Global 5G Network and Tower Deployment Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global 5G network and tower deployment market in the telecommunication sector will continue to revolutionize how societies communicate, interact, and connect. Its development has a history dating back to early mobile networks when 1G and 2G held sway over voice communication before 3G and 4G went into full gear to provide data services and internet connectivity. Initial trial runs of 5G technology started late in the 2010s, paving the way for ultra-high-speed mobile broadband, huge device connectivity, and low-latency communications. Initial deployment in key major cities promised more advanced smart city applications, autonomous vehicle integration, and real-time industrial control.

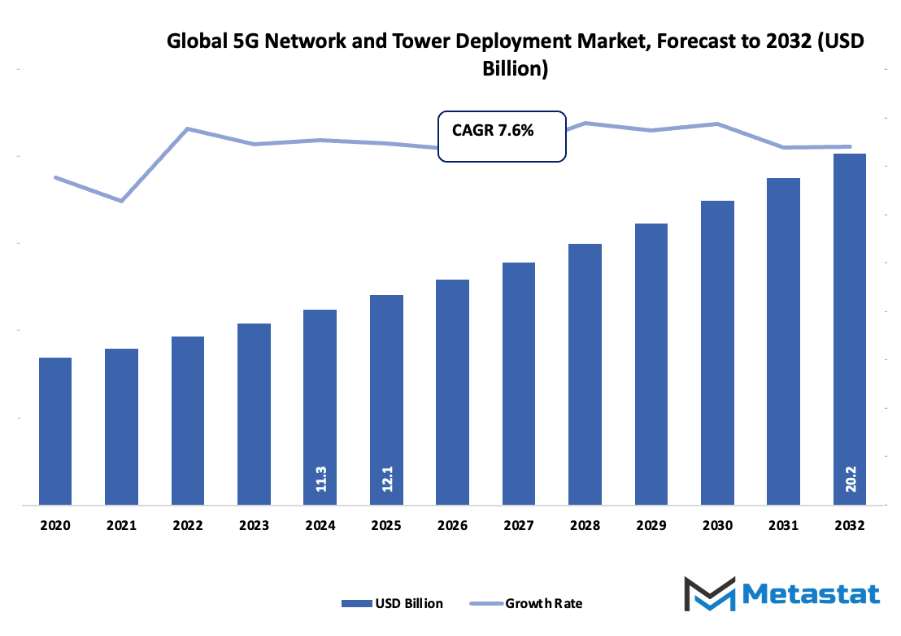

- Global 5G network and tower deployment market value of approximately USD 12.1 Billion in 2025, at a CAGR of approximately 7.6% during 2032, potentially reaching over USD 20.2 Billion.

- Small Cell account for nearly 10.9% market share, driving innovation and expanding applications through large-scale research.

- Key trends driving growth: Rising requirement for high-speed data storage and low-latency connectivity, Steady growth in IoT devices and smart city initiatives

- Opportunities are Enterprise and industrial expansion of private 5G networks

- Key takeaway: The sector will grow exponentially in terms of value in the coming decade, having the capability to recognize strong growth opportunities.

Gradually, governments of nations brought in policies to facilitate the availability of high-frequency spectrum bands to allow telecom operators to expand coverage more easily. Consumer needs changed and focused more on high-definition streaming, cloud applications, and experience-based technologies like virtual and augmented reality. Changes necessitated network providers to redo site plans for infrastructure, capacity management, and tower installation.

Technological advancements also contributed importantly. Development in small cell technology, massive MIMO antennas, and edge computing hardware will bring denser, efficient networks. Equipment manufacturers and service providers will be coordinating more closely to develop towers that can accommodate current as well as future wireless generations with seamless upgrades and minimal disruption.

The global 5G network and tower deployment market has already witnessed key milestones, such as initial commercial 5G launches in South Korea and the United States, followed by more widespread takeup in Europe and Asia. Deployment will be further encouraged by public-private partnerships, especially where connectivity gaps are still large. Moreover, new standards and interoperability protocols will ensure that next-gen networks will have the capacity to support new applications, from telemedicine to smart manufacturing.

