MARKET OVERVIEW

The global 3d cell culture market represents the current vanguard of new solutions in life sciences, changing the way in which researchers and scientists approach cellular studies. Over the past several years, the global 3d cell culture market has emerged with radically new techniques as a departure from the traditional two-dimensional cell cultures. This paradigm shift has emerged from an understanding that three-dimensional cell environments mimic better the physiological conditions of living organisms and offer a more realistic basis for the study of cell behavior and responses.

One of the drivers for the growth of the global 3d cell culture market is the ability to correlate classic culture experiments with in vivo studies. Unlike 2D cultures, 3D cell culture systems better model the complex cellular interactions identified to be present in living organisms. This progress has created a higher level of understanding of cellular functions, tissue development, and disease progression, thus pushing the global 3d cell culture market as an indispensable biological research tool.

In addition to creating a more physiologically relevant environment, the global 3d cell culture market also tries to address the limitations of traditional cell culture systems as applied in drug development. The pharmaceutical industry is increasingly turning to 3D culture models to support drug testing and screening. The 3D culture systems by their nature offer a better representation of in vivo response, improving the predictability of efficacy and toxicity. This changing paradigm has led to the fore fronting of 3D cell culture as a key enabling technology in the drug discovery pipeline.

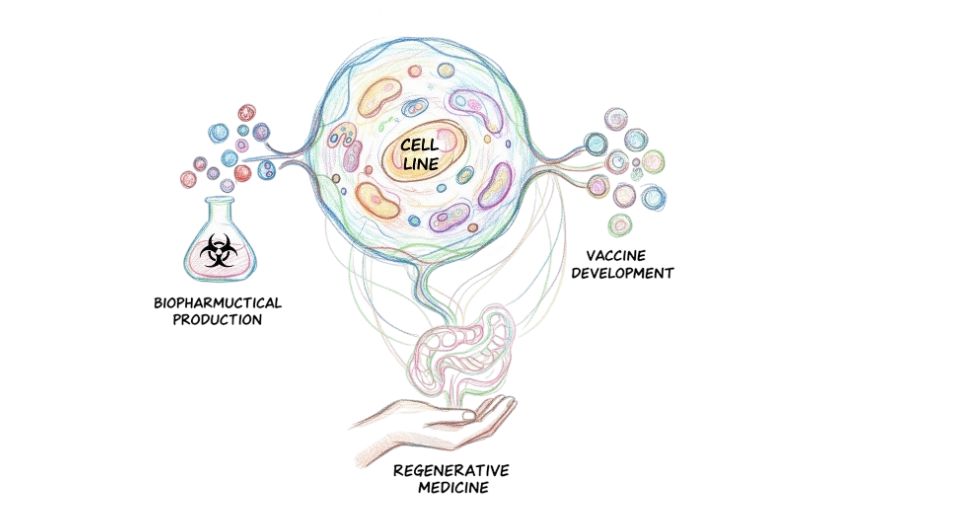

In a new research initiative, the global 3d cell culture market rapidly recruits other fields such as cancer research, regenerative medicine, and personalized medicine; therefore, researchers are utilizing 3D cell culture models to study tumor behavior, screen anticancer drugs, and develop personalized treatments. The versatility of 3D cell culture techniques can also be seen for fabricating complex tissue structures for regenerative medicine, which is a landmark step toward realizing the full potential of tissue engineering.

Meanwhile, the global 3d cell culture market is gaining traction as its technology formally enters industrial settings from academic and research interest. The biotechnology and pharma companies use the 3D cell culture platforms to hasten their R&D processes, hence improving efficiency and reducing drug discovery costs.

The global 3d cell culture market acts as a paradigm shift to cellular research and drug development. This adaptation to in vivo complexities with wide-ranging applications instantly makes it a force of change in the life sciences.

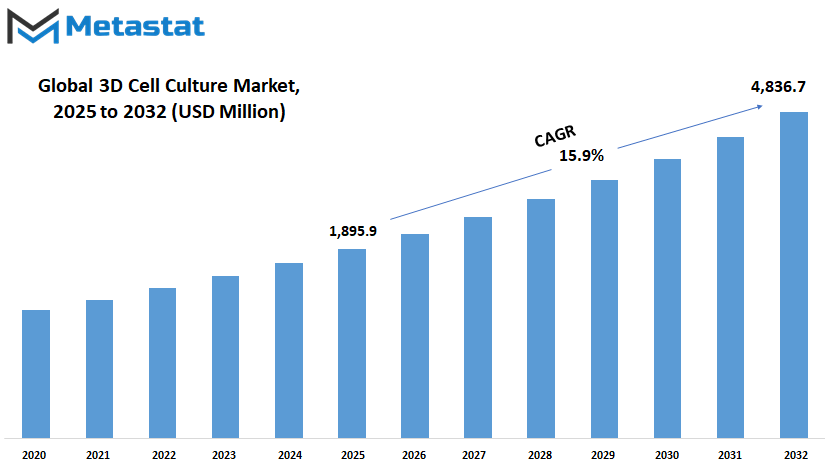

Global 3d cell culture market is estimated to reach USD 4,836.7 Million by 2032; growing at a CAGR of 15.9% from 2025 to 2032.

