MARKET OVERVIEW

The global trading cards market will be a cultural and economic phenomenon far beyond hobbyist collectability. It will become an impactful sector that mirrors changing consumer patterns, digitalization, and narrative through physical and virtual channels. The market will be not just enthusiasts trading or keeping up cards but how art, nostalgia, and investment value will come together to form a unique platform for the future.

Trading cards will no longer be relegated to memory books and collections stored in albums. Rather, they will be living assets that will become symbols of personal expression, cultural value, and even investment options. The global trading cards market will function at the crossroads of commerce and creativity, where design, scarcity, and emotional value will determine buying decisions as much as financial speculation. The symbolic significance of these cards will render them beyond mere mementos; they will become cultural icons that characterize whole generations.

Since technology will continue to shape consumer experiences, the trading card market will persist beyond their traditional cardboard frames. Digital channels will introduce new opportunities that merge tangible ownership with virtual interaction. Collectors will not only be holding cards in their pockets but also displaying them in engaging virtual galleries, exchanging on blockchain-enabled marketplaces, and verifying their scarcity using sophisticated verification tools. The Global Trading Cards industry will embody how collectibles can connect both the touch satisfaction and digital innovation into a dual experience that appeals to collectors today.

Trading cards in the coming years will also be used as vehicles for storytelling. Sports, entertainment franchises, music, and even corporate identities will employ them as mediums to form greater bonds with audiences. The Global Trading Cards industry will flourish based on narratives, where every card will be more than just a picture. It will have a history, an emotion, and a shared identity that bonds makers and collectors together. By leveraging this narrative power, the business will become a gateway between mainstream culture and individual memory.

There will also be another dimension that will define the business, which is the convergence of passion and investment. Collectors will no longer want only the rarest editions for sentimental value but will also see them as alternative investments with long-term value. The global trading cards market will create a parallel with art and luxury goods, where the demand will be influenced by scarcity, condition, and cultural relevance. This blending of financial and emotional value will make sure that trading cards will not only be bought and sold but also cherished as lasting symbols of taste and vision.

In the end, the global trading cards market will transcend its conventional definition and take on a new era where creativity, technology, and culture will converge. By breaking away from its initial status as a hobby, the industry will establish itself as a high-brow industry that can shape the way individuals collect, invest, and connect with culture on individual and global scales.

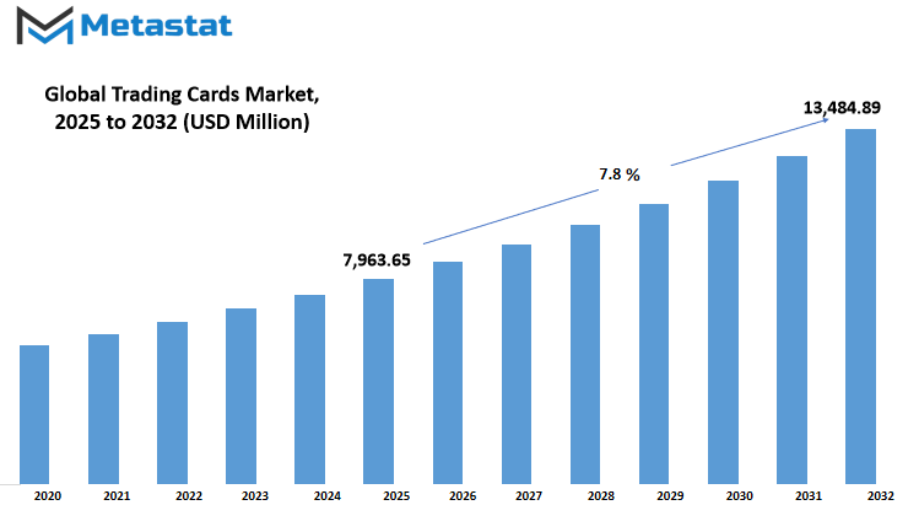

Global trading cards market is estimated to reach $13,484.89 Million by 2032; growing at a CAGR of 7.8% from 2025 to 2032.

GROWTH FACTORS

The global trading cards market has long held a special emotional significance, uniting generations with memories and the excitement of collection. For most enthusiasts, the cards are more than simple printed paper but icons of childhood happiness, friendships, and self-definition. Collectors still experience the same excitement upon ripping open a new pack, looking for that one elusive card that makes them feel linked to their enthusiasm. This sentiment propels steady demand, as trading cards continue to be something more than commodities they are treasured mementos that capture moments in time and tales worth sharing.

