Apr 18, 2025

Metastat Insight detail report presented the Global Anchor Channels market as an emerging topic of discussion in the past year's industry. Apart from the growth in the market, it elicits attention due to some rather subtle and specific shifts in usage patterns, supply chains, and material preferences that have come into play within the sector. This unique sector, framed within the broader picture of construction and civil engineering, is intensified by the delicate correlation arising between customer demand and technological development.

Global Anchor Channels market is estimated to reach $2,769.0 million in 2025 with a CAGR of 3.5% from 2025 to 2032.

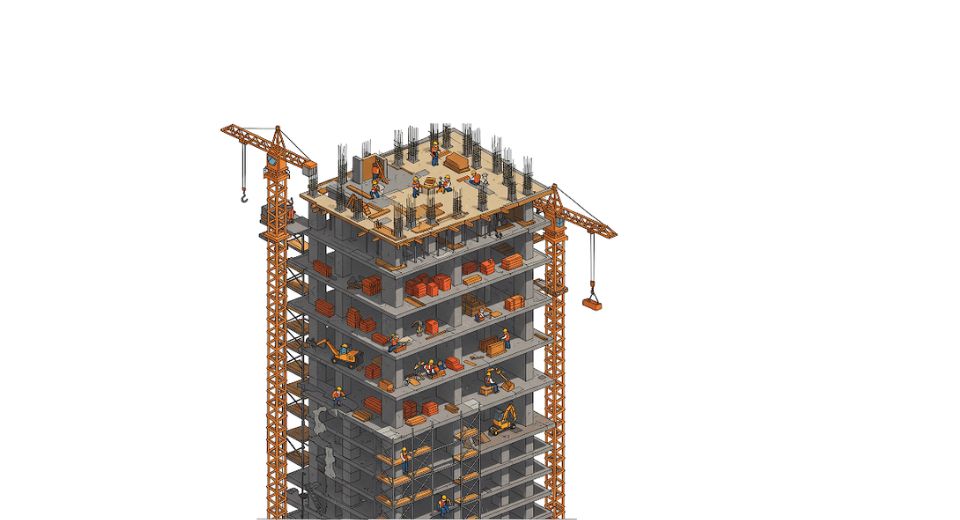

Manufacturing of anchor channels has undergone advanced processes lately, with suppliers responding to architectural demands for higher flexibility and strength and, secondly, tougher safety requirements. When looking at construction trends with conversion, there has now been a renewed interest in materials that incorporate both structural integrity and installation ease. The advantages of anchor channels in prefabricated constructions have seen the product embraced more in commercial and industrial building applications. Support for load-altering designs has made anchor channels a very attractive option for usage among engineers and project managers.

This is where the region-specific development impacts the supply chain and the product evolution of the anchor channels market. Producers in Europe, for example, will remain highly focused on precision engineering with respect to environmental certification and standard outputs. On the other hand, Asian manufacturers have been furthering their reach by providing competitive pricing coupled with high-volume production targeting global export needs. The two movements towards high-spec output and heavy scalability have thus created a scenario of commercial viability essentially reliant on flexibility.

University materials science, too, inevitably has been a regulating factor. Advances in corrosion-resistant coatings and the incorporation of stainless steel grades adapted to different climates have helped companies shape their offerings. With increased emphasis on durability over short-term costs due to climate-specific construction requirements, especially in coastal and high-humidity zones, developers have pushed suppliers to invest in durability-focused research even under environmental stressors.

The designs of anchor channels have been faring likewise: it, too, has changed in tandem with project deadlines and the availability of the working force. An emphasis on reducing installation times has allowed for the introduction of fastening systems requiring less specialized installation labor and therefore minimizing the risk of delays. This has put an unmistakable new priority on product design, packing the concentration by manufacturers on the reduction of installation errors while championing load-bearing efficiency.

Trade movements in addition to geopolitical considerations are making the industry very complex. On the other hand, regulatory changes that influence tariffs on imports in construction have changed the way in which products move across borders. Tariff patterns, regional trade agreements, and disruption of logistics have caused companies to rethink their sourcing methods. Some have moved production closer to demand centers while others have diversified supplier bases to avoid relying on a single market. Such adjustments not only contribute to risk mitigation but also to competitive pricing, which in turn has gained significance in global procurement considerations.

Investment trends, particularly infrastructure spending in the developing world, have provided avenues for growth. By supporting designs emphasizing resilience, governments supporting public transport, housing, and utilities have thereby also given an inadvertent boost to anchor channel applications. In South Asia and some parts of Latin America, public-private partnerships are increasingly opening up the market to foreign suppliers and thus are pushing the boundaries of the market beyond its traditional territories.

Digital technologies also enable the design-to-installation cycle. Building Information Modeling (BIM) integration allows developers to visualize channel placements even before actual construction begins, limiting waste and improving planning. Introducing digital infrastructure has fundamentally changed procurement decision-making; increasingly, data is guiding material selection. Instead of being based on manual and experiential judgment, the buying decision is now predicated on simulation and predictive performance metrics.

Amidst all this advancement, the market faces tough challenges. The surging costs of raw materials and the dynamics of labor have posed operational challenges. Yet many restrictions have sparked innovation instead of stalling it. Sustainability alternatives for performance have arisen as fundamental factors, such as companies seeking alternative materials or even reconfiguring production lines to minimize waste.

In essence, and as seen from another angle in Metastat Insight's recent industry documentation, the surrounding environment of the global anchor channel application clearly depicts a well-calibrated interplay of material advancements, regional peculiarities, and technological convergence. Instead of evolving separately, the Global Anchor Channels market evolved through a dynamic relationship with practices: every shift in construction demands, production methods, or regulatory parameters significantly affects its trajectory.

Drop us an email at:

Call us on:

+1 214 613 5758

+91 73850 57479