GROWTH FACTORS

The global 3d cell culture market is driven and influenced by multiple dominant factors. These factors are the key contributors to market growth, which creates an atmosphere for further development.

The major driving force behind the 3d cell culture market is the increasing recognition of 3D cell culture systems as effective substitutes of in vivo cellular environments. Researchers and scientists accept that 3D cell culture systems mimic the complexity of human tissues in a better manner giving a more suitable model for various studies and experiments. This consideration aids in the acceptance of the 3D cell culture technique across several applications from drug discovery to diseased modeling.

Another crucial driving force is the rapidly growing demand for personalized medicine. The medical field is tending toward individualized treatment approaches, and 3D cell culture plays a major role. It allows researchers to create models mimicking an environment very close to that of the specific patient cells, thereby making great strides in that area of personalized medicine.

Nevertheless, challenges still remain that could inhibit the growth of this particular market. Scalability and standardization issues are key hurdles. There is a problem with the scalability of 3D cell culture techniques, for it is one thing to generate and another to reproduce on a larger scale. This is where the issue of standardization arises. There is a need to have protocol standardization in different laboratories or research facilities for these tests to be significant.

Notwithstanding these challenges, the market survives and presents such exciting growth opportunities. The field of 3D cell biology will grow as technology advances and researchers find ways to solve inconveniences posed by limited scalability and standardization. New avenues are under development that would improve and address reproducibility and scalability of 3D cell culture techniques toward the long-time growth of the market.

In the future, the 3d cell culture market is gearing toward taking advantage of lucrative options. There is also an increased focus on regenerative medicine and stem cell research, which may become a positive route for market growth. In regenerative medicine and stem cell study, 3D cell culture techniques play an important role, providing an environment for studying and manipulating stem cells.

The increasing prevalence of chronic diseases and the need for effective drug testing have created a marketplace of many opportunities. With increased disease-like conditions, 3D cell culture models are rapidly becoming essential for drug discovery and development, thereby increasing the demand for 3D cell culture technologies in the pharmaceutical and biotechnology industries.

MARKET SEGMENTATION

By Type

The global 3d cell culture market has types, and each one reveals a variety of techniques suitable for meeting specific research or application requirements. The categories consist of an all-in-all four types; no two types of offering 3D cell culture are the same.

Scaffold-based 3d cell cultures. This currently offers an artificial three-dimensional environment for cells growing and using scaffolds; sculpting and directing cells is very much like that obtained in the natural extracellular matrix when present in live tissue.

Then, Scaffold-free 3d cell cultures also come up as another method because there is no external support here, only cells able to communicate and form three-dimensional structures with themselves. This method will greatly benefit a cell-driven organoid-like formation.

Microfluidics-based 3d cell cultures introduce a new and dynamic feature into the mix. This method lets you use microscale fluid channels to accurately control cell cultures. Reproducibility is increased and advanced avenues are opened up for researchers wishing to model even more physiologically complex microenvironments.

Magnetic & Bioprinted 3d cell cultures bring technology to the forefront. Using magnetic forces or bioprinting technologies, cells can be spatially organized with a level of precision unavailable through conventional methods. Increasingly attractive approaches regarding the creation of complex tissue architectures are bringing this approach to prominence.

These are the four types packed into an almost perfect description of diversity as far as the 3d cell cultures world is concerned. Each type very well bears a major objective regarding imitating natural tissue environments or using advanced technology so cells can be arranged with greater precision. As the field of 3d cell cultures continues to advance, these segmented approaches will continue to carve the research and application setting for the life sciences.

By Application

Segmentation of the global market is based on three application fields-cancer and stem cell research, drug discovery toxicology testing and tissue engineering, and regeneration medicine, which represents significant portions of the entire market value.

Cancer and stem cell research had the largest share of the market in 2025, which had been valued at 1,001.9 million USD. This is primarily using cell-based assays and models to study cancer biology and develop novel anti-cancer drugs. Cancer research also uses this approach in the establishment of disease models for testing therapeutic approaches, utilizing stem cells. Cancer has remained endemic and so money keeps flowing into the cancer and stem cell studies to keep driving the growth of this application domain.

Drug discovery and toxicology testing formed the second-largest segment, valued for 2025 at 616.8 million USD. The pharmaceutical industry requires cell-based assays for identifying and validating new drug compounds. Toxicology screening also uses cell assays to evaluate potential toxicity and drug safety in the early stages of development. This segment is being spurred by increased research and development investment in the pharmaceutical industry across the world as new drugs are pipelined through the industry.

