MARKET OVERVIEW

The global wound cleanser market is a niche market within the healthcare industries that specialize in products designed specially for wound cleansing and preparation. The market is at the forefront of the provision of medical care today as it caters to the problems of wound care. Preventing infection, regeneration of tissue, and appropriate care for wounds require the product, therefore the need. These are products used in every healthcare condition, such as hospitals, clinics, and home care. They accomplish several needs in patients while providing various medical conditions.

They remove debris, exudate, and pathogenic organisms from wounds, thus starting the perfect healing state of a wound. In contrast with the generally harsh nature of regular antiseptics towards sensitive tissue, this type of cleaner is specially formulated to work gently yet effectively. They are employed from minor cuts and abrasions to complicated chronic wounds, operation areas, and burns, and thus are necessary in the acute as well as in long-term care environments. Innovation and adjustment define the global wound cleanser market as producers work to develop higher-level solutions to satisfy the stringent demands of healthcare professionals and patients. Improvements in biotechnology and material sciences propel this industry behind this market.

The changing formulation, as well as delivery mechanism, of cleansers for wounds all attempt improved efficacy and added patient comfort. Through ongoing investigation of biofilm disruption and antimicrobial activity, further advancement of these products can be made to enable the healthcare practitioner in the daunting task of treating wound conditions. One thing that will become even more crucial in deciding the future of the market is integration of ecologically friendly and sustainable practice into product design. Healthcare professionals recognized the necessity of customized solutions to treat wounds, and thus increasing emphasis is being placed on wound cleansers that are customized. Targeting special kinds of wounds and healing stages becomes necessary, and thus products get launched for specific medical conditions.

Certain cleansers, for instance, are meant for sensitive pediatric or geriatric skin, and others are specifically formulated to treat diabetic patients' chronic wounds. This focused strategy highlights the dynamic context of the global wound cleanser market and its diversification potential. This field also encompasses non-clinical application, such as in first aid and sports medicine. As most individuals are becoming aware of good wound care, there is a greater likelihood of these cleaners being used outside hospitals to everyday environments. This is also indicative of the demand for products that can be readily reached by everyone, therefore the need for convenient designs, with little medical training required by its users.

In all, the global wound cleanser market is a foundational element of contemporary wound care and an indicator of the dedication to optimizing patient outcomes through effective and safe products. This market will find ways to evolve alongside emerging needs as healthcare systems change, using the evolution in science and technology to deliver the best care for patients globally. With its niche dedication and revolutionary influence, it will be a significant sector in the healthcare community at large.

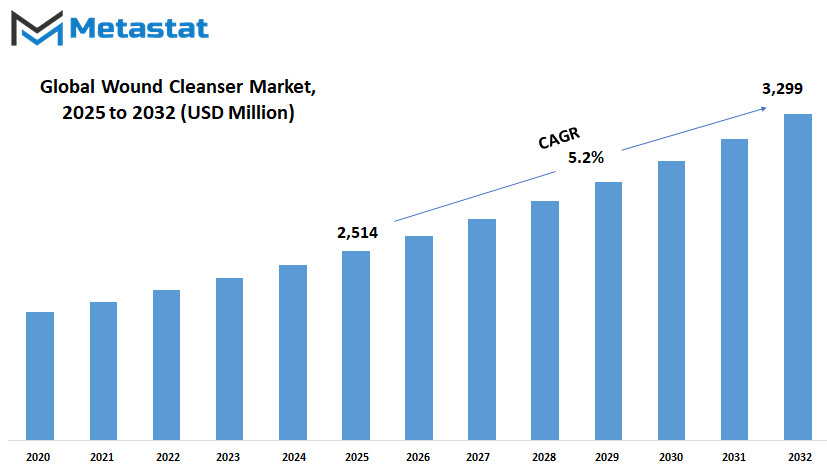

Global wound cleanser market is estimated to reach $3,299 Million by 2032; growing at a CAGR of 5.2% from 2025 to 2032.

GROWTH FACTORS

The prevalence of chronic wounds, including diabetic ulcers and pressure sores, is continually increasing to become a significant issue, particularly among elderly populations. With an increased number of patients encountered with these conditions, information regarding the importance of high-quality wound care to improve their quality of life increases. This has been among the reasons why numerous healthcare centers have adopted the new solutions in wound care. These more advanced methods highlight quick recovery and fewer complications, hence why they are most preferred within the clinical field. While advanced wound cleansers, however, do pose some challenges that can impact their widespread use.

