MARKET OVERVIEW

The Global Aircraft Carbon Brakes Market is expected to be highly innovative over the years. As advancements in technology come within the aviation industry, it is bringing innovations in braking systems due to the increasing demands for their efficiency, lightweight, and robustness. Besides, carbon brakes are expected to take precedence, being better than traditional steel-based systems. Increasingly, carbon brake systems will be placed at the high priority of aircraft manufacturers and airlines due to their capacity to withstand stresses and temperature situations that are generated at either landing or takeoff of the aircraft. By this, the Global Aircraft Carbon Brakes Market will greatly influence this transition, with manufacturers consistently working toward innovations and better performance standards.

In fact, the future will hold that fleets of commercial and military aircraft worldwide will embrace this carbon brake technology as a part of their fleets. Airlines can get onboard and make investments towards modifying their fleet to accommodate these advanced brake systems. Aircraft operations shall be enhanced, and at the same time, reduced by weight and energy consumption, contributing to sustainability. Since carbon brakes are relatively light than traditional materials, this would allow aircraft to carry more fuel and cargo, thus making economical optimizations for air travel.

Increased air traffic is expected to increase the demand for carbon brakes in virtually every rapidly developing sector in aviation. Also, as stringent regulations subsume the aviation sector to lower carbon footprints, this would leverage the Global Aircraft Carbon Brakes Market very much further. Aircraft manufacturers are expected to collaborate with the specialists of carbon brakes for incorporation into next-generation aircraft models. Incremental improvements of the technology in carbon brake systems will continue to make these systems efficient, cheap, and safer, and it will spur their natural acceptance across the aviation industry.

Along with commercial aviation, the military sector shall also entirely depend upon aircraft carbon brakes in the future. Their higher performances will be required considering the special requirements of military aircraft associated with high-speed landing and heavy-duty working. Carbon brakes will be a prime factor for military aircraft because they would provide advantage in performance and reliability to meet extremely high standards. In this context, the Global Aircraft Carbon Brakes Market will widen its horizons to cater to the specificity of the defense sectors, thus ensuring the implementation of such carbon brake systems in military aviation technologies.

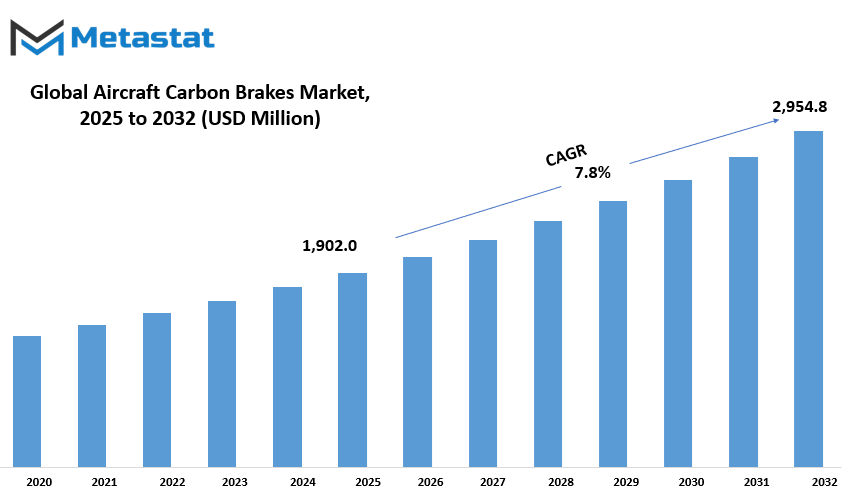

Global Aircraft Carbon Brakes market is estimated to reach $2,954.8 Million by 2032; growing at a CAGR of 7.8% from 2025 to 2032.

GROWTH FACTORS

The global aircraft carbon brakes market is steadily gaining momentum due to several coalescing influences. The increasing demand for fuel-efficient and eco-friendly brake systems is one of the primary driving forces in the aviation market. Airlines and manufacturers adopting a green approach have enhanced the appetite for modernized braking technologies that minimize fuel use and environmental impact. Carbon composite materials are at the forefront of these technologies and provide an improvement in the performance of existing brake systems. Considerations of high-temperature resistibility and braking efficiency favor the choice of carbon brakes for modern aircraft, thus contributing to their growing acceptance within the industry.

