Global Advanced Glass Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global advanced glass market in the manufacturing and material sector will remain a subject of interest as a field of adaptation and innovation. Its beginnings go back to initial research into specialty and high-strength glass in the mid-20th century when industries had already started looking for alternatives to ordinary glass for extreme application. Early development was spurred by the automotive and aerospace markets, which needed glass that would resist extreme conditions without degrading or losing strength and transparency. In the 1980s, glass manufacturing plants and labs started producing chemically toughened glass and coated types, one of the first in a series of revolutionary sea changes in its manufacture.

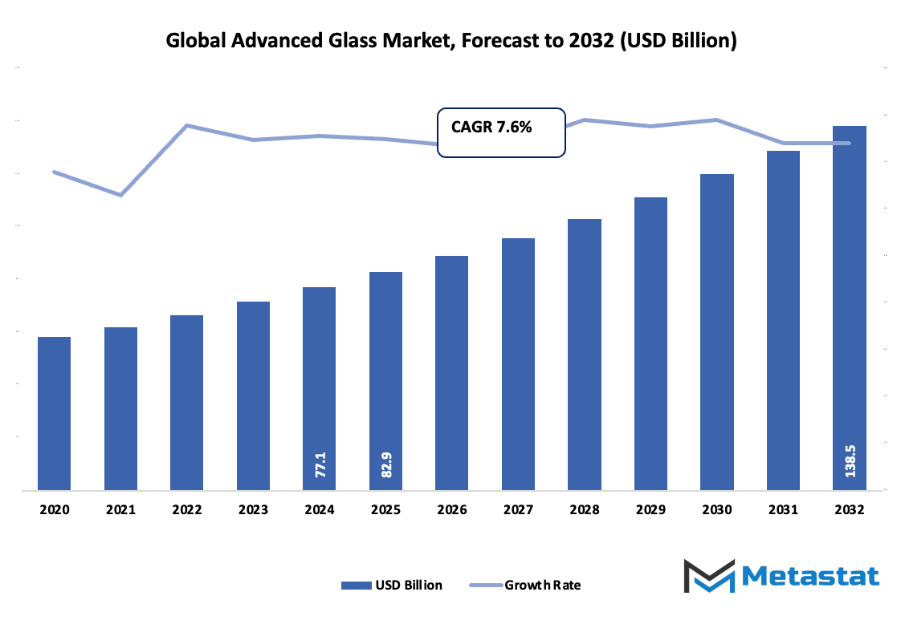

- Global advanced glass market value of about USD 82.9 Billion in 2025, growing at a CAGR of about 7.6% from 2032, with potential to reach USD 138.5 Billion.

- Coated Glass accounts for about 28.5% market, leading the charge of innovation and growth through focused research.

- Growing Demand for Energy-Efficient Buildings (e.g., LEED Certification), Expanded Adoption of Advanced Glass in Automotive Sector for Lightweighting and Safety are some of the most significant trends fueling growth.

- Opportunities are: Growing Applications of Intelligent Glass in Electronic and Display Technologies

- Findings: The market is anticipated to grow exponentially in value over the next decade, emphasizing significant opportunities for growth.

The 1990s witnessed unprecedented technological development, including laminated and tempered solutions, soon to be universally adopted throughout consumer electronics and construction. Throughout this time, the market was starting to react to coming consumer demand for thinner, safer, and more multifunctional glass products. Smartphones, tablets, and new display technologies were driving growth in thin yet durable glass, further solidifying its application beyond typical windows and building use. Concurrently, changing regulations regarding energy efficiency and building codes compelled the creation of low-emissivity and insulated glass, which had to dictate the methods of production as well as products within an industry. Entering the 21st century, the industry will experience an even more robust shift. Technologies such as self-cleaning surfaces, flexible sheets of glass, and smart glass technologies will reconfigure application in automotive, construction, and electronics markets. Customer requirements for high-performance and multi-functional glass will continue to define research agendas, while increasingly stringent safety and environmental regulations will inform manufacturing practice. Key landmarks, including the engineering of ultra-thin smartphone displays and energy-efficient skyscraper glazing, will drive the pace of the world advanced glass market's narrative.

Its path will be a mix of material science innovation and shifting market requirements, demonstrating how a previously niche industrial material will be going out into mainstream life. While technology capability improves and cross-industry usage becomes more prevalent, the marketplace will not merely adjust but alter, providing answers that will achieve performance and sustainability thresholds previously considered impossible.

Market Segments

The global advanced glass market is mainly classified based on Product Type, Function, End Use Industry.

By Product Type is further segmented into:

- Coated Glass: Coated glass will remain in the limelight as it has the potential to make car and building energy use more efficient. The newest coatings will cause surfaces to reflect or absorb sun radiation selectively, thus lowering energy use. Development in the future will be targeted at durability and utilizing coatings in smart technologies.

- Laminated Glass: Laminated glass will have greater utility in safety-oriented applications. It will offer improved impact resistance with continued clarity. Advances in technology will enhance sound barrier capabilities and UV filtering, and laminated glass will be increasingly useful in urban infrastructure, transportation, and specialized situations where comfort and safety are paramount.

