MARKET OVERVIEW

The US Power Sports market embodies the spirit of adventure and thrill-seeking. It encompasses a diverse array of motorized recreational vehicles, transcending mere functionality to become a cultural phenomenon. These power sports vehicles, ranging from all-terrain vehicles (ATVs) to personal watercraft, cater to enthusiasts seeking adrenaline-fueled experiences in the great outdoors.

The US Power Sports market lies in a blend of technology and recreation. These vehicles, designed for off-road escapades and waterborne adventures, symbolize the pursuit of freedom and the exhilaration of pushing boundaries. In essence, industry is a celebration of mobility, attracting a community that values the rugged and the untamed.

One of the prominent segments within this market is the ATV sector. All-terrain vehicles, with their robust design and off-road capabilities, have become synonymous with exploration beyond conventional limits. Riders, from outdoor enthusiasts to farmers, find in ATVs a versatile companion that effortlessly navigates diverse terrains. The market for these vehicles has evolved beyond utility, embracing a lifestyle choice that resonates with those seeking a break from routine.

Jet skis, another key player in the US Power Sports market, redefine water-based excitement. Personal watercraft enthusiasts revel in the speed and agility of these machines, making lakes and coastlines their playgrounds. The market for jet skis mirrors a culture that thrives on aquatic escapades, where the boundary between rider and the vast expanse of water blurs in a symphony of speed and spray.

Snowmobiles, with their ability to traverse snowy landscapes with ease, represent the winter facet of the power sports realm. These vehicles, not mere tools for commuting through snow-covered terrains, have become an emblem of winter recreation. From snow-covered trails to backcountry powder, snowmobiles carve a niche for enthusiasts seeking a unique blend of adrenaline and winter wonder.

The US Power Sports market is not merely a transactional exchange of vehicles; it is an ecosystem that fosters communities. Events, such as off-road races, watercraft competitions, and snowmobile rallies, serve as rallying points for enthusiasts to share their passion. The market’s influence extends beyond the purchase of a vehicle, shaping a lifestyle that values the thrill of exploration and the camaraderie forged through shared adventures.

The US Power Sports market transcends the conventional boundaries of industry, embodying a vibrant culture that celebrates the pursuit of excitement and freedom. It is a tapestry woven with the threads of technological innovation, recreational fervor, and community spirit. As enthusiasts continue to seek new avenues for adventure, the power sports market remains a dynamic and integral part of their journey, offering a gateway to the untamed realms of nature.

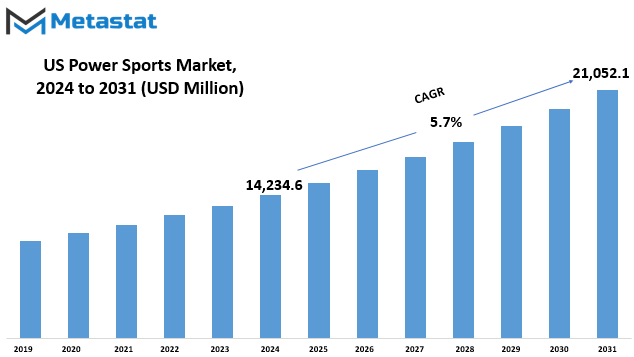

The US Power Sports market is estimated to reach $21,052.1 Million by 2031; growing at a CAGR of 5.7% from 2024 to 2031.

GROWTH FACTORS

The US Power Sports market is experiencing a surge in demand driven by various factors. One notable factor is the increasing interest in off-road recreational activities and adventure tourism. People are drawn to the thrill of outdoor sports, fueling a rising demand for power sports vehicles.

A significant contributor to this trend is the growing popularity of outdoor sports and leisure activities, particularly among millennials and Gen Z. The younger generations are actively seeking exciting and adrenaline-pumping experiences, leading to a boost in the market for power sports.

However, this upward trajectory is not without its challenges. Stringent government regulations on environmental pollution and emissions control pose a notable restraint. The need for compliance with environmental standards affects the manufacturing and operation of power sports vehicles, influencing market dynamics.

Another obstacle comes from high initial and maintenance costs associated with power sports vehicles. While enthusiasts are eager to indulge in off-road adventures, financial considerations often become a limiting factor, affecting the broader accessibility of power sports.

Despite these challenges, there is a promising opportunity on the horizon. The market stands to benefit from the growing adoption of electric power sports vehicles. As consumers become increasingly environmentally conscious, there is a heightened interest in energy-efficient and sustainable alternatives.

The shift towards electric power sports vehicles aligns with the changing consumer preferences and offers a positive outlook for the market. This trend not only addresses environmental concerns but also caters to the demand for innovative and eco-friendly options.

The US Power Sports market is currently shaped by the dynamic interplay of drivers, restraints, and opportunities. The surge in demand fueled by the appeal of off-road recreational activities and the changing preferences of younger generations is met with challenges such as regulatory constraints and financial considerations. However, the growing adoption of electric power sports vehicles signals a positive trajectory for the market, aligning with the evolving values of environmentally conscious consumers.

