MARKET OVERVIEW

The US Foodservice B2B Vegetable Oils market is of critical importance in the overall food service industry. This market sells vegetable oils to commercial businesses, restaurants, catering services, and institutional kitchens. This market requires the large-scale distribution of vegetable oils by suppliers to foodservice establishments, which consume them for frying, cooking, and preparation of foods. Vegetable oils, from canola oil to soybean oil, sunflower oil, and palm oil, play an important role in the formulation of most food products, hence improving quality, texture, and taste.

The US Foodservice B2B Vegetable Oils market will actually be increasingly challenging the needs and demands of foodservice operators toward more efficient, cost-effective, and higher-quality solutions for businesses in the industry. With increasing interest in healthier cooking options, the demand for oils with specific attributes, such as lower saturated fat content or higher nutritional benefits, will increase. These shifts will encourage suppliers to adapt and provide innovative vegetable oil products tailored to these requirements. The scope of the US Foodservice B2B Vegetable Oils market covers several segments across oil types, regional markets, and application areas.

Examples of this include soybean and canola oils, which are affordable, fungible, and neutral in tasteboth reasons they are in such high demand by fast food chains and caterers of many large restaurants. In comparison, there is specialty oil such as olive or avocado that may be found in some of the high-end establishments due to a perceived contribution to flavor and a perceived health benefit. Increased awareness regarding sustainability and health will make the market continue to experience an increased focus on organic and non-GMO oils. New regulations and shifts in consumer behavior in the coming years will also shape demand for vegetable oils in the foodservice sector.

Increased focus on sustainability by foodservice businesses will put suppliers under pressure to provide vegetable oils coming from environmentally responsible and socially sustainable sources. Problems like transparency about sourcing practices, traceability, and certifications will also challenge the US Foodservice B2B Vegetable Oils market to meet new sustainability standards. Technology and processing techniques will also play their role in innovation in the market. Producers will again focus much attention on developing healthier vegetable oils with improved cooking properties or a longer shelf life. The benefits of these improvements will flow not only to the foodservice business but also to consumers seeking products more in line with current dietary preferences.

This would increase competition in the market, especially with the increased number of suppliers of oils offering choices as alternatives. Another method for competition among suppliers would be the capacity to carry on specific business according to the needs of the customer. For example, custom packaging sizes may become as important as the kind of oil being offered-suitable for particular types of cooking. In tandem with these market dynamics, e-commerce and digital platforms in the B2B sector may transform how vegetable oils are procured and sold.

Changing foodservice business needs, it will keep on supplying critical products to support both the quality and sustainability of the foodservice sector. Innovation and sustainability will characterize the future of this market, with increasing healthy products. With constant evolution, it will be positioned to meet both sides-the business and the consumer.

US Foodservice B2B Vegetable Oils market is estimated to reach $10556.1 Million by 2031; growing at a CAGR of 3.2% from 2024 to 2031.

GROWTH FACTORS

The US Foodservice B2B Vegetable Oils market is growing through years, with some important factors that shape the future of the market. The first factor is healthy cooking oils, which are increasingly in demand, because consumers have become more health-conscious and food-service providers increasingly support dietary needs. This has made vegetable oils, perceived as more healthy compared with animal fats or fats with high saturated levels, the commodity that garners increasing popularity. Vegetable oils, known for their heart-healthy properties, are one of the preferred commodities by businesses in the foodservice industry, including restaurants, catering services, and food producers in large scales.

Another factor behind this growth is the expansion of the foodservice industry. The trend of eating out, delivery services and ready-to-eat meals is on the rise and vegetable oils are highly used in commercial kitchens. This happens because such quick foodservices require ample cooking oils from foodservice companies. As the economy of the United States advances, so will the foodservice industry drive demands for vegetable oils to record-breaking levels.

Sustainability also continues to grow in importance for many foodservice companies. More and more now assume greener ways of doing things, and sustainable and renewable sources of procuring oils contribute to this trend. However, more and more young consumers associate a brand with environment-friendly practices, thus accelerating demands for health- and planet-friendly vegetable oils. This should act as a growth driver in the market for several more years.

However, there are also some restraints that may curb the growth of the US Foodservice B2B Vegetable Oils market. Volatility of prices of raw materials is one such restraint. Vegetable oils from crops such as soybeans, corn, and canola are the other sources of oil. Their prices are volatile, which can precipitate instability in oil prices, thereby increasing foodservice business expenses, particularly for leanly capitalized businesses. The other possible reason for reversed growth in the long run may be connected with wide-scale oil production and environmental problems associated with it, such as those that result from extensive deforestation and the widespread application of pesticides.

