MARKET OVERVIEW

One of the most powerful participants in the global war against illegal financial dealings is the anti-money laundering service market within the financial sector at large. Overall, the spectrum of services and solutions offered to detect, prevent, and mitigate money laundering activities across many industries and jurisdictions is quite vast.

The rationale that the Global Anti-money Laundering Service market is based upon is that a world financial system must be secured. Money laundering poses significant risks, including facilitating terrorism, and organized crime can bring about financial organizations more unstable. Therefore, regulatory bodies, as well as financial institutions require anti-money laundering services to exhibit maximum compliance coupled with the abatement of threats related to a money laundering service.

The main sectors that come under the basket of Global Anti-money Laundering Service market are compliance software. Adoption for compliance software which integrates advanced technologies like AI, ML, and big data analytics is highly seen. This is used for analyzing voluminous financial data in real time. There is a search for suspicious activity patterns based on the transaction history, customer profiles, and more that are flagged for further investigation.

The actual financial transaction monitor monitors activities for any signals of money laundering or other fraudulent activities. High-end algorithms, in the current transaction monitoring software, detect possible patterns, deviations, and tendencies that might identify suspicious activity that financial institutions are able to follow up on earlier.

The Global Anti-money Laundering Service market also includes know your customer (KYC) and customer due diligence (CDD). The KYC and CDD services include the activities of customer identity identification, risk profiling analysis, and monitoring customers' activities in such a way that they would be aligned with the regulatory requirements. Such services are used by financial institutions to build and maintain transparent and trustworthy customer relationships while having fewer risks associated with financial crimes.

Regulator compliance and reporting services also constitute a significant portion of the Global Anti-money Laundering Service market. Regulatory requirements are on the move, getting tougher with each passing day, and financial institutions are under pressure to comply with anti-money laundering regulations. Compliance and reporting services help in the interpretation of regulatory guidelines, implementation of compliance programs, and preparation of regulatory filings and reports.

The Global Anti-money Laundering Service market is that part of the financial industry which prevents money laundering as well as other financial crimes. This market provides modern technologies along with comprehensive solutions for financial organizations to comply with regulations, identify dubious activities, and ultimately help protect the integrity of the world's financial system. This tendency of the threat landscape will be seen to increase the role of anti-money laundering services, thus implying that the market would play a significant role in maintaining the integrity and stability of the financial sector.

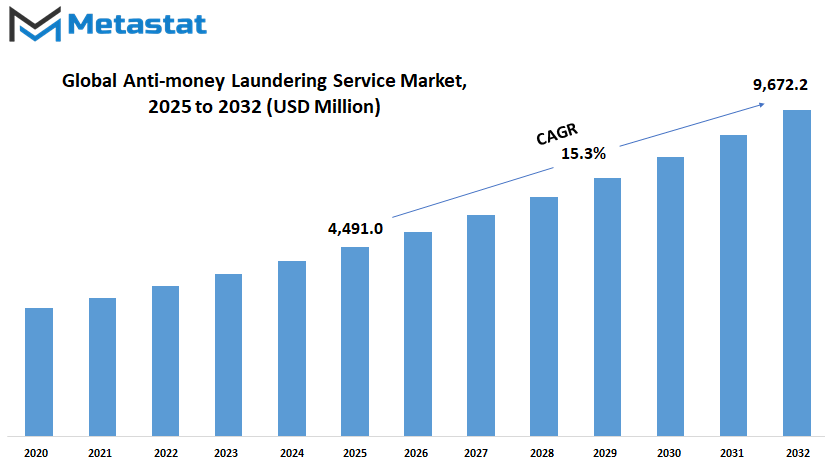

Global Anti-money Laundering Service market is estimated to reach $9,672.2 Million by 2032; growing at a CAGR of 15.3% from 2025 to 2032.

GROWTH FACTORS

This global AML service market is at a crossroads within the constantly evolving financial transaction space. There are so many factors that determine the trajectory of such a market-from propelling growth to providing the restraint.

Regulatory and compliance pressure has been the most significant growth driver for the AML service market. At all levels, governments and their agencies are enforcing increasingly tight constraints on financial institutions to curb money laundering and terrorist financing. The more companies seek to maneuver such strict regulations, the higher demand for effective AML solutions there will be for them.

Due to cutting-edge technologies, the future of AML practice is going to be revolutionized. For example, blockchain offers immutable ledgers enhancing transparency and traceability that is critical in combating financial crimes. Algorithms run by AI can scan vast quantities of data on a particular transaction of any finance within a real-time system that flags suspicious transactions with a level of accuracy that surpasses humanity.

However, promising such an interesting landscape, several challenges threaten and interfere with seamless integration and proliferation of AML solutions. Inhibiting its smooth adaptation process are hefty costs of its implementations and difficulties faced in its integration to the present system. Very large amounts of money need to be borne by financial institutions due to implementation hassles when such sophisticated solutions require extremely hefty solutions.

