MARKET OVERVIEW

The Global Artificial Pancreas market is emerging as a transformative force within the healthcare industry. This market focuses on developing and distributing advanced systems that automate blood glucose control for individuals with diabetes. Unlike traditional diabetes management methods that require continuous monitoring and manual insulin administration, artificial pancreas systems integrate real-time glucose monitoring with automated insulin delivery. This innovation promises to significantly improve the quality of life for diabetic patients by reducing the burden of constant glucose monitoring and insulin injections.

Artificial pancreas systems, often referred to as closed-loop insulin delivery systems, utilize sophisticated algorithms to mimic the glucose-regulating function of a healthy pancreas. These systems typically consist of a continuous glucose monitor (CGM), an insulin pump, and a control algorithm that communicates between the two devices. The CGM continuously tracks the glucose levels in the patient's blood, transmitting this data to the control algorithm. The algorithm then calculates the appropriate amount of insulin needed and signals the insulin pump to deliver the precise dosage. This process occurs throughout the day and night, offering a more consistent and responsive management of blood glucose levels than manual methods

The market for artificial pancreas systems is driven by the increasing prevalence of diabetes worldwide, coupled with advancements in medical technology. With diabetes being one of the most prevalent chronic conditions globally, there is a growing demand for more effective and convenient management solutions. The artificial pancreas market aims to address this need by providing a solution that reduces the risk of hypoglycemia and hyperglycemia, two common and dangerous complications of diabetes.

Regulatory approvals play a significant role in the market dynamics of artificial pancreas systems. As these devices are classified as high-risk medical devices, they must undergo rigorous testing and approval processes before they can be marketed and used by patients. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are instrumental in setting the standards for safety and efficacy that these devices must meet. The future will likely see more streamlined and expedited approval processes as the technology matures and demonstrates its effectiveness and safety.

Research and development are at the heart of the Global Artificial Pancreas market. Continuous innovation is crucial to enhancing the accuracy, reliability, and user-friendliness of these systems. Companies and research institutions are investing heavily in developing next-generation artificial pancreas systems that incorporate artificial intelligence and machine learning to further improve glucose regulation. These advancements will enable more personalized and adaptive insulin delivery, catering to the unique needs of each patient

The market's future trajectory is promising, with numerous opportunities for growth and development. As the technology becomes more sophisticated and accessible, it is expected that artificial pancreas systems will become the standard of care for diabetes management. This shift will likely be supported by healthcare policies that recognize the long-term benefits of automated insulin delivery systems, both in terms of patient outcomes and overall healthcare costs.

The Global Artificial Pancreas market is set to revolutionize diabetes management by offering a seamless and automated solution for blood glucose control. With ongoing advancements and increasing adoption, these systems will play a critical role in enhancing the lives of millions of diabetic patients worldwide. As research and innovation continue to drive this market forward, the future of diabetes care looks increasingly promising.

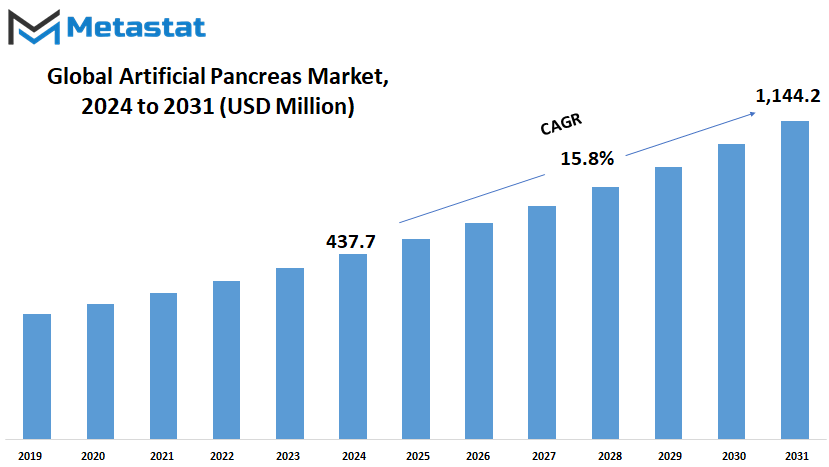

Global Artificial Pancreas market is estimated to reach $1,144.2 Million by 2031; growing at a CAGR of 15.8% from 2024 to 2031.

GROWTH FACTORS

The future of the global Artificial Pancreas market is shaped by several key factors that point towards significant growth. One of the primary drivers is the increasing prevalence of diabetes worldwide, which is creating a higher demand for advanced technologies to manage and control the disease effectively. As more people are diagnosed with diabetes, there is a growing need for innovative solutions that can help patients maintain their health with greater ease and precision.