Despite these challenges, there seems to be great promise in the market itself. More technological development will likely improve upon efficiency in the production of vegetable oils, thereby bringing better costs and opening up better oils to the market. New product lines could also result from improved processing techniques that increase the nutritional value, or specifically design oils for specific methods of cooking. All these trends may unlock numerous profitable avenues for American commercial players in the Foodservice B2B Vegetable Oils market, thus emerging as a space to be monitored in the near future.

MARKET SEGMENTATION

Demand will increase because foodservice industries are increasingly preferring various cooking oils. This market mainly bases its demand on a growing requirement by restaurants, hotels, catering services, and other food ventures for high-quality oils. Changes in customer preferences are forcing most foodservice organizations to explore different vegetable oils in order to cater to the different tastes and dietary requirements in culinary preparation. This is especially influenced by the nutritional value of these oils, versatility in cooking, flavor profiles, and cost-effectiveness.

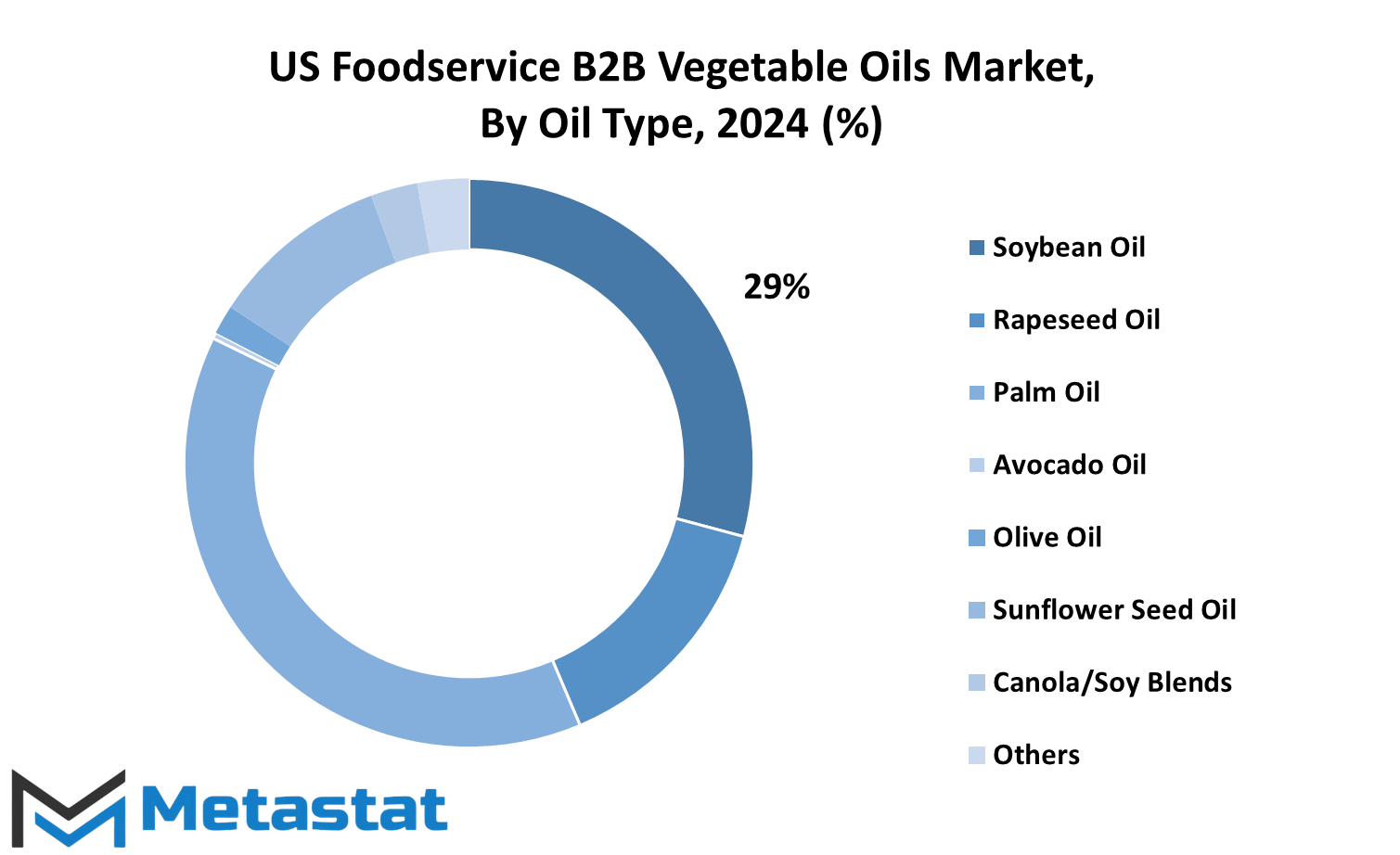

One of the most significant segments in the US Foodservice B2B Vegetable Oils market is segmented by type of oil. The most common types used are soybean oil, rapeseed oil, palm oil, avocado oil, olive oil, sunflowerseed oil, canola/soy blends, and others. Each of these oils has a feature or characteristic that is suitable to the needs in foodservice, thus their dynamic variability in the market.

