MARKET OVERVIEW

The Global 3D Optical Profiler Market is a niche area under the measurement and inspection technology sector, well-specialized in advanced diagnostic technologies that allow for high-precision surface and dimension analysis. Profiling takes place through non-contact optical methods such as interferometry and focus variation to map and analyze the features at the micro- and nano-scales of surfaces. Across the ranges where precision and detail are key requirements, from electronics to automotive and aerospace, and even in medical devices, these items are vital due to their ability to deliver high-resolution, accurate three-dimensional data.

The Global 3D Optical Profiler market goes beyond the basic measurement technologies. It encompasses a lot of devices and systems designed specifically to address the different needs in industries starting from research and development, to quality control and production monitoring. These profilers are equipped with advanced software for data processing, enabling detailed visualization and comprehensive analysis of surface characteristics. As industries increasingly adopt miniaturized components and complex geometries, the demand for 3D optical profilers will become integral to ensuring compliance with stringent manufacturing standards.

This market encompasses a diverse range of applications. For instance, in the electronics sector, these devices are critical for inspecting microchips, circuit boards, and semiconductor wafers. These engineers are hired in the automotive industry to test engine parts, paint finishes, and structural parts for durability and performance. The aerospace sector also uses 3D optical profilers to test the integrity of high-precision components in extreme conditions. In healthcare, they are used for the production of medical implants and diagnostic tools and other testing such as the strength of artificial joints and the fragility or robustness of materials inside diagnostic tools. Such wide applicability will continue to drive this market’s relevance across sectors.

This evolution of the Global 3D Optical Profiler market will, in turn, be shaped by technological advancements. Innovations in sensor technology, data processing algorithms, and automation will further enhance the speed, accuracy, and ease of use of these systems. Integration with artificial intelligence and machine learning will further expand the capabilities of 3D optical profilers, since they can identify patterns, predict failures, and can be optimized. Portable and handheld devices are going to break applications into the field even for smaller manufacturing setups.

Regional dynamics also define the market. The established industrial hubs in North America, Europe and Asia-Pacific regions sustain the current status, with manufacturers and end-users investing in high-performance profiling solutions for maintaining their competitive edge. Emerging economies are increasingly adopting these technologies while modernizing their production infrastructure. Global regulations and quality standards will continue to push industries toward precise and reliable measurements, further propelling demand for 3D optical profilers.

As industries seek higher efficiency, precision, and sustainability, it would be the Global 3D Optical Profiler market that would take center stage in fulfilling these requirements. With the delivery of unmatched accuracy with surface analysis, adoption and relevance in an ever-growing complex manufacturing landscape will continue to grow. Innovation will propel the market, driven by innovation and the ability to adapt to shifting demands of modern industries.

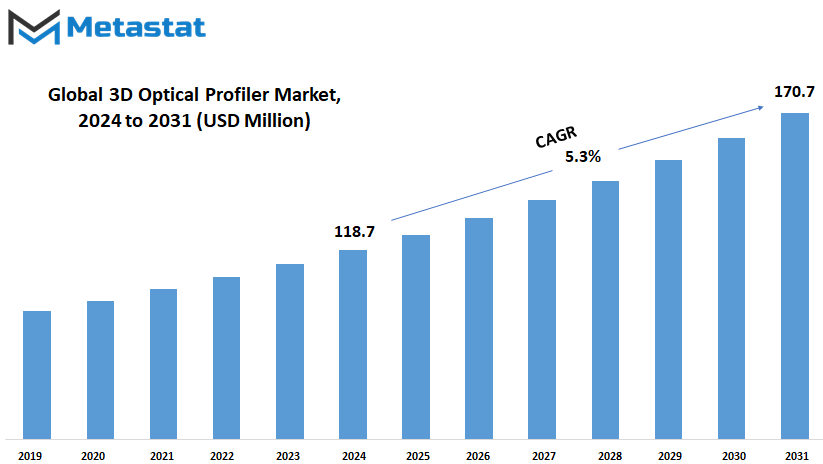

Global 3D Optical Profiler market is estimated to reach $170.7 Million by 2031; growing at a CAGR of 5.3% from 2024 to 2031.