Keeping the market active today is not just emotional appeal, but also the magic of shortage and high-value chase cards. The thrill of discovering a sought-after card gives every purchase the thrill of adventure, making routine transactions into memorable events. These limited prints are seen by collectors as gems that will appreciate with the passing of time. This hobby turns trading cards into investments and pastimes, ensuring the global trading cards market remains active and compelling fans to keep purchasing packs hoping to find something special.

However, there are challenges that the industry cannot overlook. Market saturation has decreased the perceived value of common cards, and collectors now have huge stacks with little monetary value. Price volatility also instills uncertainty, and some are deterred from new purchases. In addition to that, spreading counterfeits and the fact that it's miles difficult to verify uncommon reveals have left collectors being extra careful. These obstacles threaten to undermine believe among buyers and dealers, vital for preserving growth. Without stable systems to protect informal collectors and critical traders alike, the agree with that drives the buying and selling card subculture might be misplaced.

In spite of these challenges, fresh possibilities are set to transform the destiny of the Global Trading Cards enterprise. The blending of virtual technology and augmented reality into physical playing cards will provide layers of engagement that pass past mere accumulating. Imagine an extremely-rare card that can be scanned to get admission to unique content or enjoy, and for that reason, is more than a collector's item but additionally the portal to novel leisure. This blend of lifestyle and newness will appeal to more youthful generations at the same time as respecting the emotional and mawkish importance precious by veteran collectors. As the global trading cards market continues to develop, it will discover new methods to bring people together, making trading playing cards a valued staple of famous tradition for future years.

MARKET SEGMENTATION

By Type

The global trading cards market will remain in the spotlight as it moves into digital arenas, combining nostalgia, technology, and new types of value. What was originally a market for physical cards is now moving toward NFT-based categories that provide collectors and enthusiasts new opportunities to interact. These digital assets not only lock in authenticity but create possibilities for interactive experiences previously unimaginable. The shift towards blockchain-backed cards has provided a platform wherein old trading culture comes together with contemporary technology, and that will continue to shape the way individuals perceive collecting in the days to come.

Collectible NFT Trading Cards is one of the biggest segments and carries an estimated value of $809.90 million, illustrating the immense demand for verifiable digital collectibles already present. These cards will appeal to veteran collectors and new entrants alike who desire ownership that cannot be replicated or forged. The digital nature also is that collectors no longer have to contend with restrictions based on physical condition and storage, making the experience more streamlined and accessible. As this market expands, it will continue to mix personal enthusiasm with investment upside, appealing to those who view collectibles as more than a hobby.

Game-based Trading Cards as NFTs will further open up the global trading cards market by bridging entertainment and utility. Unlike being just collectibles that live in protective sleeves, these cards will frequently serve a purpose within digital games, providing utility to their ownership. Players won't just purchase them for their aesthetics but for the things they will unlock within gaming environments. This engagement will enhance loyalty and participation, since users will have emotional as well as practical causes to invest in these cards.

Sports-themed NFT Trading Cards will remain highly appealing to fans who desire stronger relationships with their favorite teams and players. Collectors always have been attracted to sports memorabilia, and NFTs will continue that tradition but in a digital environment. These cards will be meaningful not only as pictures but as portals to unique fan experiences, limited releases, and unique moments in sports history. Entertainment and Celebrity NFT Trading Cards can even flourish as people look for approaches to be able to expose appreciation for public figures. Whether connected to movie stars, celebrities, influencers, or performers, these cards will establish an instantaneous connection among enthusiasts and their idols, making fandom an internet souvenir that is of tolerating private and cultural importance.

Overall, the global trading cards market will preserve to benefit momentum because it will become greater entrenched in virtual formats. Every section collectible, recreation-primarily based, sports, and superstar will add its very own flavor to the marketplace, and every will attraction to a wide kind of hobbies. The range of these categories will maintain the market going sturdy and drawing in groups that extend across generations, cultures, and life, reaffirming the region of buying and selling cards as cultural tokens and digital assets with enduring fee.

