MARKET OVERVIEW

The Global Wound Cleanser market is a small field within the health care industries that focus on products made specifically for wound cleansing and preparation. This market finds itself at the center of the current provision of medical care since it addresses the challenges facing wound care. There is a need to prevent infection, tissue regeneration, and proper care for wounds, hence the demand for the product. These are products utilised in each healthcare condition, including hospitals, clinics, and home care. They achieve multiple needs in patients while offering various medical conditions.

Wound cleaners are cleansers. They clean debris, exudate, and pathogenic organisms off wounds, thereby initiating the ideal healing condition of a wound. Unlike typical antiseptics that can be harsh on delicate tissues, this kind of cleaner is designed to provide gentle but effective care. Their use ranges from minor cuts and abrasions to complex chronic wounds, surgical sites, and burns, making them essential in both acute and long-term care settings. Innovation and adaptation characterize the Global Wound Cleanser market as manufacturers strive to come up with advanced solutions to meet the stringent requirements of healthcare professionals and patients. Advancements in biotechnology and material sciences drive this industry supporting this market.

The evolving formulations, along with the delivery mechanism, of wound cleansers all aim for better efficacy and increased comfort for the patient. Through constant research into biofilm disruption and antimicrobial properties, more development of these products may be made to empower the healthcare provider in the challenging approach to wound conditions. Something that will play an increasingly important role in determining the future of the market is integration of eco-friendly and sustainable practice into product development. Healthcare providers have seen the need for tailormade solutions in wound care, hence a rising focus on customizing wound cleansers.

It is thus essential to target specific types of wounds and stages in healing, leading to products being introduced for particular medical scenarios. For example, some cleansers are designed for sensitive pediatric or geriatric skin, and others are specifically designed for chronic wounds in diabetic patients.

This area also extends to non-clinical uses, for instance, in sports medicine and first aid. Since most people are becoming conscious of proper wound care, there is an increased possibility of using these cleaners beyond hospitals into common life environments. This also points to the need for products that can be accessed easily by all, hence the necessity of user-friendly designs, with minimal medical training needed by its users.

Overall, the Global Wound Cleanser market is a cornerstone of modern wound care, and it reflects a commitment to improving patient outcomes through effective and safe solutions. This market will continue to adapt to emerging needs as health systems evolve, leveraging the advancements in science and technology to ensure optimal care for patients worldwide. Through its specialized focus and transformative impact, it will remain an important part of the overall healthcare landscape.

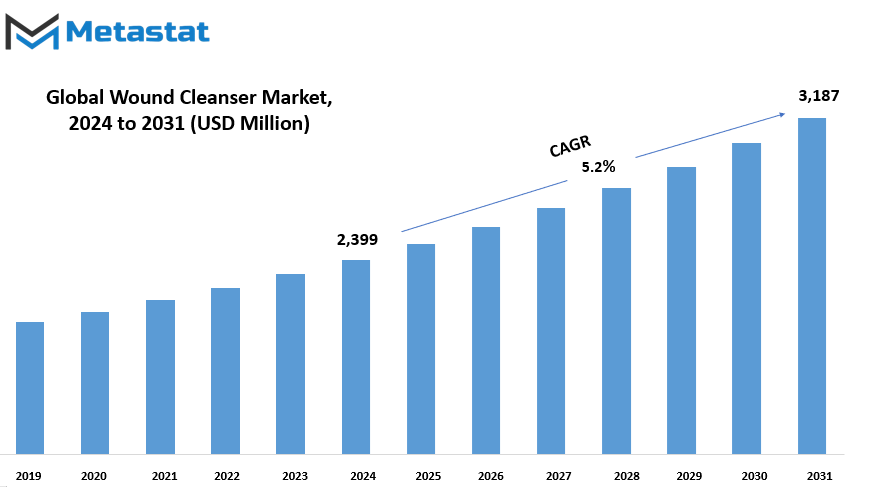

Global Wound Cleanser market is estimated to reach $3,187 Million by 2031; growing at a CAGR of 5.2% from 2024 to 2031.

GROWTH FACTORS

The incidence of chronic wounds, such as diabetic ulcers and pressure sores, is steadily growing to become an important concern, especially in aging populations. As more patients are faced with these conditions, knowledge about the necessity of proper quality wound care to enhance their quality of life grows. This has been one of the reasons why many healthcare facilities have embraced the advanced solutions in wound care.

