Global Audio Surveillance Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

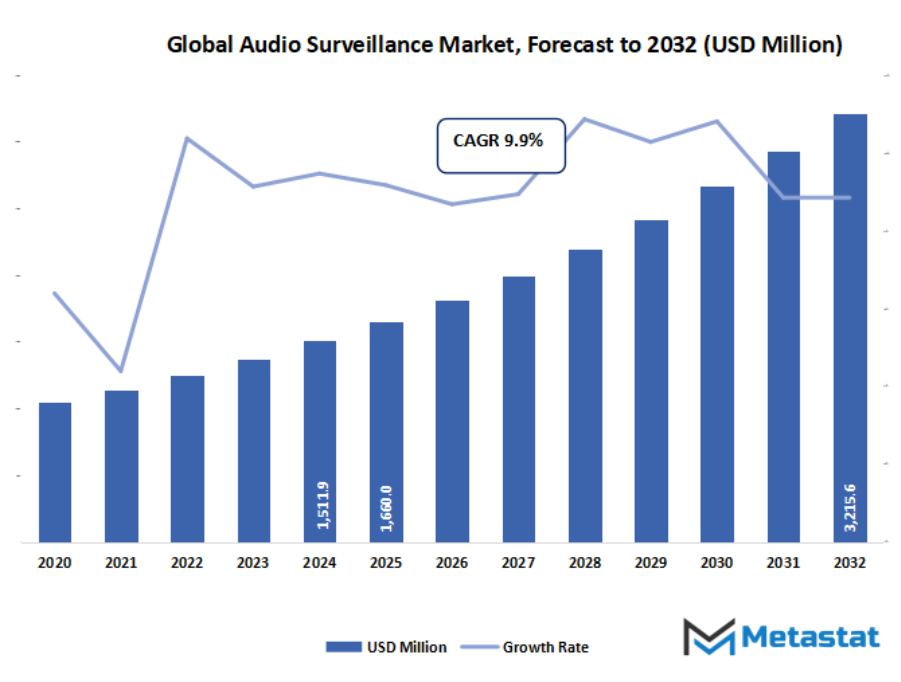

- The global audio surveillance market valued at approximately USD 1660 million in 2025, growing at a CAGR of around 9.9% through 2032, with potential to exceed USD 3215.6 million.

- Hardware (Cables & Connectors, Microphones, Recorders, Speakers) account for a market share of 58.9% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising demand for enhanced security and situational awareness across public spaces and enterprises., Growing adoption of AI-enabled audio analytics and voice recognition for threat detection.

- Opportunities include: Increasing opportunity in multi-sensor surveillance platforms combining audio, video and analytics.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

The global audio surveillance market will further shape an industry wherein sound will carry far more meaning than simply monitoring. As technology advances, acoustic awareness will stretch beyond familiar security confines into spaces that will appreciate interpretation above mere detection. In coming years, sound-based systems will be expected to operate at a level of intelligence akin to human judgment, allowing them to discern mood, urgency, and unusual patterns that traditional tools cannot detect.

What falls outside the confines of today's comprehension is how deeply this marketplace will permeate sectors other than security. Very soon, hospitals might use advanced acoustic systems to identify distress in patients who cannot communicate. Transportation networks may use smart listening tools to sense crowd flow or mechanical strain before issues surface. Even workplaces could use subtle audio cues to support productivity or keep environments safer with less intrusive measures. The marketplace will be broadened to change sound from a silent, background element into a practical asset.

Market Segmentation Analysis

The global audio surveillance market is mainly classified based on Component, Type, Frequency Range, Industry Vertical.

By Component is further segmented into:

- Hardware (Cables & Connectors, Microphones, Recorders, Speakers)

Steady adoption of advanced hardware will shape the future movement across the global audio surveillance market, with new designs promising to offer clear transmission, long life of the device, and easy integration with control systems. Growing attention towards secure monitoring in complex facilities would support wider acceptance of cables, microphones, recorders, and speakers with refined functions.

- Services (Installation & Setup, Maintenance & Support)

As the global audio surveillance market transitions towards long-term performance assurance, service-based functions will hold greater value. Installation and support teams will work to fine-tune system layout, prevent downtime, and enhance sound capture accuracy. Fast-paced upgrades and incessant support will be at play to help facilities maintain reliability of audio coverage in dynamic environments.