Soybean oil is one of the most popular vegetable oils used in the foodservice area. Its neutral taste, mild flavor, and relatively cheap price make it suitable for any type of cooking such as frying and sautéing. Since soybean oil is also mass-produced in the US, foodservice companies prefer this oil type due to a relatively cheaper option. Similarly, rapeseed oil, canola and others are preferred for their higher smoke points, but also with the more health-conscious appeal of simply having a lower saturated fat level than other oils.

Palm oil, another giant in the market, is valued for its stability and long shelf life. Due to the stable performance of palm oil at high temperatures, it is used in large food processing and foodservice companies. Because sustainability concerns related to palm oil production are increasing, this will encourage foodservice operators to seek alternative solutions, thus causing demand to shift.

Avocado oil and olive oil are gaining an ever more substantial share in healthier alternatives as consumers increasingly care about plant-based diets and healthy cooking. Consumers appreciate avocado oil primarily due to its high level of healthy fats and antioxidants; olive oil is used more often for unique taste and health benefits perceived from it. Both types of oil will grow in demand in premium foodservice segments, especially restaurants that focus on healthier menu options.

Another oil relevant to the market is sunflowerseed oil, identified by its light flavor and high smoke point, thereby making it possible to use this versatile oil for frying and baking. The advantage behind the canola/soy blends is the balanced attributes from both oils, culminating in a much-needed blend for foodservice operations looking for a more cost-effective and functional oil applicable for a wide range of cooking-related applications.

Emergence of a constantly evolving market As the US Foodservice B2B Vegetable Oils market continues to evolve, oil preferences will probably shift further with new and changing trends from consumers that are shaping the face of the foodservice industry. Production methods will see an upgrade in the future of this market along with an impact created by sustainability and changes in eating habits, which the foodservice business will be able to bank upon, innovate for, and effectively cater to the growing and diversifying needs of the foodservice professional.

By Region

The US Foodservice B2B Vegetable Oils market is expected to rise because consumers demand healthier, plant-based choices. Consequent demand ripples in the restaurant, foodservice provider, and other business operations. Changing consumer preferences, dietary habits, as well as rising awareness of nutrition spur a continued market. This market shall look toward new and surprising ways to its dimensions in the upcoming years. As per region, it can be divided into four sections; Northeast, Midwest, South, and West, each of which will experience their unique trends and developments.

In the Northeast, with the diversified and health-conscious population, demand for vegetable oil shall rise in the foodservice sector. More consumers choosing vegetarian diets are beginning to bring vegetable oils into kitchen across the region. The ones most in demand will be olive, canola, and avocado-their health benefits make them premium products. Foodservice B2B businesses will respond with greater diversity and a nod to the need for both nutrition and taste. The Midwest will feel differently over the next few decades, not only in terms of agricultural production but also demographic demand.

This region will be heavily aligned with the different oils from regional crops, like soybean oil, which becomes a staple within foodservice operations. Demand will continue to rise for vegetable oils grown regionally, as consumers want to support regional agriculture and sustainable approaches. This will, in all likelihood, be expressed in the decision that restaurants and foodservice companies make towards their suppliers as well as how they market their products. In the south, therefore, US Foodservice B2B Vegetable Oils is likely to boom due to deep-fried foods among other essential needs such as soybean and peanut oil.

As southern cuisine will likely continue to top local as well as national trends in foods, these oils will again be in demand; however, future shifts also might emphasize healthier alternatives. The Southern foodservice industry is likely to find a balance between traditional cooking, which is a hallmark of the region’s cuisine, and the growing demand from consumers for health-conscious options. Innovation and sustainability will further propel plant-based oils, as well as innovative cooking solutions, in the West. The more consumers learn about environment threats and health risks, the greater their demands will be for oils that are sustainable and close to nature, such as coconut, sunflower, and avocado. This market should expand, as these three oils are considered healthier and environmentally friendlier.