- Toughened Glass: Toughened glass will also find its niche where there is a need for strength and impact resistance. Its production methods will make it able to absorb more stresses, hence its niche will be in the automotive sector, construction sector, and electronics sector. It will have a future that will be lightweight but not at the expense of strength and visual acuteness.

- Ceramic Glass: Ceramic glass will be used in heat-resistance and stable applications. It will be extensively utilized in industry and specialized equipment. Future developments will enable the material to be able to withstand greater temperatures, offer better thermal insulation, and allow for integration in electronic displays or highly efficient heating units.

- Others: Other high-end glass forms will evolve, geared towards solving specialized uses. Hybrid and multifunctional glass innovations will bring synergies of transparency, strength, and thermal performance. Technology will increase the market segment as demand is driven for more specialized and multipurpose glass solutions.

By Function the market is divided into:

- Safety & Security: Safety and security glass will increasingly find applications in public and private buildings. The products will have impact resistance in conjunction with smart monitoring capabilities. Glass will not only serve as a barrier but also as a source of sensors that transmit real-time safety alerts, ensuring buildings, vehicles, and sensitive spaces become safer and more secure.

- Solar Control: Solar control glass will remain a staple of energy-efficient building and transport. It will limit heat gain without compromising natural light, reducing the cost of energy. Future advancements will center on dynamic solar control in which glass properties change automatically with fluctuating sunlight intensity and climatic conditions.

- Optics & Lighting: Optics and lighting glass will play an increasingly vital role in precision instruments and illumination systems. Future applications will deliver greater light transmission, clarity, and efficiency of energy usage. Glass will have a key role to play in emerging technologies such as next-generation sensors, photonics, and adaptive lighting, both in terms of function and appearance.

- High Performance: High-performance glass shall be produced for extreme applications, with strength, thermal stability, and resistance to the environment. Today's applications will expand to extreme industrial conditions, aerospace, and high-technology electronics. Advances in the future will be based on multi-functional performance without added weight or loss of transparency.

By End Use Industry the market is further divided into:

- Building & Construction: Advanced glass will find greater use in the building and construction sector for energy efficiency, safety, and beauty. Dynamic windows that can change transparency and insulating ability will be a feature of buildings in the future. Glass will be instrumental in creating sustainable, intelligent buildings.

- Aerospace & Defense: Defense and aerospace will depend upon high-performance glass for optical transparency, toughness, and thermal resistance. Such developments will drive improved performance under hostile environments, both to facilitate safety as well as technological needs. High-strength, lightweight glass will be paramount in aircraft, space vehicles, and defense systems today.

- Automotive: Automotive use will expand with vehicles featuring tougher, lighter, and more flexible glass. Future vehicles will embrace advanced glass for safety, solar control, and improved visibility. Smart sensor compatibility and heads-up display integration will further make it a central component in contemporary mobility solutions.

- Electronics: Glass electronics will grow with touchscreens, protective covers, and optical components. Future design will center around flexibility, scratch resistance, and increased transparency. Glass will keep on making innovative devices possible while evolving with new technologies such as foldable displays and augmented reality.

- Sports & Leisure: Sports and recreation gear will be enhanced by impact and light glass. Future designs will integrate protection and performance enhancement. Breakthroughs in glass will enhance optical clarity, safety, and endurance on sports grounds, sunglasses, and recreation vehicles.

- Optical: Optical application will require high-performance, high-quality glass. Future needs will be for improved light transmission, lower distortion, and engineered refractive properties. Glass will be an essential component in lenses, imaging systems, and scientific instruments employing precision and reliability.

- Others: Other end-use industries will find more advanced glass solutions being used by them. New trends will push demand for responsive, multi-functional glass. From renewable energy to medicine, industries will derive advantage from materials that provide strength, clarity, and energy efficiency together.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$82.9 Billion |

|

Market Size by 2032 |

$138.5 Billion |

|

Growth Rate from 2025 to 2032 |

7.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

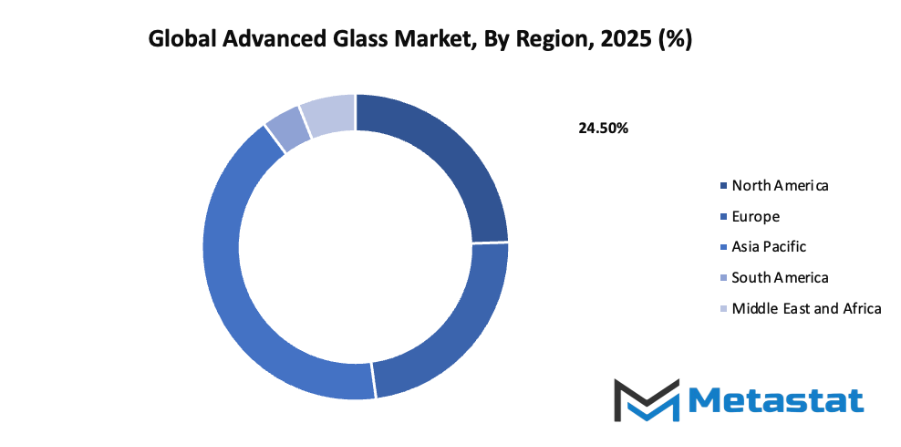

By Region:

- Based on geography, the global advanced glass market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing Demand for Energy-Efficient Buildings (e.g., LEED Certification): Adoption of energy-efficient designs in urban areas is accelerating, prompting developers to choose materials that enhance thermal insulation and reduce electricity use. Advanced glass meets these requirements, offering benefits like heat control and daylight optimization. LEED-certified projects will further push the global advanced glass market forward as sustainability becomes a priority.