These newer techniques emphasize rapid healing and reduced complications, which is why they are favored in the clinical arena. Advanced wound cleansers do, however, present some challenges that may affect their widespread acceptance. This targeted approach underlines the dynamic nature of the Global Wound Cleanser market and its potential for diversification.

One of the primary issues is that these are relatively more expensive than the traditional alternatives. To many, especially those who fall within the low-income bracket or are uninsured, such prices are simply too steep. Additionally, availability of these products is still a barrier to access in rural and underserved communities. Limited availability means patients in these areas have no choice but to use less effective alternatives, leading to longer recovery times and complications more frequently. Eliminating these barriers will be necessary to make sure that anyone who needs such advanced solutions will have access to them. On the other hand, innovative wound cleansers are promising future developments.

These will be eco-friendly and nontoxic, going along with the worldwide trend towards sustainability in health care. These new products would reflect the concerns of the environment and patient outcomes in the reduction of irritation and acceleration of healing. If these innovations can be made affordable and accessible, they may revolutionize wound care in accessibility and efficacy. As the focus is more on research and development in this field in the coming years, the market for wound cleansers is bound to expand.

By overcoming the current challenges and developing products that suit the diverse needs of patients, there is much room for growth. With continuous education of healthcare providers and the public on the benefits of these products, the use of advanced wound care solutions is likely to increase further and will benefit both the patients and the healthcare industry at large.

MARKET SEGMENTATION

By Type

Wound cleansers are highly essentially part of any healing system with regards to the wound. It is a procedure whereby it makes the wounds clean in a manner that evicts all the debris leaving little room for infection. There are readily available types of wound cleaners for every kind of wound and depending on the character of the wound or gravity they are serving, antiseptic wound cleaners; antibacterial wound cleaners, saline wound cleaners, hydrogen peroxide wound cleaners and iodine-based wound cleaners among others.

Prevent infection by killing or inhibiting the growth of pathogenic microorganisms. These solutions are specifically useful for at risk-contamination wounds. Antibacterial cleaners are particularly designed to neutralize bacteria, and for this reason, they ensure that wounds have less load of bacteria, which implies higher chances of healing. There are some cases where selection is done based on there being an active or potentially bacterial infection.

Saline wound cleaners are broadly used because of their nontoxic and non-irritant nature. They help in the removal of dirt and debris without affecting the surrounding tissue, so they are a common preference for routine wound care. Hydrogen peroxide-based wound cleaners are also used. The bubbling action of these can help to dislodge debris and dead tissue from wounds. However, they should be used cautiously as their strong oxidizing nature may cause irritation if applied in excess.

Yet the broad use of an iodine-based wound cleansing agent is yet another of the most prevalent categories with the capability of killing various pathogens. There are specific uses for surgeries or very strong disinfections needed. Other wound cleaning solutions are more specialized to achieve specific tasks, such as those involving advanced ingredients and technologies specific to certain forms of trauma or for sensitive skin.

Selection of an appropriate wound cleanser is significant to manage wounds and have good recovery. This can vary from person to person with differences in wound conditions, sizes, locations, and possible infections. Using and adhering to the prescriptions or guidance by doctors guarantee proper cleansing and supporting natural body recovery processes. Wound cleaners remain an essential component of modern healthcare, providing critical support in maintaining hygiene and fostering recovery in many wound care scenarios.

By Application

Markets by application consist of acute wounds, chronic wounds, and post-operative care of wounds. This encompasses a division to cater to every specified condition related to wound injury and healing; each section is crucial for medical healthcare services.

Acute Wound Injury Acute refers to any type of sudden or severe injuries. It mostly comes due to accidents and might involve cuts or burning as part of the incidents. Wounds of these types tend to heal predictably when cared for appropriately. The objective of acute wound care products is to prevent infection, hasten healing, and make it more painless. The range includes the simplest, such as basic bandages and dressings, up to antiseptic sprays and hydrocolloid dressings for those with more serious requirements, so patients receive what they need to recover best. Chronic wounds typically are those that do not heal as fast or as easily, and therefore, require extended care.