MARKET SEGMENTATION

By Type

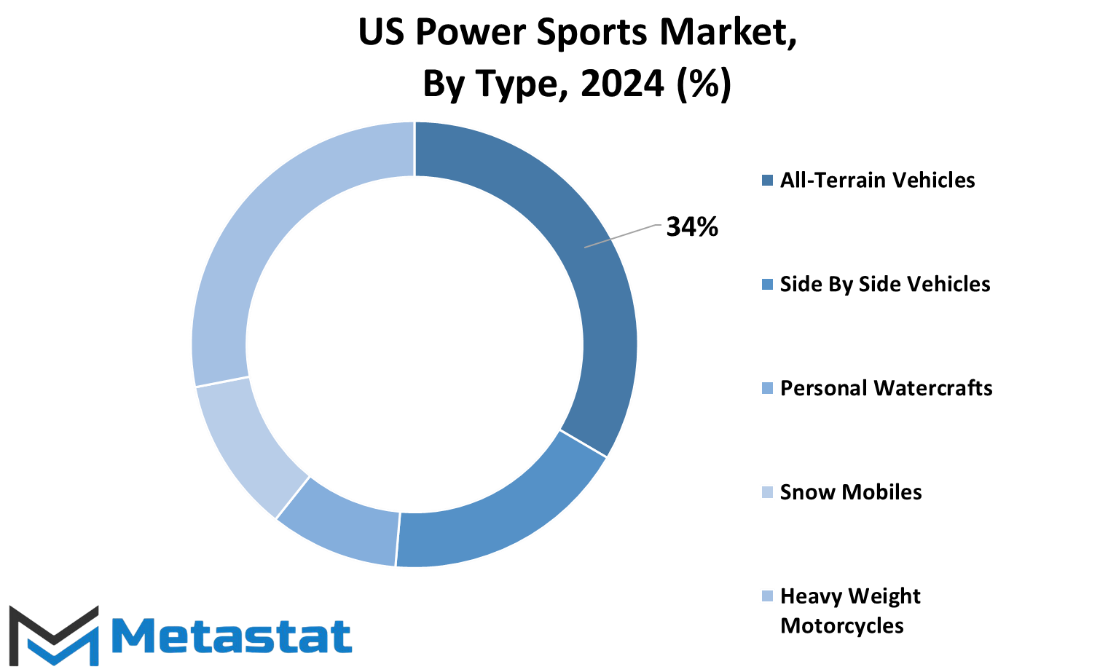

The U.S. Power Sports market with various segments catering to enthusiasts seeking adventure and recreational activities. One prominent classification is based on types, which includes All-Terrain Vehicles (ATVs), Side by Side Vehicles, Personal Watercrafts, Snow Mobiles, and Heavy Weight Motorcycles.

ATVs, or All-Terrain Vehicles, are versatile machines designed to traverse a variety of terrains. These vehicles are known for their off-road capabilities and are widely used for recreational purposes such as trail riding and exploring rugged landscapes. Side By Side Vehicles, on the other hand, provide a unique riding experience, accommodating multiple passengers. This category has gained popularity for its social aspect, allowing friends and family to share the thrill of off-road adventures.

Personal Watercrafts, commonly known as jet skis, contribute to the excitement of water-based activities. These nimble and agile machines offer a thrilling experience on lakes and oceans, attracting water sports enthusiasts. Snow Mobiles, designed for snowy terrains, provide an exhilarating means of transportation across winter landscapes. With their ability to glide through snow, they have become a favorite among those who seek adventure in colder climates.

Heavy Weight Motorcycles form another significant segment within the U.S. Power Sports market. These motorcycles, known for their robust engines and substantial build, cater to riders with a passion for the open road. Whether cruising on highways or embarking on long-distance journeys, heavy-weight motorcycles offer a unique riding experience.

The segmentation of the U.S. Power Sports market by type reflects the diverse preferences of consumers seeking recreational vehicles. Each category caters to specific interests, providing enthusiasts with a range of options to choose from based on their desired experience. As the market continues to evolve, these distinct segments contribute to the overall dynamism and vibrancy of the power sports industry in the United States.

By Application

The US Power Sports market exhibits a dynamic landscape with its segmentation based on applications. In 2022, the On-road segment held a significant value of 5068.4 USD Million, showcasing its prominence in the market. Simultaneously, the Off-road segment contributed substantially, being valued at 7806.3 USD Million in the same year.

This distinction in values underscores the diverse preferences and demands within the Power Sports market. The On-road category encompasses various vehicles designed for conventional road use, including motorcycles and scooters. On the other hand, the Off-road segment caters to enthusiasts seeking vehicles suitable for off-the-beaten-path adventures, such as all-terrain vehicles (ATVs) and dirt bikes.

Examining these segments individually provides insights into the consumer trends shaping the industry. The noteworthy valuation of the On-road category suggests a robust interest in conventional road-bound power sports vehicles, possibly fueled by urban commuting needs or recreational riders. In contrast, the substantial value attributed to the Off-road segment indicates a thriving market for adventure-driven power sports enthusiasts, emphasizing the appeal of off-road experiences.