One of the main problems is that these are comparatively more costly than the older methods. For many, particularly those who fall into the low-income category or are not insured, prices as high as this are just too prohibitive. Moreover, availability of these products continues to be a point of access restriction in rural and under-privileged communities. Limited accessibility implies that patients in these regions have no other option but to make do with less effective products, resulting in longer recovery periods and complications occurring more often. Removal of these access restrictions will be required to ensure that any patient who requires such advanced products will be able to access them. Conversely, new wound cleansers with innovative designs are the future breakthroughs. They will be green and harmless, aligning with the global drive towards sustainability in health care.

The new products would demonstrate the interests of the environment and patient outcomes in minimizing irritation and speeding up healing. Should these technologies become affordable and attainable, they could revolutionize wound care in access and effectiveness. Since there is greater emphasis on research and development in this sector in the next couple of years, the demand for wound cleansers will definitely increase. By overcoming the existing challenges and manufacturing products that cater to the varied needs of patients, there is ample scope for expansion. With ongoing education of healthcare professionals and the general public on the advantages of such products, the consumption of advanced wound care products is bound to increase in future and will benefit both the patients and the healthcare sector as a whole.

MARKET SEGMENTATION

By Type

Wound cleansers are very much a vital part of any healing regimen as far as the wound is concerned. It is a process through which it cleans the wounds in a way that removes all the trash, leaving no space for infection. There are also readily available forms of wound cleaners for all types of wounds and based on the nature of the wound or severity they are intended for, antiseptic wound cleaners, antibacterial wound cleaners, saline wound cleaners, hydrogen peroxide wound cleaners, and iodine-based wound cleaners among others.

Prevent infection by killing or inhibiting the development of pathogenic microorganisms. Such solutions are particularly ideal for at-risk-contamination wounds. Antibacterial cleaners are specifically intended to de-activate bacteria, and for this reason, they guarantee that wounds contain less burden of bacteria, which means better healing prospects. There are a few scenarios in which selection is made on the basis of there being an active or possible bacterial infection.

Saline wound cleaners are widely employed due to their non-toxicity and lack of irritation. They assist in the debridement of dirt and debris without the influence on surrounding tissue, therefore they are a popular choice for standard wound management. Wound cleaners based on hydrogen peroxide are also employed. The action of bubbling present in these can assist in loosening debris and dead tissue from wounds. However, they are to be used with caution since their intense oxidizing characteristic can lead to irritation if used in excess. However, the mass application of an iodine-based wound cleanser is another of the most common categories with the ability to kill many kinds of pathogens. There are particular applications for surgeries or extremely potent disinfections required. Other cleansers for wounds are more niche to accomplish certain functions, like those that have advanced ingredients and technologies geared toward specific types of trauma or sensitive skin.

Choosing a proper wound cleanser is important to treat wounds and enjoy proper recovery. This may differ from individual to individual with variations in the conditions, sizes, areas, and potential infections of wounds. Applying and following doctor prescriptions or recommendations ensure proper cleansing and aiding natural body recovery mechanisms. Wound cleaners continue to be a fundamental aspect of contemporary health care, lending invaluable assistance in ensuring cleanliness and promoting recovery in most wound therapy situations.

By Application

Acute wounds, chronic wounds, and post-operative wound care constitute markets by application. This includes a segment to address each stipulated condition for wound injury and healing; each segment is imperative for medical healthcare services.

Acute Wound Injury signifies any form of sudden or severe injuries. It is largely acquired through accidents and may entail cutting or scalding as part of the accident. Wounds of such a nature heal on a predictable basis when taken care of properly. The goal of acute wound care products is to avoid infection, accelerate healing, and render it less painful. The variety covers the most basic, like simple bandages and dressing, to antiseptic sprays and hydrocolloid dressing for people who have greater needs, so patients get what they need to heal optimally. Chronic wounds are generally those that heal slower or less easily, and hence need longer care. Such types of wounds are usually associated with conditions of diabetes or circulatory problems, making it harder to heal. So, for such wounds, special products are required that can control the risk of infection, bring moisture in the wound bed, and help regenerate tissue.

