MARKET OVERVIEW

The global air container market operates within the context of the broader logistics and transport sector, an integral player in the transit of temperature-controlled, high-value, and time-critical goods. This segment within the logistics network has worked secretly behind the banner of commercial limelight but can only gain even greater prominence with industries like drugs, biotechnology, and electronics requiring even higher levels of deliverance parameters. What the future holds for this market goes far beyond conventional projections, reaching into dimensions not yet fully measured or mapped.

Wherein much scrutiny has been devoted to volumes of cargo and dimensions of containers, the latent revolution of air container use will be born of fundamental shifts in supply chain engineering. As global supply chains become more decentralized, with factories brought nearer to regional centers of demand, air containers will have to keep pace with split and dynamic shipping patterns. Containers will no longer be required to move solely between key airports but along new routes defined by regional free trade agreements and geopolitical power. This will most likely induce the necessity for modular solutions and track intelligence beyond today's benchmarks.

Peering past capacity statistics, a quiet but dramatic change will manifest in the way that these containers engage with intelligent infrastructure. Airports will become digitally responsive logistics hubs in which air containers directly connect to automated cargo systems. This change will not be merely about information exchange. It will demand structural integration, with containers having active communications nodes that attach directly to airport control systems. The consequences of this evolution will reach procurement policies, design guidelines, and air transportation operations, interlinking an integrated logistics web.

The question of regulation also will reach into the discussion. International regulation regarding environmental considerations will affect the selection of container materials, energy used in temperature control, and the recyclability of existing units. In a future world, compliance will not be merely ensuring certifications—it will require open disclosure and real-time tracking of the performance of containers throughout all flight and transfer phases. These will not be universal expectations, driving a multi-speed regulatory landscape whereby market participants are constantly having to reset.

Manufacturers alone will not drive innovation. Airlines, ground handling companies, and even the customs department will start influencing container development through shared platforms. These platforms will promote predictive services where faults in the containers are resolved prior to departure, not upon arrival. Predictive maintenance will become a service norm, not an optional package, particularly as lost time equates to supply chain disruptions and penalty charges.

In addition, expectations in the culture of handling cargo will shift. As sustainability and ethical business practices become more in vogue, stakeholders will not only want to know how quickly cargo is delivered but also under what circumstances. Such a focus will pressure the market to create containers that are not only secure and durable but also ethical in production and lifecycle. In such a case, the air container ceases to be merely a vessel—it is a declaration of brand responsibility and operational openness.

Therefore, the global air container market will not develop in a vacuum but will be influenced by forces converging in technology, regulation, ethics, and decentralization. Its future will mirror the broader redefinition of global logistics, requiring new thinking, partnerships, and accountability at all levels.

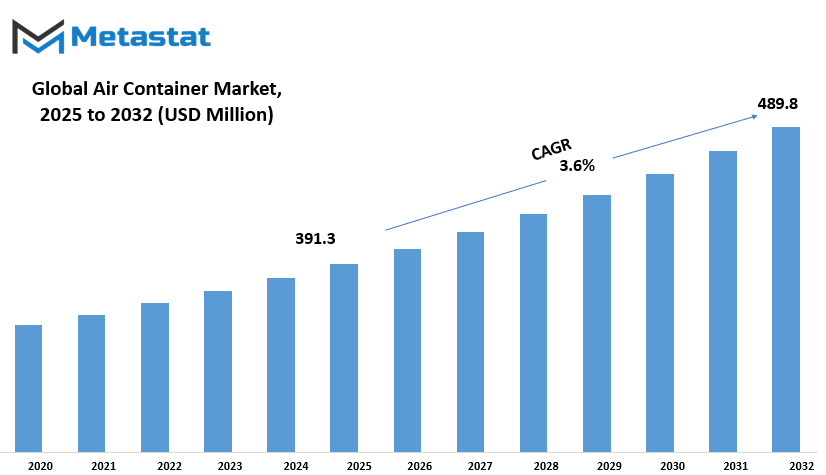

Global air container market is estimated to reach $489.8 Million by 2032; growing at a CAGR of 3.6% from 2025 to 2032.

GROWTH FACTORS

The global air container market is experiencing gradual increase, primarily due to ongoing demand for fast and secure transportation of cargo. With companies and buyers looking for faster deliveries, especially on valuable and time-sensitive goods, air cargo is on the map of global logistics more than ever. The ongoing boom in e-commerce is additionally supporting the increases in air freight demands, with a growing number of online shoppers across the globe wanting narrower delivery windows. In particular, the pharmaceutical industry has relied heavily on air freight for shipping minimally stable medicines and vaccines needing to arrive safely and on time. Specialized air containers come in to handle this responsibility, safeguarding cargo from damage and temperature changes during transport.