Understanding the market dynamics within these application segments is vital for stakeholders, as it allows them to tailor their strategies to the specific needs and preferences of consumers. Manufacturers, retailers, and other industry players can leverage these insights to develop targeted marketing approaches and innovative product offerings.

Moreover, the fluctuating values between the On-road and Off-road segments over time can provide valuable information on emerging trends and shifts in consumer behavior. Keeping a pulse on these trends enables businesses to stay agile and responsive in an ever-changing market, ensuring sustained relevance and competitiveness.

The US Power Sports market's division into On-road and Off-road segments reflects the nuanced preferences of consumers. The substantial valuations in both categories indicate a thriving industry with diverse demands. Stakeholders navigating this market should remain attuned to these dynamics, utilizing insights to shape strategies that resonate with the evolving needs of power sports enthusiasts.

By Model

The US Power Sports market, a dynamic landscape shaped by consumer preferences and technological advancements, comprises various segments, each catering to distinct interests and needs. One of the keyways to understand this diverse market is by examining it through different models.

Breaking down the market by model, we find three primary segments: Stand-up, Sit-down, and Multi-personal. These segments serve as indicators of the diverse range of power sports vehicles available to consumers.

The Stand-up segment, with a valuation of 1600.3 USD Million in 2022, captures the essence of solo riding experiences. It appeals to enthusiasts who seek the thrill of navigating the open terrain on a single-rider vehicle. This segment resonates with those who appreciate the freedom and agility that come with stand-up power sports.

In contrast, the Sit-down segment, valued at 9774.5 USD Million in 2022, caters to a different set of preferences. This category is characterized by vehicles designed for seated operation, providing a more relaxed and comfortable riding experience. It often attracts individuals who prioritize comfort and a leisurely ride over the adrenaline rush associated with stand-up models.

The multi-personal segment, with a valuation of 1499.9 USD Million in 2022, addresses the needs of those who prefer a shared adventure. These vehicles are designed to accommodate multiple riders, promoting a sense of camaraderie and shared excitement. The appeal of the multi-personal segment lies in the social aspect of power sports, allowing friends or family to embark on adventures together.

Understanding the market through these model-based divisions provides a comprehensive view of the choices available to consumers. Whether one seeks the solo thrill of stand-up riding, the relaxed comfort of sit-down models, or the shared excitement of multi-personal vehicles, the US Power Sports market offers a diverse array of options, reflecting the varied preferences within the consumer base. As the market continues to evolve, these distinct segments are likely to witness further innovations and adaptations to meet the ever-changing demands of power sports enthusiasts.

COMPETITIVE PLAYERS

The landscape of the US Power Sports market is marked by the presence of significant players, each contributing to the dynamic nature of the industry. Among the noteworthy participants are Arctic Cat Inc., Bombardier Recreational Products, Honda Motor Co. Ltd., Harley Davidson, Kawasaki Motor Corporation, Indian Motorcycle International, LLC, KYMCO, Polaris Inc., Suzuki Motors Corporation, and Yamaha Motor Corporation.

These companies play a vital role in shaping the Power Sports sector, offering a diverse range of products and services to cater to the varied preferences of consumers. Arctic Cat Inc., for instance, is known for its commitment to delivering high-performance snowmobiles and ATVs. Bombardier Recreational Products has become a prominent player in the market focusing on innovative recreational vehicles. Honda Motor Co. Ltd. brings its expertise to the table with a wide array of motorcycles and off-road vehicles.

Harley Davidson, a well-known name in the motorcycle world, has a significant impact on the Power Sports market, particularly with its iconic cruisers. Kawasaki Motor Corporation, with its line-up of motorcycles, ATVs, and Jet Skis, is another influential player in the industry. Indian Motorcycle International, LLC, is recognized for its heritage and craftsmanship in producing heavyweight motorcycles.

KYMCO, a global brand, contributes to the competitive dynamics of the market by offering a diverse range of scooters, ATVs, and utility vehicles. Polaris Inc. is a key player known for its off-road vehicles, snowmobiles, and electric vehicles, showcasing a commitment to sustainability. Suzuki Motors Corporation, a renowned name in the automotive world, extends its influence to the Power Sports sector with a range of motorcycles and ATVs. Yamaha Motor Corporation, with its comprehensive portfolio spanning motorcycles, ATVs, and watercraft, is a significant player driving innovation and choice in the market.

The competitive landscape shaped by these key players reflects a vibrant and evolving Power Sports market in the United States. Their individual strengths, product offerings, and market strategies contribute to the overall dynamism of the industry, providing consumers with a rich array of options to explore and enjoy.

Power Sports Market Key Segments:

By Type

- All-Terrain Vehicles

- Side By Side Vehicles

- Personal Watercrafts

- Snow Mobiles

- Heavy Weight Motorcycles

By Application

- On-road

- Off-road

By Model

- Stand-up

- Sit-down

- Multi personal

Key US Power Sports Industry Players

- Arctic Cat Inc.

- Bombardier Recreational Products

- Honda Motor Co. Ltd.

- Harley Davidson

- Kawasaki Motor Corporation

- Indian Motorcycle International, LLC

- KYMCO

- Polaris Inc.

- Suzuki Motors Corporation

- Yamaha Motor Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252