GROWTH FACTORS

The Global 3D Optical Profiler market is expected to keep on growing in the coming years due to the following listed key reasons. One of the growth factors in the industry is the increasing demand for precision measurement in industries such as aerospace, automotive, and electronics, where highly accurate characterization of surfaces is required for high-quality assurance and improvement in manufacturing processes. Moreover, growth in the adoption of advanced manufacturing technologies, such as additive manufacturing, continues to increase the need for 3D optical profilers, which have a significant role in inspecting and analyzing complex surfaces and geometries.

Technological advancements in 3D optical profiler systems are also promoting growth of the market. Profilers today have enhanced imaging capability, higher resolution, and much faster processing speeds, making them more efficient and user-friendly. As industries continue to adopt automation and digitalization, the integration of 3D optical profilers into smart manufacturing systems will increase. There is a likely scope for this market to expand its reach and for further innovation.

Still, the Global 3D Optical Profiler market may face a few deterrents in terms of growth. First, advanced equipment used for this operation is very costly and hence its adoption by small and medium-sized enterprises will be limited. Further, requirements for experts to handle and analyze the data from this device may become a restriction factor in certain regions due to lower availability of technical staff. These challenges can be associated with the drive by manufacturers to optimize low-cost solutions and user-friendly designs for spreading market applications.

The market does, on the other hand, however promise promising growth areas in the future. Emerging industries such as renewable energy and biotechnology are constantly growing and creating new ways to apply 3D optical profilers. For example, the requirement to check and fine-tune materials used in solar panels or even medical devices can be highly increasing demand. In addition, investments in infrastructure in developing economies open new markets for these systems as industries in these economies upgrade the manufacturing capabilities of their plants.

In the near future, the Global 3D Optical Profiler market is expected to increase greatly. There are plans to overcome the present limitations, and there is an emphasis on sustainability and innovation that will catapult the market toward ever-newer heights. With advanced technology and changing industries, the role of 3D optical profilers in achieving precision and quality will be highly indispensable for an optimistic future.

MARKET SEGMENTATION

By Type

The Global 3D Optical Profiler market is a rapidly evolving sector based on new technological developments and growing demands for highly accurate surface measurement solutions in various industries. Furthermore, the market is expanding due to its provision of accurate, non-contact, and reliable measurements, which has made it highly indispensable in various applications where manufacturing, quality control, and research involve precise measurements. As industries move toward more efficiency and accuracy, the role of 3D optical profilers becomes progressively important, paving the way toward great growth in the future.

By type, the Global 3D Optical Profiler market is further divided into two major categories: Desktop and Portable 3D Optical Profilers, which serve different yet complement each other in overall market requirements. The Desktop 3D Optical Profiler segment is generally known for measurement capability and robust performance. This segment is valued at 76.1 million USD as of 2023, thereby showing its dominance in the market. These devices are often used in situations requiring high precision, such as laboratories and industrial applications where stationary equipment is conducive to giving stable and reliable results. As innovations increase their capabilities, profilers are expected to become more efficient and user-friendly, thus being adopted across various sectors.

On the other hand, the Portable 3D Optical Profiler accounted for 40.8 million USD in the year 2023; this market handles the demand of portability and flexibility in surface measurement. These portable profilers are particularly helpful during field work or where immobile equipment is inapplicable. The compactness of these profilers along with their ease of use provides professionals with the accessibility to precisely make measurements at different locations without compromising on its accuracy. As industries move toward decentralized operations, demand for portable solutions is likely to rise, further fuelling the advancement in this sector.

The future of Global 3D Optical Profiler market lies in continuous development of such more sophisticated and efficient technologies. Advanced manufacturing processes adoption by several industries such as aerospace, automotive, and healthcare will mandate the need for reliable surface measurement tools. In addition, inclusion of artificial intelligence and machine learning in the profiling systems is bound to make them more functional and intuitive with the ability to promptly analyze complex data. This forward-looking approach ensures that the market remains dynamic, catering to evolving industrial requirements while fostering innovation. Overall, the fixed and portable profilers would ensure that the Global 3D Optical Profilers Market had all the diverse needs for a sustained growth and technological breakthrough.

By Technology

The Global 3D Optical Profiler market is, therefore witnessing a great growth as advancements in technology mold different industries. This market, focused on tools used to measure surface profiles with exceptional precision has, in turn, gained importance due to the rising demand for quality control methods for which there is the accurate and efficient process. As industries seek improved production processes and better product standards, reliance on technologies such as confocal and white light interference is rising gradually.