Yet this development comes with its own set of problems. One of the largest issues is expense. Air freight is already more costly than other modes of transport, and to include the cost of manufacturing and upkeep of air containers just adds to the cost. Such containers are designed to be durable, secure, and in some instances, to maintain cargo at a certain temperature, all which contribute to manufacturing and running costs. Air cargo is also tightly regulated by aviation authorities. These regulations are designed to make flights safe but are restricting the weight and size of what can be transported, placing additional pressure on the amount of value each shipment can deliver.

Despite these challenges, the future presents a number of encouraging prospects. Technology is having a significant role in determining the course of the air container business. Design and material innovations are enabling companies to produce lighter containers without compromising on safety or quality. This not only reduces airline fuel costs but enables more cargo to be transported.

Furthermore, more nations are becoming accessible for air cargo solutions. With emerging economies growing, firms in these markets are embracing quick shipping solutions as a means of satisfying increasing customer demands. These countries are finding the benefit in putting money into air freight, so there is greater demand for containers specifically designed to suit particular trade and safety requirements. All of these put together imply that although there are a couple of hiccups in the global air container market, its future is characterized by innovation, growing markets, and a constant urge for improved performance and dependability.

MARKET SEGMENTATION

By Type

The global air container market is seeing a consistent growth trend in response to increased air freight demand around the world. Businesses are relying more and more on timely and reliable transportation, especially if the goods are required to reach their destination quickly or - in the case of pharmaceuticals or electronics, for example - because of valuable. Air containers remain a significant component of the air freight system and provide a mechanism for transporting goods in a safe manner via air. Also, they are designed to provide product security, organization, while also enhancing loading/unloading efficiency, ultimately saving moving times and costs. With continued growth in the e-commerce, pharmaceuticals, electronics, and food exporting industries, there is expected growth in air container demands.

There are different types of air containers - and this is further segmented on purpose and aircraft configuration. The market segmentation is informative as it relates to the use of the Lower Deck Container, which is currently valued at $115.4 million and has a notable presence in the cargo logistics space. Generally speaking, Lower Deck Containers are typically used in the lower parts of passenger aircraft, which maximizes the cargo space capacity and enhances overall transport logistics efficiency. Conversely, the Main Deck Container conforms with space available on cargo aircraft with unnecessary space for goods. The Main Deck Container generally supports larger or bulkier size goods.

The desire for smarter and more robust materials is also supporting market growth. There is also an increased attraction to use containers with tracking features such as temperature or location, which really start to play a role in the transport of medicines or fresh foods. Innovations along these lines are improving safety measures for transport and enabling greater efficiency and control of processes along supply chains.

Another factor for the growth of this market is the increased number of international trade agreements, and expansion of trade routes. As more businesses look to enter international markets, more emphasis is being placed on ensuring that delivery of products is on-time and that there are no delivery concerns. Air containers provide a trusted method for getting goods from point A to point B with minimal delays, and are a mainstay of contemporary air cargo systems. Markets are driven by speed - the need for each product to be delivered quickly without logistical issues. The air container market will continue to develop in ways that meet the needs of business operations and various industrial sectors.

By Application

The global air container market is affected by a multitude of real-world applications with commercial and military use being the primary fields of influence. Ultimately, these two fields determine the demand for air containers and influence the way in which air containers are designed, manufactured, and employed. The commercial use of air containers is to safely and quickly transport goods from country to country and from continent to continent. With the increase of ecommerce and a growing reliance of businesses on delivering goods quickly by air, the demand for air containers for transporting goods will continue to be necessary. Goods need to arrive to customers in the condition established when sold, and transport packaging plays a critical role in supporting that condition when moved, especially by air. Air containers help provide that kind of security whether it is medical supplies, electronics, clothing, or otherwise. When busy supply chains result in missing or damaged equipment or supplies, air container demand continues to be prevalent and necessary.

With respect to military - air containers are used to transport equipment, supplies, and sometimes personnel. Military operations often occur in remote areas, or in times of urgency, that require speed and assurance of reliability. Air containers provide quality manufacturing and overall strong and secure transportation packaging, which is intended to provide protection for sensitive materials and heavy materials. They also allow easier loading and unloading which saves time when conducting operations. Many military air containers are laid out to Government specifications so they can be transported using different aircraft without issues. This flexibility is critical to military logistics since time is crucial and materials must reach their destination intact.

As commercial and military demands continue to increase, the air container market will continuously adapt to address the demand. Manufacturers are looking at design and materials to manufacture lighter containers, providing airlines with increased fuel efficiencies but at no cost to safety. There is also growing emphasis on utilizing recycled materials that will contribute to their green initiatives. These improvements in terms of materials also continue to focus on better designs and conveniences which enable users to meet the needs of those day-to-day consumers that depend on those air containers.