- Software

Advancements in software will shape the global audio surveillance market toward faster processing, smart detection, and adaptive monitoring workflows. Advanced programs will analyze sounds with greater clarity, automate alerts, and support multi-location oversight. Growing digital dependence will encourage developers to build flexible solutions that adjust to future security demands.

By Type the market is divided into:

- IP-Based Systems

The global audio surveillance market will be driven towards connected and centrally managed monitoring setups by IP-based structures. Seamless data transfer, scalable links, and remote access will characterize future installations, enabling organisations to monitor large spaces with minimal delay. Improved transmission quality will make the systems more viable for complex sites.

- Analog Wired Systems

In the global audio surveillance market, analog wired formats will continue serving locations seeking stable, interference-free communication. Many facilities will be able to maintain dependable sound collection with durable wiring and predictable performance. Continued upgrades to clarity and noise control will enable continued relevance in traditional security layouts.

- Digital Wired Systems

The global audio surveillance market will continue to be strengthened by digital wired designs with their higher sound accuracy and synchronized data handling. Advanced converters and structured wiring will be used in future networks to support smooth recording. Growth will be pushed further by a greater demand for reliable monitoring in sensitive environments.

- Bluetooth Enabled

Bluetooth-based options add mobility and flexibility in placement in the global audio surveillance market. Compact designs and wireless links will support temporary setups, mobile teams, and fast installation needs. Improved range and stable pairing will make the units practical in environments where quick adjustments repeatedly occur.

- RF Technology

RF-enabled systems will result in wider coverage potential across the global audio surveillance market. Strong signal penetration and long-distance communication would benefit large industrial or outdoor spaces. Advancements in interference reduction and energy efficiency will support broader acceptance of RF-based monitoring tools.

- Wi-Fi Enabled

Wi-Fi-powered tools will strengthen adaptability across the global audio surveillance market. Future devices will support high-resolution audio transmission, cloud storage connectivity, and multi-device networks. Rising focus on flexible layouts will encourage the use of Wi-Fi systems in locations where wired structures are difficult to maintain.

By Frequency Range the market is further divided into:

- High

Environments requiring precise sound recognition will be supported by high-frequency systems within the global audio surveillance market. The tools will capture sharper tones and support detailed analysis in controlled spaces. Growing demand for accurate monitoring in research, inspection, or restricted zones will encourage development in this segment.

- Low

Low-frequency solutions will advance within the global audio surveillance market for locations needing detection of deep vibrations or distant sounds. Improved sensitivity and enhanced filtering functions will allow accurate capture in large industrial sites. This range will serve the needs of monitoring where subtle audio patterns must be identified.

- Mid

Mid-frequency products will continue to see wide application in the global audio surveillance market owing to their balanced natures, which will suit several applications. Designs in the future will offer dependable clarity for everyday monitoring in commercial and operational contexts. Improved versatility will make the range suitable for multi-purpose audio coverage.

By Industry Vertical the global audio surveillance market is divided as:

- Chemical & Petrochemical

The advanced incorporation of audio monitoring will strengthen safety compliance at chemical and petrochemical facilities, thus helping the growth in the global audio surveillance market. The sound detection would identify the irregular activity or potential risk signals in sensitive equipment zones. Product development will be guided by an improvement in resistance to harsh site conditions.

- Oil & Gas

Specialized sound monitoring will be adopted to track machinery behavior and secure remote zones by oil and gas structures, while rugged devices will play a vital role in improved detection before the operational changes escalate. The broadened connectivity will improve supervision across widely dispersed assets.

- Energy & Power

Energy and power stations will adopt advanced sound devices in the global audio surveillance market to facilitate early detection of equipment disturbances. Future systems will help monitor turbines, control rooms, and substations without gaps in clarity. Improved analysis will facilitate prevention-orientated maintenance plans.

- Automotive

Automotive plants will leverage enhanced audio systems to monitor production lines and control seamless workflow in the global audio surveillance market. Devices will automatically detect odd sounds coming from machines, which will aid teams in minimizing downtime. With expanding automation, monitoring audio will continue to enable output regularity and operational precision.

- Food & Beverages

Food and beverage units will make use of audio tools in the global audio surveillance market in order to maintain hygiene-linked efficiency and the health of equipment. Continuous listening can identify irregular vibrations or processing faults. Improved systems facilitate smooth operations with no disturbance to sensitive production zones.