The growing acceptance of carbon composites belongs to the other extensive reasons driving the market. These materials are in use for applications beyond braking systems, including critical functions in wings, fuselages, and engines. Carbon composites have myriad advantages: lighter weight, greater durability, and superior performance. The demand for carbon composites will certainly gain a foothold as the aeronautics sector continues along its path of innovation and evolution; such gains in demand will, of course, lead to a further gain in carbon brake applications in aircraft.

The carbon brakes market is also faced with some challenges. One among them is the very high price of carbon brakes, a constraint that hinders acceptance into a wide market, particularly among smaller airlines and those operating older aircraft. While the long-term benefits of carbon brakes, like reduced maintenance costs and enhanced fuel efficiency, are now self-evident, for some companies, the upfront investment is still heavy. Hence, the introduction of the advanced braking systems would be relatively slow in such regions and for smaller players in the aviation market.

Another impediment for the market is the garden-variety compliance with regulations and environmental standards prevailing in the aviation business. With tightening environmental laws from governments and regulatory bodies, ensuring carbon brakes' compliance with such regulations is often complicated and lengthy. Furthermore, these manufacturers need to keep up with any development in safety and environmental regulations, which might hinder the development and adoption of modern technologies.

Such challenges, however, are offset by ample opportunities in the aircraft carbon brakes market. Among them, very high-potential opportunities exist for increased investment in sustainable aviation technologies. Never before have governments, airlines, and manufacturers put forth such great effort and resources toward advanced technologies to minimize the environmental impact of air travel-including carbon brakes. Along with upgrading their fleets, the air travel industry demands more efficient, high-performing braking systems.

MARKET SEGMENTATION

By Type

The global market for aircraft carbon brakes is emerging with the fast growth of the aviation industry aiming towards better efficiency and lowering environmental hazard due to air travel. Brakes made of carbon are gaining ground for their lightweight, high performance under abrupt extremes of temperature, and suitability for installation on modern aircraft now.

Philosophically speaking, the carbon brake market can be subdivided further in terms of its brake types: drum brakes and disk brakes would be two major divisions. Drum brakes, which have been used for quite some time in both areas, are durable and good in absorbing and dissipating heat. Recently, disk brakes, whose operation is said to be better-performing and wear-resistant, have gained favor. Disk brakes are light in weight, having an upper hand in efficiency, and providing a greater braking field on the high-speed end or when loads reach the limit.

The drum brake segment of the aircraft carbon brakes market has an estimated value of around $98.7 million. This segment is widely used in older aircraft models and continues to be the backbone of the aviation arena. However, with more and more designs of new aircraft using disk brakes, demand for drum brakes is gradually expected to decrease in upcoming years. Nevertheless, drum brakes surely have a big role in the market for small or older aircraft, where value for money and long service life is appreciated.

On the other hand, there has been rapid acceptance of disk brakes in aviation for new models. Disk brakes have become the great preference across various modern aircraft due to their capability to withstand high temperatures and efficiency with respect to braking performances. Therefore, the disk brake segment is poised for further growth due to breakthroughs in materials and technology supporting enhanced performance and durability.

Market forces directing growth in the aircraft carbon brakes sector include the momentum of demand for fuel-efficient and environmentally friendly aircraft. Airlines are searching for ways to cut carbon emissions and operational costs; in this regard, moving to carbon brakes helps achieve these objectives. Hence, as industry descends down the sustainable route, increasing acceptance of carbon brakes should be seen.

In conclusion, with drum brakes and disk brakes being the primary types of brakes, forecasted growth will ensure some sustainability for the global aircrafts carbon brakes market. Disk brakes will now take over from drum brakes into the future and will further increase sales as the demand for higher efficiency and performance from modern On-the-road display. The worth of drum brakes valued at $98.7 million will still be significant, while disk brakes will take the mayorship.

