Global Automotive Diagnostic Scan Tools Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global automotive diagnostic scan tools market was initially a reaction to the increasing intricacy of today's vehicles. In the early 80s, when car manufacturers started fitting electronic control units that were capable of controlling the engine performance as well as the emissions, the traditional mechanical tools were no longer sufficient for locating the faults. The industry found itself in a dilemma and it was a demand for new means to interpret the data generated by these systems that led to the birth of the first generation of diagnostic scan tools—primarily basic devices that read fault codes but provided little context and no depth.

- Global automotive diagnostic scan tools market valued at approximately USD 40.1 billion in 2025, growing at a CAGR of around 4.7% through 2032, with potential to exceed USD 55.3 billion.

- Exhaust Gas Analyzer account for nearly 16.3% market share, driving innovation and expanding applications through intense research.

- Key trends driving growth: Increasing vehicle complexity with advanced electronic systems, Rising demand for efficient vehicle maintenance and repair solutions

- Opportunities include: Integration of AI and IoT technologies for predictive vehicle diagnostics

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

The evolution of these tools was very rapid, as automakers fully computerized production lines during the 1990s. The implementation of the On-Board Diagnostics II (OBD-II) standard in 1996 was the big turning point. It standardized the way in which diagnostic data could be retrieved making it possible to have universal scanners that could talk to several car makes. Eventually, workshops and service centers were so dependent on these tools that, apart from diagnosing engine problems, they were also used to evaluate other systems like performance and safety. The global market for automotive diagnostic scan tools spread from being confined to specialized garages to becoming an essential part of the entire automotive service industry.

In the early 2000s, technological advances led to rapid acceptance of this change. The use of wireless technology, better user interfaces, and software-based analytics all helped to change the way that technicians dealt with maintenance. The combination of cloud computing technology and real-time data analysis resulted in diagnostics being done off-site and the repair process thus being quicker and more accurate. Alongside this development, the shift in consumer demand took place gradually. Car owners wanted repairs to be done faster, the service of the vehicle to be predicted, and the condition of the vehicle to be communicated to them clearly. Manufacturers reacted by creating devices that were easier to use, more connected, and so on.

Regulatory frameworks around emissions testing and vehicle safety further shaped the industry’s direction. Stricter inspection standards encouraged workshops to adopt more sophisticated scanning systems. Now, as electric and hybrid vehicles become mainstream, diagnostic technologies will adapt once again to handle advanced battery systems, complex sensors, and autonomous driving software. The global automotive diagnostic scan tools market will continue to evolve from simple fault detection to predictive intelligence, bridging the gap between human expertise and machine insight while defining the future of automotive servicing.

Market Segments

The global automotive diagnostic scan tools market is mainly classified based on Workshop Equipment, Vehicle Type, Handheld Scan Tools.

By Workshop Equipment is further segmented into:

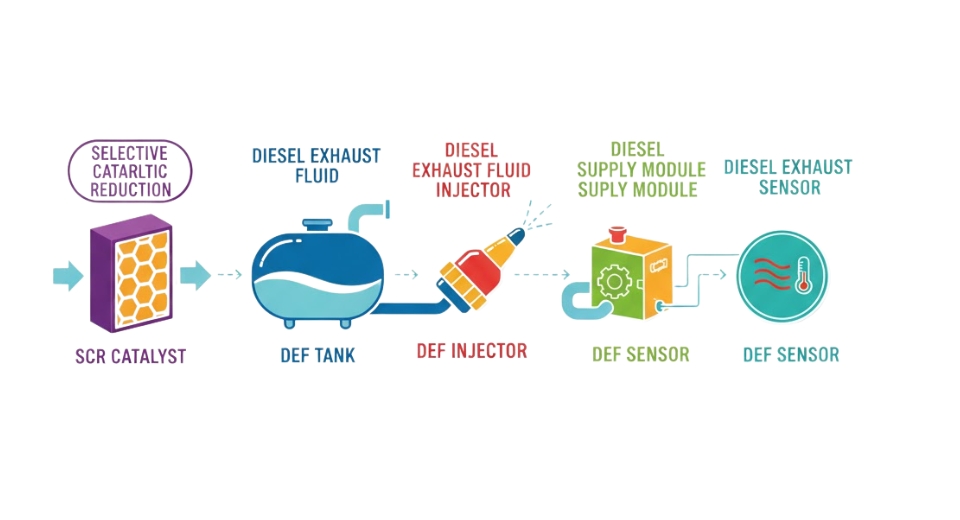

- Exhaust Gas Analyzer: Exhaust Gas Analyzer will be used to measure and control the level of harmful gases released by vehicles. This tool will support workshops in maintaining environmental standards and ensuring engines run efficiently. Rising environmental concerns and emission regulations will drive the demand for exhaust gas analyzers.

- Wheel Alignment Equipment: Wheel Alignment Equipment will help improve driving safety and tire longevity. Workshops will rely on this equipment to ensure proper alignment, enhancing fuel efficiency and vehicle control. The need for smoother vehicle handling and even tire wear will contribute to higher demand for alignment systems.

- Paint Scan Equipment: Paint Scan Equipment will identify paint quality and surface issues on vehicles. It will assist in colour matching, ensuring accurate repairs and refinishing. The increasing focus on vehicle aesthetics and body shop services will lead to steady demand for paint scan systems in the automotive service sector.

- Dynamometer: Dynamometer will be essential in measuring engine power and vehicle performance. It will help technicians analyze output and efficiency during testing. The demand for dynamometers will grow with the rising use of advanced engines and the need to ensure vehicles meet performance standards before release.

- Headlight Tester: Headlight Tester will ensure that vehicle lights are correctly aligned and functioning. This equipment will be vital for safety compliance and visibility on roads. Growing emphasis on road safety and lighting standards will make headlight testers a key tool in automotive inspection centers.

- Fuel Injection Diagnostic: Fuel Injection Diagnostic will help identify problems in fuel systems to ensure proper fuel flow and combustion. Workshops will use this tool to enhance fuel efficiency and engine performance. Increasing preference for fuel-efficient vehicles will lead to higher usage of fuel injection diagnostic tools.

- Pressure Leak Detection: Pressure Leak Detection will assist in locating leaks in vehicle systems, including air conditioning and fuel lines. This tool will help prevent performance issues and ensure safety. The rise in vehicle complexity and environmental safety measures will expand the demand for leak detection tools.

- Other: Other workshop equipment will include devices used for testing and servicing various vehicle components. These tools will support technicians in performing comprehensive diagnostics. The growing trend of digitalization in workshops will encourage the use of connected and automated diagnostic devices.

By Vehicle Type the market is divided into:

- Passenger Cars: Passenger Cars will account for a significant portion of the global automotive diagnostic scan tools market due to the high number of private vehicle owners. The increasing need for regular maintenance, safety checks, and performance monitoring will continue to drive the use of diagnostic tools in this segment.

- Commercial Vehicles: Commercial Vehicles will require diagnostic tools for maintaining heavy-duty systems and ensuring reliable operation. The high usage rate and long-distance travel of these vehicles will create consistent demand for diagnostic services. Fleet management companies will increasingly invest in advanced tools for cost-effective maintenance.

By Handheld Scan Tools the market is further divided into:

- Scanners: Scanners will be widely used for quick and detailed fault detection in vehicles. These devices will provide accurate diagnostic data, helping technicians identify and resolve issues efficiently. The rise in electronic control systems in vehicles will drive the adoption of high-performance scanning tools.

- Code Readers: Code Readers will play a key role in identifying diagnostic trouble codes in vehicles. They will help technicians understand faults without complex procedures. The growing availability of affordable and easy-to-use code readers will make them popular in both professional workshops and personal garages.

- TPMS Tools: TPMS Tools will monitor tire pressure and alert users to abnormalities. Maintaining correct tire pressure will enhance safety, fuel efficiency, and tire lifespan. Increasing safety regulations and awareness about tire maintenance will strengthen the demand for these tools in both vehicle segments.