Comparatively small but growing fast is the tissue-engineering and regenerative medicine application segment, estimated at 277.2 million USD in 2025. It employs cell-based approaches in the development of biological substitutes restoring tissue and organ function. Regenerative medicine, emerging as it is, holds great promise for the treatment of injuries, genetic defects, with chronic diseases, and the progress of research in this field will see the application segment growing into a robust market.

This market is diverse, but it is indeed based on cell-based research for the treatment pathways of diseases and drug development at large. Innovative strides continue to be witnessed across biomedical research, leading to a bright outlook as each application segment expands to meet critical healthcare needs around the world.

By End user

Key end-user categories that arise from the 3d cell culture market include pharmaceutical and biotech companies, research institutes, the cosmetics industry, and other kinds of end-users. Pharmaceutical and biotechnology companies, among these, held the largest market in 2025.

The segment of pharmaceutical and biotechnology companies accounted for 1,162.2 million USD in revenue in the year 2025, making it the greatest share of the 3d cell culture market. The scope of this segment encompasses drug developers and medical researchers who employ 3D cell models in drug discovery, employ predictive toxicology screening, and develop novel therapies built on cells. This rapid adoption catches biopharma into a transition from traditional cultures in two dimensions to advanced systems in three dimensions that better mimic the body.

In 2025, research institutes formed the second largest end user segment of the 3d cell culture market, with an estimated value of 543.6 million USD. This consists of university laboratories, government funded research centers, and independent institutes using 3D cell models for disease modeling, drug testing, and research in regenerative medicine. Increased governmental funding into medical research globally has supported demand for this user segment.

Although smaller than most of the other market segments, the cosmetics industry is yet another emerging end-user group under the 3D cell culture heading. This segment will be somewhat different in that it is not yet conducting research but plans in the near future to do toxicity and efficacy research on 3D tissue models instead of through animal experimentation. This change has been created in order to satisfy the ethical consumer demand.

Biopharmaceutical companies conducting drug development and medical research institutes account for the major share of the market currently. However, a steady revenue generation across various user segments holds a bright promise for the future since 3D cell culture will soon be known as a global standard biological research platform.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,895.9 million |

