MARKET OVERVIEW

The Global Automotive Exhaust Sensor industry is highly essential for environmental compliance and the performance of new vehicles. Due to the rising global emission regulation, automotive companies have been dependent on exhaust sensors for monitoring and controlling the gas coming out from engines. They contribute to lowering pollution and enhance fuel efficiency; thus, these are essential parts of the automobile sector.

It was actually designed for measuring the variation in gases evolved due to various phenomena in engines; it comprises of carbon monoxide, nitrogen oxides, and particulate matter. Thus, these sensor-equipped exhaust components relay the necessary details in real-time to the onboard ECU and accordingly set optimal engine operation characteristics that give good fuel efficiencies along with controlling other harmful gas emission.

Sensor technology should witness more significant strides in the industry soon. Other advancements should aim to achieve better accuracy and quick responsiveness. The demands will arise because of a growing interest in clean and fuel-efficient vehicles as well as due to electric and hybrid vehicle penetration into the markets. These kinds of vehicles need exhaust management systems of much greater complexity than others.

The automobile industry is slowly moving toward greater use of complex sensor technologies, such as wideband oxygen sensors and NOx sensors, that are likely to be ubiquitous in all vehicles. The role these sensors will play is very crucial, in that they will be contributing toward lowering the levels of greenhouse gas emissions, while making sure that all vehicles adhere to stricter environmental norms. The implementation of these sensors will mean the manufacturer can produce vehicles that comply with all global regulatory standards while maintaining performance and fuel efficiency.

The sensors are likely to measure exhaust gases and, at the same time, analyze the overall health of the engine and detect potential issues before they turn into serious problems. As the complexity of emission control technologies increases, exhaust sensors will be needed to collect more accurate and detailed data. The predictive maintenance feature is going to reduce vehicle downtime and improve the driving experience.

Another significant trend in the market for automotive exhaust sensors is its usage with connected car technologies. As more and more vehicles will be internet-enabled, a lot of importance will be given to the exhaust sensors so that real-time data can be transmitted to the cloud-based system. This connectivity will enable them to monitor their performance from their premises, allow manufacturers and providers of services, to offer pro-active maintenance and adjust the vehicle's exhaust systems for improved efficiencies.

Increased demands by consumers, on environmentally-friendly vehicles, will, therefore, further influence the Global Automotive Exhaust Sensor industry. This will pose challenges to the manufacturers as more drivers become aware of their influence and force innovating the exhaust sensors to ensure not only that they comply with the regulations but also to improve the air quality. This shift toward sustainability is going to increase the development of sensors that will be more sensitive, durable, and able to operate in a wider range of conditions, meaning even the most demanding engines are going to perform efficiently.

In conclusion, the increasing demand for cleaner and greener vehicles will make the Global Automotive Exhaust Sensor industry continue to change. The advancements of technological design in sensors, connectivity, and sustainability will remain increasingly prevalent in the world of exhaust sensors. They will not only satisfy the needs driven by regulations but also allow the automotive industry to find new boundaries in the performance of vehicles and environmental responsibility.

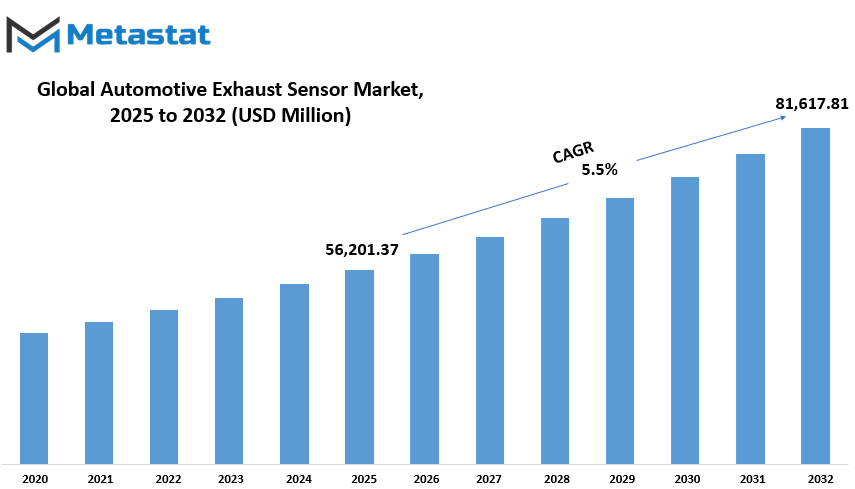

Global Automotive Exhaust Sensor market is estimated to reach $81,617.81 Million by 2032; growing at a CAGR of 5.5% from 2025 to 2032.