- Growing Adoption of Advanced Glass in Automotive Sector for Lightweighting and Safety: The automotive industry is integrating advanced glass to improve safety and reduce vehicle weight. Lighter vehicles enhance fuel efficiency and reduce emissions, while high-strength glass ensures passenger protection. Innovations such as laminated, tempered, and smart glass will continue to expand applications, contributing to growth in the global advanced glass market.

Challenges and Opportunities

- High Production Costs Associated with Advanced Glass Manufacturing: Manufacturing advanced glass requires sophisticated processes and technology, making production expensive. Costs include precision equipment, quality control, and energy-intensive operations. While these expenses can limit adoption in some markets, ongoing innovations in production methods will gradually reduce costs and make advanced glass more accessible globally.

- Limited Availability of Raw Materials for Certain Advanced Glass Types: Some specialized glass types depend on rare or high-purity materials, which are not always readily available. Supply constraints may impact production schedules and pricing. Strategic sourcing, recycling, and material substitution will be crucial for overcoming these challenges while maintaining the growth trajectory of the global advanced glass market.

- Opportunities

- Expansion of Advanced Glass Applications in Electronics and Display Technologies: Electronics and display industries are driving demand for advanced glass in screens, protective layers, and touch panels. Improvements in clarity, strength, and responsiveness are essential for future devices. Continuous innovation will support higher adoption rates and create new market segments, ensuring the global advanced glass market remains on a strong growth path.

Competitive Landscape & Strategic Insights

The global advanced glass market will continue to experience dynamic changes as it balances the presence of established international leaders with the rise of regional players. Companies such as Asahi Glass Co., Ltd., Saint-Gobain, PPG Industries, Inc., Corning Incorporated, Guardian Industries, Tyneside Safety Glass, Huihua Glass Co. Limited, Nippon Sheet Glass Co. Ltd., Euroglas GmbH, Duratuf Glass Industries (P) Ltd., Cardinal Glass Industries, and Pilkington Group Limited have already shaped the market with a strong influence on global trends. These competitors have demonstrated the ability to innovate and adapt, creating products that meet increasingly specialized demands. At the same time, emerging regional companies are entering the market with flexible strategies and cost-efficient operations, challenging the dominance of long-standing leaders.

Looking forward, the competitive landscape will be driven by technology adoption, sustainability initiatives, and the ability to customize products for diverse applications. Companies will invest in research and development to create stronger, lighter, and more energy-efficient glass solutions, responding to both industrial and consumer demands. Strategic partnerships and mergers may become more common as firms aim to consolidate resources, enhance production capabilities, and expand geographic reach. Regional competitors will likely leverage local market knowledge, faster decision-making, and agility to capture niche opportunities, forcing global leaders to reevaluate pricing, distribution, and innovation strategies.

Market success will rely not only on technological advancement but also on understanding evolving customer needs and regulatory environments. Advanced glass solutions will be increasingly integrated into construction, automotive, electronics, and renewable energy sectors, driving competition on both quality and performance.

Market size is forecast to rise from USD 82.9 Billion in 2025 to over USD 138.5 Billion by 2032. Advanced Glass will maintain dominance but face growing competition from emerging formats.

Companies that can anticipate shifts in demand, invest in sustainable production, and maintain flexible supply chains will have a distinct advantage. Strategic insights will play a key role in guiding investment decisions, identifying untapped markets, and achieving long-term growth. As the industry progresses, the balance between global influence and regional agility will shape competitive dynamics, ensuring that leaders are those who combine innovation with strategic foresight.

Report Coverage

This research report categorizes the global advanced glass market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global advanced glass market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global advanced glass market.

Advanced Glass Market Key Segments:

By Product Type

- Coated Glass

- Laminated Glass

- Toughened Glass

- Ceramic Glass

- Others

By Function

- Safety & security

- Solar Control

- Optics & Lighting

- High Performance

By End Use Industry

- Building & Construction

- Aerospace & Defense

- Automotive

- Electronics

- Sports & Leisure

- Optical

- Others

Key Global Advanced Glass Industry Players

- Asahi Glass Co., Ltd.

- Saint-Gobain

- PPG Industries, Inc.

- Corning Incorporated

- Guardian Industries

- Tyneside Safety Glass

- Huihua Glass Co. Limited

- Nippon Sheet Glass Co. Ltd.

- Euroglas GmbH

- Duratuf Glass Industries (P) Ltd.

- Cardinal Glass Industries

- Pilkington Group Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252