One of the sophisticated dressings, negative pressure wound therapy units, and bioengineered skin grafts have been created to utilize in treating chronic wound patients and improve their results.

Other essential pieces are postoperative wound care. Proper wound care following surgery is required in patients to prevent complications, reduce scars and generally enhance recovery experience. Here, products were made to aid healing across the surgical incision. There are sterile dressings, sutures, and adhesives that help keep it clean and prevent movement and pressure that would interfere with healing.

These three groups describe how wound care solutions are designed to meet the complex needs of the patient. Every category of wound has a particular issue, and the market is still available to provide products to tackle these issues in a suitable manner. Whether through accelerating the healing of acute wounds, controlling the complexity of chronic wounds, or making recovery smooth after surgery, the focus is still on improving patient outcomes and quality care in medical settings. Used judiciously, these products go a long way in facilitating patients to recover.

By Distribution Channel

The various forms of distribution channels ensure that the products are delivered to customers in the most convenient way for them. These are hospital pharmacies and retail pharmacies along with online sites and, to a lesser extent, to a direct sales channel for other products. Each is engaged with a distinct role or need in satisfying the special demands of customers.

True to form, one source of prescription medication is hospital pharmacies where patients receive prescription medication to supplement the treatment or upon arriving to visit the doctors and health practitioners when they go to hospitals for checkups following treatment.

The hospital pharmacies normally come with a health care facility; thus, the prescription product will be able to reach the patients quite easily most likely in consultation with health workers. The same will also serve a large number of patients, primarily those whose medication would require immediate dispensing.

Retail pharmacies are, nonetheless, one of the longest-standing and most prevalent distribution channels in use. They consist of physical stores in neighborhoods and commercial areas with in-store service by pharmacists. They sell everything: prescription drugs, over-the-counter drugs, and health-and-wellness items. Retail pharmacies' convenience and ubiquity make them the first choice for many customers seeking to save time and get their wanted items immediately available. Internet pharmacies have been in the news lately because they provide an easy shopping experience. Buyers can order medications and accessories at home, and delivery services see to it that these reach them promptly.

This medium is particularly useful for those who are bedridden or reside in faraway places. Internet pharmacies also generally provide the advantage of price comparison and greater variety. Direct selling is another highly effective method, particularly for specialty or niche products. This tends to involve reps who have direct contact with the consumer and are able to give all of the information and advice on the product. It is a more customized experience and, therefore, can be highly effective for products that need more explanation or personalized recommendations.

Each of these channels offers its own strengths so that the combination will be certain to offer the difference in availability and accessibility in what goods the buyers will have. The combination will ensure individuals have choices or alternatives in obtaining what is required: personal contact for convenience or customized service. In fact, the variety of channels demonstrates an attempt to address the varied preferences of the market and their varied needs.

By End-Use

The global wound cleanser market is segmented into a few predominant end-use categories: hospitals, clinics, home care facilities, ambulatory surgical centers, and other medical facilities. Each of these facilities greatly influences the demand for wound cleansers that play an important role in efficient cleaning and wound management.

Hospitals are also one of the biggest consumers of wound cleansers. With their diverse range of patients and complicated medical conditions, hospitals need a constant turnover of wound care products. Hospitals tend to handle severe wounds such as surgical wounds, traumatic injuries, and chronic diseases like diabetic ulcers. The demand for wound cleansers in hospitals stems from preventing infection and healing faster.

Clinics also drive the demand for wound cleansers worldwide. The majority of the healthcare units deal with minor injuries, general surgeries, and specialty care. Wound cleansers play a vital role in the maintenance of hygiene and healing during the treatment of small cuts, scrapes, or post-op care. Clinics, particularly dermatological or minor surgery clinics, will further depend on these products for the upkeep of patient health and recovery.

Home care environments have relied more on wound cleansers as more patients are being treated at home than in the hospital environment. Surgical, injured, or chronically ill patients usually require wound care while at home. Wound cleansers are used by patients or their carers to keep the area clean and to avert complications like infection. This sector is bound to expand as most individuals want to receive treatment from home.

Ambulatory Surgical Centers (ASCs) are also a major target market segment. ASCs are facilities that deal with outpatient surgery, where the patients, in a majority of instances, experience minor to moderate injuries. It is thus through proper wound care solutions that ASCs will be able to treat the postoperative injury and ensure their patients recover adequately after the operation. The application of the wound cleansers in these facilities will thus continue to be crucial in preventing infection and facilitating recovery.

