MARKET OVERVIEW

In the bridal industry, the Wedding Dress Rental Service Market has emerged as a transformative force, reshaping the traditional approach to acquiring wedding attire. This market represents a paradigm shift in how individuals perceive, and access wedding dresses, fostering a new era of sustainability, cost-effectiveness, and style diversity.

At the heart of the Wedding Dress Rental Service Market is the fundamental idea of providing brides with a practical alternative to the conventional practice of purchasing a wedding gown. The market's essence lies in its ability to offer a wide array of wedding dresses for rent, enabling brides to access high-quality, designer garments without the burden of ownership. This novel concept not only aligns with the growing societal emphasis on sustainability but also addresses the changing preferences of a modern, cost-conscious clientele.

One of the key drivers propelling the Wedding Dress Rental Service Market is the economic advantage it affords to brides. As weddings entail a considerable financial investment, the option to rent a wedding dress allows individuals to allocate resources more efficiently. This cost-effective approach does not compromise on style, as rental services often curate a diverse collection of dresses, spanning various designs, trends, and sizes.

Furthermore, the Wedding Dress Rental Service Market contributes to the reduction of environmental impact associated with the fashion industry. The conventional model of purchasing a wedding dress is notorious for its environmental repercussions, from resource-intensive production processes to garment disposal challenges. By encouraging dress reuse, the rental market aligns with sustainability goals, offering an eco-friendly alternative that resonates with environmentally conscious consumers.

The market's appeal is not limited to financial and environmental aspects; it also caters to the desire for variety and novelty among brides. With the ever-evolving trends in bridal fashion, the Wedding Dress Rental Service Market becomes a gateway for brides to experiment with diverse styles and designs, enabling them to wear a different gown for various wedding-related events without the burden of ownership.

The Wedding Dress Rental Service Market stands as a revolutionary force in the wedding industry, reshaping traditions, and offering a practical, sustainable, and stylish solution for brides. As this market continues to gain prominence, it underscores the transformative power of innovative business models that cater to the evolving needs and values of the contemporary consumer.

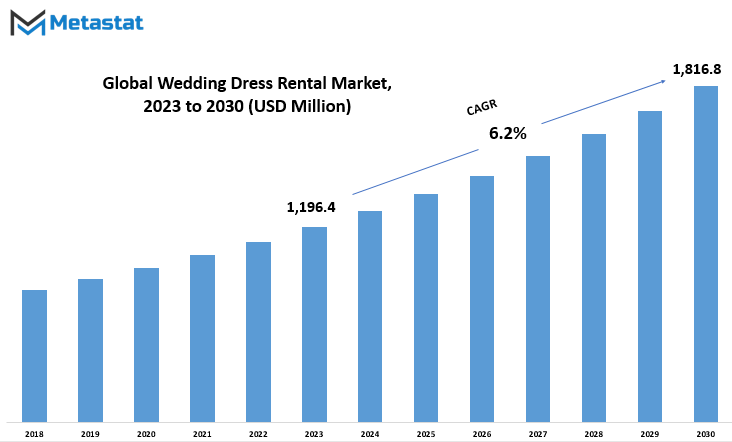

Global Wedding Dress Rental Service market is estimated to reach $1,816.8 Million by 2030; growing at a CAGR of 6.2% from 2023 to 2030.

GROWTH FACTORS

The Wedding Dress Rental Service Market is propelled by key driving factors that underscore its growth trajectory. The demand for cost-effective yet elegant options in wedding attire is a prime driver, allowing individuals to experience the glamour of a designer dress without the hefty price tag. Moreover, the rising trend of sustainability contributes to the market's expansion, as consumers opt for rental services to reduce environmental impact.

However, challenges linger on the horizon. The emotional attachment associated with a wedding dress poses a hurdle, as some may be hesitant to rent rather than own this significant garment. Additionally, concerns about hygiene and cleanliness may deter prospective customers, impacting market growth.

Despite these challenges, opportunities abound. The growing acceptance of the sharing economy, coupled with an increasing preference for experiences over possessions, presents a promising avenue for the Wedding Dress Rental Service Market. As societal norms shift towards sustainability and practicality, more individuals may embrace the idea of renting their wedding attire.

While emotional sentiments and hygiene concerns pose challenges to the Wedding Dress Rental Service Market, the allure of cost-effectiveness and sustainability positions it for substantial growth. The evolving landscape of consumer preferences, coupled with a greater emphasis on environmental consciousness, paints a promising picture for the market's future.

MARKET SEGMENTATION

By Type

The Wedding Dress Rental Service Market, a vibrant sector in the wedding industry, sees its diversity unfold through various dress types. These dresses, each catering to different tastes and preferences, contribute to the dynamic landscape of the market.