This kind of wounds are often connected with underlying health conditions like diabetes or poor circulation, complicating the healing process. Therefore, for such cases, specialized products are needed that can manage the risk of infection, provide moisture in the wound area, and promote tissue regeneration. Some of the advanced dressings, negative pressure wound therapy devices, and bioengineered skin substitutes have been developed to treat patients with chronic wounds and enhance their outcomes. Other vital components include post-surgical wound care.

After surgery, proper care of the wound is needed for patients to avoid complications, minimalise scars and overall improve recovery experience. In this area, products were prepared to assist with healing over the surgical incision. There exist sterile dressings, sutures, and adhesives that assist in keeping it clean and avoid movement as well as pressure that would disrupt healing. These three categories explain how solutions for wound care are formulated to cater to the multifaceted needs of the patient.

Each type of wound comes with a specific problem, and the market remains open to supplying products to face these challenges appropriately. Whether through speeding the healing of acute injuries, managing the intricacy of chronic wounds, or ensuring easy recovery following surgery, the emphasis continues to be on the enhancement of patient outcomes and quality care in medical environments. Thoughtfully applied, these products contribute enormously to helping patients get well.

By Distribution Channel

The different modes of distribution channels ensure that the products reach customers in the most convenient manner for them. These include hospital pharmacies and retail pharmacies as well as online platforms and, to a direct sales channel for other products. Each is involved with a unique role or requirement in addressing the specific demands of customers.

Sure enough, a source of prescription medication is through hospital pharmacies where patients get prescription medication to complement their treatment or once they have come to see the doctors and health practitioners when visiting hospitals for checkups after treatment. Hospital pharmacies usually exist with a health care facility; therefore, the prescription product will reach the patients quite readily most likely in consultation with health workers. The same will also benefit many patients, mainly those whose drugs would need urgent dispensation.

Retail pharmacies, however, remain one of the oldest and most commonly used channels for distribution. They are composed of brick-and-mortar stores located within neighborhoods and commercial districts with in-person service at the hands of pharmacists. They provide everything: prescription medication, over-the-counter medication, and health-and-wellness products. The availability and familiarity of retail pharmacies make them a popular choice for many consumers who want to save time and have instant access to their desired products.

Online pharmacies have recently been in the limelight as they offer a smooth shopping experience. Customers can place orders for drugs and accessories from the comfort of their homes, and delivery services ensure that the products reach them on time. This channel is especially helpful for those who are immobile or live in remote locations. Online pharmacies also usually give the benefit of price comparison and a wider range of products.

Direct sales is another very effective route, especially for niche or specialty products. This often involves representatives who can speak directly with the consumer and provide all the details and guidance about the product. It is a more personalized experience and, hence, can be highly effective for products that require more explanation or tailored recommendations.

Each of these channels provides its own strengths so that the combination will be sure to provide the difference in availability and accessibility in what products the consumers will have. The combination will mean that people have choices or alternatives in getting what is needed: personal contact for convenience or tailored service. Indeed, the variety of channels reflects an attempt to meet the diverse preferences of the market and their different requirements.

By End-Use

The global market for wound cleansers is divided into several key end-use categories: hospitals, clinics, home care settings, ambulatory surgical centers, and other healthcare facilities. All of these settings significantly contribute to the demand for wound cleansers, which play a pivotal role in effective cleaning and management of wounds.

Hospitals are among the largest users of wound cleansers. With their wide variety of patients and complex medical conditions, hospitals require a constant supply of wound care products. These facilities often treat severe wounds, including surgical wounds, traumatic injuries, and chronic conditions like diabetic ulcers. The need for wound cleansers in hospitals is driven by the need to prevent infection and promote faster healing.

Clinics also contribute to the demand for wound cleansers across the globe. Most of these healthcare facilities focus on minor injuries, routine surgeries, and specialized care. Wound cleansers are essential in ensuring proper hygiene and healing during treatments for small cuts, abrasions, or post-procedure care. Clinics, especially those focused on dermatology or minor surgery, will continue to rely on these products for maintaining patient health and recovery.

Home care settings have increasingly used wound cleansers as more patients are treated from home rather than in a hospital setting. Patients recuperating from surgery, injury, or chronic conditions often need wound care at home. Patients or carers use wound cleansers to maintain cleanliness and to prevent complications such as infection. This market segment is expected to grow since many people desire to be given care from the comfort of their homes.