By Application

Beginning stage in the global aircraft carbon brakes market, due to a signed growth in demand pertaining to high-performance brake systems on both civil and military aircraft, the market can be segmented on broad application categories into civil aircraft and military aircraft.

It's the civil aircraft segment that constitutes a major share in terms of revenue generation for the carbon brakes market. The increase in passenger load traveling by air has resulted in airlines looking for more efficient and affordable systems to be employed in their fleets. Taking this into account, carbon brakes are being adopted in civil aircraft faster than any other brakes simply because of their advantages over conventional steel brakes.

The weight-saving, reduced fuel and operating costs during takeoff and landing operations, as well as superior high-temperature operational performance at critical times, are other factors favoring their choice. It also offers high-time replacement cycles thus saving maintenance costs, making it a viable consideration for commercial airlines in the long run. In addition, the upward trend towards having more energy-efficient and environmentally friendly technologies in aviation further supports the increasing adoption of carbon brakes in civil aircraft.

On the other hand, the military aircraft also represent a huge chunk of the market. The military sector requires a braking system designed to handle most constraints coming out of military operations such as high-speed landing, short takeoff, and landing conditions, as well as direct exposure to extreme conditions. Carbon brakes perfectly meet all these requirements, performing optimally even during high-stress situations. They specify excellent deceleration rates with good heat resistance and a better ratio between endurance and weight, which are essential for any tactical military aircraft. Besides, the military budget and the increased demand for advanced technology can always pressure the branch into upgrading the performance of its components, which encourages the usage of carbon brakes in this branch.

Matured markets are both civil and military, but economies of scale will be achieved in both segments as demand for aircraft increases around the world. The carbon brake option is popular across both sections because of its high efficiency, durability, and lower maintenance costs and will be appealed to by future aviation technologies. This translates directly into a growth enabler within the market for both civil and military applications.

By Aircraft Type

The Global Aircraft Carbon Brakes Market is an important segment within the aerospace arena, and the primary force that drives it is the demand for a braking system that offers efficiency and life. The scope of the market is segmented by specific aircraft, unlike their respective preferences toward braking technologies. Narrow-Body Aircraft (also termed Single-Aisle Aircraft), Wide-Body Aircraft, Regional Aircraft, and Military Helicopters can be cited here.

Narrow-Body Aircraft or Single-Aisle Aircraft are widely used for short- to medium-range flights. These fly in domestic or regional areas and carry a moderate load of passengers. Because of heavy operational usage, these aircraft demand braking systems that can withstand frequent take-off and landing, while all the while ensuring passenger safety and comfort. Carbon brakes provide the right mix of lightweight design and high thermal resistance in such applications to be the right candidate for Narrow-Body Aircraft.

Wide-Body Aircraft are distinguished by their larger size and design for long hauls. Heavy customer load plus cargo make wide-bodies the heart of any international operation. The demand on the braking systems of wide-body airplanes, therefore, is tremendously more powerful because these planes are designed for long hours in the air at heavily loaded conditions. The additional forces acting on brake components during landing would call for high-performance materials such as carbon able to withstand extremely high temperatures and extreme stresses associated with high-speed landings.

Regional Aircraft are usually smaller in size and operate short routes, often between small airports. These planes are intended for short-haul flights and operate comparatively differently from Narrow-Body and Wide-Body airplanes. Because the aircraft generally carry fewer passengers on shorter distances, the braking systems do not undergo significant stress and yet require the durability and efficiency that carbon brakes provide to guarantee reliability for frequent operations.

Another key segment of this market is Military Helicopters, which also come with advanced braking systems featuring carbon brakes. Unlike airplanes, military helicopters require totally different encryption of braking with emphasis on high-performance materials that may work under severe conditions and generally based on the specific nature of military missions. The braking system of military helicopters ought to be dependable for functioning in extremely harsh environments.