Improving the quality of life for diabetes patients is becoming a major focus. Traditional methods of diabetes management often involve frequent blood sugar testing and multiple daily insulin injections, which can be cumbersome and stressful. Automated systems, like the Artificial Pancreas, offer a more precise and less burdensome approach, which can significantly enhance patient well-being. These systems can automatically monitor blood glucose levels and deliver the right amount of insulin, reducing the risk of human error and making diabetes management much more manageable.

However, there are challenges that need to be addressed to ensure the widespread adoption of Artificial Pancreas systems. Regulatory hurdles and safety concerns are significant issues. The approval process for medical devices is rigorous, and any automated system that delivers medication must meet strict safety standards. These regulations, while essential for patient safety, can slow down the introduction of new technologies to the market. Additionally, the cost of these advanced systems can be prohibitive for some patients and healthcare providers. This financial barrier limits access to Artificial Pancreas technology in certain regions and populations, potentially hindering overall market growth.

Despite these challenges, there are promising opportunities on the horizon. The integration of Artificial Pancreas technology with continuous glucose monitoring (CGM) devices and smartphone applications is a particularly exciting development. This integration allows for more seamless and user-friendly diabetes management solutions. By connecting these technologies, patients can benefit from real-time data and more intuitive controls, making it easier to manage their condition effectively.

Looking ahead, the market for Artificial Pancreas systems is likely to expand as these technologies become more sophisticated and accessible. Innovations in technology and improved integration with existing diabetes management tools will drive growth, offering better solutions for patients worldwide. As the healthcare industry continues to evolve, the focus on enhancing patient quality of life and reducing the burden of diabetes management will remain a key factor in the development and adoption of these advanced systems. With ongoing advancements, the future of diabetes care looks promising, providing hope for improved outcomes and a better quality of life for millions of patients globally.

MARKET SEGMENTATION

By Type

The global artificial pancreas market is poised for significant growth, driven by advancements in medical technology and a growing need for better diabetes management solutions. These systems, designed to automate blood sugar control, offer hope for millions of individuals managing diabetes. With innovations continuously emerging, the future looks promising for those relying on these devices.

Artificial pancreas systems are generally categorized into four main types: Threshold Suspended Device System, Non-Threshold Suspended Device System, Control to Range System (CTR), and Control to Target System (CTT). Each type represents a different approach to managing blood glucose levels, tailored to meet varying needs and preferences of patients.

The Threshold Suspended Device System functions by suspending insulin delivery when glucose levels drop below a certain point, preventing hypoglycemia. This system is particularly useful for patients who struggle with low blood sugar episodes, offering a safeguard against potentially dangerous situations. As technology improves, these systems will likely become more precise, reducing the incidence of false alarms and ensuring better overall glucose management.

The Non-Threshold Suspended Device System, on the other hand, provides more continuous and nuanced control by not just suspending insulin but adjusting its delivery based on real-time glucose readings. This approach allows for a more dynamic response to blood sugar fluctuations, potentially leading to better long-term health outcomes. Future developments in sensor technology and algorithms will enhance the accuracy and responsiveness of these systems, making them more reliable for daily use.

Control to Range Systems (CTR) are designed to keep blood glucose levels within a predefined range. These systems monitor glucose levels and adjust insulin delivery to prevent both hyperglycemia and hypoglycemia. As we move forward, improvements in artificial intelligence and machine learning will likely refine these systems, enabling them to predict and respond to glucose trends more effectively. This will help in maintaining a more stable glucose range, which is crucial for reducing the risk of diabetes-related complications.

Control to Target Systems (CTT) aim for even more precise control by targeting specific glucose levels rather than a range. These systems use advanced algorithms to make continuous adjustments, striving for optimal glucose levels at all times. The future of CTT systems looks especially bright, with ongoing research focused on enhancing algorithmic learning and sensor precision. This could result in artificial pancreas systems that not only mimic but potentially surpass the natural regulatory mechanisms of the human body.

Overall, the future of the global artificial pancreas market is bright, driven by technological advancements and a growing understanding of diabetes management. As these systems become more sophisticated and accessible, they will play an increasingly vital role in improving the quality of life for individuals with diabetes, offering more precise and reliable glucose control.