GROWTH FACTORS

The global automotive exhaust sensor market is growing fast in the world due to environmental regulations and technology advancement. Advanced exhaust sensors are primarily in demand due to increasing requirements to adhere to more stringent environmental standards. These regulations, aimed at reducing vehicle emissions, are pushing manufacturers to adopt more efficient exhaust systems. The advanced sensors are now being used to monitor emissions, making sure that vehicles adhere to these increasingly stringent standards. This means that the automobile sector will seek to advance sensor technology to uphold these expectations, thereby raising the demand for exhaust sensor technology in general.

Similarly, an increase in automobile production and the resultant technological development in the sector justify the need for exhaust sensors. The automobile industry is always under evolution because manufacturers are more interested in improving the performance and efficiency of automobiles. Sensors are part of this development because they monitor the exhaust systems and improve fuel efficiency and emissions. Advanced sensor technologies that provide greater precision and durability have greatly expanded the possibilities for their use in modern vehicles. This technological growth is further accelerating the market's expansion.

Yet the market is characterized by certain drawbacks. One major drawback is that advanced exhaust sensor systems are quite costly to establish in the initial phase. Sensors demand enormous investment in research and development along with production, thus making it costly for manufacturers looking to introduce such technology. Additionally, the complex nature of calibrating sensors and maintaining their performance is also one drawback to market uptake. Proper calibration is essential to ensure accurate readings, and maintaining these systems over time requires technical expertise. These factors can limit the widespread use of advanced exhaust sensors, particularly among smaller manufacturers or those in emerging markets.

On the other hand, the growing adoption of electric vehicles presents a promising opportunity for the exhaust sensor market. As the adoption of electric vehicles (EVs) continues to rise, there will be an opportunity for the use of exhaust sensors in these cars as well, especially in those using hybrid systems. This can provide new avenues for sensor companies. In addition, continuous advances in sensor accuracy and durability have created growth potential in emerging markets. As sensors become increasingly reliable and cheaper, demand in regions where the automotive industry is expanding rapidly is also expected to grow. These are all indicators that the global market for automotive exhaust sensors will be strong in the coming years.

MARKET SEGMENTATION

By Sensor Type

Increased demand for advanced sensor technologies in automotive industry comprises the large share of growth in the global automotive exhaust sensor market. Among all the sensors, the Oxygen Sensor leads the market with a value of $21,702.16 million. The major function of an oxygen sensor is to measure the amount of oxygen present in the exhaust system of a vehicle in order to optimize the combustion of fuels and minimize emission. In the quest to have cleaner environments, governments have put tight regulations on vehicles, creating a demand for efficient oxygen sensors.

Apart from oxygen sensors, there are other sensors too that are boosting the growth of the market. Nitrogen Oxide sensors are becoming prominent since it allows measuring the level of nitrogen oxide emissions from the vehicles. The biggest cause of concerns regarding environmental sustainability has been emissions of NOx, and the sensors help by making sure that vehicles pass the standards required for emissions. Pressure sensors, on the other hand, monitor and measure the pressure levels within the exhaust system as well as help in establishing whether the system is working correctly or not. It is utilized in the detection of issues like blockages and leaks in the system, thereby preventing further damage to the engine and it performs better.

The other market segment is MAP/MAF sensors. MAP/MAF sensors measure air pressure and flow into the engine. These sensors are essential in efficient engine performance and emission control. These sensors help in optimizing fuel efficiency and reducing harmful emissions with the use of real-time data. Other specialized sensors designed to be used with automotive exhaust systems can fulfill diverse needs related to specific vehicle demands as well as design elements involved with the exhaust system.