- Healthcare

Audio systems will also be refined to reinforce safety and communication in healthcare facilities across the global audio surveillance market. This will be beneficial in clearly capturing sounds to detect incidents, monitor patient care, or manage secure rooms. Future solutions will emphasize privacy safeguards while ensuring dependable oversight.

- Others

Other sectors will also continue the adoption of diverse audio solutions in the global audio surveillance market as monitoring needs expand in commercial, civic, and operational sites. Future tools will offer adaptable designs, allowing smooth installation into complex structures. Expanding digital functions will support consistent security coverage.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1660 Million |

|

Market Size by 2032 |

$3215.6 Million |

|

Growth Rate from 2025 to 2032 |

9.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

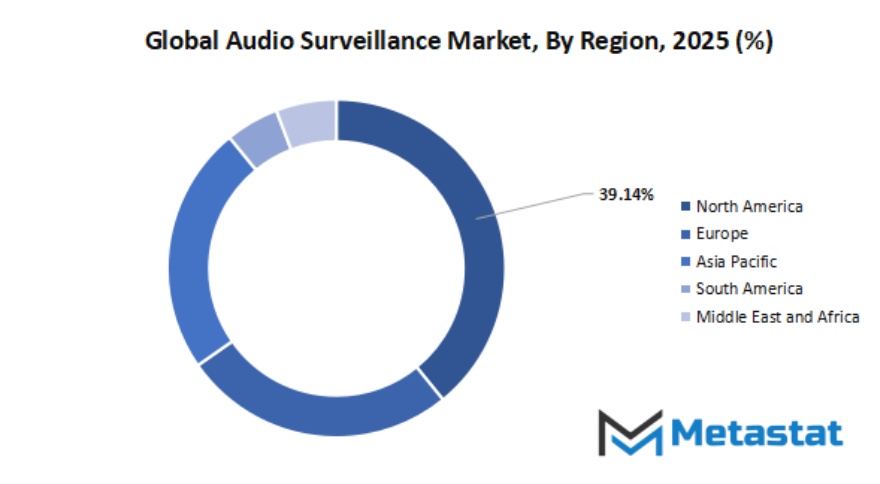

By Region:

- Based on geography, the global audio surveillance market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Market Dynamics

Growth Drivers:

- Increased demand for improved security and situational awareness in public places and organizations.

The rising demand for enhanced security and situational awareness in public spaces and enterprises sets the path that the global audio surveillance market will take. Continuous observation by sound will bring speedier detection of unusual activities, thus putting organizations in a better position to prevent risks from surfacing in busy and sensitive environments.

- Growing adoption of AI-enabled audio analytics and voice recognition for threat detection.

The growing adoption of AI-enabled audio analytics and voice recognition for threat detection will support the growth in the global audio surveillance market in the future. Smarter systems will listen for patterns, alerts, and warning cues, helping operators respond quickly, while reducing the need for constant manual supervision in large and complex locations.

Restraints & Challenges:

- Privacy regulations and ethical concerns limiting the pervasive use of audio monitoring.

The strategic path of the global audio surveillance market will be hampered by rigid privacy regulations and moral concerns that restrain the pervasive use of audio monitoring. Strict rules would demand planning and transparent usage, hence making organizations more cautious with how sound-based tools are installed and managed across various settings.

- High implementation complexity and the cost of integration with existing video-centric systems.

High implementation complexity and the cost of integration with existing video-centric systems are expected to continue affecting the global audio surveillance market. As upgrading older security setups to advanced audio functions will require technical skill, time, and investment, this may delay the adoption in organizations with smaller budgets or very outdated infrastructures.

Opportunities

- Increasing opportunity in multi-sensor surveillance platforms that combine audio, video, and analytics.

The destiny direction of the global audio surveillance market might be decided by means of the growth in possibilities associated with multisensor surveillance structures that integrate audio, video, and analytics. Such mixed structures will provide richer insights, more potent chance detection, and smoother control, enabling safety teams to build greater shrewd and linked monitoring networks over the coming years.

Competitive Landscape & Strategic Insights

The global audio surveillance market will continue to gain attention as competition increases and technology moves closer to more advanced monitoring tools. The need for better sound seize, pace, and integration inside security networks will ultimately boost up call for across public safety, industrial settings, and residential spaces. Growth might be driven by way of increasing focus associated with protection threats so one can compel stop-customers to put money into structures that provide reliable performance during everyday operations and eventual emergencies. Attention may even shift towards the ones solutions that limit heritage noise and help lengthy-distance sound series, thereby instilling self belief in selection-makers for long-time period deployment.