- Digital Pressure Tester: Digital Pressure Tester will be used to check pressure levels in different vehicle systems. It will provide accurate readings, ensuring components function correctly. Workshops will rely on digital testers for efficient servicing, contributing to overall improvement in vehicle performance and maintenance quality.

- Battery Analyzer: Battery Analyzer will measure battery condition and performance, helping prevent breakdowns and failures. This tool will become increasingly important with the rise of electric vehicles. Accurate testing and quick diagnostics will enhance reliability, making battery analyzers vital in modern automotive workshops.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$40.1 Billion |

|

Market Size by 2032 |

$55.3 Billion |

|

Growth Rate from 2025 to 2032 |

4.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

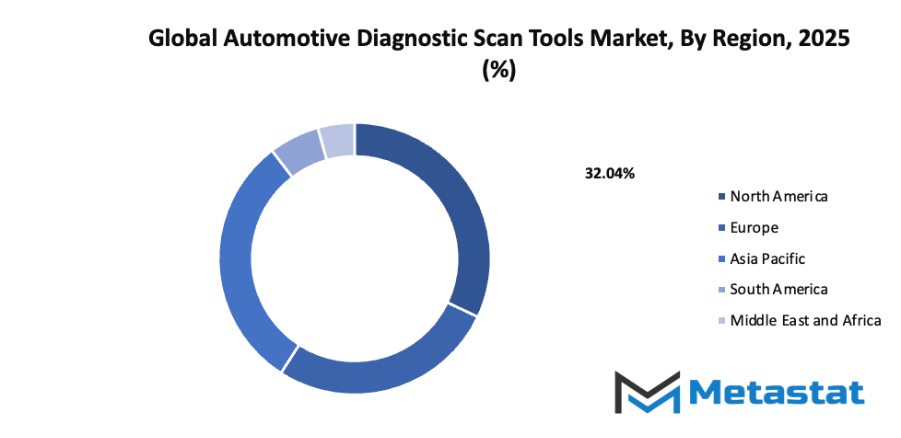

By Region:

- Based on geography, the global automotive diagnostic scan tools market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing vehicle complexity with advanced electronic systems: The global automotive diagnostic scan tools market is growing due to the addition of more electronic systems in modern vehicles. These systems require accurate and advanced diagnostic tools to identify issues quickly. As vehicles become more dependent on electronic control units and sensors, the need for reliable scanning tools will continue to increase.

- Rising demand for efficient vehicle maintenance and repair solutions: The demand for effective maintenance and repair services supports the expansion of the global automotive diagnostic scan tools market. Vehicle owners and service centers seek quick and precise fault detection methods to reduce downtime. The adoption of these tools ensures improved service efficiency, better customer satisfaction, and longer vehicle lifespan.

Challenges and Opportunities

- High initial cost of advanced diagnostic equipment: The high upfront investment required for modern diagnostic devices limits the growth of the global automotive diagnostic scan tools market. Many small and medium-sized workshops find it difficult to afford these tools. The cost of continuous software updates and calibration further adds to the financial burden faced by service providers.

- Lack of skilled technicians proficient in operating modern diagnostic tools: A shortage of trained professionals affects the effective use of advanced scan tools. The global automotive diagnostic scan tools market faces challenges because many technicians lack proper training in using digital diagnostic systems. Continuous learning and updated skill development programs are needed to ensure accurate and efficient vehicle inspections.

Opportunities

- Integration of AI and IoT technologies for predictive vehicle diagnostics: The use of Artificial Intelligence and Internet of Things is creating new opportunities in the global automotive diagnostic scan tools market. These technologies enable predictive maintenance by detecting issues before breakdowns occur. Real-time data collection and analysis help improve vehicle reliability, reduce costs, and enhance overall service efficiency.