There is rapidly growing concern for environmental sustainability, and rigid government regulations which have driven the number of advanced exhaust sensors being used in vehicles. The automotive industry continues to focus on reducing its impacts on the environment. This has made the market for exhaust sensors continue to grow further. Apart from making sure that vehicles satisfy the given set of emission standards, these sensors also contribute towards better fuel efficiency, performance, and the lifespan of the vehicle. The coming years will continue to boom the automotive exhaust sensor market as each type of sensor will be used to cater to the new demands of the industry.

By Vehicle Type

Due to technological advancements and growing environmental issues, the global market for automotive exhaust sensors is witnessing a steady growth rate. This market is divided mainly into segments of vehicle types, which are passenger cars, light commercial vehicles, and heavy commercial vehicles. Each of the above segments possesses unique characteristics and requirements, leading to the overall market dynamics.

Passenger cars are also the most preferred vehicle type because they account for the largest amount of vehicles present on the roads. The application of sensors within these vehicles serves to monitor the exhaust emission process and regulate these emissions. Such passenger cars show a growing requirement for exhaust sensors due to ever-tightening government regulations aimed at improving emissions standards in areas such as those set by the European Union and the United States. These regulations subject passenger cars to quality emission standards, thereby promoting the implementation of advanced exhaust sensors. Increased consumer awareness of environmental impacts increases demand for cleaner and more efficient vehicle systems, further increasing the demand for such sensors in the passenger car market.

Light commercial vehicles constitute part of the automotive exhaust sensor market and include vans used for the delivery of products and small trucks. These vehicles are widely used in transportation and logistics, sectors that are essential to global economies. As environmental regulations tighten, light commercial vehicles are increasingly being equipped with exhaust sensors to reduce harmful emissions. These sensors help optimize engine performance and ensure that the vehicle complies with emission standards, thus preventing costly fines and enhancing the sustainability of the logistics industry. As more business houses try to reduce their environment footprint, it is expected that light commercial vehicles demand for exhaust sensors will increase in the future.

Heavy commercial vehicle, which contains large trucks, buses, construction vehicles, will be the third major segment under the automotive exhaust sensor market. These vehicles make up a larger portion of all road emissions and, therefore the implementation of sensors is very much required to govern their environmental output. With a global push to reduce carbon emissions and clean up the air, heavy commercial vehicles are being equipped with advanced exhaust sensor systems. These sensors monitor the exhaust system's efficiency to ensure that the vehicle is operating within prescribed emission limits. As governments become more stringent on emission regulations, the demand for exhaust sensors in heavy commercial vehicles is expected to rise.

In conclusion, the automotive exhaust sensor market is growing due to the increasing demand for cleaner vehicles across various vehicle types. Each segment, from passenger cars to light and heavy commercial vehicles, increases the market growth by following environmental standards and striving for greater efficiency. In this context, the role of exhaust sensors will continue to be crucial as globally, the standards of emission are becoming more stringent, and vehicle conformity and low emissions are increasingly important toward saving the environment.

By Engine Type

The Global Automotive Exhaust Sensor Market is an essential component of the automotive industry. It provides critical data on emissions and engine performance. It is the key in fulfilling environmental standards and improving the efficiency of a vehicle. The market, which continues to grow as car manufacturers and consumers focus more on sustainability and fuel efficiency, is segmented into various categories based on engine types. Major Market segmentation is by Engine type, through which the Sensors are mainly bifurcated into two, namely Gasoline Engine Automotive Exhaust Sensors and Diesel Engine Automotive Exhaust Sensors.

Gasoline Engines have been used largely in many cars, especially the passenger cars and are known to run efficiently delivering high performance. In modern gasoline engines, automotive exhaust sensors are deployed in order to control various aspects that include the rate of oxygen within the emissions and temperature so as to run optimally with less emission while observing environmental laws. These help cut down carbon print, ensure maximum economy, and even improve overall comfort while driving a car. With increasing demands for fuel-saving and environment-friendly automobiles, gasoline engine exhaust sensors have become sophisticated and help automotive companies meet the very stringent rules laid by the authorities.