In conclusion, for the safe and efficient operation, the aircraft carbon brakes market plays a significant role in the working of all operations of Narrow-Body Aircraft, Wide-Body Aircraft, Regional Aircraft, and Military Helicopters, all unique in their own demand. Nevertheless, they all bring together the properties of durability, heat resistance, and performance qualities that qualify carbon brake systems.

By End Users

Rapid growth in the global aircraft carbon brakes market has been seen in recent years from advancement in technologies in aviation along with increased demand for efficient braking systems. Aircraft carbon brakes have various end-use applications in Original Equipment Manufacturer and aftermarket. The future performance and growth of the entire industry are mainly governed by these two factors.

The OEMs mostly consist of Original Equipment Manufacturers and major players in the aircraft carbon brake market. These manufacturers design and develop carbon brake systems that are installed in brand-new aircraft. As the aviation industry continues to develop, airlines and aircraft manufacturers require high-performance braking systems that comply with safety standards, reduce maintenance costs, and enhance fleet efficiency. Carbon brakes are increasingly used in newly introduced aircraft, along with some other fundamentally solid rationales, including light weight and great durability and heat resistance that further allow the said aircraft-type to flindle while operating in environments where commercial jets fly at fast speeds, which pose a greater demand on their braking systems.

The aftermarket sector significantly represents the global aircraft carbon brakes market. This aftermarket facilitates the replacement, repair, and refurbishment of carbon brake systems installed in older aircraft. Such maintenance and repair actions become inevitable as the aircraft age and the flight hours accumulate on each of them. This way, the aftermarket services sustain the aircraft toward its enhanced levels regarding safety and operational standards. Most airlines that are willing to upgrade their old fleets begin with acquiring carbon brakes in the aftermarket, given their greater affordability. The dynamic nature of the aftermarket services will intensify, as a lot of airlines are working using different mechanisms towards upkeep and aging gracefully of aircraft for generation-low operational costs.

As a result, the global aircraft carbon brakes market is essentially bifurcated into two end-user categories: OEMs and the aftermarket. While aftermarket services are seen as repair and service for such systems for older commercial aircraft, OEMs are adopting the new and modern advanced high-performance carbon brakes into the latest designs of commercial aircraft. Since it is very likely that demand will be rising for these highly sophisticated, efficient, and durable braking systems, every single segment will play its significant role in the overall growth and development of the market.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,902.0 million |