Confocal technology has emerged as one significant method within this market, in that it is one of the methods used to obtain high-resolution images and in which precision measurements are possible. Electronic, automotive, and medical devices companies are using this technology for the inspection of complex components to ensure flawless performance of the final product. With white light interference, on the other hand, high resolution is possible based upon the interference of light waves to measure surface features. This method has some advantages, which include a non-contact method that does not damage delicate surfaces when inspecting.

The future of the Global 3D Optical Profiler market is very promising. Rising demand across industries for smaller, more intricate products will create a need for more advanced profiling tools. For instance, in the electronics industry, demands for smaller and more powerful devices mean there is an increasingly urgent need for tools able to inspect microscopic details. Furthermore, with green manufacturing thrusts mounting, industries are looking for more sustainable and energy-friendly solutions; hence 3D optical profilers align pretty well with these because they are known for their precision and minimal amount of waste generated.

Technological innovation is another factor that will define this market. Researchers and manufacturers are continuously working to improve the capabilities of 3D optical profilers, including features such as faster processing speeds and enhanced automation. These advancements not only improve efficiency but also open doors to new applications in aerospace and biotechnology, where demand for detailed surface analysis is on the increase.

In addition to this, further growth in the market is forecasted with the adoption of Industry 4.0 practices. The compatibility of 3D optical profilers with smart manufacturing systems will allow real-time monitoring and data analysis, which will further enable industries to achieve higher degrees of accuracy and productivity. With such trends evolving into the future, the Global 3D Optical Profiler market is slated for incredible growth driven by technological advancement and other emerging requirements across various sectors.

By End-Use Industry

With advanced technology and increasing demand across a host of sectors, the Global 3D Optical Profiler market is expected to grow multifold. This market includes instruments for measuring the surface profiles and texture at resolutions so high that the benefits include non-contact measurement and high-resolution imaging. As industries evolve, the scope for applications in 3D optical profiling will expand toward sectors that rely heavily on accurate measurements and detailed analysis.

In the manufacturing segment, 2023 was dominated with a valuation of 36 million USD. This is mainly because 3D optical profilers are needed in this sector with lots of precision in the production processes. Quality control is ensured and support is given towards maintaining high standards, especially in areas where the slightest deviation can cause a huge setback. Increased use of advanced manufacturing techniques and the advent of smart factories is likely to increase dependency on accurate profiling tools, further fueling demand in this segment.

Research organizations, the second and most important contributor of Global 3D Optical Profiler, was as high as 22.9 million USD in 2023. These institutions adopt profilers for research and development activities in advanced categories, especially in materials science and nanotechnology. With increasing investment in research and development globally, this sector is also expected to increase further. Innovation and discovering new materials possessing unique properties have placed 3D optical profiling in an undisputed position in such organizations.

Quality control and precision manufacturing of automotive industry components are also based on this technology. Highly accurate measurement tools will be in high demand as the industry gravitates towards electric and autonomous vehicles. Aerospace and defense sectors, where requirements are unique with unparalleled precision and reliability, are rapidly incorporating these profilers into their operations. This is expected to increase further as these industries advance their technologies and raise the bar for innovation.

Medical devices form a significant application sector, where small, complex parts are to be measured correctly. And with the increasing need for sophisticated medical equipment and medical implants, the use of 3D optical profilers is becoming more prominent. Further, the domains of other industries are also realizing these applications, which would eventually increase the market size.

Looking ahead, the Global 3D Optical Profiler market is expected to experience steady growth as industries prioritize precision and efficiency. Emerging technologies and increasing investments in automation and research will continue to drive demand for these tools, ensuring their relevance in shaping the future of various fields.

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$118.7 million |

|

Market Size by 2031 |

$170.7 Million |

|

Growth Rate from 2024 to 2031 |

5.3% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Global 3D Optical Profiler Market is offering promising opportunities across different regions where the market is experiencing significant advancements. However, technology advancement is rapid; therefore, this market has the potential to grow and adapt with evolved needs in different industries. The market geographically is segmented into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa where growth is witnessed distinctly due to regional demands and technological capabilities.

In North America, the United States, Canada, and Mexico are going to be the main markets. This region enjoys strong industrial sectors, technological advancement, and high investments in the field of research and development. All these factors create favorable conditions for industries, including manufacturing and material analysis, which eagerly embrace advanced techniques such as 3D optical profilers. The growing emphasis on precision in production processes and quality assurance is driving the adoption of these systems, ensuring North America maintains its leading position.