|

Market Size by 2032 |

$4,836.7 million |

|

Growth Rate from 2025 to 2032 |

15.9% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

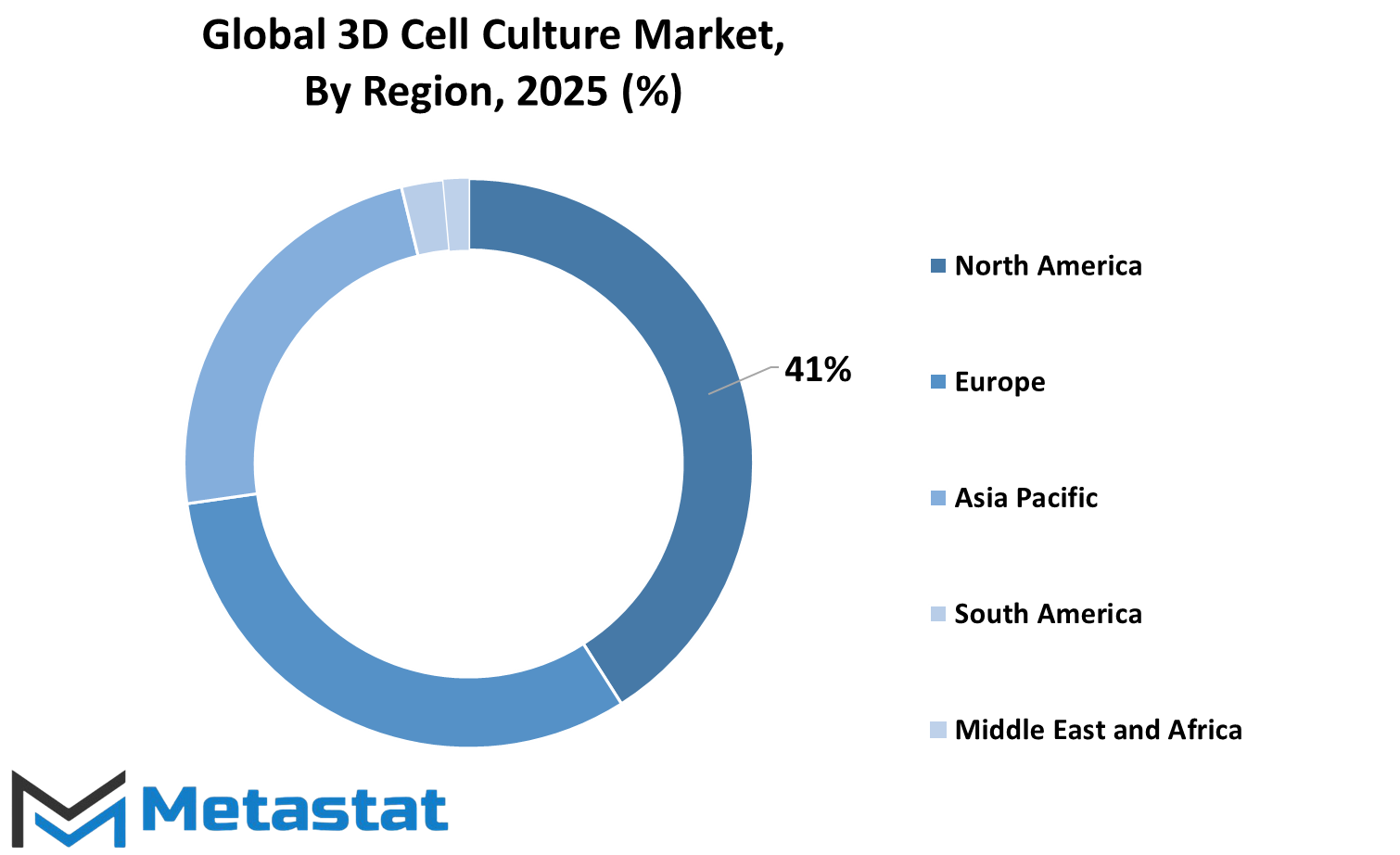

The global 3d cell culture market is a very vast terrain. When it comes to looking at the geographical segregation of 3d cell culture, two leading regions come to mind-North America and Europe. Each of these regions has its unique significance, thereby contributing to the larger dynamics of the market.

Boasting technological advancements and scientific input as a powerhouse, North America holds considerable market share in the 3d cell culture market. This region is well supported with research and development infrastructure that fosters reflection, thereby driving the adoption of 3d cell culture technologies. Prominent institutions and companies in the US and Canada are at the forefront in maximizing the potential of 3d cell cultures for various applications.

Europe, with its glorious scientific tradition and collaborative research initiatives, gives shape to the market as well. With Germany, United Kingdom, and France taking the lead in the regulation of cell culture technologies, Europe benefits from a collaborative environment where research institutions work alongside industry players in advancing the application of 3D cell culture methods in diverse fields.

Even if each region has gone about its own way in pursuit of scientific growth and advancement in technology, the global market thereby being fundamentally shaped by the efforts of North America and Europe-is forever being pushed and sustained by a two-pronged interplay of collaboration and innovation thus securing its relevance within the growing domains of cell culture technologies.

COMPETITIVE PLAYERS

The global 3d cell culture market is ever changing, with the purposes and aspirations of key market players directly affecting its path. Among these contributors are 3D Biotek, LLC, and Avantor, Inc. Far too active to be called mere players in the market, they are indeed catalysts of market development.

3D Biotek, LLC, being an important player, contributes its expertise to the 3d cell culture area. Their presence is synonymous with innovation, for they are engaged in providing solutions to address the ever-changing needs of the industry. They offer forward-thinking products to the 3d cell culture industry that respond to the needs of today's researchers and developers.

Another name to be reckoned with in this space is Avantor, Inc. The mark they have set in the3d cell culture business combines their assurance to quality with an intricate understanding of the undercurrents existing in the market. The experiences of Avantor Inc. will complement the growth and advancement of the 3D cell culture technologies.

These key players cannot be merely called to have reached in a market where they are presumably driving forces, trendsetters, and benchmark-setters. Their role goes beyond just engaging in a market; it extends into leadership and innovation. The forerunners in the market, 3D Biotek,LLC, and Avantor Inc., not only set trends in leadership and innovation, but are also instrumental in propelling this highly technology-driven and competition-ridden industry into new horizons.

3D Cell Culture Market Key Segments:

By Type

- Scaffold-based 3D Cell Cultures

- Scaffold-free 3D Cell Cultures

- Microfluidics-based 3D Cell Cultures

- Magnetic & Bioprinted 3D Cell Cultures

By Application

- Cancer & Stem Cell Research

- Drug Discovery & Toxicology Testing

- Tissue Engineering & Regenerative Medicine

By End user

- Pharmaceutical & Biotechnology Companies

- Research Institutes

- Cosmetics Industry

- Other End Users

Key Global 3D Cell Culture Industry Players

- 3D Biotek, LLC

- Avantor, Inc.

- Corning Incorporated

- Greiner Bio-One International

- InSphero AG

- Lena Biosciences

- Merck KGaA

- MicroTissues, Inc.

- Nanofiber Solutions

- PromoCell GmbH

- REPROCELL Inc.

- Synthecon, Incorporated

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

- Emulate

- Mimetas

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383