With the market moving forward, its growth will no longer be based on speed and coverage but on capabilities to connect various technologies, changing user expectations, and evolving with altering regulatory environments. The global 5g network and tower installation market will transform city planning, production practices, and way of life, creating a world that will touch almost every element of human activity.

Market Segments

The global 5G network and tower deployment market is mainly classified based on Component, Location, End-User.

By Component is further segmented into:

- Small Cell: Small cell technology will play a crucial role in increasing the network's coverage and capacity, particularly for urban hotspots. These devices will deliver quicker data speeds, reduced latency, and greater traffic capacity. Additional small cells will be deployed in the future to meet increasingly rising demands for convenient connectivity.

- 5G Mobile Core Network: The 5G mobile core network will be the foundation of tomorrow's telecommunications, controlling the traffic flow of data efficiently and providing stable connections. It will have the capability to cater to emerging services and applications like IoT and smart cities. The core network will be made more flexible and scalable by ongoing innovation.

- Radio Access Network: Radio access networks will expand in terms of area they cover with higher signal strength. This feature will enhance network efficiency, speed, and reliability. Software-defined networks and next-generation antenna investment will deliver real-time optimization and establish stronger links between users and network infrastructure.

- Other: The other products available in the market will be support devices and technology that complement the 5G environment. They will include network monitoring, management, and security and offer trouble-free operations and minimal disruption. Innovation in the future will revolve around how these components smoothly interface with the current infrastructure.

By Location the market is divided into:

- Ground Tower: Ground towers will remain necessary to provide wide coverage in the network, particularly in the suburban and rural areas. They will be upgraded to carry higher traffic loads and more robust signals. Long-term lifespan, efficiency in energy consumption, and simplicity of maintenance will be considered in future evolution in order to sustain long-term network expansion.

- Rooftop Tower: Rooftop towers will introduce network coverages in cities where space is restricted. They will minimize signal congestion and tie data speeds tighter. Innovation in tower design and installation technology will allow rooftop towers to be installed in urban settings and enhance connectivity.

By End-User the market is further divided into:

- Residential: Residential customers will enjoy quicker internet speeds and better connections, supporting easier online use. As homes become increasingly smart and device-enabled, 5G home services will see greater demand. Opportunities in the future will include providing good coverage and quality performance inside the home.

- Commercial: Commercial operations will depend on 5G networks for more efficient operations and communication. Companies will employ enhanced connectivity for cloud computing, video conferencing, and real-time handling of data. Towers and network enhancements will keep getting added in order to meet growing commercial needs.

- Industrial: Industrial applications will use 5G networks to automate industrial processes and boost productivity. Factories, warehouses, and logistics will utilize real-time data transfer and IoT devices extensively. Rollout of network infrastructure will shift to address the rising demands of industrial monitoring and automation.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$12.1 Billion |

|

Market Size by 2032 |

$20.2 Billion |

|

Growth Rate from 2025 to 2032 |

7.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

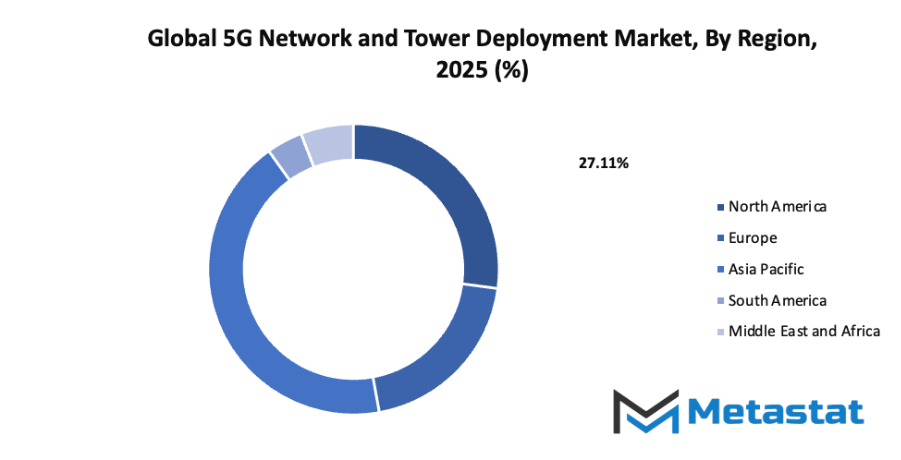

By Region:

- Based on geography, the global 5G network and tower deployment market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing demand for high-speed data and low-latency connectivity: The need for seamless and rapid communication will push operators to upgrade networks and expand coverage. High-definition video streaming, cloud computing, and interactive online experiences will require low-latency networks. This demand will ensure that the global 5G network and tower deployment market remains a priority for governments and private investors.

