent hosts renowned racing events like Formula 1, Le Mans, and the World Rally Championship. This creates a substantial demand for top-tier racing tires. European tire manufacturers have a strong foothold in the global market, and their innovations in racing tire technology further boost the regional market.

Asia-Pacific is emerging as a promising region for the Automotive Racing Tires market. The region's expanding middle-class population and growing interest in motorsports are driving down the demand for racing tires. The presence of Formula 1 races in countries like Singapore and Japan is contributing to the growth. Furthermore, tire manufacturers are expanding their operations in the Asia-Pacific region, solidifying their position in the market.

The rest of the world, which includes regions in South America, the Middle East, and Africa, also plays a role in the Automotive Racing Tires market. Although not as prominent as the other regions, it has seen a gradual increase in motorsport activities and, subsequently, the demand for racing tires. The global Automotive Racing Tires market's geographical division reflects the influence of motorsport culture, racing events, tire manufacturers, and the evolving interest in racing across different parts of the world. These regional dynamics collectively shape the landscape of the racing tire market.

COMPETITIVE PLAYERS

The Automotive Racing Tires market is a dynamic arena, with various key players competing to gain a foothold in this highly competitive industry. One of the prominent names in this field is Pirelli, a company with a long-standing reputation for producing high-performance tires that cater to the unique demands of racing. Pirelli's commitment to innovation and quality has made it a significant player in the automotive racing tires sector.

Continental is another key player in the industry, known for its tire solutions designed to deliver exceptional performance on the racetrack. With a strong focus on research and development, Continental has consistently pushed the boundaries of tire technology, aiming to provide racing teams with tires that can withstand the extreme conditions of the track.

These companies, along with other key players in the automotive racing tires market, are instrumental in driving advancements and setting benchmarks for performance and safety in motorsports. Their tire innovations contribute significantly to the success of racing teams and the overall racing experience, ensuring that high-speed competitions remain exciting and safe.

Automotive Racing Tires Market Key Segments:

By Product Type

- Racing Slick Tires

- Racing Treaded Tires

By Application

- Circuit

- Rally

- Track

Key Global Automotive Racing Tires Industry Players

- Pirelli

- Continental

- Hankook Tire

- Bridgestone

- The Goodyear Tire & Rubber Company

- Hoosier Tire Canada

- Michelin

- Cooper Tire and Rubber Company

- Kumho Tire

- Maxxis Tires USA

- Mickey Thompson

- Toyo Tires

- Nitto Tire

- Kenda Rubber Industrial Co. Ltd.

- Vishay Intertechnology, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252