In conclusion, the future of the air container market will greatly depend on how well it serves commercial and military markets. The better these containers perform in the field, the more valuable they become.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$391.3 million |

|

Market Size by 2032 |

$489.8 Million |

|

Growth Rate from 2025 to 2032 |

3.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global air container market has been categorized by geography and each geographical region has benefited from its regional role in helping to push the market. North America continues to be a contributing market with the United States ranked highest in terms of demand and technological advancements. The air container market also benefits from the growth factors of Canada as well as Mexico, both of which have demonstrated a growing need for an efficient and secure air transport system to meet the needs of their economies/industries (e.g., pharmaceuticals, electronics and fresh produce, etc.) for air transportation and shipping of products. The European market is still alive and kicking. The United Kingdom, German and Italian markets show strong import/export activity, which is supported by air freight infrastructures and airport infrastructures to manage the loading of high air cargo activity. The rest of Europe is steadily involved in the air container market.

The Asia-Pacific Region continues to develop in terms of levels of industrial output and global trade as demonstrated by the China, India, Japan and South Korea are great markets for air containers. China has a strong manufacturing foundation and India has a growing export environment, both are adding to the overall demand for air containers. Japan and South Korea also contribute to the market with their advanced logistics systems supported by air cargo services. The rest of the Asia-Pacific region appears to have potential as international and regional trade continues to grow and with improvements in transportation infrastructures.

South America is has also seen progress in air container sales, primarily in Brazil and Argentina, where both countries are exporting agricultural and other products, that require fast and secure transportation. Although other South American countries may have small market share but are improving cargo handling and trading efforts which help strengthen the market. The Middle East & Africa also comprises important contributors of the air container market; in the Middle East there are the GCC members, Egypt and South Africa. These regions are ideal players in the air container market thanks to their locations, which help them become great gateways to connecting globalization. Moreover, the air container market has also been stimulated by the demand for fast, reliable and temperature-controlled cargo solutions, especially in the healthcare and food services sectors.

Each region supports the global air container market in several different aspects. Collectively, they are synonymous with each other in terms of contributing to the global airport supply chain to allow goods to cross borders around the world quickly and safely. With an ever increasing international trade and demand for reliable logistics, the global air container market is only brief to continue to grow while all regions will be essential for developing this market.

COMPETITIVE PLAYERS

The global air container market has a significant role in the larger transportation market with reliable and effective ways to move goods using air transport. As demand for faster and more efficient cargo delivery continues to grow, air containers have become an important factor in ensuring the safe delivery, temperature and condition of products through airfreight. Air containers are unique in that they fit the designed storage systems of aircraft and built with materials that are sturdy, yet more lightweight. This balance between sturdy yet lightweight containers allow for containers to endure the physical stresses of air travel and minimize fuel requirements.

Many companies are actively changing the landscape of the air container market. Prominent companies operating in the air container market include Cargo Composites, DokaSch GmbH, Envirotainer, Granger Aerospace, Nordisk Aviation, Champion GSE, PalNet GmbH, Satco Inc., VRR-Aviation and Safran. Each one of these companies is advancing the air container market by enhancing the design and improving product performance based on the demand within the air freight industry. There are companies in the industry that specialize in temperature-controlled containers which is an important factor for air transporting pharmaceuticals, foods and other goods sensitive to temperature. Additionally, companies produce container systems that are strong and yet lightweight and designed with an eye to minimize airline costs.

The growth of air containers is driven primarily by the increase in the global trade. Companies all over the world are looking for all the air freight can provide in terms of immediate movement of goods, as well as safe passage. Medical material, electronics, food; air transport and air containers get the cargo out of the warehouse and towards the receiver as safe and secure as possible. In addition to securing the cargo, improved technology has resulted in better tracking and monitoring for shippers and customers alike.

A second reason for growth has been the sustainability focus on minimizing carbon emissions. An added effort from airlines and manufacturers to meet sustainability goals has resulted in more focus on the development and utilization of containers with more energy-efficient, recyclable qualities. Many manufacturers have adopted new technologies and materials which support company commitments to sustainability along with meeting the needs of the customer.

As the world continues to improve and increase its safety transportation and safety requirements, air freight will continue to be a larger portion of global logistics. The demand for air container transportation will continue with adjustments from suppliers and input from leading organizations. As the industry continues to raise the standard of development and commitment, the air cargo market will continue to evolve.

Air Container Market Key Segments:

By Type

- Lower Deck Container

- Main Deck Container

By Application

- Commercial Use

- Military Use

Key Global Air Container Industry Players

- Cargo Composites

- DokaSch GmbH

- Envirotainer

- Granger Aerospace

- Nordisk Aviation

- Champion GSE

- PalNet GmbH

- Satco Inc.

- VRR-Aviation

- Safran

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252