By Treatment Type

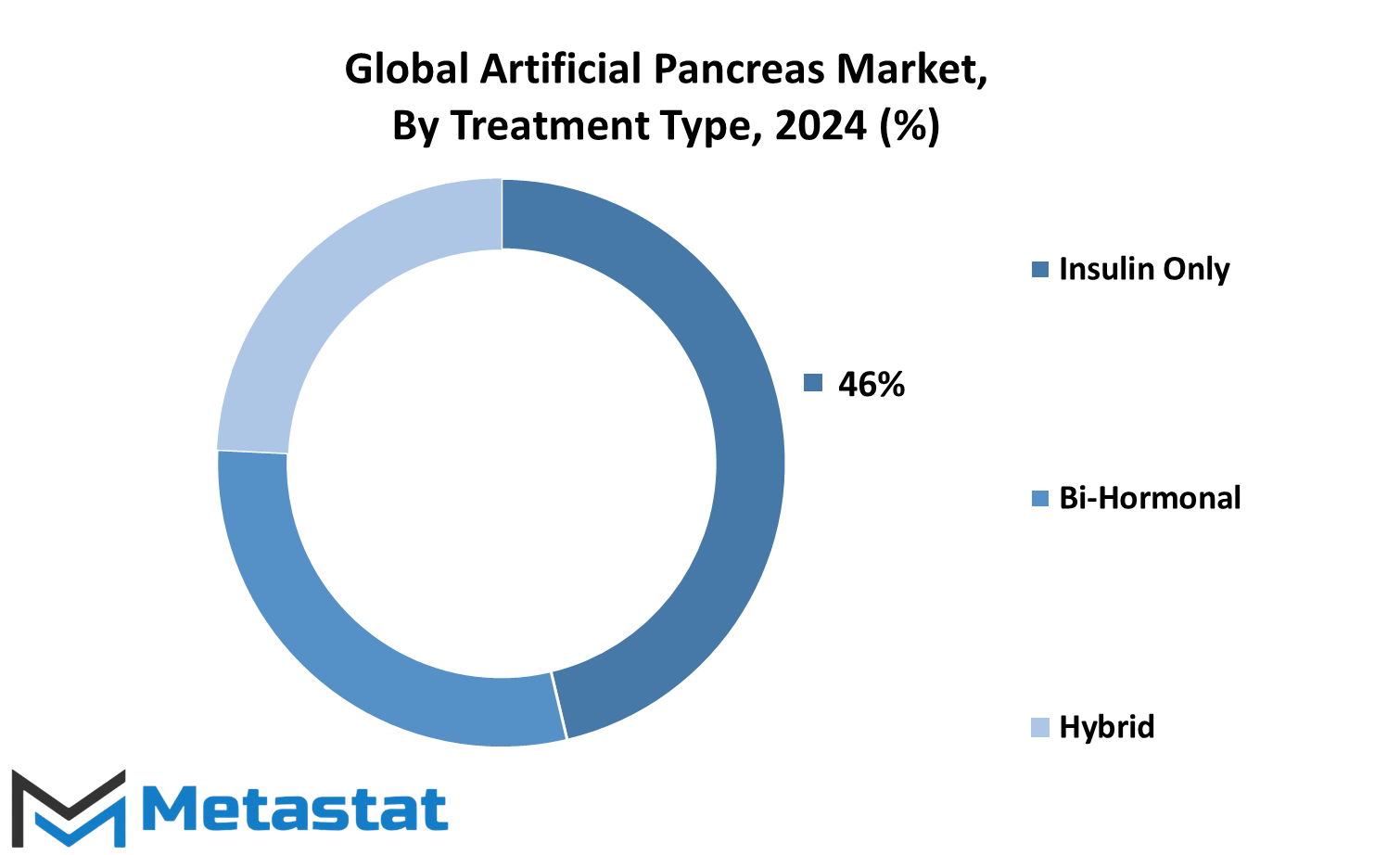

The global artificial pancreas market is on the brink of significant advancements, driven by ongoing innovations and the increasing need for effective diabetes management solutions. The market is primarily divided into three treatment types: insulin-only, bi-hormonal, and hybrid systems. Each of these treatment types offers unique benefits and caters to different patient needs, and their future development holds promising potential for improving the quality of life for individuals with diabetes.

Insulin-only systems are currently the most common type of artificial pancreas on the market. These systems focus on delivering insulin, which is crucial for people with type 1 diabetes who cannot produce this hormone on their own. In the future, advancements in insulin-only systems will likely focus on improving accuracy and responsiveness. This will ensure that blood sugar levels are maintained more effectively, reducing the risk of both hyperglycemia and hypoglycemia. Moreover, integrating advanced algorithms and machine learning into these systems will enhance their ability to predict and respond to the body's insulin needs more precisely.

