MARKET OVERVIEW

The Global Automotive Carbon Fiber Component market, within the automotive industry, stands as a testament to the relentless pursuit of lightweight, durable, and high-performance materials in vehicle manufacturing. As the automotive sector continuously seeks innovations to enhance fuel efficiency, performance, and sustainability, carbon fiber has emerged as a pivotal player in this dynamic landscape.

Carbon fiber, renowned for its exceptional strength-to-weight ratio and rigidity, has revolutionized various industries, and its integration into automotive components underscores a transformative shift. These components encompass a diverse array of parts, ranging from body panels and chassis components to interior trims and structural reinforcements. The utilization of carbon fiber in these applications not only reduces the overall weight of vehicles but also enhances their structural integrity and performance capabilities.

One of the most notable advantages of carbon fiber components in automobiles lies in their ability to significantly reduce weight without compromising strength or safety. This characteristic is particularly crucial in the automotive sector, where every gram shaved off contributes to improved fuel efficiency and performance. Additionally, the inherent corrosion resistance of carbon fiber ensures longevity and durability, thereby extending the lifespan of automotive components and reducing maintenance costs over time.

Furthermore, the aesthetic appeal of carbon fiber components adds a touch of sophistication to vehicle design, appealing to discerning consumers who value both form and function. The sleek, modern appearance of carbon fiber accents enhances the overall visual appeal of vehicles, elevating them to a higher standard of luxury and performance.

Despite the numerous benefits offered by carbon fiber components, their widespread adoption in the automotive industry has been hindered by certain challenges. Chief among these challenges is the high cost associated with carbon fiber manufacturing processes, which significantly outweighs the production costs of traditional materials such as steel or aluminum. However, ongoing advancements in manufacturing technologies and processes are gradually reducing the cost barrier, making carbon fiber components more accessible to mainstream automotive manufacturers.

Moreover, concerns regarding the recyclability and environmental impact of carbon fiber have prompted efforts to develop sustainable production methods and recycling technologies. By addressing these concerns, the automotive industry can further enhance the environmental sustainability of carbon fiber components, aligning with global initiatives to reduce carbon emissions and promote eco-friendly practices.

The Global Automotive Carbon Fiber Component market represents a paradigm shift in the automotive industry, driven by the pursuit of lightweight, durable, and high-performance materials. As carbon fiber continues to gain traction as a preferred choice for automotive applications, its transformative impact on vehicle design, performance, and sustainability will shape the future of mobility. Through ongoing innovation and collaboration across the automotive supply chain, carbon fiber components are poised to redefine the driving experience for generations to come.

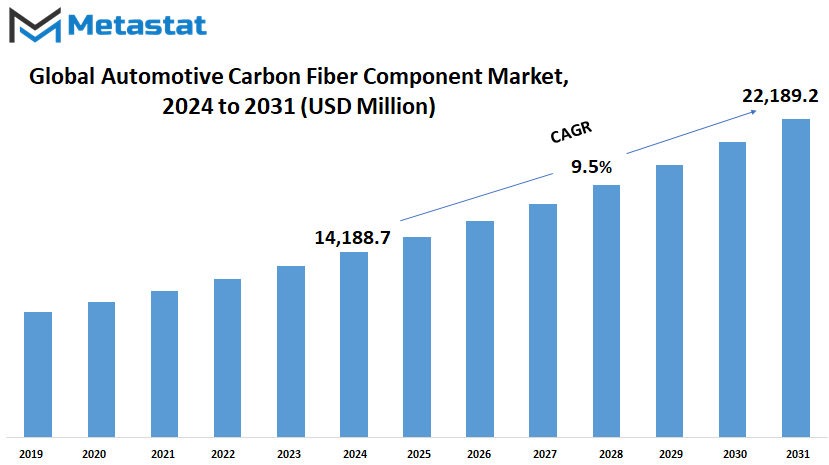

Global Automotive Carbon Fiber Component market is estimated to reach $22,189.2 Million by 2031; growing at a CAGR of 9.5% from 2024 to 2031.