Other health facilities are nursing homes, rehabilitation centers, and even urgent care centers, also in need of wound cleaners. These institutions accommodate different levels of chronic-wound or injured patients or individuals from surgical operations. Increased need for wound care among patients in health facilities increases the demand for wound cleansers.

|

Report Coverage |

Details |

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2,514 million |

|

Market Size by 2032 |

$3,299 Million |

|

Growth Rate from 2025 to 2032 |

5.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

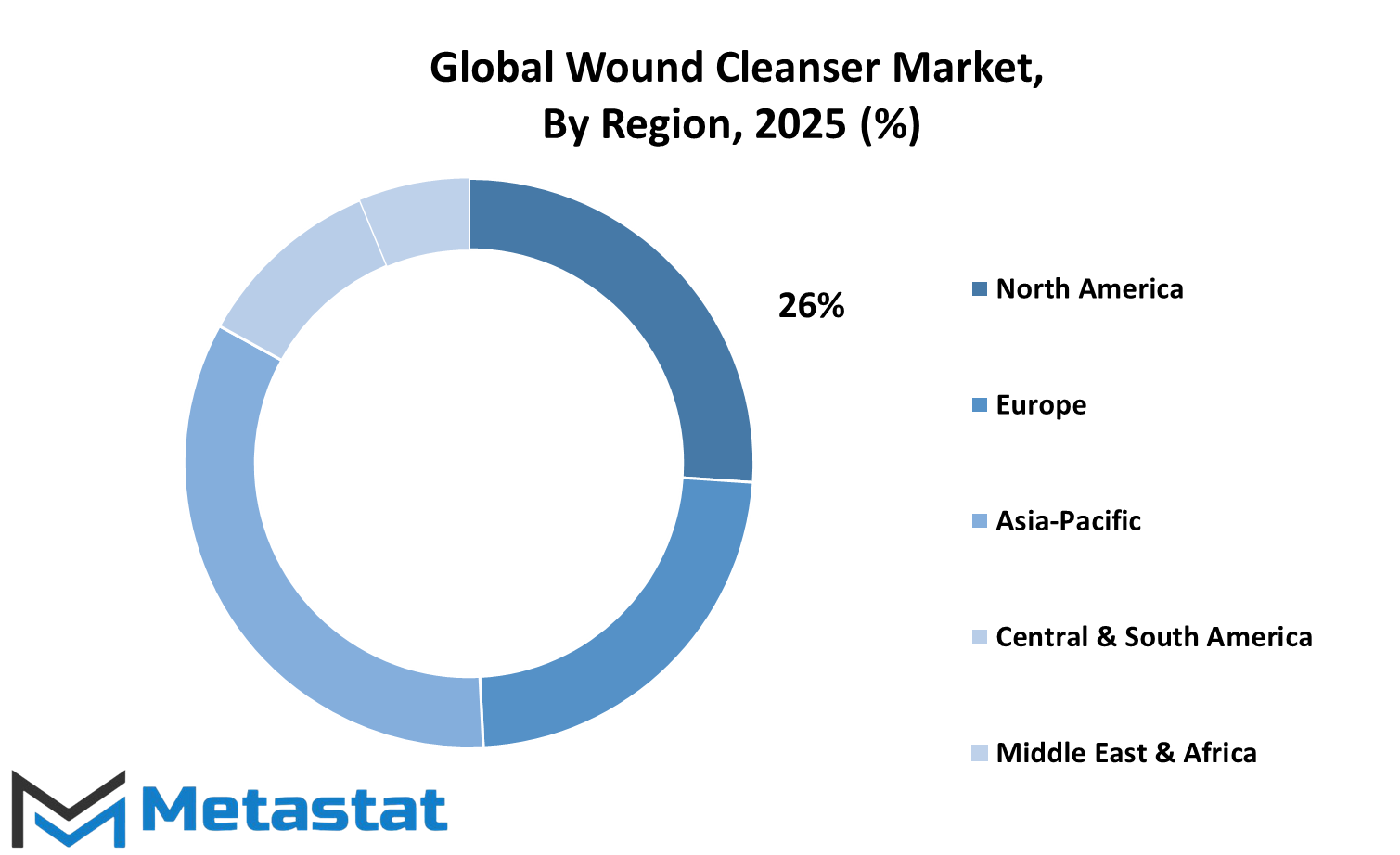

REGIONAL ANALYSIS

The geographical segments of the global wound cleanser market have been fragmented into five regions, namely North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. In addition to that, North America has been segmented into three countries-the United States, Canada, and Mexico. Europe includes the United Kingdom, Germany, France, Italy, and other countries in this region. The Asia-Pacific can be divided further into India, China, Japan, South Korea, and the rest of the region.