|

Market Size by 2032 |

$2,954.8 Million |

|

Growth Rate from 2025 to 2032 |

7.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

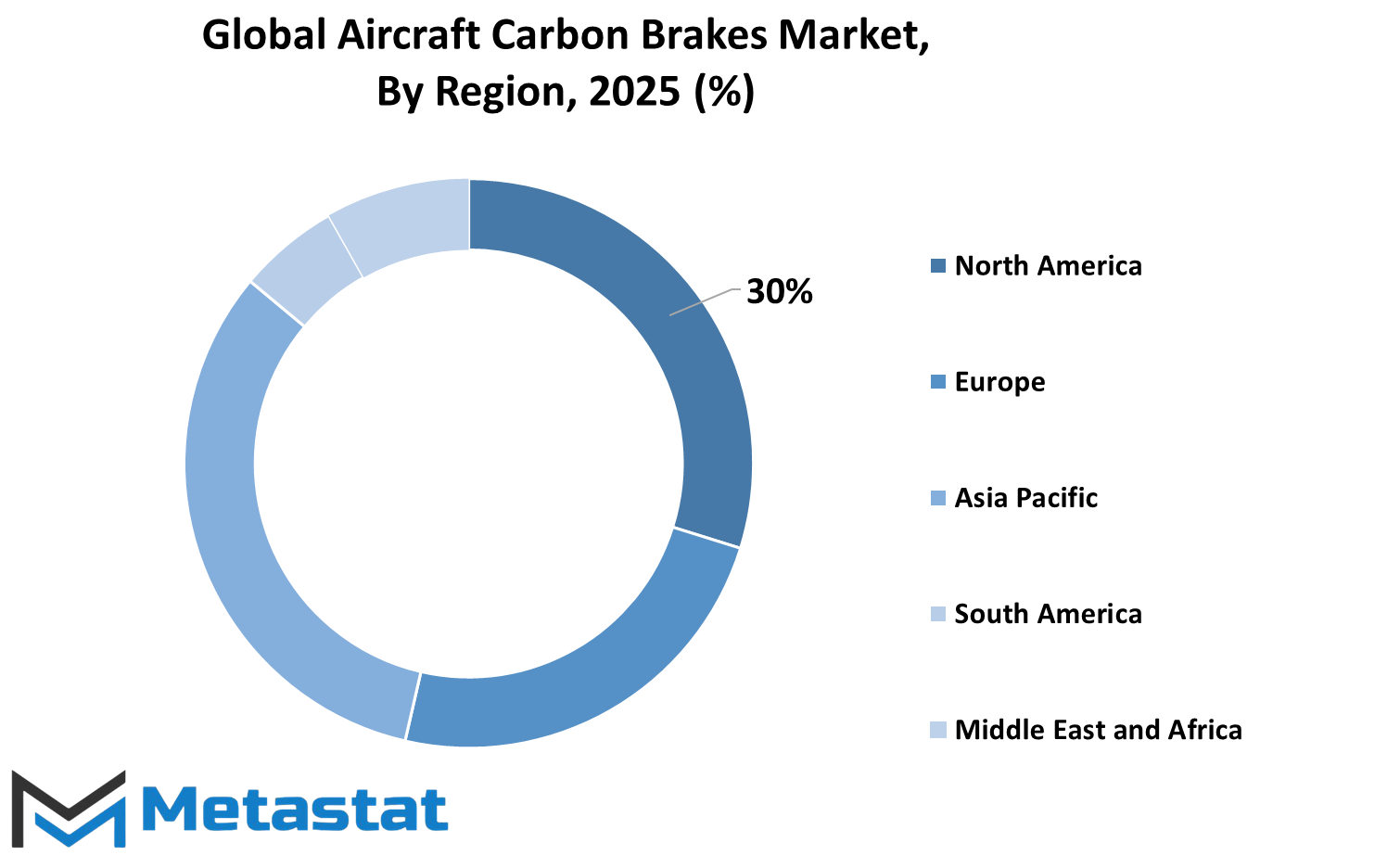

Asia-Pacific will contribute to grave burden in carbon brakes Aircraft held worldwide. The region will include North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. Further, these countries within North America with respect to the market will include the US, Canada, and Mexico. The remaining countries in Europe to take part in this market will include the UK, Germany, France, Italy and the rest of Europe. Asia-Pacific, which is a major market in the region, is recognized into India, China, Japan, South Korea and other remaining countries in the region. Three countries such as Brazil, Argentina, and other South American countries classify South America into certain parts. Last of these division is the Middle East where GCC countries, Egypt, and South Africa divide away from the rest.

Each one of these geographies will have its unique and critical role in the development of the Aircraft Carbon Brakes market. The USA, as a part of North America, would be classified as one of the main markets in terms of having a high aviation industry that demands high-performance braking in planes. Whereas Canada and Mexico make their share of contribution to overall growth in this region too by increasing air travel, hence the demand for advanced aircraft technologies.

Among the main European players within the market, the United Kingdom, Germany, and France become quite prominent in that regard. These countries have a large aerospace industry, having a number of major manufacturers and airlines needing reliable yet efficient braking systems in their fleet. Rest of Europe would not be so dominant in terms of market but is still very much developing its demands for aircraft carbon brakes because of increasing air traffic and growing regional aviation.

Asia-Pacific, especially countries like China, Japan, and India, have an extensively flourishing market. The aviation industry here is growing very fast, trying to advance with the modernization of the fleet and infusion of latest technologies. The demand for aircraft carbon brakes in these countries is expected to escalate with an increase in air travel, thus enhancing the demand for advanced braking systems.