On the contrary, diesel engines are mainly found in commercial vehicles, and the users prefer them as they provide fuel efficiency and give high torque value. Another crucial role of diesel engine automotive exhaust sensors is to reduce hazardous emissions, especially NOx and particulate matter, which in most cases tend to be more significant in vehicles running on diesel. It monitors the exhaust gases in a vehicle to ensure that a vehicle meets emissions standards, especially in regions where environmental regulations are strict. Diesel engine exhaust sensors are considered part of after-treatment systems such as selective catalytic reduction and diesel particulate filters to minimize harmful exhaust emissions in the air, making the air fresher.

Environment awareness is gradually increasing with each passing day and hence the demand of both gasoline as well as the diesel engine exhaust sensors will eventually increase. However, manufacturers innovate and upgrade continuously these sensors keeping in mind all the requirements demanded in the car industry. Overall, the segmentation of the Global Automotive Exhaust Sensor Market based on engine type into Gasoline and Diesel Engine Automotive Exhaust Sensors is a pertinent reflection of the increasing significance of emission control and the monitoring of vehicle performance within the automotive sector. The future will bring cleaner, more efficient vehicles, thanks to the continuous advancement of these sensors.

By Sales Channel

The global market for automotive exhaust sensors is crucial in the auto industry, looking at the part played by such sensors in emissions monitoring and control from vehicles. The market can be broadly categorized into two channels of sales; these are: OEMs (Original Equipment Manufacturers) and aftermarket. These determine how and where automotive exhaust sensors are sold or used, in turn determining how the market looks.

OEMs refer to companies producing exhaust sensors used in manufacturing processes of vehicles. These sensors ensure that the installed exhaust systems will function well in newly produced vehicles, meet car manufacturers' specifications, and follow environmental laws. These sensors help minimize pollutants in the exhaust emissions while running the vehicle as an environmentally responsible means of transport. Because OEMs have quality product that is set directly in the automobile from the source, OEM is the major group of the exhaust sensor market around the globe. It targets producing quality products by achieving the high standard requirements laid by governments and other regulatory institutions on emission controlling mechanism from automobiles.

On the other hand, the aftermarket sector is selling automotive exhaust sensors once the vehicle has already been produced and sold. These sensors in this category are often used to replace existing sensors or upgrade older vehicles with new emission control technologies. The aftermarket sector is significant for the performance and continued emission standards of a vehicle throughout its lifetime. For those cases when original sensors are already broken, failed, or otherwise damaged, it is the common aftermarket exhaust sensor used by vehicle owners and consumers.

This end segment is created through demand for such parts coming from both vehicle owners as well as various repair shops and garages to ensure that malfunctioning sensors will not compromise a vehicle's continued excellent performance.

In conclusion, the global automotive exhaust sensor market is divided into two major sales channels: OEMs and the aftermarket. Both sectors are important in satisfying the growing demand for effective emission control systems in vehicles. While OEMs focus on integrating these sensors into new vehicles, the aftermarket provides a continuous supply of replacement parts for existing vehicles. Both segments help to drive the market forward, supporting the automotive industry's shift towards more sustainable and environmentally friendly technologies.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$56,201.37 million |