Bi-hormonal systems represent a more complex approach by delivering both insulin and another hormone, typically glucagon. This dual-hormone strategy aims to mimic the body's natural regulation of blood sugar more closely. Looking ahead, bi-hormonal systems are expected to become more sophisticated, with better delivery mechanisms and enhanced hormone stability. This will provide a more balanced approach to blood sugar management, offering a higher degree of control and reducing the frequency of blood sugar swings. The development of stable and long-lasting glucagon formulations will be a key factor in the success of these systems.

Hybrid systems combine features of both manual and automated insulin delivery, providing a middle ground between completely automated systems and those that require more user input. These systems are designed to ease the transition for patients moving from traditional insulin pumps to fully automated artificial pancreas systems. Future improvements in hybrid systems will likely focus on enhancing user-friendliness and minimizing the need for manual adjustments. By incorporating more automated features, these systems will gradually reduce the burden on patients while still providing effective blood sugar management.

By End User

The global artificial pancreas market is on the brink of a significant transformation, poised to bring about remarkable advancements in diabetes management. This cutting-edge technology, designed to automate blood sugar control, is expected to have a profound impact on various healthcare settings. As we look to the future, it becomes evident that the application of artificial pancreas systems will expand across multiple end users, including hospitals, clinics, homecare, ambulatory surgical centers (ASCs), and other healthcare facilities.

In hospitals, the adoption of artificial pancreas systems will revolutionize patient care. These institutions, often dealing with severe and complex cases of diabetes, will benefit immensely from the precision and automation provided by these systems. The reduction in human error and the continuous monitoring capability will enhance patient outcomes, making hospital stays shorter and more effective. Furthermore, the integration of artificial pancreas systems in hospitals will pave the way for more efficient use of medical resources and personnel, allowing healthcare providers to focus on other critical aspects of patient care.

Clinics, which serve as primary care centers for many patients, will also see substantial benefits. With the artificial pancreas, clinicians will be able to offer a higher standard of care, especially for those requiring frequent monitoring and adjustments to their insulin therapy. This technology will enable personalized treatment plans, reducing the burden on both patients and healthcare providers. Clinics will likely become the frontline for widespread adoption, given their accessibility and the ongoing relationship they maintain with patients.

Homecare is another area where the artificial pancreas market is set to flourish. For many individuals living with diabetes, managing their condition at home is both a necessity and a challenge. The convenience of having an artificial pancreas system at home will significantly improve the quality of life for these patients. It will empower them to manage their condition with greater independence and confidence, reducing the need for frequent hospital visits and allowing for more consistent management of their blood sugar levels.

Ambulatory surgical centers (ASCs) will also benefit from the integration of artificial pancreas technology. These centers, which specialize in same-day surgical procedures, will find the technology particularly useful for managing diabetic patients undergoing surgery. The precise control over blood sugar levels will minimize complications during and after surgery, leading to better surgical outcomes and faster recovery times.

Other healthcare settings, including specialized diabetes care centers and research institutions, will contribute to the growth of the artificial pancreas market. These settings will drive innovation and improvements in the technology, ensuring that the systems remain at the forefront of diabetes care.

REGIONAL ANALYSIS

The global Artificial Pancreas market is segmented based on geography into several key regions: North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each of these regions presents unique opportunities and challenges for the market, influenced by factors such as healthcare infrastructure, economic conditions, and the prevalence of diabetes.

In North America, the market is further divided into the United States, Canada, and Mexico. The U.S. is expected to lead the region due to its advanced healthcare system, high awareness about diabetes management, and significant investments in medical technology. Canada and Mexico are also contributing to the market growth, albeit at a slower pace, as they continue to enhance their healthcare facilities and access to advanced medical devices.

Europe, encompassing the UK, Germany, France, Italy, and the Rest of Europe, is another significant region for the Artificial Pancreas market. Countries like Germany and the UK are at the forefront, driven by strong healthcare systems and ongoing research and development in diabetes care. France and Italy also play crucial roles, with their focus on improving healthcare outcomes and government initiatives to support medical advancements. The rest of Europe, with its diverse healthcare landscapes, is gradually catching up, propelled by increasing awareness and the availability of innovative treatments.