In the US Foodservice B2B Vegetable Oils market it would then diversify its ways across the different regions as the consumer needs and preferences change. Thus, when the healthy selection choices keep on assuming the mainstream position in America, oil offerings would grow evermore diversified because companies that serve the foodservice sector adapt to the demand.

By End User

Within the context of the overall foodservice industry, the US Foodservice B2B Vegetable Oils market contains a sharp focus on different end-users and their specific needs. Change in consumer preferences and the channeling of economic conditions will continue to drive this market toward healthier and sustainable food options. Given the perspectives gained by closer examinations of many segments within this market, it becomes really understandable how diverse and specialized demand for vegetable oils is.

The Club Stores segment, which includes retailers such as Costco and Sam’s Club, accounts for the majority market share because it incorporates massive wholesale businesses that cater to consumer and business streams, thus selling huge volumes of vegetable oils. As these giant stores continue to gain popularity, demand for the best quality, affordable vegetable oils will surely follow in its wake. In addition to the growing volume of bulk buying, this segment is expected to continue to grow with value-driven option availability for both consumers as well as small businesses.

Hotels and Resorts is the other significant segment that is expected to grow steadily in the subsequent years. There is an ever-growing requirement for high-quality ingredients with this industry largely recovering from the Impacts of the pandemic. Vegetable oils also play an important role in the hotel and resort kitchen in terms of both everyday cooking and signature dishes. Expanding market opportunities will further open up even greater opportunity for suppliers to innovate and offer oils that appeal to health-conscious and cost-conscious customer.

Other important players in the foodservice distributors market are Sysco and US Foods, which also wield significant influence on the market. The Foodservice Distributors segment contributed about 2,675.7 million USD in 2023. Foodservice distributors serve to connect the manufacturers and end-users, distributing massive volumes of vegetable oils to end-users. As healthier plant-based oils gain prominence, foodservice distributors will find it unavoidable to ensure these oils are available to restaurants, schools, and hospitals. Since it is a distributor level operation at enormous scales, there would be surety in the shift of market trends and consumer preferences.

Another area where vegetable oils are getting much importance is Ethnic Retail, which involves large procurements for ethnic grocery stores. The segment of Ethnic Retail in the year 2023 is placed at 475.4 million USD, and this is pertaining to the high demand for the oils used in traditional cooking. With multicultural communities on the rise across the United States, this segment is likely to grow as more consumers look for ingredients integral to their cultural cuisines. These oils often serve a niche but growing market, providing unique flavors and preparation methods that people seek.

The Institutional segment, which includes schools, hospitals, military facilities, and prisons, also presents opportunities. As these institutions come to focus increasingly on producing food that is healthier and more sustainable, demand for oils that serve such goals will follow. Vegetable oils that are both affordable and nutritious will be essential in this market.

Restaurants and QSR are two of the largest players in the US Foodservice B2B Vegetable Oils market. In 2023, Restaurants and QSR accounted for 2,264.1 million USD. Going forward, with the expansion of foodservice, especially quick-service and fast-casual dining outlets, demand for variable, quality vegetable oils will continue to increase. As such, as consumers look more towards healthier dining options, they’ll need restaurants to use oils that will not only fulfill their idea of taste but also provide a better nutritional profile than what existed before.

The US Foodservice B2B Vegetable Oils market will see more changes, and every category is due for evolutionary needs based on changing demands and trends. Increased health awareness, stress on sustainability, and the role of food in cultural identity are likely to make this market dynamic. From suppliers through distributors to end users, all of this is possible and could influence a future where vegetable oils meet most culinary and nutritional expectations. The increasing diversity of this market suggests that businesses in the foodservice sector will need to make appropriate adjustments to varying preferences and demands, not forgetting other trends such as plant-based eating and sustainability.

By Package Size

The US Foodservice B2B Vegetable Oils market has been incredibly progressing in the recent past, with high demand witnessed in restaurants, catering services, and food distributors. The market, which provides vegetable oils to businesses, rather than end-users, is expected to continue changing to suit the changing needs of the foodservice industry. The packaging of these vegetable oils is one of the crucial aspects that meet business-specific requirements. It can be expected that the market will further diversify in the coming years.

Variety of options for packaging is an important factor that influences the US Foodservice B2B Vegetable Oils market. By the size of package, the market is generally classified into Small Pack, Medium Pack, and Bulk Pack. Small Packs, such as the 6/1 Gallon Pack, will fit smaller operations or usage levels. These packs will be ideal for small kitchens that have a desire for a volume of oil more manageable in terms of ease. Over time, the convenience and portability that small packs offer will make them attractive to small foodservice businesses, such as cafes, food trucks, and smaller restaurants.

