MARKET OVERVIEW

The Global 5G Radio Unit Market encompasses a vast array of companies, products, and technologies, all driven by the demand for faster and more reliable connectivity. The 5G revolution has been nothing short of transformative, redefining the way we connect, communicate, and conduct business on a global scale. At the heart of this technological leap forward lies the 5G Radio Unit, a critical component responsible for the speed, reliability, and coverage of 5G networks. In this essay, we will delve into the dynamic landscape of the Global 5G Radio Unit Market, exploring the key factors, players, and trends that shape this industry.

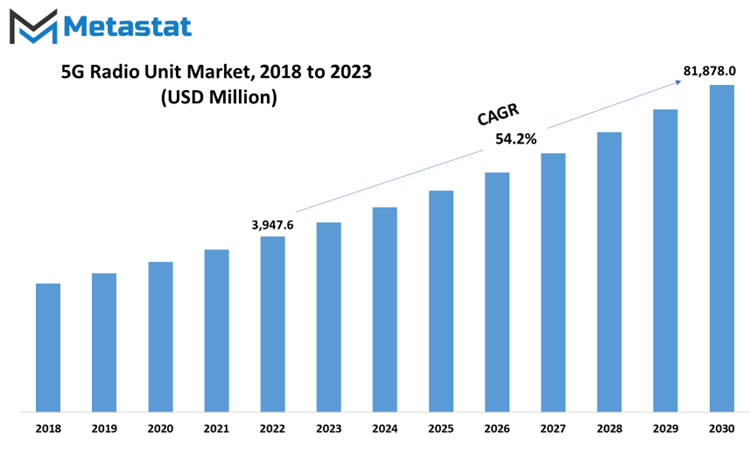

In this dynamic arena, several key players stand out. Companies like Ericsson, Nokia, Huawei, and Samsung have emerged as industry giants, relentlessly pushing the boundaries of technology and infrastructure. These companies invest heavily in research and development, striving to be at the forefront of 5G technology. Global 5G Radio Unit market is estimated to reach $81,878.0 Million by 2030; growing at a CAGR of 54.2% from 2023 to 2030.

The Global 5G Radio Unit Market is a dynamic and ever-evolving landscape, driven by key players, market segmentation, and market dynamics. The constant evolution of standards and technologies, spectrum allocation, and emerging trends contribute to the sector's vitality. As the demand for 5G connectivity continues to grow, the market for 5G radio units will remain pivotal in shaping the global telecommunications industry.

GROWTH FACTORS

The global 5G Radio Unit market is experiencing notable growth, primarily fueled by the escalating demand for high-speed and low-latency connectivity. This demand has been instigated by the exponential surge in data generation and transmission across diverse industries. Several factors are propelling this demand, encompassing the following key drivers.

The relentless growth in mobile data traffic has strained traditional 4G networks, leading to congestion and slower data speeds. Consequently, there has emerged a pressing need for a more advanced and efficient network infrastructure. 5G technology addresses these needs by significantly enhancing data transfer rates, network capacity, and latency, offering a solution to the congestion and slowdown issues witnessed in 4G networks.

Moreover, various industries, such as healthcare, gaming, media, smart cities, and manufacturing, rely on high-bandwidth applications that necessitate uninterrupted connectivity. For instance, telemedicine and gaming require real-time, low-latency data transmission. 5G technology meets this requirement by providing seamless and high-speed connectivity.

The rise of the Internet of Things (IoT) has brought forth new opportunities for 5G networks. IoT devices require constant and reliable connectivity. 5G networks, with their capability to support a massive number of connected devices, are pivotal for the deployment of IoT applications in sectors like smart cities, smart homes, industrial automation, and autonomous vehicles.

Furthermore, the ongoing digital transformation across industries has ignited the demand for high-speed and low-latency connectivity. Businesses are progressively embracing cloud computing, edge computing, and data analytics. 5G technology plays a pivotal role in facilitating faster and more dependable access to these services, thus contributing to the demand for 5G Radio Units.

In summary, the 5G Radio Unit market is being propelled by the necessity for swifter data transfer rates, amplified network capacity, and diminished latency. These factors are indispensable for various industries and emerging technologies.