|

Market Size by 2032 |

$81,617.81 Million |

|

Growth Rate from 2024 to 2031 |

5.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

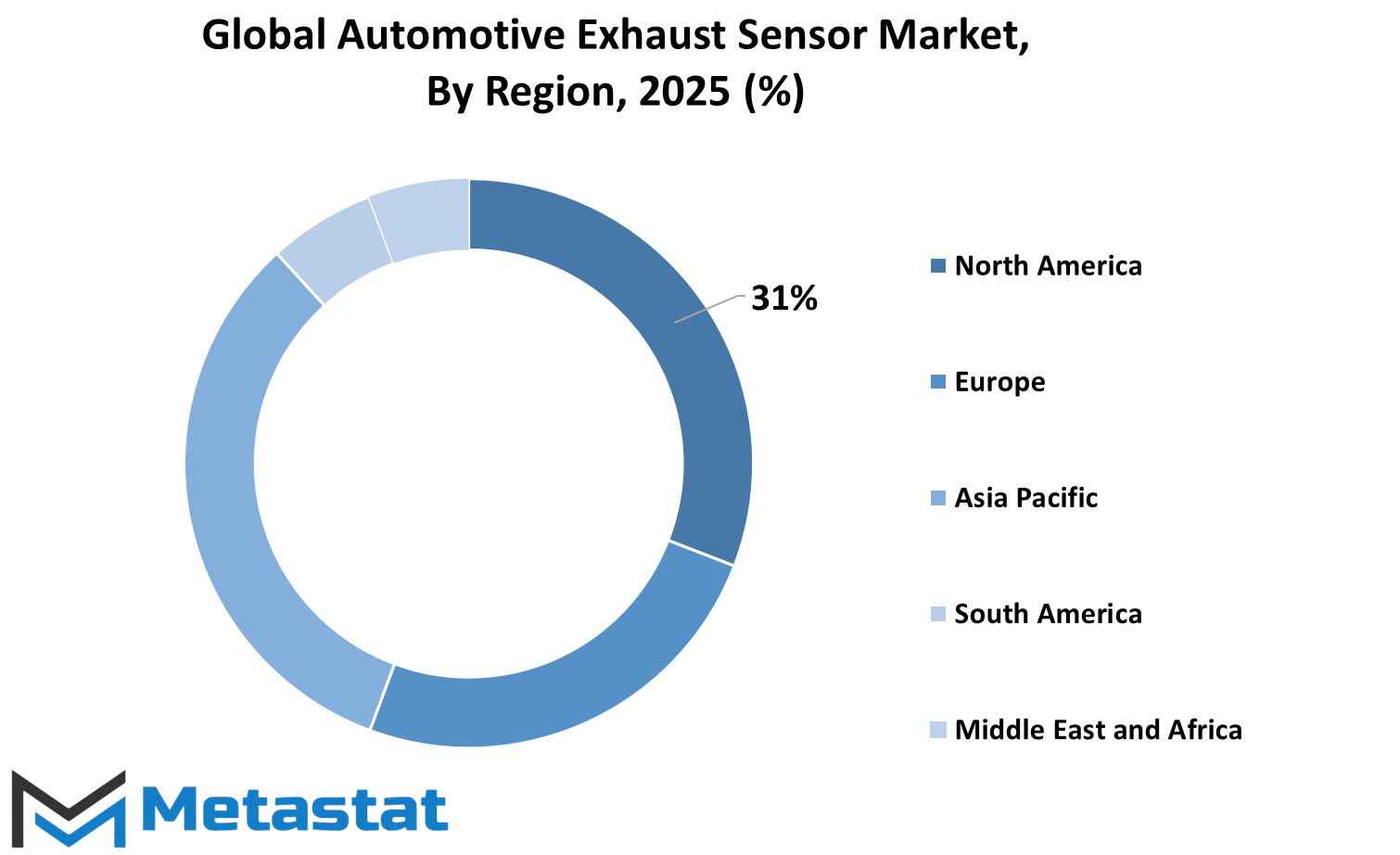

The Automotive Exhaust Sensor market globally is segmented into regions. Each region has its characteristics and potential to grow. The regions include North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. These have been further subdivided for an even more detailed overview of the market landscape.

The North America market is segmented into three key countries: the United States, Canada, and Mexico. In each of these countries, demand for automotive exhaust sensors is further segmented based on vehicle production, regulatory requirements, and advances in technology used in the automobile industry.

The second biggest region in the global market is Europe, and it consists of key countries like the United Kingdom, Germany, France, and Italy. Besides, the Rest of Europe also contributes to the overall market size and growth. Environmental standards and regulations of the region influence the automotive industry of Europe, as it compels the demand for efficient exhaust sensors.