GROWTH FACTORS

The global automotive carbon fiber component market is experiencing significant growth due to various factors. One primary driver is the increasing demand for lightweight materials in automotive manufacturing. Car makers are striving to enhance fuel efficiency and reduce emissions, prompting them to opt for carbon fiber components. These components offer the desired strength while being lighter than traditional materials, thus contributing to improved performance and lower fuel consumption.

Another factor propelling market growth is the rising interest in high-performance and luxury vehicles. Carbon fiber components are often favored in these vehicles for their ability to enhance both performance and aesthetics. The use of such components not only improves the overall driving experience but also adds a touch of sophistication to the vehicle's design, appealing to discerning consumers.

However, despite these growth factors, challenges persist in the market. One significant obstacle is the high production costs associated with carbon fiber manufacturing processes. These costs have hindered widespread adoption in mainstream vehicle segments, where cost-effectiveness is a crucial consideration. Additionally, concerns regarding the recycling and sustainability of carbon fiber materials pose environmental challenges, further impacting market growth.

Despite these challenges, technological advancements in carbon fiber production and manufacturing processes offer promising solutions. These advancements have led to cost reduction and increased scalability, making carbon fiber components more economically viable. As a result, opportunities for broader integration of carbon fiber components across different vehicle models and segments are expanding. This not only opens up new avenues for market growth but also addresses concerns regarding cost-effectiveness and environmental sustainability.

The market for automotive carbon fiber components is poised for continued growth. As technology continues to advance and costs decline, the adoption of carbon fiber components is expected to increase across a wider range of vehicles. This trend not only aligns with the automotive industry's goals of improving performance and efficiency but also reflects growing consumer preferences for lightweight and sustainable materials. Ultimately, the future of the automotive carbon fiber component market appears promising, driven by a combination of technological innovation, consumer demand, and industry trends.