Another significant contributor to the growth of the 5G Radio Unit market is the increasing adoption of IoT devices and applications. This trend is driven by several key factors. The proliferation of IoT devices, which are embedded with sensors and connected to the internet, is revolutionizing industries such as healthcare, manufacturing, transportation, and smart cities. The growing number of IoT devices necessitates dependable, high-speed, and low-latency connectivity for seamless data transmission.

5G technology is uniquely poised to address the connectivity requirements of IoT devices. It offers high data transfer rates, increased capacity, and ultra-low latency, enabling real-time monitoring, analysis, and decision-making in sectors like healthcare and manufacturing. The adoption of edge computing, a paradigm that processes and analyzes data at or near the source, is further propelling the demand for 5G Radio Units. 5G networks play a pivotal role in enabling efficient edge computing by providing reliable and fast connectivity between edge devices and the cloud.

Smart city initiatives, characterized by extensive networks of connected devices, rely on 5G technology to support large-scale device deployment, ensuring seamless connectivity and efficient data exchange. Lastly, the overarching trend of digital transformation is spurring the adoption of IoT devices across industries. This surge increases the demand for reliable, high-performance connectivity, a demand that 5G networks effectively meet by enabling real-time data exchange and supporting advanced analytics and automation.

In conclusion, the increasing adoption of IoT devices and applications serves as a substantial driver for the 5G Radio Unit market. It addresses the connectivity requirements of IoT devices and unlocks their full potential across a spectrum of sectors.

MARKET SEGMENTATION

By Type

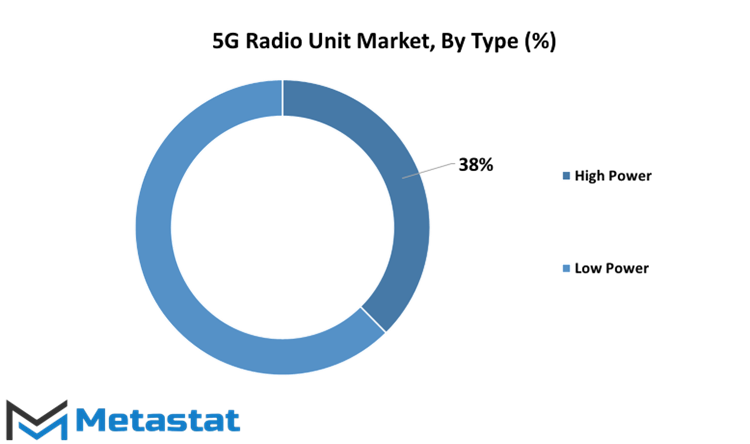

The High-Power segment, as of 2022, held a value of 1075.1 USD Million. On the other hand, the Low Power segment was valued at 1835.7 USD Million in the same year. This division signifies a crucial aspect of the 5G Radio Unit market. High Power and Low Power units serve different purposes, catering to the diverse needs of the 5G infrastructure landscape.

High Power units are known for their ability to transmit signals over longer distances. They are the workhorses, facilitating the wider coverage that 5G demands. In areas where network reach is a priority, High Power units come to the fore.

On the flip side, Low Power units are adept at serving densely populated regions or locations with numerous connected devices. These units excel in maintaining connectivity in areas where the concentration of users and devices is high.

The varying values attributed to these segments in 2022 underscore the demand dynamics within the 5G Radio Unit market. The higher valuation of the Low Power segment suggests a substantial requirement for such units, possibly reflecting the increasing adoption of 5G in urban and densely populated areas.

Conversely, the High-Power segment retains its significance, particularly in ensuring the reach and coverage of 5G networks, especially in less densely populated or rural areas.

This segmentation strategy caters to the versatile needs of the ever-expanding 5G landscape. As the market continues to evolve and mature, the demand for both High Power and Low Power units is expected to grow. The 5G Radio Unit market's ability to adapt to these diverse requirements is pivotal in supporting the widespread adoption and effectiveness of 5G technology.

By Application

The Global 5G Radio Unit market features distinct segments, primarily categorized by application. These segments represent different facets of the market, each with its own set of dynamics and values.

One of the key segments within the Global 5G Radio Unit market is the Integrated Base Station. In 2022, the Integrated Base Station segment held a significant value of 1507.2 USD Million. This segment is crucial in the 5G infrastructure, where various components are integrated into a single unit, facilitating efficient and streamlined deployment. Integrated Base Stations are known for their cost-effectiveness and space-saving attributes, making them a popular choice in the market.