Ambulatory Surgical Centers (ASCs) represent another key market segment. ASCs are centers that cater to outpatient surgeries, where patients, in most cases, suffer minor to moderate wounds. It is, therefore, through effective wound care solutions that ASCs can manage the postoperative wounds and ensure that their patients heal well after the procedures. The use of wound cleansers in these settings will thus remain essential in preventing infections and promoting recovery.

Other health care facilities include nursing homes, rehabilitation centers, and even centers for urgent care, also in the demand of wound cleaners. Such places cater for varied levels of patients with chronic wounds or injury or for people coming from surgical procedures. More demand for wound care among patients in health facilities enhances the need for wound cleansers.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$2,399 million |

|

Market Size by 2031 |

$3,187 Million |

|

Growth Rate from 2024 to 2031 |

5.2% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

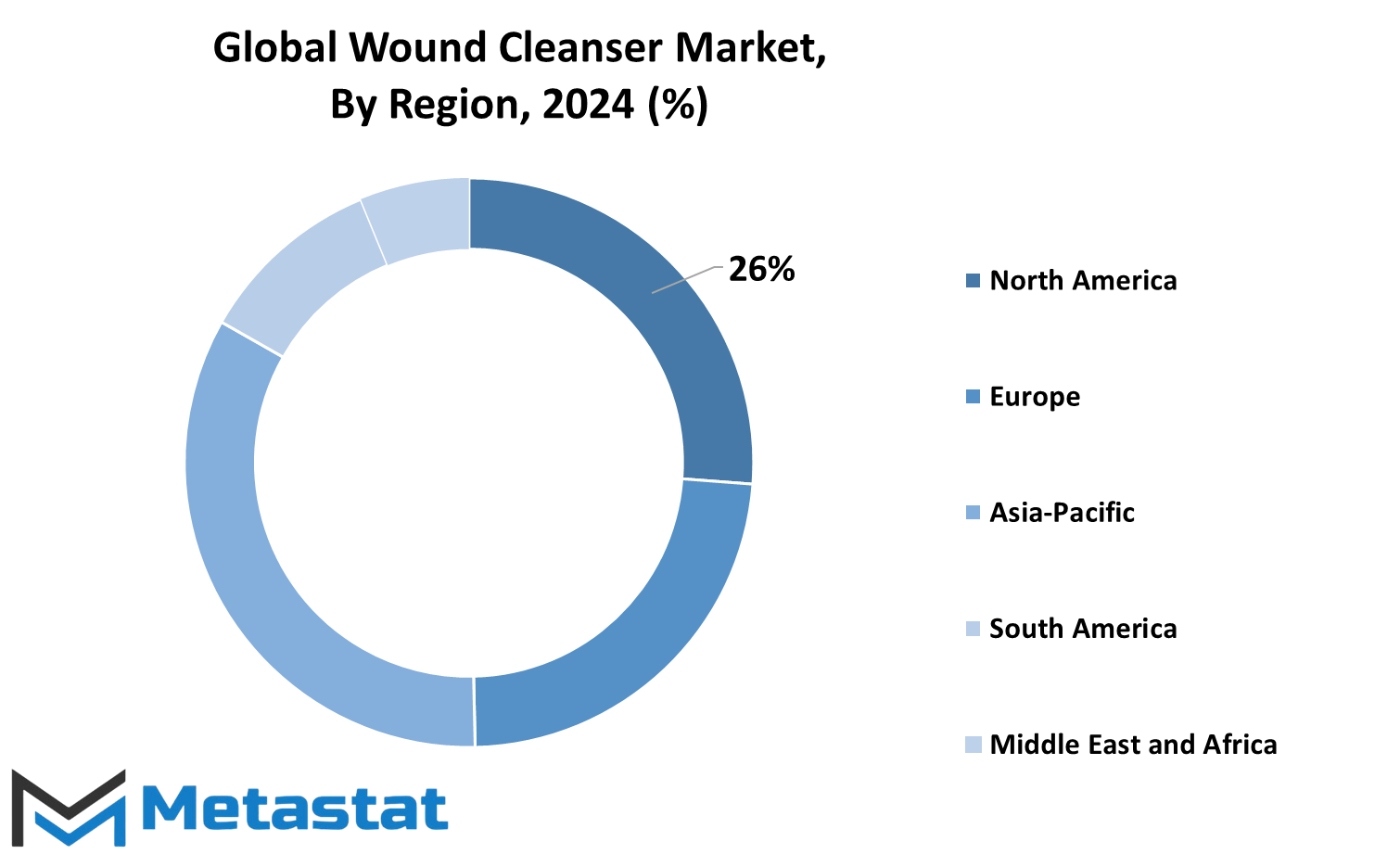

The geographical segments for the global wound cleansers market are divided into five regions, which are North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Further to that, North America has been bifurcated into three countries-the United States, Canada, and Mexico. Europe encompasses the United Kingdom, Germany, France, Italy, and the remaining countries of this region. The Asia-Pacific region can be further broken down into India, China, Japan, South Korea, and the rest of the region.

