Global Air Quality Monitoring System Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global air quality monitoring system market in the environmental technology sector will have an interesting ride as it continues to evolve in the years ahead. Its beginning was in the mid-20th century when urbanization and industrial growth started to make a serious dent in air purity. Initial monitoring was primitive, with much of it being manual sampling and laboratory testing. These early systems were limited to local snapshots, but they did represent the first systematic attempt at monitoring pollution levels and estimating its impact on public health. During the late 1970s, increased public concern and the establishment of environmental protection agencies in many nations led to the installation of automatic air quality monitoring stations. These stations enabled monitoring day and night, which was simple to conduct for observing pollutants like sulfur dioxide, nitrogen oxides, and particulate matter in cities.

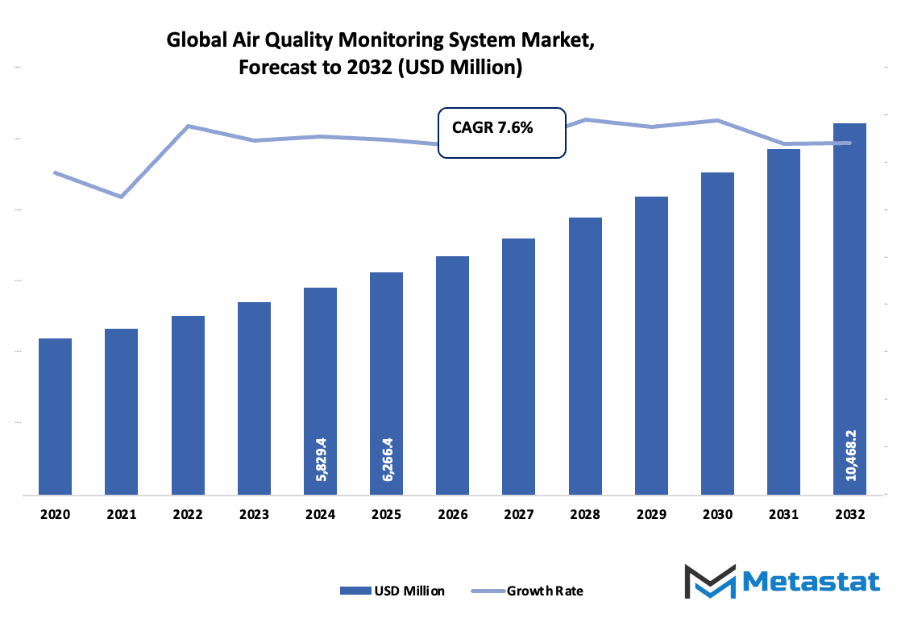

- Global air quality monitoring system market value of approximately USD 6266.4 million in 2025, which is likely to grow at a CAGR of approximately 7.6% until 2032, with the potential to grow beyond USD 10468.2 million.

- Indoor Air Quality Monitoring Systems occupy a market share of close to 35.5%, fueling innovation and expanding applications through extensive research.

- Sustaining forces: Growing Environmental Awareness, Strict Government Regulations

- Challenges and opportunities: IoT (Internet of Things) adoption in Environmental Monitoring

- Core insight: The market will evolve leaps and bounds in value in the next decade, predicting prime growth prospects.

The market will yet develop in the 1990s when digital technologies begin to converge with monitoring equipment. Real-time data transmission and collection by IoT-enabled sensors and early remote sensing will bring in increased geographical reach as well as more accurate pollution mapping.

At roughly the same time, global treaties to reduce emissions and stricter air quality requirements will require governments and industry to put in more advanced monitoring systems, pushing the market toward compliance-based and innovation solutions. Market demand will eventually follow these advances, calling for not only precise measurement but also usable and readable information. Mobile devices and web platforms will be central to it all, cutting into complicated information to make it usable intelligence for city planners, medical professionals, and citizens. New economies will play an increasingly larger role, utilizing low-cost and scalable monitoring systems to address fast industrialization and urban growth. As the global air quality monitoring system market keeps expanding, it will incorporate artificial intelligence, machine learning, and cloud analytics to forecast pollution patterns, streamline sensor networks, and improve public safety. It will go beyond the conventional government-driven programs to smart cities, industrial compliance, and even personal Air Quality Monitoring Systems.

