MARKET OVERVIEW

The US Duty-Free Shops market represents a distinctive sector within the retail industry, catering to a niche audience seeking tax-free shopping experiences. This market has carved a unique niche by providing a haven for international travelers looking to indulge in retail therapy without the burden of hefty import duties and taxes. The industry thrives on the premise that consumers can purchase goods at these establishments without the usual financial constraints imposed by customs and taxation authorities.

This specialized market primarily targets travelers departing or arriving at international airports and border crossings. The strategic placement of duty-free shops in these high-traffic locations capitalizes on the transient nature of the customer base. Unlike traditional retail outlets, the US Duty-Free Shops market taps into the dynamics of global mobility, aligning its offerings with the preferences and demands of a diverse international clientele.

At its core, the industry hinges on the exemption of certain taxes and duties that typically accompany cross-border commerce. Shoppers at duty-free stores can revel in the opportunity to acquire a wide array of products ranging from luxury goods to everyday items, all at prices unburdened by the financial encumbrances associated with conventional retail transactions. Fragrances, cosmetics, electronics, and alcoholic beverages are among the popular categories that grace the shelves of these specialized stores, enticing travelers to indulge in tax-free purchases.

The operational model of duty-free shops involves close collaboration with government authorities to ensure compliance with regulations and standards. The industry operates within a framework that enables it to provide a unique shopping experience while adhering to the legal requirements governing cross-border trade. The symbiotic relationship between duty-free shops and regulatory bodies ensures that both the interests of consumers and the fiscal objectives of governments are duly considered.

Moreover, the US Duty-Free Shops market has evolved to incorporate technological advancements, enhancing the shopping experience for travelers. The integration of digital platforms, pre-order services, and personalized recommendations reflects the industry's commitment to staying relevant in an ever-changing retail landscape. These innovations not only streamline the shopping process but also contribute to the overall appeal of duty-free shopping as a seamless and enjoyable part of the travel experience.

The US Duty-Free Shops market stands as a testament to the adaptability and strategic positioning within the retail sector. By aligning itself with the needs of a transient international clientele, this niche market has successfully carved out a space where consumers can indulge in tax-free shopping, creating a unique and enticing retail experience at the crossroads of travel and commerce.

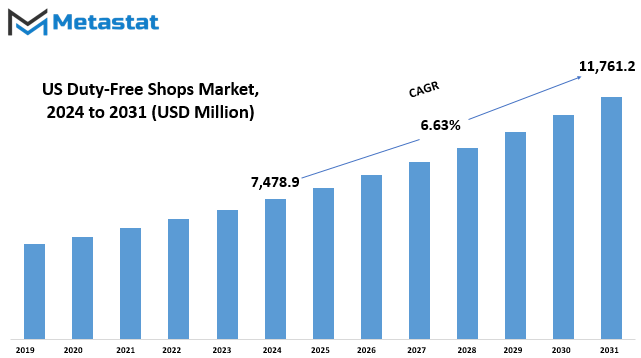

The US Duty-Free Shops market is estimated to reach $11,761.2 Million by 2031; growing at a CAGR of 6.63% from 2024 to 2031.

GROWTH FACTORS

One of the prominent drivers fueling this market is the surge in the number of both domestic and international travelers frequenting US airports. This influx of travelers not only amplifies the footfall in duty-free shops but also contributes to the overall growth of the market. The expanding customer base, comprised of individuals from diverse backgrounds, stimulates the demand for duty-free products, creating a favorable environment for market expansion.

Additionally, the proactive approach of duty-free retailers plays a pivotal role in propelling the market forward. The expansion of store numbers and diversification of product offerings contribute significantly to meeting the evolving preferences of consumers. This adaptability not only attracts new customers but also retains the interest of existing ones, fostering sustained growth in the market.

However, amid the positive dynamics, certain challenges act as restraints for the US Duty-Free Shops market. One such challenge is the fleeting attention of passengers at travel points when it comes to engaging in retail shopping. The hustle and bustle of airports, coupled with the rush to catch flights, often limit the time passengers allocate for shopping. Additionally, restrictions in luggage weight pose a hurdle, as travelers may be deterred from making purchases that could add to their baggage burden.

Nevertheless, the market holds promising opportunities that can be capitalized on. A key opportunity lies in the increasing awareness among travelers about the benefits of duty-free shopping. As consumers become more informed about the potential savings and the exemption of excise taxes associated with duty-free purchases, there is a growing inclination towards engaging in such shopping experiences.

The US Duty-Free Shops market is navigating its course through the ebb and flow of travelers, expanding store fronts, and evolving consumer preferences. While challenges exist in capturing the attention of time-pressed passengers, the market stands poised to leverage opportunities arising from heightened awareness among travelers. The interplay of these drivers, restraints, and opportunities shapes the narrative of the US Duty-Free Shops market, reflecting the dynamism inherent in this sector.

MARKET SEGMENTATION

By Type

The US Duty-Free Shops market is a dynamic landscape, showcasing a variety of products catering to different consumer needs. One of the key facets that define this market is its segmentation based on product types. These segments provide a glimpse into the diverse offerings available within the duty-free shopping space.