Strong participation from industry leaders and regional developers will mark progress in the global audio surveillance market. AXIS Communications AB, Becker Avionics GmbH, BrickHouse Security, ETS Inc., KJB Security Products, Louroe Electronics, Inc, MG Electronics, Ovation Systems Limited, S. Siedle & Söhne Telefon- und Telegrafenwerke OHG, Smart Cabling & Transmission Corp., Speco Technologies, Vivotek Inc, Crowne Audio, Harman International Industries, Incorporated (AKG), Avigilon Corporation (Motorola Solutions), Bosch Security Systems GmbH, Dahua Technology Co., Ltd., Guangzhou Sizheng Technology Co., Ltd., Hangzhou Hikvision Digital Technology Co., Ltd., Hanwha Vision Co., Ltd., Honeywell International Inc., i-PRO Co., Ltd., Pelco, Inc., SPON Communication Co., Ltd., Uniview Technologies Co., Ltd. (Uniview), and Verint Systems Inc. continue to build wider product lines that support surveillance goals across diverse settings. A broad mix of companies will encourage constant upgrades, as each brand seeks stronger results in clarity, durability, and network compatibility.

Manufacturing will become much more innovative, as many producers will try using hardware that can deliver clearer recording without any interference from crowded or low-light environments. Software improvements will help in finding suspicious activities with the help of sound patterns. These will further lead to greater confidence among buyers who need fast detection and correct analysis without making the system unduly complicated. Regular enhancements in storage capacity, wireless connectivity, and automation of the system will, therefore, always guide product planning for many future years to come and keep the performance in line with user needs and budget constraints.

Future movement in the global audio surveillance market will be shaped by rising interest from government projects, transportation networks, education centers, and retail environments. Wider deployment will encourage companies to offer better pricing, flexible installation choices, and simplified maintenance support. As technology continues to mature, tools should increasingly provide smooth integration with cameras and access control devices that help end users maintain safer surroundings with minimal effort. Ongoing participation from long-standing companies and new entrants will keep progress steady, ensuring that audio surveillance solutions stay relevant, practical, and dependable.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 1660 million in 2025 to over USD 3215.6 million by 2032. Audio Surveillance will maintain dominance but face growing competition from emerging formats.

Another area that will stretch the boundaries of the industry is ethical development. As abilities grow, developers will want to layout structures that shield non-public space even as still handing over valuable awareness. This balance will form how corporations adopt the technology and the way societies receive its presence in daily existence. The shift will now not just be approximately performance but approximately believe, transparency, and responsible handling of records.

Report Coverage

This research report categorizes the Audio Surveillance market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Audio Surveillance market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Audio Surveillance market.

Audio Surveillance Market Key Segments:

By Component

- Hardware (Cables & Connectors, Microphones, Recorders, Speakers)

- Services (Installation & Setup, Maintenance & Support)

- Software

By Type

- IP-Based Systems

- Analog Wired Systems

- Digital Wired Systems

- Bluetooth Enabled

- RF Technology

- Wi-Fi Enabled

By Frequency Range

- High

- Low

- Mid

By Industry Vertical

- Chemical & Petrochemical

- Oil & Gas

- Energy & Power

- Automotive

- Food & Beverages

- Healthcare

- Others

Key Global Audio Surveillance Industry Players

- AXIS Communications AB

- Becker Avionics GmbH

- BrickHouse Security

- ETS Inc.

- KJB Security Products

- Louroe Electronics, Inc

- MG Electronics

- Ovation Systems Limited

- S. Siedle & Söhne Telefon- und Telegrafenwerke OHG

- Smart Cabling & Transmission Corp.

- Speco Technologies

- Vivotek Inc

- Crowne Audio

- Harman International Industries, Incorporated (AKG)

- Avigilon Corporation (Motorola Solutions)

- Bosch Security Systems GmbH

- Dahua Technology Co., Ltd.

- Guangzhou Sizheng Technology Co., Ltd.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Hanwha Vision Co., Ltd.

- Honeywell International Inc.

- i-PRO Co., Ltd.

- Pelco, Inc.

- SPON Communication Co., Ltd.

- Uniview Technologies Co., Ltd. (Uniview)

- Verint Systems Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383