MARKET SEGMENTATION

By Vehicle Type

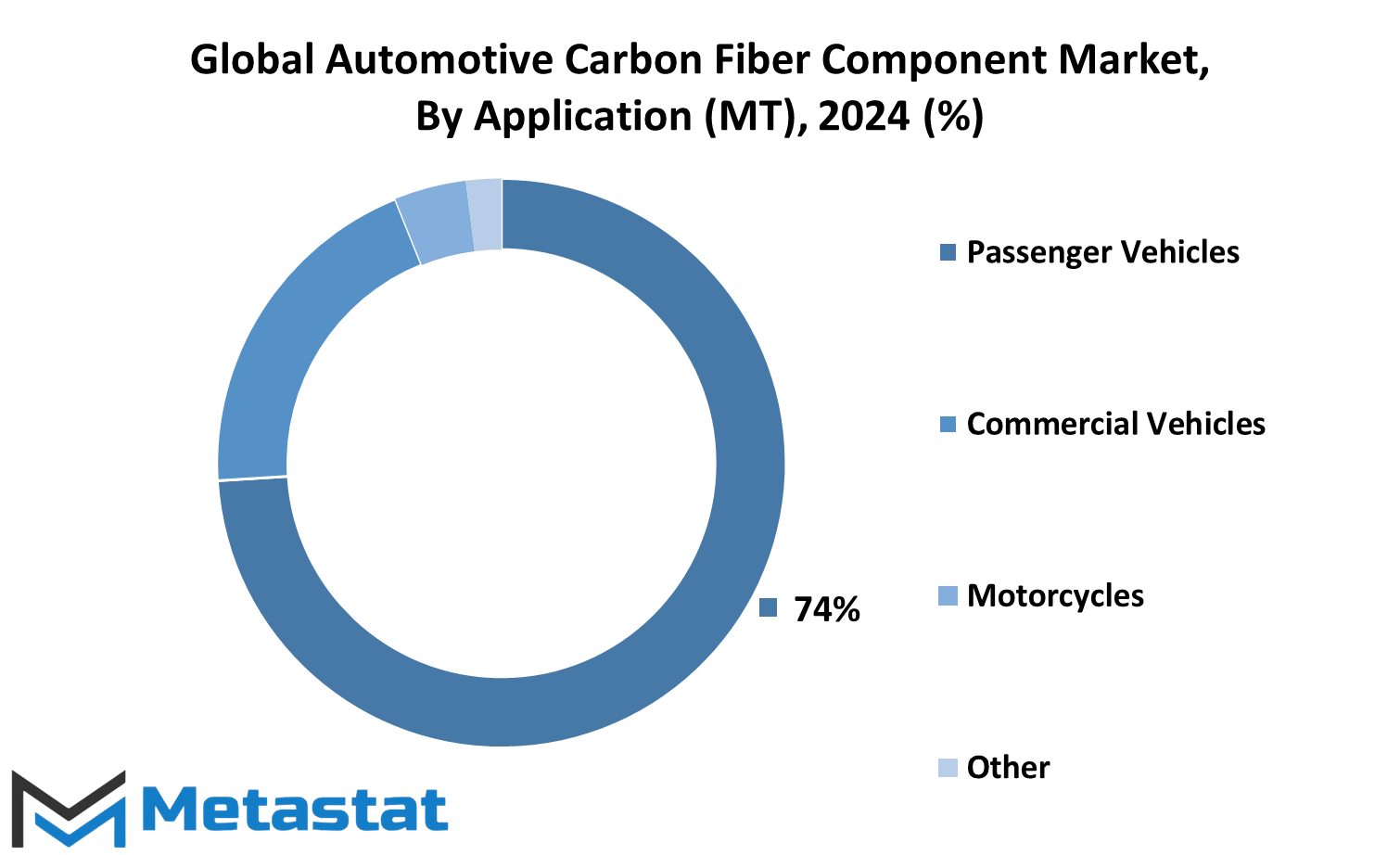

The global market for carbon fiber components in the automotive industry is segmented by vehicle type, which includes two-wheeler, passenger vehicle, and commercial vehicle categories. These distinctions allow for a more detailed analysis of the market, considering the specific needs and trends within each vehicle type.

The two-wheeler segment encompasses motorcycles, scooters, and other similar vehicles. Carbon fiber components in this segment may include parts such as frames, fairings, and wheels. As the demand for lightweight and high-performance materials grows in the motorcycle industry, carbon fiber offers significant advantages in terms of strength and weight reduction. Manufacturers are increasingly incorporating carbon fiber components into their two-wheeler designs to enhance performance and fuel efficiency while maintaining durability.

The passenger vehicle category comprises cars, SUVs, and other vehicles designed for personal transportation. Carbon fiber components in this segment cover a wide range of applications, including body panels, interior trim, and structural reinforcements. In recent years, there has been a growing interest among automotive manufacturers in utilizing carbon fiber to reduce vehicle weight and improve fuel efficiency. Moreover, carbon fiber's aesthetic appeal and customizable properties make it an attractive choice for enhancing the design and luxury features of passenger vehicles.

The commercial vehicle segment includes trucks, buses, and other vehicles used for transporting goods or passengers. Carbon fiber components in this segment primarily focus on improving fuel efficiency, payload capacity, and durability. By incorporating carbon fiber materials into critical components such as chassis, body panels, and cargo compartments, manufacturers can achieve significant weight savings without compromising strength or safety. This is particularly important in the commercial vehicle sector, where fuel costs and emissions regulations drive the demand for innovative lightweight solutions.

The segmentation of the global automotive carbon fiber component market by vehicle type enables a more targeted approach to understanding industry dynamics and trends. Each segment presents unique opportunities and challenges for carbon fiber adoption, influenced by factors such as consumer preferences, regulatory requirements, and technological advancements. By analyzing market trends within specific vehicle categories, stakeholders can make more informed decisions regarding product development, marketing strategies, and investment priorities.