Another vital segment is the Distributed Base Station, valued at 1403.6 USD Million in 2022. Distributed Base Stations, in contrast to the integrated ones, involve a decentralized setup where various network components are distributed across a broader area. This approach offers advantages in terms of flexibility and scalability, allowing for efficient network expansion. The Distributed Base Station segment caters to the requirements of 5G networks that require extensive coverage and adaptability.

These two segments, Integrated Base Station and Distributed Base Station, represent a fundamental divide in the 5G Radio Unit market, each catering to distinct operational needs and preferences. The Integrated Base Station stands out for its compactness and cost-efficiency, while the Distributed Base Station excels in providing extensive coverage and scalability. The choice between these segments often depends on the specific requirements of the 5G network and its intended application.

REGIONAL ANALYSIS

The global 5G Radio Unit market, when examined through the lens of geography, unveils intriguing insights into its regional dynamics. This market, inherently dynamic and responsive to shifting landscapes, presents a fascinating tapestry of regional variations. Two such regions, North America and Europe, provide valuable illustrations of the market's regional diversity.

In North America, the 5G Radio Unit market has demonstrated considerable growth. This region witnessed an estimated market value of 482.5 million USD in 2018. This remarkable figure underscores the robust demand for 5G radio units in North America, driven by factors such as technological advancements and a growing need for high-speed connectivity.

Conversely, Europe presents a slightly different picture in the 5G Radio Unit market landscape. The estimated market value in Europe in 2018 stood at 417.1 million USD. While slightly lower than North America, this figure still attests to the significance of 5G radio units in Europe. The market here is also influenced by technological trends, but regional preferences and regulatory dynamics contribute to the unique European market dynamics.

Both North America and Europe exhibit promising trajectories in the 5G Radio Unit market, reflecting the global demand for enhanced connectivity and communication. These regions showcase how geography, with its diverse economic, technological, and regulatory characteristics, influences the 5G Radio Unit market's regional nuances.

The 5G Radio Unit market's regional variations, as illustrated by North America and Europe, emphasize the importance of considering the geographical context in assessing market trends. These regions provide not only insights into the current market landscape but also serve as indicators of future possibilities as 5G technology continues to evolve and redefine the way we connect and communicate.

COMPETITIVE PLAYERS

The Global 5G Radio Unit market is a dynamic landscape, and key players are steering the industry forward. One of these influential players is Semiconductor Components Industries, LLC, often recognized as Onsemi.

Onsemi is a prominent participant in the 5G Radio Unit sector, contributing to the ongoing evolution of telecommunications. Their presence in this market signifies their commitment to advancing technology and connectivity. By focusing on the development and supply of key components, Onsemi plays a pivotal role in shaping the 5G ecosystem.

The 5G Radio Unit market is a critical component of the broader 5G infrastructure. This technology is at the heart of next-generation wireless networks, promising faster speeds, lower latency, and enhanced connectivity. As the demand for 5G services continues to rise, companies like onsemi are at the forefront of driving innovation and delivering the essential components that power these networks.

Onsemi's involvement in the 5G Radio Unit market highlights their expertise in semiconductor components. These components are the building blocks of 5G infrastructure, enabling the efficient and rapid transmission of data. onsemi's contributions encompass a range of critical technologies, from power management solutions to sensor technologies, all designed to enhance the performance of 5G networks.

In this ever-evolving landscape of 5G technology, key players like onsemi are vital. Their role extends beyond the development of components; it encompasses collaboration, research, and the constant pursuit of innovation. By providing the industry with essential tools and technologies, onsemi contributes to the global expansion of 5G networks, connecting people, businesses, and devices on a scale previously unattainable. This interconnected world is made possible by the continuous efforts of key players like onsemi, who understand the significance of their role in shaping the future of communication and connectivity.

5G Radio Unit Market Key Segments:

By Type

- High Power

- Low Power

By Application

- Integrated Base Station

- Distributed Base Station

Key Global 5G Radio Unit Industry Players

- Semiconductor Components Industries, LLC (onsemi)

- NXP Semiconductors N.V.

- Fujitsu Limited

- Singtel Optus Pty Limited

- Nokia Corporation

- Hytera Communications Corporation Limited

- Sterlite Technologies Limited

- HFR, Inc.

- Benetel Ltd.

- NEC Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252