Brazil and Argentina are the main countries that are promoting the aircraft carbon brakes market in South America, while the rest of the region fall behind. This segment is small when compared with other regions but is expected to develop at a steady rate with the growth of the aviation industry.

Again, the markets in the Middle East Africa region will grow Egypt, as part of Middle East Africa, and South Africa have recently started developing the aircraft carbon brakes market. In the highway of the modern aviation development hub, quality and durable aircraft braking systems demanded by the end users will witness increased demand with rising investments in aviation expansion in the GCC countries, especially in the United Arab Emirates and Saudi Arabia.

COMPETITIVE PLAYERS

Within the aviation industry, the global aircraft carbon brakes market is a very significant division of equity participation in account for the growth and development. The manufacturers provide a wide range of carbon brake systems, which positively impact the safety, efficiency, and performance of the modern air travel system. Some of the major players include Boeing, CFCCARBON Co. Ltd., Crane Aerospace & Electronics, Honeywell International, Meggitt PLC, Mersen Group, Nasco Aircraft Brake, Parker-Hannifin Corp., Raytheon Technologies, RUBIN AVIATION CORPORATION, Safran Landing Systems, SGL Carbon, SKYbrary, THERMOCOAX, United Technologies, and ZOLTEK Corporation.

Known as a global pioneer in the field of aerospace, Boeing has also been involved in the development of carbon brakes in helping catapult the future of aviation through the application of advanced technology to aircraft systems. Specializing in high-performance carbon composite materials key for aircraft braking systems, CFCCARBON Co., Ltd. has majorly impacted the carbon brakes market. Crane Aerospace & Electronics is truly another giant adding its weight to the market with state-of-the-art aircraft system solutions, and so enhancing the quality of braking processes.

Honeywell International is a multinational corporation known for its technology through carbon brake systems developed for aviation with better efficiency and durability. Another major player in the market, Meggitt PLC, manufactures carbon brake systems for commercial and military aircraft, while Mersen Group serves to supply solutions that help meet the other demands of the aerospace market.

Brakes are manufactured by Nasco Aircraft Brake, which plays an important role in the supply chain activities of the market with repair services. Parker-Hannifin Corp. and Raytheon Technologies work together in applying advanced technologies into brake systems on aircraft, providing products with certified reliability and efficiency. In addition, RUBIN AVIATION CORPORATION helps develop the industry through their commitment to supply a wide range of essential aviation products that include carbon brake systems.

Another market player is Safran Landing Systems that offers various ranges of brake systems, including carbon brakes, for applications in the commercial aviation sector. The SGL Carbon name specializes in the development of lightweight, strong carbon materials, which form the backbone for making high-performance brakes. Other key players continue to stretch the envelope in the development of aircraft braking systems: SKYbrary, THERMOCOAX, United Technologies, and ZOLTEK Corporation.

With expansion into air travel comes a greater requirement for carbon brakes to be efficient and reliable, and the corresponding ability to satisfy such demand rests upon the innovation of these players. Maintaining the efforts of ensuring the aviation industry remains safe, cost-friendly, and technologically sound.

Aircraft Carbon Brakes Market Key Segments:

By Type

- Drum Brakes

- Disk Brakes

By Application

- Civil Aircraft

- Military Aircraft

By Aircraft Type

- Narrow-Body Aircraft/Single-Aisle Aircraft

- Wide-Body Aircraft

- Regional Aircraft

- Military Helicopters

By End Users

- OEM

- Aftermarket

Key Global Aircraft Carbon Brakes Industry Players

- Boeing

- CFCCARBON Co. Ltd.

- Crane Aerospace & Electronics

- Honeywell International

- Meggitt PLC

- Mersen Group

- Nasco Aircraft Brake

- Parker-Hannifin Corp.

- Raytheon Technologies

- RUBIN AVIATION CORPORATION

- Safran Landing Systems

- SGL Carbon

- SKYbrary

- THERMOCOAX

- United Technologies

- ZOLTEK Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252