MARKET OVERVIEW

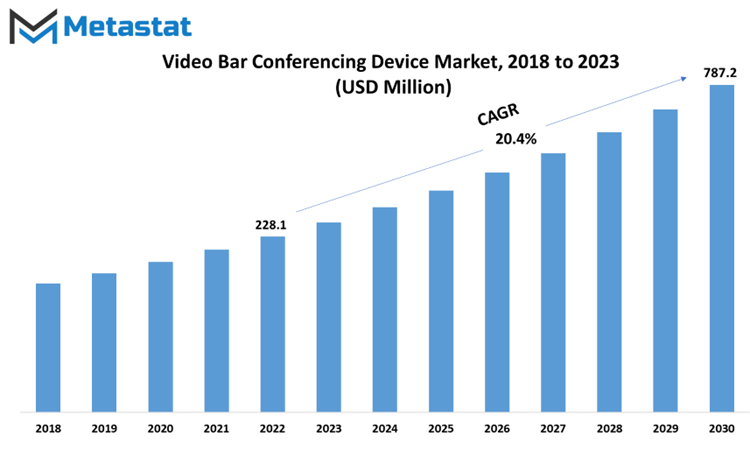

The landscape of communication and collaboration has undergone a remarkable transformation in recent years, driven primarily by the growing demand for remote work solutions and ever-evolving technological advancements. Among the key players in this transformation is the Global Video Bar Conferencing Device Market, a dynamic market that has seen substantial growth and innovation. This report on Video Bar Conferencing Device Market delves into the details of this market, exploring its evolution, key players, driving factors, challenges, and prospects. Global Video Bar Conferencing Device market is estimated to reach $787.2 Million by 2030; growing at a CAGR of 20.4% from 2023 to 2030.

The evolution of video conferencing can be traced back to the early 2000s when rudimentary webcam solutions were first introduced. These devices represent a leap forward from traditional video conferencing systems, offering simplicity, compactness, and integrated functionality. They combine high-definition cameras, microphones, and speakers into a single, user-friendly device, eliminating the need for elaborate setups and technical expertise.

The future of the Global Video Bar Conferencing Device Market looks promising. As businesses continue to adopt hybrid work models, the demand for flexible, high-quality communication solutions will persist. To stay competitive, manufacturers are likely to focus on improving AI-driven features, enhancing security, and expanding their product portfolios to cater to evolving needs.

The Global Video Bar Conferencing Device Market has evolved into a critical component of modern communication and collaboration. It has not only revolutionized the way businesses connect but has also played a pivotal role in enabling remote work and bridging geographical gaps. As the market continues to grow and innovate, users can expect even more sophisticated and user-friendly solutions that empower seamless and efficient communication in an increasingly interconnected world.

MARKET DYNAMICS

In the expansion of the video bar conferencing device market, myriad factors have played a pivotal role. Firstly, the global paradigm shifts towards remote work arrangements, catalyzed by the advent of the COVID-19 pandemic, has engendered a substantial demand for communication tools that are both efficacious and dependable. Video bars, distinguished by their plug-and-play simplicity, have ascended to an indispensable status, catering to the needs of businesses endeavoring to maintain seamless collaboration within their geographically dispersed teams.

Secondly, the relentless march of technology, encompassing the seamless integration of artificial intelligence (AI) and machine learning algorithms, has wrought a profound transformation in the capabilities of these devices. AI-driven functionalities, including automatic framing, noise abatement, and astute speaker tracking, have considerably elevated the user experience, rendering video bars the preferred choice for a multitude of users.

However, the soaring trajectory of the video bar conferencing device market is not bereft of its fair share of trials. Among these challenges, the most prominent is the cutthroat competition among manufacturers, leading to market saturation. To stand out and maintain a competitive edge, companies must perpetually innovate their offerings.

Furthermore, the specter of cybersecurity looms large as a formidable issue, with video conferencing platforms being highly susceptible to breaches and invasions of privacy. Vendors are compelled to invest significantly in fortified security measures to instill confidence and trust among their users.