There is also a lack of professionally qualified professionals well aware of the intricacies involved in the AML domain. As the demand for AML services increases, the inadequate talent that can easily navigate the intricate regulatory landscape of the region forms a major concern. The inadequacy of the same, along with the need to evolve a pool of skilled resources, is intrinsically crucial to the sustainable development of the AML service market.

All this seems like a headache for AML service providers, yet they bring an opportunity along to be harvested. With the growth in the size and depth of their respective economies and the breadth of growth of the finance sector, the growth of the developed markets remains a yet-to-be-harnessed opportunity for the AML service providers. As the regulatory frameworks in those markets matured, so would be the demands for a strong AML solution, thereby increasing the customers for the AML service providers and further strengthening the market presence.

The Global Anti-money Laundering Service market is poised to grow exponentially mainly due to regulatory imperatives, technological advancements, and burgeoning opportunities in emerging markets. Challenges like high implementation costs and the shortages of talent continue to plague the market; however, the proactive measure along with strategic initiatives will play a very important role in the navigation of these very challenges in order to unlock the full potential of the AML service market.

MARKET SEGMENTATION

By Type

The Anti-money Laundering (AML) services global market can be divided into various types that include Transaction Monitoring Software, Currency Transaction Reporting (CTR) Software, Customer Identity Management Software, Compliance Management Software, and Others. All these types offer various features as part of the AML service and make individual contributions to preventing crimes involving illegal flow of funds.

Transaction monitoring software is an extremely critical tool used in financial institutions to flag suspicious transactions. It scans large numbers of transactions continuously, on the lookout for patterns that could indicate money laundering or other illicit activities. This flagging by the software can help an institution avoid becoming an accomplice to criminal financial activity.

The CTR software aims at compliance with the reporting of large currency transactions and regulatory needs. Financial institutions are mandated to report transactions of more than a specified threshold to the relevant regulatory authority, since this prevents money laundering and other financial crimes. CTR software automates report filing and ensures compliance is accurate and efficient.

Customer Identity Management Software serves the critical purpose of authenticating and verifying who a customer is. It would help in defining the real identity of people conducting financial transactions, meaning that all the efforts at verifying the identity so far have a very high barrier on identity theft and risk fraud. The successful identity management would ensure that the transactions done are valid, and the crooks will not exploit weaknesses in the system.

Compliance management software is a necessary tool for a financial institution because it tracks how regulatory requirements or industry standards concerning money laundering vary. They make compliance processing fast and efficient with the ability to manage changes, and they could be a certainty that an institute would be forthcoming to the consistently changing AML regulation requirements. To avoid all the legal as well as the reputational risk that is implied by no compliance, this particular compliance management software is all that more important in this regard.

Other falls under the category of additional AML services and solutions that may not necessarily fall into the aforementioned categories. Such may include special tools, consulting services, or emerging technologies with the aim of further enhancing efforts in AML. The more innovative AML solutions under this category may come to play increasingly important roles in the on-going struggle against money laundering schemes that are getting complicated as AML continues to change its landscape.

Generally, the segmentation of the global anti-money laundering service market as per all its types reflects the complications of AML efforts. Every segment deals with every challenge and requirement under the umbrella of efforts towards more profound financial crime prevention and maintaining integrity in the financial system.

By Application

The Global Anti-money Laundering Service market is very vital in countering illegal financial transactions. It embraces many sectors with various roles. The sectors are categorized mainly based on the tier level of the financial operation; that is, Tier 1 Financial Institutions is the most privileged tier, followed by Tier 2, then Tier 3, and lastly Tier 4 Financial Institutions.

Tier 1 financial institutions amounting to 957.2 USD million in the year 2020 form the pinnacle of the finance sector. Tier 1 institutions include big banks, investment banks, and all the large-scale financial houses that deal with high volume transactions.

Tier 2 Financial Institutions had a value of 591.8 USD Million in 2020. It is comprised of smaller banks, credit unions, and regional financial institutions. These institutions are not as large as Tier 1, but they still manage large amounts of financial flows within their region or sector.

The third tier, or Tier 3 Financial Institutions, was at 457.4 USD Million in 2020. The players in the category include community banks, cooperative banks, and other specialized financial institutions that tend to cater for a specific segment or industry.

Tier 4 Financial Institutions constitute the smallest in the financial space and were worth 210.9 USD Million in 2020. Examples include microfinance institutions, savings and loan associations, credit cooperatives, among other small institutes.

The valuation figures of 2020 are also a testament to the importance that each tier will have in the Global Anti-money Laundering Service market. While Tier 1 institutions take the highest values because of extensive operations and increased risk exposure, Tier 2, Tier 3, and Tier 4 institutions also take a significant proportion in the entire dynamics of the market.