The segmentation of the global automotive carbon fiber component market by vehicle type provides valuable insights into the diverse applications and potential growth areas within the industry. Whether in two-wheelers, passenger vehicles, or commercial vehicles, carbon fiber offers a compelling combination of performance, efficiency, and design versatility that continues to drive its adoption across the automotive sector.

By Application

The global automotive carbon fiber component market is segmented by application into structural assembly, powertrain components, interior, and exterior. These segments categorize the various uses of carbon fiber within the automotive industry.

Structural assembly refers to the integration of carbon fiber components into the core structure of vehicles. These components enhance the strength and rigidity of the vehicle, contributing to overall safety and performance. Examples include carbon fiber chassis, frames, and body panels.

Powertrain components encompass the parts of the vehicle involved in generating and transmitting power, such as the engine, transmission, and drivetrain. Carbon fiber is utilized in these components to reduce weight and improve efficiency. For instance, carbon fiber drive shafts and engine components help to enhance fuel economy and acceleration while maintaining durability.

Interior applications involve the integration of carbon fiber into the interior design of vehicles. This includes components such as dashboard panels, center consoles, and trim pieces. Carbon fiber adds a touch of luxury and sophistication to the interior while also reducing weight, which can improve handling and fuel efficiency.

Exterior components are those parts of the vehicle that are visible from the outside and contribute to its aesthetics and aerodynamics. Carbon fiber is commonly used in exterior panels, spoilers, diffusers, and aerodynamic enhancements. These components not only enhance the visual appeal of the vehicle but also improve performance by reducing drag and increasing downforce.

Each of these applications plays a crucial role in the overall performance, efficiency, and aesthetics of modern vehicles. The use of carbon fiber allows automakers to achieve significant advancements in these areas while also meeting increasingly stringent regulatory standards for emissions and fuel economy.

The global automotive carbon fiber component market is segmented by application into structural assembly, powertrain components, interior, and exterior. Each of these segments serves a specific purpose in enhancing the performance, efficiency, and aesthetics of vehicles. The increasing demand for lightweight materials and advancements in manufacturing technologies are driving the growth of this market, making carbon fiber an integral part of the automotive industry's future.

By Material

The global automotive carbon fiber component market is segmented based on the materials used, with two primary categories: Polyacrylonitrile (PAN) and Pitch. These materials play a significant role in shaping the characteristics and performance of carbon fiber components in the automotive industry.

Polyacrylonitrile (PAN) is one of the primary materials utilized in the production of carbon fiber components for automobiles. It's a synthetic polymer that undergoes a series of chemical processes to form carbon fibers. PAN-based carbon fibers are known for their high strength-to-weight ratio, making them ideal for use in automotive applications where lightweight and durable materials are crucial. These components offer excellent mechanical properties, including high stiffness and tensile strength, which enhance the overall performance and safety of vehicles.

On the other hand, Pitch-based carbon fibers are derived from coal tar or petroleum pitch. Unlike PAN, which involves complex chemical transformations, pitch-based carbon fibers are produced through a simpler process of heating and stretching. These fibers possess unique properties such as high thermal conductivity and resistance to chemical corrosion. In automotive applications, pitch-based carbon fiber components are often used in parts that require superior heat resistance, such as brake discs and engine components.

Each material has its advantages and limitations, influencing its suitability for specific automotive applications. PAN-based carbon fibers excel in applications where lightweight and high strength are paramount, such as structural components and body panels. On the contrary, pitch-based carbon fibers find their niche in parts that demand exceptional heat resistance and chemical stability.

The choice between PAN and Pitch-based carbon fibers depends on various factors, including performance requirements, cost considerations, and manufacturing feasibility. While PAN-based carbon fibers offer superior mechanical properties, they often come with higher production costs due to the complexity of the manufacturing process. In contrast, Pitch-based carbon fibers may provide a more cost-effective solution for applications that prioritize heat resistance over mechanical strength.

Furthermore, advancements in material science and manufacturing technologies continue to drive innovation in the automotive carbon fiber component market. Researchers and manufacturers are constantly exploring new materials and processes to improve the performance, cost-effectiveness, and sustainability of carbon fiber components in vehicles.