By Sales Channel

The global trading cards market will continue to evolve to meet shifting consumer trends and digital opportunities, particularly when considered in the context of sales channels. Online marketplaces and NFT platforms will be at the forefront of this revolution, providing buyers and sellers with instant access to physical and digital cards. These websites will enable consumers from all regions of the globe to connect instantly, which will make it easier to get unique cards or collectible digital editions than ever before. Due to NFTs connecting ownership to blockchain, this pipeline will receive even more prominence among younger collectors who desire both uniqueness and authenticatable distinctness.

Official brand sites and apps will also be a big force in determining the market. Trading card companies will also increasingly utilize their online platforms to retail directly to consumers, cutting out the middlemen and enhancing loyalty. The direct relationship will not only provide purchasers with advance access to new releases but will also enable brands to gain information on consumers' liking to better shape their future strategies. With technological growth, these sites will feature things such as live drops, interactive previews, and special bundles that create anticipation and stimulate repeat buy.

Auction houses and secondary markets will continue to be a necessary component of the trading card market because numerous collectors perceive long-term value in resale. This channel will be an area where rare cards ongoingly draw competitive bidding, both in conventional auction format and by virtual means. Transparency, grading criteria, and safe transactions will be even more vital since purchasers want assurance prior to the expenditure of large sums. As more prominent sales become public, these auctions will keep establishing standards for the way the rest of the global trading cards market views value.

Alternative sales channels, such as in-game shops and virtual marketplaces, will introduce new degrees of access. These venues will blur the line between collecting and entertainment, enabling users to buy cards while they are playing or engaging in digital worlds. These sites will be attractive to casual gamers who seek instant and thrilling means to engage without entering structured auctions or company websites. All together, these various channels of sale will create a market that combines tradition and innovation, presenting collectors with various ways to find, own, and exchange cards that suit their individual interests.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$7,963.65 million |

|

Market Size by 2032 |

$13,484.89 Million |

|

Growth Rate from 2025 to 2032 |

7.8% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

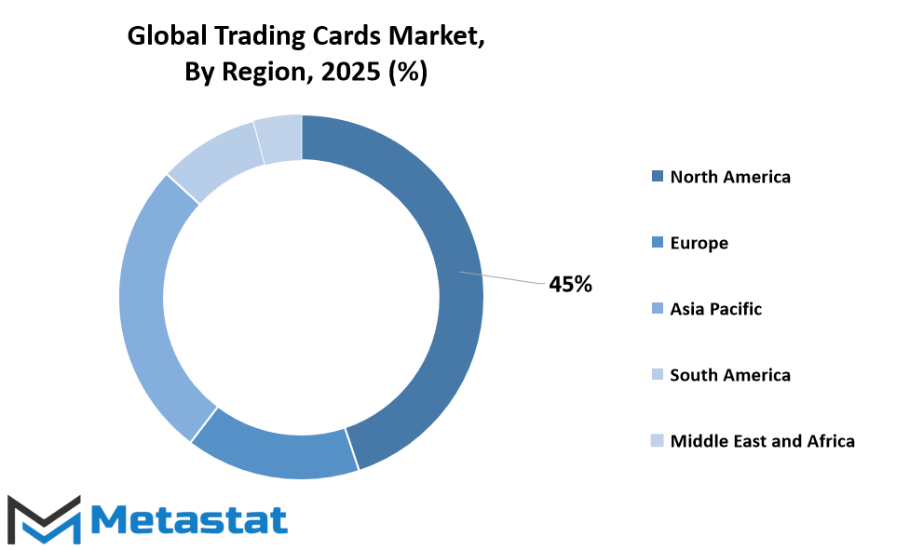

The global trading cards market has grown into a commercial and cultural phenomenon with presence in several regions. In North America, the market has been influenced for years by the United States, Canada, and Mexico, and in these countries, card collecting will continue to be a strong pastime and investment. The United States will be particularly dominant, assisted by robust brand awareness and a large collector base. Canada and Mexico will also experience growing participation, with on-line platforms and local activities contributing to expanded viewership for buying and selling playing cards.

Europe gives a multicultural surroundings for the buying and selling card marketplace, with the United Kingdom, Germany, France, and Italy taking the lead. All those international locations may have their own customer conduct and collecting traditions, preserving the global trading cards market vibrant and diverse. The UK will remain specific with its love for sports card gathering, whilst Germany and France will experience boom with amusement and gaming collections. Italy, like the relaxation of Europe, will be fostered via cross-border partnerships and on line marketplaces that connect creditors at some stage in the continent.