Within the market, the segmentation by type brings forth a range of choices for brides-to-be. Ball Gowns, with their timeless elegance and full skirts, stand out as a popular choice. These dresses exude a classic charm, making them a favored option for those envisioning a fairy-tale wedding.

A-Line dresses, another segment in the market, offer a versatile silhouette that flatters a range of body types. Their fitted bodice and gradual flare create a balanced and graceful look, making them a go-to option for brides seeking both style and comfort.

Mermaid dresses, known for their fitted style that flares out at the bottom, embody a more contemporary and glamorous aesthetic. These dresses, often chosen by brides wanting to showcase their curves, add a touch of sophistication to the wedding ensemble.

Sheath dresses, with their form-fitting design that flows straight down from the neckline to the hem, appeal to those desiring a sleek and minimalist look. These dresses radiate modernity and are ideal for brides with a preference for simplicity.

Tea-Length dresses, characterized by their hemline falling between the knee and the ankle, introduce a playful and retro vibe. These dresses are perfect for brides seeking a less formal and more casual feel for their special day.

The Wedding Dress Rental Service Market, through its segmentation by dress type, accommodates a spectrum of styles, ensuring that every bride can find the dress that aligns with her vision. From the timeless allure of Ball Gowns to the contemporary flair of Mermaid dresses, this market caters to diverse preferences, making the journey to finding the perfect wedding dress an exciting and personalized experience.

By Application

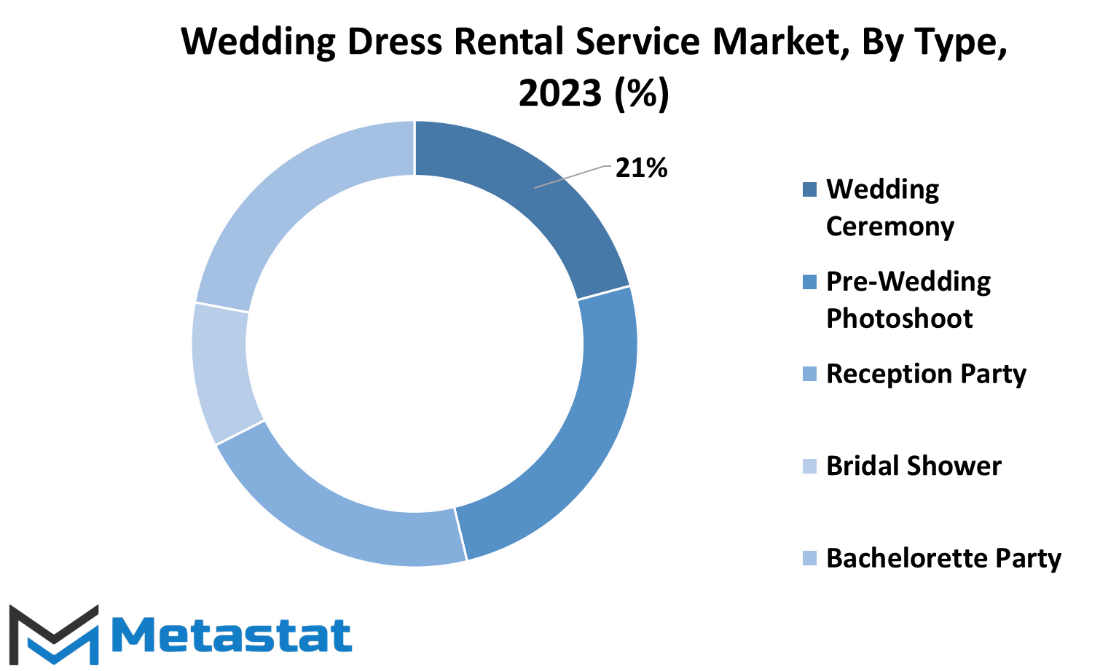

The Wedding Dress Rental Service Market is a dynamic landscape, responding to the evolving needs and preferences of today’s couples. Within this market, applications play a pivotal role, catering to various stages of the wedding journey.

One significant application is the Wedding Ceremony segment, valued at 236.1 USD Million in 2022. This segment addresses the core element of the wedding, offering a cost-effective solution for couples who seek a memorable ceremony without the long-term commitment of owning a dress.

The Pre-Wedding Photoshoot segment, valued at 288.5 USD Million in the same period, caters to the growing trend of capturing special moments before the big day. Renting dresses for these photoshoots allows couples to indulge in a variety of styles without the constraints of ownership.

The Reception Party segment, valued at 242.1 USD Million in 2022, extends the utility of rental services beyond the ceremony. It acknowledges that brides may desire a different look for the reception, providing them with a diverse range of options without the need for a hefty investment.