The Asia-Pacific region, segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific, is poised for substantial growth. China and India, with their large diabetic populations and improving healthcare infrastructure, are key markets. Japan and South Korea, known for their technological advancements, are rapidly adopting artificial pancreas systems, driven by high rates of diabetes and supportive healthcare policies. Other countries in the region are also witnessing a rise in market demand as they enhance their healthcare services and technology adoption.

In South America, Brazil and Argentina are the primary markets, with the Rest of South America following suit. Brazil, with its robust healthcare initiatives and growing awareness about diabetes management, is leading the way. Argentina is also making strides, supported by efforts to improve healthcare access and quality. The rest of South America is gradually advancing, with increasing investments in healthcare infrastructure and technology.

The Middle East & Africa, categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa, presents a mixed picture. GCC countries, with their significant healthcare investments and high rates of diabetes, are at the forefront. Egypt and South Africa are also important markets, focusing on improving healthcare delivery and access to advanced medical technologies. The rest of the region is slowly progressing, driven by international aid and efforts to enhance healthcare systems.

The global Artificial Pancreas market is evolving differently across regions, shaped by local factors and global trends. As healthcare systems worldwide continue to improve and technology advances, the market is expected to grow, offering better management options for diabetes patients everywhere.

COMPETITIVE PLAYERS

The global artificial pancreas market is experiencing a rapid expansion, driven by continuous advancements in medical technology and an increasing prevalence of diabetes. The artificial pancreas, a system that mimics the glucose-regulating function of a healthy pancreas, is a groundbreaking solution for people with diabetes. Key players in this market are striving to develop more effective and user-friendly devices, positioning themselves at the forefront of this critical healthcare innovation.

Medtronic, a leader in medical device technology, has been pioneering the development of artificial pancreas systems. Their advanced insulin pumps and continuous glucose monitoring (CGM) systems are widely recognized for their reliability and effectiveness. Medtronic's commitment to innovation ensures they remain a dominant force in the market, constantly improving their products to better meet the needs of patients.

Bigfoot Biomedical is another significant player, known for its smart insulin delivery systems. By leveraging artificial intelligence, Bigfoot Biomedical aims to simplify diabetes management for users, offering systems that adapt to individual needs and provide real-time adjustments. This approach not only enhances user experience but also improves overall health outcomes.

Dexcom Inc is renowned for its state-of-the-art CGM systems, which play a crucial role in artificial pancreas technology. Dexcom's sensors provide accurate and real-time glucose readings, allowing for precise insulin delivery. Their continuous focus on technological advancements and partnerships with other industry leaders underscores their influential presence in the market.

Tandem Diabetes Care Inc has made notable strides with its insulin pump technology, which integrates seamlessly with CGM systems to form a complete artificial pancreas solution. Tandem's user-friendly designs and innovative features have garnered significant attention, making them a key competitor in the industry.

Roche and Diabeloop SA are also making waves with their collaborative efforts to enhance artificial pancreas systems. Diabeloop's algorithm-driven solutions, combined with Roche's extensive experience in diabetes care, are driving significant advancements in automated insulin delivery.

Other important players like EoFlow, Beta Bionics Inc, Glooko Inc, Insulet Corporation, Teladoc Health Inc, and Abbott Laboratories are contributing to the market's growth through their unique technologies and innovative approaches. EoFlow's wearable insulin delivery devices, Beta Bionics' bionic pancreas, and Glooko's data management solutions are just a few examples of the diverse technologies shaping the future of diabetes care.

As the global artificial pancreas market continues to evolve, the competition among these key players will likely drive further innovations. These advancements promise to improve the quality of life for individuals with diabetes, offering more precise and convenient ways to manage their condition. Looking ahead, the collaboration between technology and healthcare companies will be crucial in developing next-generation artificial pancreas systems, ultimately aiming for a future where diabetes management is seamlessly integrated into daily life.

Artificial Pancreas Market Key Segments:

By Type

- Threshold Suspended Device System

- Non-Threshold Suspended Device System

- Control to Range System (CTR)

- Control to Target System (CTT)

By Treatment Type

- Insulin Only

- Bi-Hormonal

- Hybrid

By End User

- Hospitals

- Clinics

- Homecare

- Ambulatory Surgical Centers (ASCs)

- Others

Key Global Artificial Pancreas Industry Players

- Medtronic

- Bigfoot Biomedical

- Dexcom Inc

- Tandem Diabetes Care Inc

- Roche

- Diabeloop SA

- EoFlow

- Beta Bionics Inc

- Glooko Inc

- Insulet Corporation

- Teladoc Health Inc

- Abbott Laboratories

- Beta Bionics

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252