The Anti-money Laundering Service market segmentation regarding the tiered nature of financial institutions has very valuable information on the way resources and efforts are devoted to preventing financial crimes around the world. For every tier, there exists at the service of safeguarding the integrity of the financial system; however, it differs significantly in terms of influence and resources made available by the structure for each tier.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4,491.0 million |

|

Market Size by 2032 |

$9,672.2 Million |

|

Growth Rate from 2024 to 2031 |

15.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

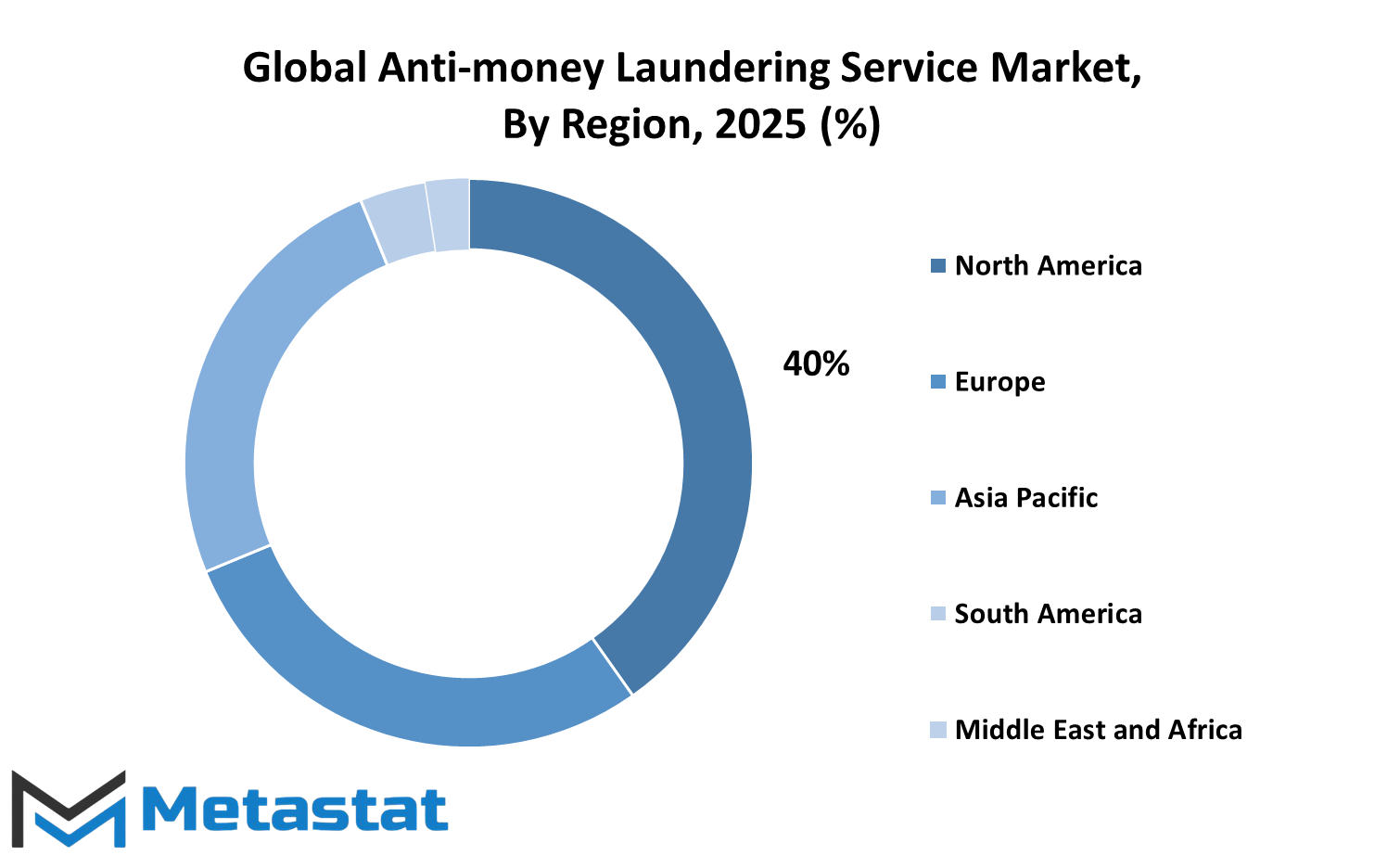

REGIONAL ANALYSIS

Global regions in the Anti-money Laundering Services market include North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. As varied and localized each region is, so are the regional features and the trends of adoption and usage of anti-money laundering services.

The key geography for the anti-money laundering services is North America. In North America, countries such as the United States and Canada form a region that has strict rules and mechanisms of enforcing money laundering activities. To avoid financial crimes, North America financial institutions need to adhere to regulatory requirements while having robust measures against money laundering.