The escalating demand for remote collaboration and virtual meetings stands as the primary impetus behind the adoption of video bar conferencing devices. The augmentation in video and audio quality, driven by technological advancements, fortifies the user experience and fuels the market's proliferation. Nevertheless, the steep initial capital investment and the attendant maintenance expenses could potentially act as deterrents, impeding the widespread adoption of video bar conferencing devices. Additionally, network connectivity issues and compatibility challenges may serve as limiting factors, circumscribing the effectiveness of these devices in certain environments.

The upward trend of hybrid work models presents a unique opportunity for video bar conferencing devices to facilitate seamless communication between in-person and remote participants. This emerging landscape portends profitable prospects for the market in the foreseeable future.

MARKET SEGMENTATION/REPORT SCOPE

By Type

The By Type classification, which provides a deeper understanding of the diversity within this industry, is divided into three subcategories. The 1080p category is for the video bar conferencing devices that offer a resolution of 1920 x 1080 pixels. These devices are well-suited for many business applications, providing high-definition video quality that enhances communication and collaboration during virtual meetings. The market for it is expected to grow and it will be 738.7 USD Million in 2033. As they have become a popular choice for organizations seeking a balance between cost-effectiveness and video quality.

On the other hand, the 4K category is a more advanced segment within the video bar conferencing device market. These devices boast a resolution of 3840 x 2160 pixels, delivering stunningly crisp and detailed visuals. The 4K resolution allows for a truly immersive meeting experience, making it an attractive option for businesses that prioritize top-tier video quality and want to impress clients and partners with lifelike video conferencing. The 4K segment is estimated at 87.2 USD Million in 2025.

In addition to 1080p and 4K, the others category includes video bar conferencing devices that do not fit neatly into these two resolutions. It is a catch-all category that may include devices with unique features, unconventional resolutions, or specialized use cases. These devices cater to specific needs and preferences, providing versatility in the market and catering to niche requirements. It is forecast to grow at a CAGR of 19.4% during 2026-2033

By segmenting the video bar conferencing device market based on resolution type, businesses can make more informed decisions when selecting the right solution for their communication needs. Whether prioritizing affordability with 1080p, aiming for top-tier quality with 4K, or exploring specialized options within the others category, this segmentation offers a valuable framework for navigating the diverse landscape of video conferencing technology.

By Area

The video bar conferencing device market is segmented based on geographical regions, with a focus on two main categories: Small Rooms and Large Rooms.

Small Rooms refer to spaces that accommodate a limited number of people, typically up to a dozen or so. These rooms are often found in small businesses, home offices, or huddle spaces within larger organizations. Video bar conferencing devices designed for Small Rooms are compact and easy to install, catering to the specific needs of these smaller spaces. They are characterized by their simplicity, cost-effectiveness, and suitability for informal meetings and collaboration.

On the other hand, Large Rooms encompass conference rooms, boardrooms, and auditoriums that can accommodate larger groups of people, ranging from dozens to hundreds. Video bar conferencing devices tailored for Large Rooms are equipped with advanced features and technologies to ensure high-quality audio and video performance in larger spaces. They may include features like multiple microphones, high-resolution cameras, and advanced audio processing to facilitate effective communication during important meetings, presentations, and conferences.

By Enterprise Size

This segmentation plays a crucial role in understanding the dynamics and requirements of various businesses when it comes to video conferencing solutions.

One of the keyways the market is categorized is by enterprise size, which typically falls into two broad categories: Small & Medium Enterprises (SMEs) and Large Enterprises. This division is based on the size, scope, and operational capacity of businesses.

Small & Medium Enterprises, often referred to as SMEs, constitute a significant portion of the video bar conferencing device market and it will be 498.6 USD Million in 2033. These enterprises are characterized by their relatively smaller scale compared to large corporations. They typically have fewer employees, a smaller customer base, and more limited resources. For SMEs, cost-effectiveness, scalability, and ease of use are paramount considerations when choosing video conferencing solutions. They often seek solutions that can be easily integrated into their existing infrastructure without extensive investments in additional hardware or IT support.