The Asia-Pacific wound cleanser products market was valued at 469 million USD in 2017 and is projected to reach 740 million USD by 2025, with a compound annual growth rate (CAGR) of 5.9% from 2018 to 2025. This growth represents an increase in demand for wound care products in the region, driven by factors like a rising awareness of healthcare, a growing population, and an increasing incidence of chronic conditions and injuries.

Major markets include Brazil, Argentina, and other countries within the rest of South America. The market for wound cleaners in South America is expected to be substantial as improvements in the healthcare sector mean that more people will acquire medical products. The Middle East & Africa region is categorized into countries of the Gulf Cooperation Council (GCC), Egypt, South Africa, and other Middle East & African countries. This region has growing health care demand that will eventually contribute to a rising number of wound care products demand.

In summary, each market for wound cleansers is growing within different geographies, each having separate drivers for growth. Population growth, upgraded health infrastructure, and raised awareness about the proper way to care for wounds and wounds will drive the shape of the future global market of wound cleansers. When these regions develop into larger markets, demand for more wound cleansers is set to increase, thereby creating scopes for businesses and healthcare providers serving an increasing population around the globe.

COMPETITIVE PLAYERS

Some key players drive the wound cleanser industry, pushing it towards growth and development. Amongst some of the most renowned names in the industry include Johnson & Johnson, Coloplast A/S, ConvaTec Group PLC, and Mölnlycke Health Care AB. Such companies have earned themselves a reputation by delivering quality products to satisfy a variety of medical requirements. Along with them, the giant brands such as 3M Company, Smith & Nephew PLC, and Biolife, Inc. are marked for innovation and reliable solutions in wound care.

Other notable companies that participate in the wound cleanser market include Derma Sciences, Inc., Medline Industries, Inc., and BSN Medical GmbH, a business unit of Essity. These companies continue to make progress in wound care technology and offer products that help achieve better outcomes for patients. B. The development of wound cleansing solutions by Braun Melsungen AG, Cardinal Health, Inc., and Advanced Medical Solutions Group PLC ensures that the industry has a wide range of effective options for different types of wounds and patient needs.

Competition among these companies creates innovation, leading to the creation of advanced products designed to promote quicker healing and better infection prevention. With a wide range of offerings, these industry leaders support hospitals and home care environments as they look to meet the rising demand for efficient and reliable wound care solutions. New, improved wound cleansers will be available to meet the needs of patients and healthcare providers through continued research and development.

Such big companies established already in the market of wound cleaning guarantee access for consumers and, therefore, healthcare professionals toward a whole range of product lines emphasizing safety, efficacy, and general improvement regarding health. All these efforts continued will eventually influence the very industry with better solutions around the management of wounds globally.

Wound Cleanser Market Key Segments:

By Type

- Antiseptic Wound Cleansers

- Antibacterial Wound Cleansers

- Saline Wound Cleansers

- Hydrogen Peroxide Wound Cleansers

- Iodine-Based Wound Cleansers

- Other Wound Cleansers

By Application

- Acute Wounds

- Chronic Wounds

- Post-Surgical Wound Care

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Direct Sales

By End-Use

- Hospitals

- Clinics

- Home Care Settings

- Ambulatory Surgical Centers (ASCs)

- Other Healthcare Facilities

Key Global Wound Cleanser Industry Players

- Johnson & Johnson

- Coloplast A/S

- ConvaTec Group PLC

- Mölnlycke Health Care AB

- 3M Company

- Smith & Nephew PLC

- Biolife, Inc.

- Derma Sciences, Inc.

- Medline Industries, Inc.

- BSN Medical GmbH (A Part of Essity)

- B. Braun Melsungen AG

- Cardinal Health, Inc.

- Advanced Medical Solutions Group PLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252