The evolution of simple lab measurements into advanced, networked systems will drive the direction of the market and become a sought-after device for solving environmental and human health problems.

Market Segments

The global air quality monitoring system market is mainly classified based on Product, Sampling Method, Pollutant, End User.

By Product is further segmented into:

- Indoor Air Quality Monitoring Systems: The market for indoor Air Quality Monitoring Systems will increase as concern for indoor pollution and its effects on health becomes more prominent. Advances in technology would render real-time monitoring possible, and precise data on indoor pollutants like volatile organic compounds and carbon oxides would be collected. Indoor Air Quality Monitoring Systems would be integrated with smart home systems to promote air safety in the home and the workplace.

- Outdoor Air Quality Monitoring Systems: Outdoor Air Quality Monitoring Systems will be a major tool for monitoring pollution in urban and industrial complexes. Constant innovation will enhance sensor efficiency so that advance warning of harmful gases and particulate matter becomes possible. Installation of such systems in cities will benefit environmental regulations and assist green urbanization planning.

By Sampling Method the market is divided into:

- Active/Continuous Monitoring: Active monitoring will reign supreme with its potential to offer real-time information regarding air quality. Emerging technologies will make sensors more sensitive such that there will be continuous pollutant detection. Continuous monitoring will facilitate predictive analysis and decision-making for governments and industries seeking to minimize environmental footprints.

- Manual Monitoring: Manual monitoring will remain in use at chosen sites where human observation is necessary. Future uses will cover mobile kits used for quick air quality determination in emergency or field research purposes. This technique will supplement automatic systems with the offer of flexibility in remote monitoring applications.

- Passive Monitoring: Passive monitoring will play an increasingly important role in long-term air pollution assessment without continuous energy use. Future passive sensors will be cheaper and more durable, and will allow for widespread deployment in residences and in rural areas. Data from these sensors will help facilitate comprehensive environmental research.

- Intermittent Monitoring: Intermittent monitoring will be a cost-effective balance. Scheduled sampling will give selective information collection for seasonal or situation-related trends of pollution to study. Advanced monitors will make the intermittent monitoring highly accurate and efficient in the detection of episodic pollutant concentrations.

- Stack Monitoring: Stack monitoring will be critical for industrial regulatory compliance and emissions management. Future equipment will have intelligent analytics to give instant feedback on emissions. This will assist industries in adhering to regulations and lowering their environmental footprint in an efficient manner.

By Pollutant the market is further divided into:

- Chemical Pollutants: Chemical pollutant monitoring will be increased as industries implement stricter emission levels. Systems in the future will be able to detect minute traces of chemicals, helping in environmental conservation and public health protection. On-time action against pollution will improve through real-time reporting.

- Nitrogen Oxides: Nitrogen oxides will remain a focal point due to their role in smog and lung ailments. New monitoring technology will provide reliable measurements in urban and industrial settings to manage pollution levels effectively.

- Sulfur Oxides: Sulfur oxides monitoring will advance to protect against acid rain and deterioration of air quality. Advanced sensors will allow for real-time monitoring and reporting, enabling regulatory enforcement and industrial control against pollution.

- Carbon Oxides: In real-time measurement of carbon oxides will be vital to determine air toxicity and climate effect. Succeeding systems will measure carbon monoxide and dioxide in real time so that authorities can move against a rise in pollution in time.

- Volatile Organic Compounds: VOCs will increase in significance with health risks indoors and in industry. Sophisticated sensors will provide very precise chemical analysis, supporting mitigation action and public safety.

- Other Chemical Pollutants: More and more of the other chemical pollutants will be monitored as sensors continue to identify more species of chemicals. Future systems will supply full data for urban design and industrial regulation.

- Physical Pollutants: Physical pollutants such as particulate matter will be measured by more sensitive instruments. New technologies will determine size and concentration with precision, allowing for better health risk evaluation and pollution abatement.

- Biological Pollutants: Biological pollutant monitoring will rise with urban living and indoor dwelling. Advanced detection systems will quantify bacteria, viruses, and allergens, enabling public health programs and prevention.

By End User the global air quality monitoring system market is divided as:

- Government Agencies and Academic Institutes: These users will expand the adoption of Air Quality Monitoring Systems for research and policy-making. Future systems will provide accurate data for studies, regulations, and environmental programs.