Bridal Shower and Bachelorette Party applications complete the spectrum, recognizing that the celebrations leading up to the wedding are integral parts of the overall experience. Renting dresses for these events allows brides to enjoy the festivities with style and variety.

The Wedding Dress Rental Service Market adapts to the modern approach to weddings, where couples seek both elegance and practicality. It caters to various facets of the wedding journey, offering a flexible and affordable alternative to traditional dress ownership. This market reflects the shifting dynamics of the wedding industry, where couples prioritize experiences and memories over long-term possessions, making wedding dress rental services a fitting choice for the contemporary bride.

REGIONAL ANALYSIS

The global Wedding Dress Rental Service market, a flourishing industry, unfolds across geographical landscapes, with North America and Europe standing out as key players in this dynamic market. These regions, marked by their diverse cultures and fashion preferences, contribute significantly to the growth and evolution of the wedding dress rental service sector.

In North America, the wedding dress rental service market has witnessed substantial traction. The cultural tapestry of this region, with its diverse wedding traditions and styles, fuels the demand for a wide array of wedding dresses. From classic and traditional to modern and trendy, the varied preferences of brides contribute to the vibrant landscape of the market.

Similarly, in Europe, the wedding dress rental service market is a thriving hub. Europe, known for its rich history and cultural diversity, sets the stage for a wedding dress market that caters to a spectrum of tastes and preferences. The allure of historical wedding venues, coupled with the penchant for blending tradition with contemporary styles, shapes the demand for wedding dress rental services in this region.

Both North America and Europe share a common thread in the wedding dress rental service market, emphasizing the shift in consumer behavior towards more sustainable and cost-effective choices. The appeal of renting a wedding dress, rather than buying, aligns with the growing consciousness about environmental impact and the desire for budget-friendly yet stylish options.

Moreover, the convenience offered by wedding dress rental services resonates with the contemporary lifestyle, where practicality and experience often take precedence. Brides in North America and Europe increasingly appreciate the flexibility and reduced financial burden associated with renting a wedding dress, allowing them to allocate resources to other aspects of their special day.

The wedding dress rental service market finds a robust foundation in the diverse and culturally rich landscapes of North America and Europe. These regions, with their distinct yet intertwined preferences, contribute significantly to the expanding market, driven by a shift towards sustainability, cost-effectiveness, and the desire for a seamless wedding experience. As the industry continues to evolve, the wedding dress rental service market in North America and Europe stands as a testament to the changing dynamics of the bridal fashion landscape.

COMPETITIVE PLAYERS

The Wedding Dress Rental Service Market boasts a range of key players, and among them, two noteworthy contributors stand out – Cocoon Bridal and Dare and Dazzle. These companies play a significant role in shaping the landscape of the wedding dress rental industry.

Cocoon Bridal, a prominent player in the market, has established itself as a good choice for individuals seeking wedding dress rental services. Their offerings encompass a diverse array of styles, catering to the varied preferences of soon-to-be brides. With a commitment to quality and a keen understanding of the evolving trends in bridal fashion, Cocoon Bridal has carved a niche for itself in the competitive market.

Similarly, Dare and Dazzle add their unique flair to the Wedding Dress Rental Service Market. This company brings a fresh perspective to the industry, offering a curated selection of wedding dresses that align with contemporary tastes. Their approach combines a blend of elegance and modernity, resonating with a demographic that seeks a departure from traditional bridal attire.

These key players not only contribute to the diversity of choices available in the market but also set benchmarks for service quality and customer satisfaction. Their presence underscores the growing popularity of wedding dress rental services, providing an accessible and cost-effective alternative to purchasing a dress outright.

Cocoon Bridal and Dare and Dazzle stand as influential entities in the Wedding Dress Rental Service Market. Their contributions extend beyond mere products, influencing the trends and expectations within the industry. As brides-to-be increasingly explore rental options, these key players are at the forefront, shaping and redefining the landscape of the wedding dress market.

Wedding Dress Rental Service Market Key Segments:

By Type

- Ball Gowns

- A-Line

- Mermaid

- Sheath

- Tea-Length

By Application

- Wedding Ceremony

- Pre-Wedding Photoshoot

- Reception Party

- Bridal Shower

- Bachelorette Party

Key Global Wedding Dress Rental Service Industry Players

- Cocoon Bridal

- Dare and Dazzle

- DBR Weddings

- KLOVIA

- La Belle Couture

- Laine London Company

- LMR Weddings

- Poshare

- Rent the Runway

- Sunset Bridal

- Wardrobista Limited

- Central Weddings

- Wedding She Wrote Limited

- Glamourental

- The Wedding Gown

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252