Alternatively, large eating places that use large amounts of oil, such as large chain restaurants, caterers, and institutional food services, like Medium Packs. For, among others, the 4/1 Gallon Pack fills the bill to equalize between quantity and control. Medium Packs offer a convenient supply of oil so businesses can keep their kitchens cooking without tying up unnecessary storage space. These kits will remain in much demand, particularly in speedy kitchens that require a constant supply of oil for their operations.

Bulk Packs Basically, larger quantities of vegetable oils are called Bulk Packs. For large producers, industrial kitchens, or large restaurant chains, it is truly a key option. It will save costs and manage the stock much better. When and if companies do shift to gain cost saving and rationalize their business, demand for bulk packs is likely to expand since companies would like to optimize their supply chain.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$8451.4 million |

|

Market Size by 2031 |

$10556.1 Million |

|

Growth Rate from 2024 to 2031 |

3.2% |

|

Base Year |

2022 |

COMPETITIVE PLAYERS

Some of the notable growth seen in the US Foodservice B2B Vegetable Oils market is through changing consumer preferences for healthier cooking oils, advancement in foodservice operations, and increased demand for vegetable oils. Going forward, several companies will continue to shape this market, introducing innovation, sustainability, and competition. Such major players as Archer Daniels Midland, Golden Barrel, Bunge US SA, Louis Dreyfus Company, among so many others, will help tackle the evolving needs of the foodservice providers with more demand for vegetable oils in commercial and large-scale food preparation.

Among the agroprocessing firms, Archer Daniels Midland is best positioned to expand its operations in B2B vegetable oils. Agroprocessing leader ADM has further strengthened its network in the food industry and will remain in the leader's position. Then the international presence with a strong supply chain companies like Bunge US SA and Louis Dreyfus Company will provide critical roles and balanced supply and quality vegetable oils to foodservice businesses across the United States.

Building reputation in the competitive landscape will continue through more Golden Barrel and Columbus Vegetable Oils businesses built on specialized offerings that meet specific needs. These companies will thrive, maintaining close customer relationships and adding more organic and healthier oils offerings, which represent a growing demand for health-conscious customers and foodservice operators looking to align themselves with wellness movements.

Pompeian, Inc., and Ventura Foods with their sustainability and innovation approach are likely to come up with new products considering the needs of the foodservice industry. The commitment of the company to create oils that support food preparation while significantly reducing the imprint on the environment aligns well with future trends of eco-friendly and sustainable sourcing practices.

There are also other players like Richardson International (Pure Wesson), Riceland Foods, Incobrasa Industries, Ltd., and Stratas Foods that will seek opportunities to innovate and diversify to supply massive foodservice operations seeking quality yet not so costly oils. As these players innovate ways on adapting preferences both of restaurants and the commercial kitchens, so will they propel the future of the US Foodservice B2B Vegetable Oils market.

Looking forward, the US Foodservice B2B Vegetable Oils market would be led by the competitive dynamics of sustainability, quality, and innovation. Keeping true to this vision, competition would continue to vie for market share based on product quality, upgrading the supply chain, and innovating towards new dietary preferences of consumers. Changes in these areas will lead to changes in the market, as foodservice businesses' key players strive to meet new demands in such a way that is relevant and competitive.

US Foodservice B2B Vegetable Oils Market Key Segments:

By Oil Type

- Soybean Oil

- Rapeseed Oil

- Palm Oil

- Avocado Oil

- Olive Oil

- Sunflowerseed Oil

- Canola/Soy Blends

- Others

By Region

- Northeast

- Midwest

- South

- West

By End User

- Club Stores (e.g., Costco, Sam’s Club)

- Hotels and Resorts

- Foodservice Distributors (e.g., Sysco, US Foods)

- Ethnic Retail (Bulk for ethnic grocery stores)

- Institutional (Schools, Hospitals, Military, Prisons)

- Restaurants and Quick Service Restaurants (QSR)

By Package Size

- Small Pack

- 6/1 Gallon Pack Medium Pack

- 4/1 Gallon Pack Medium Pack

- Bulk Pack

Key US Foodservice B2B Vegetable Oils Industry Players

- Archer Daniels Midland (ADM)

- Golden Barrel

- Bunge US SA

- Louis Dreyfus Company

- Columbus Vegetable Oils

- Pompeian, Inc.

- Ventura Foods

- Richardson International (Pure Wesson)

- The Kroger Co.

- Ag Processing Inc.

- Riceland Foods

- Incobrasa Industries, Ltd.

- Stratas Foods

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383