On the other hand, Large Enterprises tend to have more complex communication needs, including video conferencing at a larger scale and accounted for 67.2% of Video Bar Conferencing Device Market. They often require high-end video bar conferencing devices that can accommodate a higher number of participants, offer advanced features such as high-definition video and audio quality, and provide robust security measures to protect sensitive information. Integration with existing IT systems and compatibility with a range of collaboration tools are also vital considerations for large enterprises.

Understanding this segmentation by enterprise size is crucial for video bar conferencing device manufacturers and service providers. It allows them to tailor their products and services to meet the specific needs and budgets of both SMEs and large enterprises. By doing so, they can effectively cater to a diverse market and ensure that businesses of all sizes can leverage the benefits of video conferencing technology to enhance communication, collaboration, and productivity in today's fast-paced business environment.

REGIONAL ANALYSIS

In 2021, the North America Video Bar Conferencing Device market reached a valuation of 61.3 USD Million, reflecting the robust demand for such communication solutions in this region. Meanwhile, the European Video Bar Conferencing Device market was valued at 52 USD Million in the same year, indicating a substantial market presence in Europe as well. These numbers underscore the significance of video bar conferencing devices in facilitating remote communication and collaboration, a trend that gained prominence, especially in response to global events that necessitated remote work and virtual meetings.

Geographically, the global Video Bar Conferencing Device market is segmented into several regions, each with its unique characteristics and market dynamics. North America comprises the U.S., Canada, and Mexico, reflecting the diverse landscape of businesses and organizations in this region. The prevalence of large corporations, tech companies, and a thriving startup ecosystem in the United States has contributed significantly to the demand for video conferencing solutions.

The segmentation of the global Video Bar Conferencing Device market by geography highlights the wide-reaching impact of this technology across different regions and underscores the importance of tailored solutions to meet the unique needs of businesses and organizations in each geographical area. The market's valuation in North America and Europe in 2021 emphasizes the continued growth and relevance of video conferencing devices globally.

COMPETITIVE PLAYERS

In the Video Bar Conferencing Device market, several key players play pivotal roles in shaping the industry's trajectory. These companies have established themselves as leaders in providing innovative solutions that cater to the evolving needs of businesses and organizations worldwide. Among these prominent players are Logitech International S.A., Plantronics, Inc., Cisco Systems, Inc., Neat Company, Inc., Yealink Inc., GN Store Nord A/S, Crestron Electronics, Inc., Owl Labs Inc., AVer Information Inc., Konftel AB, Bose Corporation, ViewSonic Corporation, A&T Video Networks Pvt. Ltd., Vanco International, LLC, BenQ Corporation, Xiaomi Corporation, Yamaha Corporation, WolfVision GmbH, Anker Innovations Co., Ltd., Vu Video Conferencing (Vu Group), ValueHD Corporation, and Shenzhen Minrray Market Co., Ltd.. These companies collectively contribute to the ever-evolving landscape of the Video Bar Conferencing Device market, each playing a vital role in shaping the industry's future.

Especially, AVer Information Inc. has emerged as a trusted organisation, offering reliable and user-friendly solutions that enhance productivity and engagement across various sectors. Konftel AB specializes in conference phones and video conferencing equipment, emphasizing the importance of crystal-clear communication. Whereas, the Bose Corporation, with its diverse range of audio products, continues to shape the way people experience sound. Its commitment to research, engineering excellence, and sustainability has earned it a respected position in the global audio industry.

Video Bar Conferencing Device Market Key Segments:

By Type

- 1080p

- 4K

- Others

By Area

- Small Rooms

- Large Rooms

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

Key Global Video Bar Conferencing Device Market Players

- Logitech International S.A.

- Plantronics, Inc.

- Cisco Systems, Inc.

- Neat Company, Inc.

- Yealink Inc.

- GN Store Nord A/S

- Crestron Electronics, Inc.

- Owl Labs Inc.

- AVer Information Inc.

- Konftel AB

- Bose Corporation

- ViewSonic Corporation

- A&T Video Networks Pvt. Ltd.

- Vanco International, LLC

- BenQ Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Market

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche market developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252