Europe, comprising countries such as the UK, Germany, France, Italy, and others, also constitutes a major contributor. The high level of manufacturing production and strong quality requirement in the region increase the adoption of optical profiling technology. In terms of advanced engineering capabilities, Germany plays a crucial role, whereas the UK does it at the technological front. Automotive and aerospace industries, among others, rely on these systems to improve efficiency and sustain their competitiveness.

In the Asia-Pacific region, countries like China, India, Japan, and South Korea are adopting this technology rapidly. It is a fast-emerging electronics manufacturing and precision engineering region where the need for measurement tools is critical. Among these, China and India are seeing increased adoption because of their enlarging industrial bases and the emphasis on technological innovation. The potential for growth in this region is immense, as demand for high-quality products rises, along with the expansion of manufacturing facilities.

South America, led by Brazil and Argentina, and the Middle East & Africa, with Egypt and South Africa in the fold, are also slowly coming to appreciate the worth of 3D optical profilers. Industrial development and infrastructural investments will bring about demand for such technological advancements within these regions. The diversification drive in the Middle East and industrialization efforts in Africa are providing a basis for market growth.

The Global 3D Optical Profiler Market is well and truly on the cusp of transformative growth, for all industries worldwide now acknowledge the significance of precision and innovation. This technology will be an important component in fulfilling future demands and driving progress within all regions.

COMPETITIVE PLAYERS

The Global 3D Optical Profiler market is expected to witness significant growth in the years to come, driven by advancements in technology and increased demand across various industries. A 3D optical profiler is a non-contact measurement tool for measuring surface characteristics at high precision resolution. Its application is in electronics, automotive, aerospace, and healthcare, where accurate surface analysis and quality control is of paramount importance. This market has its potential not just in its technological capabilities but also in its ability to adapt to emerging industrial requirements.

The future of this market goes hand-in-hand with rapid industrialization and automation that can be seen around the world. This is because with the implementations of smart manufacturing processes, industries require advanced tools to provide both efficient and reliable solutions. This 3D optical profiler gives real-time data and detailed measurements of the surface that make it indispensable for ensuring product quality and enhancing production efficiency. Moreover, breakthroughs in machine learning and artificial intelligence should further escalate the functions of these devices and lead to more intelligent and user-friendly systems.

The key players in the Global 3D Optical Profiler market are Zygo Corporation, Sensofar Group, and KLA Corporation. These firms are continually engaged in research and development to upgrade the accuracy, speed, and usability of their products. For example, emerging technologies like automated inspection systems and portable profiling devices are finding their way into industries as this caters to the dynamic needs of industries. Bruker Corporation and AMETEK, Inc. (Taylor Hobson Ltd.) also have developed systems that can handle complex measurements with greater efficiency.

It is evident that the competitive forces of the market are driving it toward sustainability and cost competitiveness. Industries like Alicona Imaging GmbH and 4D Technology Corporation are investigating materials and technologies to help control cost but with high performance. However, Cyber Technologies GmbH and Nanovea have positioned themselves to capture niches by following specialized applications such as nanotechnology and microfabrication. As industries such as semiconductor manufacturing and precision optics grow, their niche areas are expected to be of major importance in the market's expansion.

During the next few years, the Global 3D Optical Profiler market will experience extensive collaboration of technology providers with manufacturers, which would expedite the pace of innovation. Keyence Corporation and Mahr GmbH will be among the companies that would benefit from this trend by providing customized solutions tailored to the various needs of customers. This market promises significant prospects for revolutionizing industrial processes toward accuracy, precision, and technological advancements in the world.

3D Optical Profiler Market Key Segments:

By Type

- Desktop 3D Optical Profiler

- Portable 3D Optical Profiler

By Technology

- Confocal Technology

- White Light Interference

By End-Use Industry

- Manufacturing

- Research Institutions

- Automotive

- Aerospace and Defense

- Medical Devices

- Other

Key Global 3D Optical Profiler Industry Players

- Zygo Corporation

- Sensofar Group

- KLA Corporation

- Bruker Corporation

- AMETEK.Inc. (Taylor Hobson Ltd.)

- Alicona Imaging GmbH

- 4D Technology Corporation

- Cyber Technologies GmbH

- Nanovea

- Mahr GmbH

- AEP Technology

- Keyence Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252