Anti-money laundering services have great importance for other markets also that are located within Europe. Thorough and effective regimes in the prevention of money laundering, as well as terrorist financing in the United Kingdom, Germany, France, Italy, and some other EU members, exist at the governmental and regulatory level, forcing the finance sector to focus on awareness and implement top-notch solutions, such as investment in state-of-the-art systems for fighting and preventing money laundering.

Growth in the adoption of anti-money laundering services is being experienced by the Asia Pacific. In China, Japan, India, and Australia, financial crimes are occurring increasingly, and consequently, so is the need for effective anti-money laundering solutions. Anti-money laundering solutions are in great demand as regulatory bodies in the region are increasing their regulatory oversight of financial institutions, compelling them to deploy sophisticated technologies for detecting and preventing money laundering activities.

Latin America remains a growing interest in the market for anti-money laundering services. Brazil, Mexico, and Argentina are holding special focus on strengthening their regulatory frameworks, thus embedding more robust regulation with better enforcement in their fight against money laundering and illicit financial flows. There is also recognition by the financial institutions of this region on the need to invest in anti-money laundering solutions which help reduce risk and assure regulatory compliance.

It indeed poses different types of challenges and opportunities within the anti-money laundering space in this Middle East & Africa region. On one end, there exist matured countries that have reached the regulatory and compliance standards framework, while developing others are currently at a foundational stage. Thus, with full integration into the global financial systems, more persons become cognizant of the need for an enhanced anti-money laundering system ensuring no illicit activity occurs.

Regional analysis is a synopsis of various geographic regions that work under very diversified regulatory landscapes and varying market dynamics. The financial institutions and service providers operating in these regions would have different requirements in terms of regulatory compliance. They need to be tailored for specific market needs and challenges within a particular region while developing an anti-money laundering strategy.

COMPETITIVE PLAYERS

The Anti-money Laundering Service market is highly competitive at the global level, with many key players competing for supremacy. These are the companies that shape the industry dynamics and direct its future.

Notable participants in the Anti-money Laundering Service sector include Abrigo, Inc., ACI Worldwide Inc., AML Partners LLC, AML360, Aquilan Technologies, EastNets, Experian plc, FICO TONBELLER, Fidelity National Information Services, Inc., Fiserv, Inc., NICE Actimize, Oracle Corporation, SAS Institute Inc., targens GmbH, Thomson Reuters Corporation, Truth Technologies, Inc., and Verafin Inc. Each of them has its strength, capability, and solution. The diversity of these players enriches the marketplace, making it more competitive, while their large variety of products and specialized services satisfy the increasingly diverse needs of businesses and financial institutions around the world.

This will be a highly competitive space for these players as they will be looking to increase their market share, enhance their technological capabilities, and innovate to combat money laundering and financial crimes. Excellence and differentiation will be the only means through which these companies can maintain their position and remain relevant in this increasingly competitive environment.

Beyond that, the success and growth of such market leaders will be somewhat dependent on a set of variables that include adaptation to regulatory variations, research and development, forging appropriate strategic alliances, and a strategic response to dynamic needs and challenges from clients.

Advances in technology and artificial intelligence, machine learning, and big data analytics will influence the competitive space of the Anti-money Laundering Service market. Companies with the ability to leverage these technological advancements to come up with best-in-class offerings and actionable insights will have significant competitive advantages within the market.

Increasing globalization of financial markets and growing complexity of financial transactions will further create new opportunities and complexities for the key players in the Anti-money Laundering Service industry. Companies which can better navigate these complexities and offer more comprehensive and scalable solutions will be well-positioned to take advantage of the maturing market expansion opportunities and drive sustainable growth.

The Anti-money Laundering Service market in the global scenario is very competitive with a large number of key players, all of whom are innovating and evolving constantly to keep up with the changes that the industry is facing. The factors of success in this competitive landscape would include technological innovation, regulatory compliance, and value-added solutions delivered to clients.

Anti-money Laundering Service Market Key Segments:

By Type

- Transaction Monitoring Software

- Currency Transaction Reporting (CTR) Software

- Customer Identity Management Software

- Compliance Management Software

- Others

By Application

- Tier 1 Financial Institution

- Tier 2 Financial Institution

- Tier 3 Financial Institution

- Tier 4 Financial Institution

By Key Global Anti-money Laundering Service Industry Players

- Abrigo, Inc.

- ACI Worldwide Inc.

- AML Partners LLC

- AML360

- Aquilan Technologies

- EastNets

- Experian plc

- FICO TONBELLER

- Fidelity National Information Services, Inc.

- Fiserv, Inc.

- NICE Actimize

- Oracle Corporation

- SAS Institute Inc.

- targens GmbH

- Thomson Reuters Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252