- Commercial and Residential Users: Businesses and households will adopt monitoring systems to ensure safety and comfort. Smart, connected devices will allow real-time alerts and improvements in indoor air quality management.

- Petrochemical Industry: The petrochemical sector will use monitoring systems to comply with environmental standards and reduce harmful emissions. Future technologies will provide continuous, automated analysis of industrial outputs.

- Power Generation Plants: Power plants will rely on Air Quality Monitoring Systems to control emissions and meet regulatory requirements. Advanced real-time monitoring will allow better operational adjustments and pollution reduction.

- Pharmaceutical Industry: Pharmaceutical manufacturing will adopt monitoring systems to maintain clean production environments. Future systems will detect chemical and biological pollutants, ensuring product safety and compliance with health standards.

- Smart City Authorities: Smart city projects will integrate air quality monitoring into urban infrastructure. Future systems will support traffic, industrial, and environmental planning by providing detailed, real-time data on urban pollution levels.

- Other: Various other sectors, including transport and waste management, will benefit from Air Quality Monitoring Systems. Future applications will improve environmental awareness, risk management, and community health outcomes globally.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$6266.4 Million |

|

Market Size by 2032 |

$10468.2 Million |

|

Growth Rate from 2025 to 2032 |

7.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

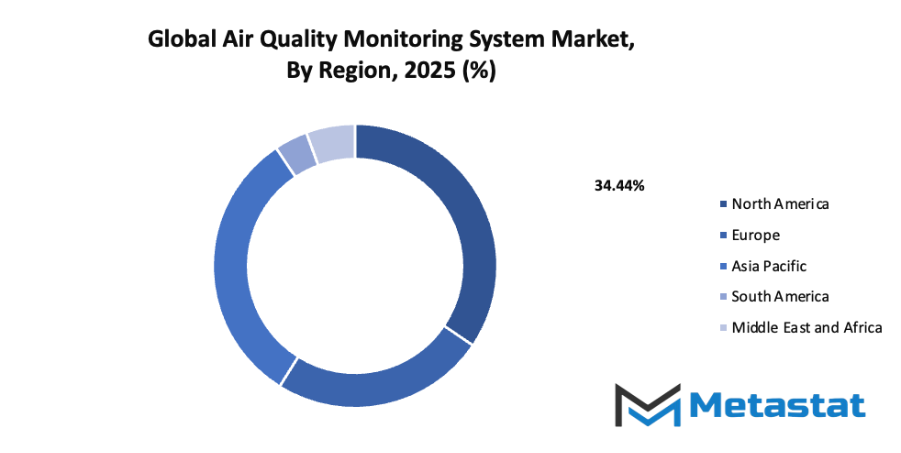

- Based on geography, the global air quality monitoring system market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing Environmental Awareness: Rising concerns about health and the environment will push governments, organizations, and individuals to invest in air quality monitoring solutions. Awareness campaigns and public demand for cleaner air will encourage adoption, with more communities implementing monitoring networks. Education and media coverage will further emphasize the importance of maintaining safe air standards.

- Stringent Government Regulations: Governments around the world are introducing stricter laws to control pollution and maintain air quality. These regulations will require industries and cities to install monitoring systems to ensure compliance. Mandatory reporting of pollutant levels will increase demand for advanced monitoring tools capable of real-time data collection and accurate measurements

Challenges and Opportunities

- High Initial Setup Costs: The installation of monitoring networks and advanced equipment will require significant investment. High setup costs may slow adoption in some areas, particularly where budgets are limited. However, long-term benefits, including improved health outcomes and compliance with regulations, will encourage gradual investment across industries and municipalities.

- Limited Accessibility in Developing Regions: In many developing regions, limited infrastructure and financial constraints will restrict access to air quality monitoring solutions. This will create gaps in data collection and hinder pollution management efforts. Expansion into these regions will require tailored solutions that balance affordability with efficiency, encouraging innovation and regional collaboration.

Opportunities

- Adoption of IoT (Internet of Things) in Environmental Monitoring: Integration of IoT technologies will transform the global air quality monitoring system market. Connected sensors will provide real-time data, enabling predictive analysis and faster decision-making. Smart cities will adopt IoT-enabled solutions to manage pollution levels efficiently, reduce operational costs, and enhance the effectiveness of environmental monitoring networks.