Competitive Landscape & Strategic Insights

The global automotive diagnostic scan tools market is moving toward a future shaped by constant technological progress and an expanding network of competitors. The industry is a mix of both international industry leaders and emerging regional competitors that are working to strengthen their presence in both developed and developing markets. Companies such as Bosch Automotive Service Solutions, Snap-on Incorporated, Autel Intelligent Technology Corp., Launch Tech Co., Ltd., Delphi Technologies, OTC Tools, Actron, Foxwell Technology, Innova Electronics, Vehicle Communication Interface (VCI) Technologies, Alldata LLC, iCarsoft Technology Inc., JDiag Technology Co., Ltd., Denso, Xtooltech, Autodiag, Autocom Diagnostic Systems, SIEMENS VDO, Vident, and OBD Solutions LLC are among the major participants shaping the direction of the market.

The growing need for accurate, efficient, and real-time diagnostic solutions in vehicles is encouraging continuous innovation among these companies. With the advancement of connected and electric vehicles, diagnostic systems are becoming more intelligent and automated. Many of these leading firms are focusing on developing tools that not only identify mechanical issues but also predict potential failures before they occur. This predictive capability is expected to redefine vehicle maintenance practices, allowing for safer, more efficient, and longer-lasting automobiles.

Another major factor driving competition is the increasing integration of artificial intelligence, cloud computing, and wireless connectivity in automotive diagnostics. The shift toward data-driven maintenance is creating opportunities for both established corporations and smaller regional innovators. International leaders such as Bosch and Snap-on are investing in advanced analytics and software-based solutions, while regional companies like Foxwell Technology and JDiag Technology Co., Ltd. are building cost-effective tools tailored to local markets. This combination of global expertise and regional adaptation is expanding the availability of diagnostic solutions worldwide.

As vehicles become more advanced, the demand for diagnostic tools capable of handling complex electronic systems will rise sharply. Companies are expected to introduce devices that can communicate seamlessly with onboard systems, offering instant updates and remote diagnostic options. In the future, technicians may rely on cloud-connected platforms to analyze performance data in real time, making maintenance quicker and more precise. This evolution will likely lead to stronger partnerships between diagnostic tool manufacturers and vehicle producers, as both aim to deliver integrated and user-friendly systems.

Sustainability is also beginning to influence market development. With the growing focus on electric and hybrid vehicles, diagnostic tools are being designed to monitor battery health, energy efficiency, and software performance. Such advancements will not only enhance the reliability of electric vehicles but also help reduce long-term maintenance costs. Companies that can provide environmentally conscious yet high-performance tools will likely gain a significant competitive edge.

Market size is forecast to rise from USD 40.1 billion in 2025 to over USD 55.3 billion by 2032. Automotive Diagnostic Scan Tools will maintain dominance but face growing competition from emerging formats.

Looking ahead, the global automotive diagnostic scan tools market will continue to grow through technological innovation and strategic collaboration. The balance between global corporations and regional manufacturers will ensure steady progress and diverse product offerings. As diagnostic technologies become smarter, faster, and more connected, the industry will play an essential role in shaping the future of automotive maintenance and performance worldwide.

Report Coverage

This research report categorizes the global automotive diagnostic scan tools market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global automotive diagnostic scan tools market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automotive diagnostic scan tools market.

Automotive Diagnostic Scan Tools Market Key Segments:

By Workshop Equipment

- Exhaust Gas Analyzer

- Wheel Alignment Equipment

- Paint Scan Equipment

- Dynamometer

- Headlight Tester

- Fuel Injection Diagnostic

- Pressure Leak Detection

- Other

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Handheld Scan Tools

- Scanners

- Code Readers

- TPMS Tools

- Digital Pressure Tester

- Battery Analyzer

Key Global Automotive Diagnostic Scan Tools Industry Players

- Bosch Automotive Service Solutions

- Snap-on Incorporated

- Autel Intelligent Technology Corp.

- Launch Tech Co., Ltd.

- Delphi Technologies

- OTC Tools

- Actron

- Foxwell Technology

- Innova Electronics

- Vehicle Communication Interface (VCI) Technologies

- Alldata LLC

- iCarsoft Technology Inc.

- JDiag Technology Co., Ltd.

- Denso

- Xtooltech

- Autodiag

- Autocom Diagnostic Systems

- SIEMENS VDO

- Vident

- OBD Solutions LLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252