Asia-Pacific is the most promising place with the likes of India, China, Japan, and South Korea at the leading edge. Japan will be in good stead with a precedent set in collectible card games, while China will see increased demand fueled by its growing youth population and pop culture enthusiasm. India and South Korea will contribute with their increasing digital communities and an increasing interest in both traditional and contemporary card formats. The remainder of the Asia-Pacific will spread steadily as knowledge grows and trading cards are made more easily available through online channels.

South America and Middle East & Africa will also be important contributors to the future of the trading cards market. Brazil and Argentina will continue to feature prominently in South America, as fans and collectors target both local and global brands. In the Middle East & Africa, GCC Countries, Egypt, and South Africa will serve as focal points, where rising disposable incomes and an emerging youthful population will drive increased adoption of trading cards. The remainder of these markets will gradually gain momentum as international businesses expand their influence and domestic demand starts to increase.

Combined, these markets create a web that will chart the course of the Global Trading Cards industry. The blending of cultural interest, online access, and regional passion will see that the industry develops in discrete but integrated manners, providing collectors and creators opportunities that transcend borders.

COMPETITIVE PLAYERS

The global trading cards market has reached an era in which digitalization is transforming how collectors and investors previously perceived a hobby activity. What was largely about physical cards kept in albums or boxes is increasingly being substituted or complemented by blockchain platforms and digital collectibles that are traded globally. It has led to a new format wherein rarity, authenticity, and ownership are authenticated by technology, enabling individuals to engage with their beloved games, sports, and pop culture moments in ways previously unimaginable. The market will now not just remain restricted to nostalgic trades but will instead move towards digital-first formats that build new experiences both for old-time fans and newcomers alike.

The involvement of world gamers has been instrumental in structuring this marketplace. Businesses like NBA Top Shot by Dapper Labs, SoRare, and Topps Digital have redefined the way lovers have interaction with collectibles by means of combining the emotional resonance of sports activities with steady virtual possession. Each of these structures offers marketplaces that function as nodes of trade, permitting creditors to without problems purchase, promote, and show their property. Moreover, businesses consisting of VeeFriends and Candy Digital are exploring methods to attach storytelling and community constructing with collectibles, making buying and selling playing cards something a lot extra than what appears on paper. Each of them is adding to a growing ecosystem that will most probably establish the standard for the next generation of digital collectibles.

The global trading cards market will also bear witness to the influence of blockchain gaming. Firms like Gods Unchained, Spells of Genesis, and Axie Infinity have led the way in a framework where trading cards are not only collectibles but work as functional tools in interactive games. Here, ownership transcends show value and enters into functional gameplay, where the value of a card can change depending on demand, availability, or performance in game. The launch of games such as Force of Will, Ether Legends, and Mythical Games guarantees the global trading cards market will continue to be richly diverse, offering competitive gaming, fantasy-themed cards, and even cross-vertical tie-ins that attract broad demographics.

As the evolution continues, the Global Trading Cards industry will be a mix of tradition and innovation. While established brands such as Topps Digital maintain ties to physical trading card culture, others like Immutable X, Ethernity Chain, Terra Virtua, and FanCraze are making inroads into environmentally friendly solutions and collaborations that bring celebrities, athletes, and entertainment legends directly into the collectibles domain. Rare Pepe, Curio Cards, and ZED RUN further highlight how the nature of a trading card is increasingly moving out of traditional forms, where value is determined by creativity and community-driven demand. This combination of nostalgia and new technology indicates that not only will the global trading cards market survive but prosper too, evolving to meet changed expectations yet maintaining the enthusiasm for collecting.

Trading Cards Market Key Segments:

By Type

- Collectible NFT Trading Cards

- Game-based NFT Trading Cards

- Sports-themed NFT Trading Cards

- Entertainment & Celebrity NFT Trading Cards

By Sales Channel

- Online Marketplaces & NFT Platforms

- Official Brand Websites & Apps

- Auction Houses & Secondary Markets

- Others (In-Game Stores, Virtual Marketplaces, etc.)

Key Global Trading Cards Industry Players

- Age of Chains

- Axie Infinity

- Blockchain Cuties Universe

- Candy Digital

- Crypto Strikers

- Curio Cards

- Ether Legends

- Ethernity Chain

- FanCraze

- Force of Will

- Gods Unchained

- Immutable X

- Mythical Games

- NBA Top Shot (Dapper Labs)

- OpenSea

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383