Competitive Landscape & Strategic Insights

The global air quality monitoring system market features a mix of well-established international companies and emerging regional players, creating a competitive environment that will shape future technological developments and market strategies. Key industry participants such as Thermo Fisher Scientific Inc., Teledyne Technologies Incorporated, Aeroqual Ltd., Siemens AG, Horiba, Ltd., TSI Incorporated, 3M Company, Emerson Electric Co., Testo SE & Co. KGaA, Honeywell International Inc., EPA, Opsis AB, Ecotech Pty Ltd., Merck KGaA, PerkinElmer, Inc., Hangzhou Zetian Technology Co., Ltd., Synspec BV, SICK AG, and Tisch Environmental Inc. play significant roles in driving innovation and expanding market reach. Each competitor brings a unique set of strengths, whether it is advanced sensor technology, robust data analytics, or extensive distribution networks, allowing them to capture specific segments of the market.

The competitive landscape will become increasingly dynamic as companies continue to invest in research and development to meet stricter environmental regulations and growing demand for real-time air quality data. Emerging players will introduce flexible and cost-effective solutions that challenge the dominance of larger organizations, creating opportunities for collaboration, strategic partnerships, and technological integration. Companies that can combine data accuracy, scalability, and ease of deployment will gain a strong advantage, particularly in urban centers facing rapid industrial growth and rising pollution concerns.

From a strategic insights perspective, companies will need to focus on integrating artificial intelligence, cloud-based analytics, and Internet of Things (IoT) connectivity into their offerings. These technologies will not only improve the precision of air quality measurements but also provide predictive capabilities that allow policymakers and industries to respond proactively to pollution events. Additionally, global expansion into emerging markets will become a critical strategy, as increasing urbanization and industrialization in these regions will drive demand for efficient monitoring systems. Strategic collaborations with local authorities and technology providers will support faster adoption and provide competitive differentiation.

Market size is forecast to rise from USD 6266.4 million in 2025 to over USD 10468.2 million by 2032. Air Quality Monitoring System will maintain dominance but face growing competition from emerging formats.

In the future, the market will witness an emphasis on sustainability-driven innovation, where products will be designed to minimize energy consumption and reduce environmental impact. Companies will invest in smart, adaptive systems capable of self-calibration and remote operation, reducing maintenance costs while enhancing reliability. Those that can anticipate shifts in environmental regulations and respond with tailored solutions will maintain leadership positions and continue to influence the market trajectory. The integration of advanced analytics, international partnerships, and emerging technologies will ultimately define the direction of growth, offering insights into areas that promise high returns and long-term value.

suggest that the global air quality monitoring system market will continue to evolve with increasing technological sophistication, regional expansion, and strategic innovation, creating a landscape where both established leaders and emerging players can thrive through careful planning and forward-looking approaches.

Report Coverage

This research report categorizes the global air quality monitoring system market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global air quality monitoring system market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global air quality monitoring system market.

Air Quality Monitoring System Market Key Segments:

By Product

- Indoor Air Quality Monitoring Systems

- Outdoor Air Quality Monitoring Systems

By Sampling Method

- Active/Continuous Monitoring

- Manual Monitoring

- Passive Monitoring

- Intermittent Monitoring

- Stack Monitoring

By Pollutant

- Chemical Pollutants

- Nitrogen Oxides

- Sulfur Oxides

- Carbon Oxides

- Volatile Organic Compounds

- Other Chemical Pollutants

- Physical Pollutants

- Biological Pollutants

By End User

- Government Agencies and Academic Institutes

- Commercial and Residential Users

- Petrochemical Industry

- Power Generation Plants

- Pharmaceutical Industry

- Smart City Authorities

- Other

Key Global Air Quality Monitoring System Industry Players

- Thermo Fisher Scientific Inc.

- Teledyne Technologies Incorporated

- Aeroqual Ltd.

- Siemens AG

- Horiba, Ltd.

- TSI Incorporated

- 3M Company

- Emerson Electric Co.

- Testo SE & Co. KGaA

- Honeywell International Inc.

- Aeroqual

- EPA

- Opsis AB

- Ecotech Pty Ltd.

- Merck KGaA

- PerkinElmer, Inc.

- Hangzhou Zetian Technology Co., Ltd.

- Synspec BV

- SICK AG

- Tisch Environmental Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252