- Rapid growth of IoT devices and smart city initiatives: The rise in connected devices will increase traffic on networks, requiring advanced 5G infrastructure. Smart city projects, including intelligent transportation systems, energy management, and public safety applications, will drive further deployment. The global 5G network and tower deployment market will expand to support these interconnected systems and future urban solutions.

Challenges and Opportunities

- High capital expenditure for infrastructure development: Building and maintaining 5G networks and towers will require large financial investments. Network operators must plan for equipment, site acquisition, and maintenance costs. Despite these expenses, the global 5G network and tower deployment market will benefit from long-term gains as more industries and consumers adopt high-speed networks.

- Regulatory hurdles and delays in spectrum allocation: Approval processes and spectrum availability may slow deployment in some regions. Compliance with local regulations and licensing requirements will challenge operators. Overcoming these obstacles will be essential for the global 5G network and tower deployment market to expand efficiently and meet growing demand.

Opportunities

- Expansion of private 5G networks for enterprises and industrial applications: Companies will increasingly adopt private 5G networks to control data, improve security, and enhance productivity. Manufacturing plants, logistics hubs, and large campuses will deploy customized networks to optimize operations. The global 5G network and tower deployment market will grow as private networks complement public infrastructure.

Competitive Landscape & Strategic Insights

The global 5G network and tower deployment market is shaped by a mix of well-established international leaders and emerging regional players. Companies such as American Tower Corporation, Ericsson, Mavenir, SBA Communications, ZTE Corporation, Huawei, Viavi Solutions, Verizon Communications Inc., Celona Inc., and Crown Castle International Corp. are important competitors, each contributing to the market's growth and technological advancement. The industry is expected to experience significant transformations as the demand for faster, more reliable connectivity increases. Network providers will invest heavily in infrastructure expansion and the integration of advanced technologies to maintain a competitive position.

Looking ahead, the competitive landscape and strategic insights will be influenced by the pace of technological innovation and regulatory developments across different regions. Companies that can efficiently deploy 5G towers, manage spectrum resources, and offer scalable solutions will secure stronger positions. Partnerships and collaborations may become a key strategy as organizations work to enhance coverage and reduce deployment costs. Additionally, smaller regional competitors may leverage niche strategies and localized expertise to challenge larger players, fostering a dynamic market environment.

Market size is forecast to rise from USD 12.1 Billion in 2025 to over USD 20.2 Billion by 2032. 5G Network and Tower Deployment will maintain dominance but face growing competition from emerging formats.

From a strategic perspective, the focus will likely shift toward sustainability and energy-efficient infrastructure as environmental considerations gain importance. Companies that embrace smart tower designs and leverage automation for network monitoring and maintenance will gain an edge. Investment in research and development will also be a defining factor, as the next generation of 5G technologies will require innovative solutions to meet rising demand for high-speed connectivity, low latency, and widespread coverage. The future of this market will be shaped by the ability to balance rapid growth with operational efficiency, ensuring that networks can adapt to changing technological and market conditions.

Report Coverage

This research report categorizes the global 5G network and tower deployment market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global 5G network and tower deployment market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global 5G network and tower deployment market.

5G Network and Tower Deployment Market Key Segments:

By Component

- Small Cell

- 5G Mobile Core Network

- Radio Access Network

- Other

By Location

- Ground Tower

- Rooftop Tower

By End-User

- Residential

- Commercial

- Industrial

Key Global 5G Network and Tower Deployment Industry Players

- American Tower Corporation

- Ericsson

- Mavenir

- SBA Communications

- ZTE Corporation

- Huawei

- Viavi Solutions

- Verizon Communications Inc.

- Celona Inc

- Crown Castle International Corp.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383