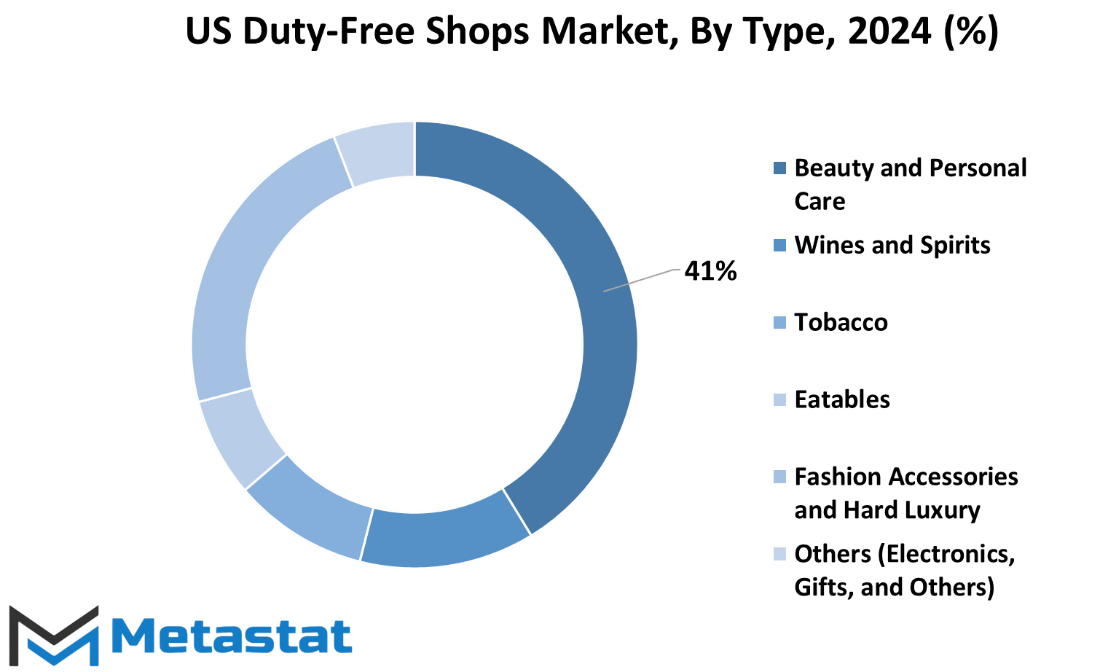

One significant category within this market is Beauty and Personal Care. In the year 2020, the Beauty and Personal Care segment held substantial value, totaling 2408.3 USD Million. This indicates a robust consumer interest in duty-free options for beauty and personal care products, reflecting a thriving market for these items.

Wines and Spirits constitute another integral segment of the US Duty-Free Shops market. In 2020, the Wines and Spirits segment recorded a valuation of 901.9 USD Million. This highlights the popularity of duty-free purchases in the realm of alcoholic beverages, suggesting a consumer preference for exploring such options within the duty-free setting.

The Tobacco segment is yet another noteworthy component of the market, registering a value of 693.6 USD Million in 2020. This signifies a significant demand for duty-free tobacco products, underlining the appeal of such offerings to consumers looking for a variety of choices in this category.

Eatables, encompassing a range of consumable products, also hold a substantial position within the US Duty-Free Shops market. In 2020, the Eatables segment recorded a valuation of 421.5 USD Million. This suggests that consumers find value in exploring duty-free options for a diverse array of food products, adding to the overall vibrancy of the market.

Fashion Accessories and Hard Luxury constitute a segment that goes beyond daily necessities, providing consumers with options that extend into the realm of style and luxury. In 2020, this segment was valued at 1279.8 USD Million, underscoring the significance of duty-free shopping in the domains of fashion and luxury accessories.

Additionally, the market includes an Others category, encompassing a variety of products such as electronics, gifts, and more. While the specific valuation for this category in 2020 is not provided, its inclusion signifies the diverse array of goods available in duty-free shops, catering to a wide range of consumer preferences and needs.

The US Duty-Free Shops market presents a multifaceted landscape shaped by the diverse preferences of consumers. The segmentation into Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, along with the catch-all Others category, provides a comprehensive view of the rich tapestry of products available in this dynamic market. These segments collectively contribute to the vibrancy and allure of duty-free shopping in the United States.

COMPETITIVE PLAYERS

The US Duty-Free Shops market is a dynamic sector with significant players shaping its landscape. Among the key contributors are DFA, Dufry, DFS Group, Flemingo International Ltd, 3Sixty (formerly known as the DFASS Group), Lagardère group, and WH Smith PLC.

These companies play a pivotal role in the industry, each bringing its unique strengths and strategies to the table. DFA, for instance, has carved a niche with its innovative approach, catering to the diverse needs of consumers looking for duty-free shopping experiences. Dufry, on the other hand, has been a consistent player, known for its widespread global presence and the ability to adapt to market trends.

DFS Group stands out for its commitment to delivering a seamless shopping experience to travelers, with a focus on luxury goods. Flemingo International Ltd brings a global perspective to the market, capitalizing on its international footprint. Meanwhile, 3Sixty, rebranded from the DFASS Group, continues to make waves with its comprehensive duty-free retail solutions.

Lagardère group and WH Smith PLC contribute their share of expertise, with Lagardère emphasizing travel retail and WH Smith PLC bringing a solid foundation in airport and railway station retail operations.

The US Duty-Free Shops market thrives on the synergy created by these key players. Their combined influence reflects the industry's competitive nature and shows the adaptability required to meet consumers' ever-changing demands. The success of these companies underscores the importance of understanding market dynamics, consumer preferences, and the globalized nature of the duty-free shopping experience. So, the US Duty-Free Shops market is characterized by the active participation of major players, each contributing uniquely to the sector's vibrancy. As the industry evolves, the strategies and innovations introduced by DFA, Dufry, DFS Group, Flemingo International Ltd, 3Sixty, Lagardère group, and WH Smith PLC will continue to shape the future landscape of duty-free retail in the United States.

US Duty-Free Shops Market Key Segments:

By Type

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others (Electronics, Gifts, and Others)

Key US Duty-Free Shops Industry Players

- DFA

- Dufry

- DFS Group

- Flemingo International Ltd

- 3Sixty (previously the DFASS Group)

- Lagardère group

- WH Smith PLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252