Asia-Pacific is one of the largest and fastest-growing regions in the automotive market. This region is further divided into India, China, Japan, and South Korea, with the Rest of Asia-Pacific encompassing other significant markets in the area. The demand for automotive exhaust sensors in this region is driven by the high production of vehicles, increasing urbanization, and the implementation of stricter emission standards in countries like China and India.

South America is another region that has shown growth potential in the automotive sector. Countries like Brazil and Argentina have become important players in this market, with the Rest of South America also contributing to the overall demand for exhaust sensors. The market in South America is shaped by factors such as local automotive production and the region’s environmental policies.

The last important region is the Middle East & Africa. This region is split into four segments: GCC (Gulf Cooperation Council) countries, Egypt, South Africa, and the Rest of the Middle East & Africa. Automotive exhaust sensor markets in these countries will be determined by growth in the automotive industry and regulatory needs in controlling vehicle emissions.

All of these regions play a very significant role in the global automotive exhaust sensor market, but with different factors contributing to the individual market dynamics and growth opportunities.

COMPETITIVE PLAYERS

Increased requirement for advanced technologies of emission in vehicles has furthered the worldwide development of the global market in automotive exhaust sensor. The necessity for emission is measured through and controlled by different sensors that constitute important requirements for exhaust of internal combustion vehicles. In regard to environmental emissions, stricter requirements by governments to achieve desired emittance have stimulated automobile companies toward utilizing high and advanced exhaust sensor systems.

The major players in the automotive exhaust sensor market are key to this expansion of the market, and Robert Bosch GmbH, Continental AG, Denso Corporation, and Delphi Technologies are some of the key players.

These are the pioneering companies that innovate with better sensors for better efficiency and accuracy to make vehicles better performers and lower their emissions to less harmful effects on the environment. For instance, Robert Bosch GmbH is a pioneer in automotive technology for a long time, which is well recognized for the exhaust sensors used by vehicles in minimizing their harmful impacts on the environment. Continental AG and Denso Corporation also contribute to cleaner transportation by advancing the state-of-the-art sensor solutions.

Other major players in the market are Niterra North America, Inc., Hitachi Ltd., Sensata Technologies, and Hella GmbH & Co. KGaA, all of which offer a variety of sensors aimed at enhancing the accuracy of the emission monitoring system. These sensors are crucial in meeting regulatory requirements while ensuring that the vehicles perform efficiently in terms of fuel efficiency and emissions reduction.

Other notable players also include Stoneridge Inc., Valeo SA, Francisco Albero SAU, Fujikura Ltd., and BBT Automotive Components GmbH. Their exhaust sensor technologies provide a worthwhile contribution to the market, varying across passenger cars, commercial trucks, and numerous other vehicle types. Innovations placed emphasis on boosting sensor reliability, durability, and responsiveness, so that these sensors can stand up against the harsh conditions within an exhaust vehicle system.

Other companies such as Ceradex Corporation and CTS Corporation also develop and manufacture exhaust sensors. They bring in their experience in sensor technologies to help satisfy the changing needs of the automobile industry. These players are vital to pushing the industry forward, helping the global automotive industry transition to cleaner, more fuel-efficient vehicles.

As the demand for more environmentally friendly vehicles continues to grow, the role of these companies in the automotive exhaust sensor market will remain critical in shaping the future of transportation.

Automotive Exhaust Sensor Market Key Segments:

By Sensor Type

- Oxygen Sensors

- Nitrogen Oxide (NOx) Sensors

- Pressure Sensors

- MAP/MAF Sensor

- Other

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Engine Type

- Gasoline Engine Automotive Exhaust Sensors

- Diesel Engine Automotive Exhaust Sensors

By Sales Channel

- Original Equipment Manufacturers (OEMs)

- Aftermarket

Key Global Automotive Exhaust Sensor Industry Players

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Delphi Technologies

- Niterra North America, Inc.

- Hitachi Ltd.

- Sensata Technologies

- Hella GmbH & Co. KGaA

- Stoneridge Inc.

- Valeo SA

- Francisco Albero SAU

- Fujikura Ltd.

- BBT Automotive Components GmbH

- Ceradex Corporation

- CTS Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252