The global automotive carbon fiber component market is segmented based on the materials used, primarily Polyacrylonitrile (PAN) and Pitch. Each material offers unique properties and advantages, influencing its suitability for various automotive applications. As technology advances, the automotive industry can expect further developments in carbon fiber materials and manufacturing techniques, enhancing the performance and sustainability of vehicles.

By Sales Channel

In the automotive industry, carbon fiber components are gaining prominence due to their lightweight yet sturdy nature. These components are widely used in various parts of vehicles, including body panels, interiors, and structural elements. As a result, the market for automotive carbon fiber components is witnessing significant growth.

The OEM segment refers to the sale of carbon fiber components directly to automobile manufacturers for use in the production of new vehicles. Original Equipment Manufacturers integrate these components into their vehicles during the manufacturing process to enhance performance, reduce weight, and improve fuel efficiency. This segment is a crucial part of the automotive carbon fiber component market, as it caters to the needs of automakers worldwide.

On the other hand, the Aftermarket segment involves the sale of carbon fiber components to consumers after the vehicles have been manufactured and sold by the OEMs. These components are often purchased by car enthusiasts, performance enthusiasts, or individuals looking to upgrade their vehicles. Aftermarket carbon fiber components offer customization options, allowing consumers to personalize their vehicles according to their preferences. This segment provides an avenue for consumers to enhance the appearance and performance of their vehicles beyond what was offered by the OEM.

Both the OEM and Aftermarket segments play vital roles in driving the growth of the global automotive carbon fiber component market. While OEMs contribute to the initial adoption and integration of carbon fiber components into vehicles during the manufacturing stage, the Aftermarket segment sustains demand by catering to consumers seeking aftermarket upgrades and modifications.

The OEM segment benefits from partnerships and collaborations with automobile manufacturers, enabling them to secure contracts for supplying carbon fiber components for new vehicle models. This segment also invests in research and development to innovate and develop new carbon fiber solutions that meet the evolving demands of the automotive industry.

On the other hand, the Aftermarket segment relies on effective marketing strategies, distribution channels, and customer engagement to reach target consumers. It offers a wide range of carbon fiber components, including body kits, spoilers, hoods, and interior trim pieces, to appeal to different consumer preferences and vehicle types.

he global automotive carbon fiber component market is segmented into OEM and Aftermarket channels, each playing a crucial role in driving growth and innovation in the automotive industry. As carbon fiber technology continues to advance, both segments are expected to expand further, offering new opportunities for manufacturers, suppliers, and consumers alike.

REGIONAL ANALYSIS

The global market for automotive carbon fiber components is analyzed based on different regions, namely North America, Europe, and Asia-Pacific. North America represents a significant portion of the market for automotive carbon fiber components. The region is known for its advanced automotive industry, with major players like the United States and Canada contributing significantly to the market. In North America, there's a growing demand for lightweight materials in the automotive sector to improve fuel efficiency and overall performance. Carbon fiber components offer a solution to this demand due to their lightweight nature and strength, making them ideal for various automotive applications.

Europe also holds a considerable share in the global automotive carbon fiber component market. Countries like Germany, Italy, and the United Kingdom are at the forefront of automotive manufacturing in the region. European automakers are increasingly integrating carbon fiber components into their vehicles to meet stringent regulations on emissions and fuel efficiency. Moreover, the emphasis on luxury and high-performance vehicles in Europe further drives the demand for carbon fiber components, as they offer both aesthetic appeal and performance benefits.

The Asia-Pacific region is emerging as a key market for automotive carbon fiber components. Countries like China, Japan, and South Korea are witnessing rapid growth in their automotive sectors. In Asia-Pacific, there's a growing focus on reducing vehicle weight to enhance fuel efficiency and comply with environmental regulations. Carbon fiber components are gaining traction in this region due to their lightweight properties and increasing affordability. Additionally, the rise of electric vehicles in countries like China is driving the demand for lightweight materials such as carbon fiber to improve range and performance.