The Asia-Pacific wound cleanser market was worth 469 million USD in 2017 and is expected to be worth 740 million USD by 2025, growing at a compound annual growth rate (CAGR) of 5.9% during 2018-2025. The growth is an upswing in demand for wound care products in the region due to factors such as a growing awareness of health, a growing population, and a rising rate of chronic diseases and injuries.

The global wound cleanser market in South America is likely to be large due to improvements in the healthcare industry such that more individuals will purchase medical products. The region of Middle East & Africa has been classified into Gulf Cooperation Council (GCC) countries, Egypt, South Africa, and other Middle East & African nations. This area has increasing health care need that will ultimately lead to an increasing number of wound care products demand. Overall, all wound cleanser market are expanding in various geographies, each with independent drivers of growth.

Population increase, improved health facilities, and increased education regarding the correct manner of wound and wound care will propel the form of the future world market of wound cleansers.

As these areas become bigger markets, more demand for more wound cleanser market will rise, thus creating business and healthcare provider scopes to cover a growing population worldwide.

COMPETITIVE PLAYERS

There are some major players that dominate the global wound cleanser market, propelling it to growth and expansion. Some of the most popular names in the field are Johnson & Johnson, Coloplast A/S, ConvaTec Group PLC, and Mölnlycke Health Care AB. These companies have made a name for themselves by providing quality products to meet a diverse range of medical needs. Along with them, the behemoths like 3M Company, Smith & Nephew PLC, and Biolife, Inc. are designated for innovation and trustworthy solutions for wound care. There are other companies that are involved in the global wound cleanser market, which include Derma Sciences, Inc., Medline Industries, Inc., and BSN Medical GmbH, a business sector of Essity.

These organizations continue to advance wound care technology and provide products that enable improved outcomes for patients. B. The innovation of wound cleansing solutions by Braun Melsungen AG, Cardinal Health, Inc., and Advanced Medical Solutions Group PLC means that the industry has many effective options for various types of wounds and patient requirements. Competition among such companies gives birth to innovation, and thus products with higher technology evolve that are meant to facilitate faster healing and improve infection prevention. These industry giants, having a vast array of products, aid hospitals and home care settings in trying to address the increased demand for effective and efficient wound care. Improved and new wound cleansers will be made available to address patients' and healthcare professionals' needs through ongoing research and development.

Such large enterprises already found in the wound cleaning market ensure accessibility for consumers and, as a result, healthcare practitioners towards entire series of product lines with an angle on safety, effectiveness, and overall improvement in terms of health. All these continued efforts will ultimately impact the very industry with improved solutions around the global wound cleanser market.

Wound Cleanser Market Key Segments:

By Type

- Antiseptic Wound Cleansers

- Antibacterial Wound Cleansers

- Saline Wound Cleansers

- Hydrogen Peroxide Wound Cleansers

- Iodine-Based Wound Cleansers

- Other Wound Cleansers

By Application

- Acute Wounds

- Chronic Wounds

- Post-Surgical Wound Care

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Direct Sales

By End-Use

- Hospitals

- Clinics

- Home Care Settings

- Ambulatory Surgical Centers (ASCs)

- Other Healthcare Facilities

Key Global Wound Cleanser Industry Players

- Johnson & Johnson

- Coloplast A/S

- ConvaTec Group PLC

- Mölnlycke Health Care AB

- 3M Company

- Smith & Nephew PLC

- Biolife, Inc.

- Derma Sciences, Inc.

- Medline Industries, Inc.

- BSN Medical GmbH (A Part of Essity)

- B. Braun Melsungen AG

- Cardinal Health, Inc.

- Advanced Medical Solutions Group PLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252