Sep 03, 2025

A new analysis of the global screw compressor market by Metastat Insight begins with a colourful explanation of the growth forces, opportunities, and change. The story is based on an experienced point of view, acquired over years of experience working with industrial air compression technology, manufacturing processes, and interaction between energy needs and equipment development. The style adopted fosters an unbroken stream of precise observations, unencumbered by fragmented bullet points or thematic subheads, to encourage immersion in the description of evolving directions, potentialities, and subtleties. Global Screw Compressor market is projected to reach $13,038.18 million in 2025 with CAGR of 6.6% during 2025-2032.

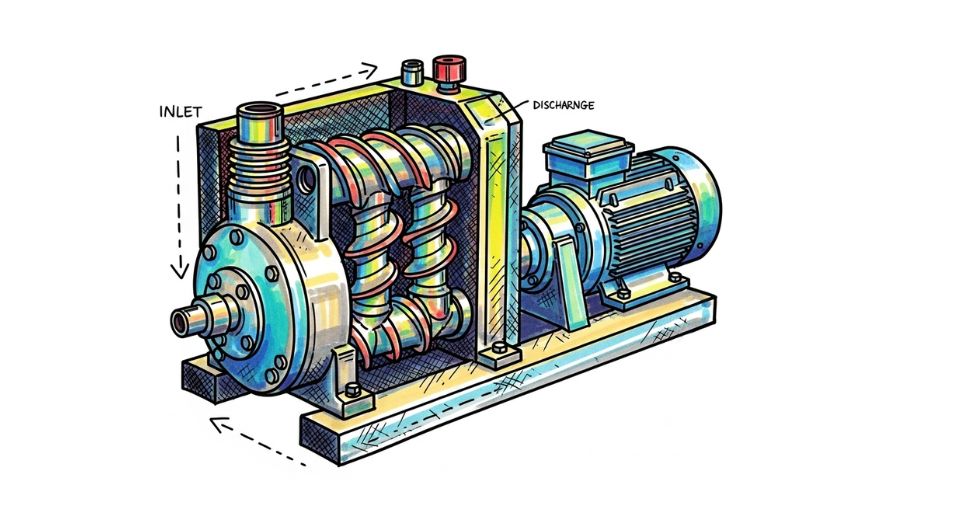

Opening sentences draw the market's path as inspired by quality research presented under the flag of Metastat Insight's handling of the global screw compressor market. An elegant view analyzes how slight changes in industrial procedures and environmental expectation drive product specifications, performance requirements, and service expectations. Plenty of industry expertise tints the commentary, drawn from extended observation and professional engagement with engineering standards, production processes, and operating performance within industries. A key theme in that debate veers toward improvements in mechanical design, material choice, and operating calibration, all driven by increased sensitivities to energy profiles and maintenance effectiveness.

Innovation lies in incremental advances in rotor design, bearing tolerancing, and lubrication systems, yielding quieter, smoother, more durable operation. Service models move towards predictive maintenance, facilitated by real-time condition monitoring and intelligence that schedules service visits against actual machine condition instead of fixed schedules. Beyond equipment supply alone, service relationships become technical partnerships, where performance information and field feedback inform improvements in both machinery and support services. Environmental regulation and corporate focus on minimizing energy use prompt customized product applications. Manufacturing, mining, oil and gas, and heavy construction projects opt for units that match duty cycles, ambient conditions, and sensitivity to energy costs.

Individual selection and sizing of equipment are facilitated by extensive field data and smart controls, avoiding energy loss and maximizing service intervals. Correspondingly, uptime reliability is made an unwavering requirement. Equipment that maintains compressed air delivery in stressful conditions with minimal downtime earns high preference. The manufacturers counter with strong fabrication, synchronized component procurement, and better after-sales service.

Geography-focused emphasis is mirrored in that developed areas require efficiency and performance maximization and energy savings, while emergent areas look for scalable, ruggedized solutions able to operate within hostile environments and provide dealing with poor power quality. Resilience against dust, temperature, and electrical grid stability is transferred to incremental additions of protective coatings, air filtration upgrades, and voltage regulation systems embedded in packages. Post-installation performance improvements are made accessible through digital platforms with the accumulation of operational statistics, facilitating remote diagnosis and updates to the control strategies. Competition focuses on system integration instead of commoditization of components. Equipment manufacturers offer turnkey compressed air packages that incorporate screw compressors in combination with dryers, filtration, and control systems, all designed to minimize lifecycle cost.

Integration builds perception of value and distinguishes products in markets where customers look for complete-service delivery. Manufacturer-service provider alliances become more intensive, supporting turnkey installation, maintenance outsourcing, and retrofit programs to install more efficient screw compressor modules into existing infrastructure. Supply chain consciousness comes to the surface quietly. Supplier organizations consolidate sourcing of precision-machined components, electronic controls, and sensors, tending to rationalize supplier bases for consistency and making use of global manufacturing networks. Manufacturing footprints derive advantage from regional assembly to minimize logistics lead time, without compromising quality through standard processes. Market responsiveness enhances with shorter lead times and options for customization meshing more into order flows.

An underappreciated yet significant evolution is found in training and support structures. Operators and maintenance personnel receive access to digital materials, mobile apps, and simulation-driven tutorials intended to maximize equipment uptime. Technical deficiencies are minimized in less-developed regions by remote support and diagnostics, with the transfer of knowledge filling experience shortfalls and supporting reliability.

Financial arrangements embrace flexibility since funding models for equipment acquisition transform from outright purchase to rental, lease, or performance-based agreements. Users exchange capital investment with operational flexibility, particularly for transient or project-based uses. Performance contracts link payments to uptime or energy targets actually attained, aligning supplier incentives with customer results.

Over the course of that story, the dynamics of data, performance, and service knit a unified narrative. Increased monitoring, digital connectivity, and nascent referential standards reshape the way reliability and efficiency are perceived. Application knowledge is ingrained in product and service design. Market behavior shifts less from specifications of raw capacity and more towards complete system compatibility, lifecycle performance, and integration into facility control architectures.

Experience gained over more than a decade gives a sense of appreciation for nuanced reframing of industry standards. Brand perception starts to rely on the capacity to provide results instead of just hardware. Customer expectations change from obtaining machines to maintaining effective compressed air delivery, reduced energy consumption, and negligible operational downtime.

In conclusion, fresh interpretation of the international screw compressor market as presented by means of Metastat Insight's report demonstrates that evolution is not in explicit re-invention but rather in nuanced adjustment of equipment, service, and operational intent. A market-forward outlook testifies to extensive familiarity with air compression technologies, adoption trends, and changing infrastructure requirements. This concluding observation emphasizes the necessity of continuity, integration, and data-driven delivery in the international screw compressor market highlighted by Metastat Insight's insights.

Drop us an email at:

Call us on:

+1 214 613 5758

+91 73850 57479