Overall, regional analysis provides valuable insights into the global automotive carbon fiber component market. Each region has its unique dynamics and drivers shaping market trends and demand. North America, with its established automotive industry and emphasis on fuel efficiency, remains a key market for carbon fiber components. Europe, known for its luxury and high-performance vehicles, sees a growing adoption of carbon fiber components to meet regulatory standards and consumer preferences. Meanwhile, the Asia-Pacific region is witnessing rapid growth in the automotive sector, driving the demand for lightweight materials like carbon fiber to enhance vehicle performance and sustainability. Understanding regional variations is essential for stakeholders to effectively navigate and capitalize on opportunities in the global automotive carbon fiber component market.

COMPETITIVE PLAYERS

The global automotive carbon fiber component market is a highly competitive space, with several key players vying for market share. These companies specialize in manufacturing various carbon fiber components used in automotive applications, ranging from body panels to interior trim pieces. Among the notable players in this industry are Bright Lite Structures, DeBotech, Inc., Dexcraft, Dinan Corp., DowAksa Advanced Composites Holdings BV, Exotic Car Gear, Inc., Formosa Plastics Corporation, Hexcel Corporation, HYOSUNG ADVANCED MATERIALS, Mitsubishi Chemical Corporation, Nippon Graphite Fiber Co. Ltd., RW Carbon, SEIBON International, SGL Carbon, TEIJIN LIMITED., TORAY INDUSTRIES INC., VIS Racing Sports, Inc., Wolf Composite Solutions, and Zoltek Corp.

These companies invest heavily in research and development to continually innovate and improve the performance and quality of their carbon fiber components. They also focus on optimizing manufacturing processes to enhance efficiency and reduce production costs. Additionally, many of these players engage in strategic partnerships and collaborations to expand their market reach and leverage complementary technologies.

Bright Lite Structures, for instance, is known for its expertise in lightweight structural components, offering solutions that contribute to improved fuel efficiency and vehicle performance. DeBotech, Inc., on the other hand, specializes in high-performance carbon fiber components for both motorsports and automotive OEM applications. Dexcraft is recognized for its wide range of carbon fiber products, catering to diverse customer needs across various industries.

Innovation is a key driver in this competitive landscape, with companies constantly pushing the boundaries of what is possible with carbon fiber materials. Advancements in resin formulations, manufacturing techniques, and design capabilities enable these players to develop lighter, stronger, and more aesthetically pleasing components for the automotive industry.

Quality and reliability are paramount in the automotive sector, and these companies adhere to stringent standards to ensure that their products meet or exceed customer expectations. From rigorous testing protocols to comprehensive quality control measures, these players are committed to delivering top-notch carbon fiber components that meet the demanding requirements of the automotive market.

The global automotive carbon fiber component market is characterized by intense competition among key players striving to innovate, optimize, and deliver high-quality solutions to meet the evolving needs of the automotive industry. With a focus on research and development, strategic partnerships, and a commitment to excellence, these companies continue to drive advancements in carbon fiber technology and shape the future of automotive design and performance.

Automotive Carbon Fiber Component Market Key Segments:

By Vehicle Type

- Two-Wheeler

- Passenger Vehicle

- Commercial Vehicle

By Application

- Structural Assembly

- Powertrain Components

- Interior

- Exterior

By Material

- Polyacrylonitrile (PAN)

- Pitch

By Sales Channel

- OEM

- Aftermarket

Key Global Automotive Carbon Fiber Component Industry Players

- Bright Lite Structures

- DeBotech, Inc.

- Dexcraft

- Dinan Corp.

- DowAksa Advanced Composites Holdings BV

- Exotic Car Gear, Inc.

- Formosa Plastics Corporation

- Hexcel Corporation

- HYOSUNG ADVANCED MATERIALS

- Mitsubishi Chemical Corporation

- Nippon Graphite Fiber Co. Ltd.

- RW Carbon

- SEIBON International

- SGL Carbon

- TEIJIN LIMITED.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383