MARKET OVERVIEW

The Global Tax Management market, a dynamic landscape within the financial domain, plays a crucial role in shaping the fiscal strategies of corporations worldwide. This market, a complex ecosystem in constant flux, revolves around the efficient handling and optimization of tax-related processes for businesses of varying scales and industries. It serves as a linchpin in the broader economic spectrum, where regulations and compliance intricacies demand a nuanced approach to tax management.

The Global Tax Management market encapsulates a spectrum of services and solutions designed to navigate the labyrinth of tax codes and frameworks. Tax management, once a straightforward task, has metamorphosed into a sophisticated practice owing to the ever-evolving global financial scenario. Companies, irrespective of their scale, find themselves entangled in a web of diverse tax regulations and reporting requirements, necessitating the adoption of robust tax management solutions.

The market thrives on providing tools and technologies that streamline tax compliance processes, offering businesses the agility required to navigate through the intricate web of global tax laws. It encompasses software solutions designed to automate tax calculations, ensuring accuracy while minimizing the risk of errors. Additionally, consultancy services form a pivotal aspect of the Global Tax Management market, wherein seasoned professionals guide businesses in devising tax strategies that align with the latest regulatory changes and international standards.

One of the notable facets of the Global Tax Management market is its responsiveness to the unique needs of various industries. Different sectors face distinct tax challenges, and the market caters to this diversity by offering specialized solutions tailored to specific industry requirements. This bespoke approach enhances the market’s relevance as it addresses the idiosyncrasies of sectors ranging from technology to manufacturing, providing nuanced solutions that go beyond a one-size-fits-all model.

The market's significance is further accentuated by the increasing cross-border activities of corporations. As businesses expand their operations globally, they encounter a myriad of tax implications stemming from diverse jurisdictions. The Global Tax Management market steps in as a strategic partner, aiding companies in navigating the intricate landscape of international taxation. It facilitates cross-border compliance, helping businesses stay abreast of tax obligations across multiple countries, thereby mitigating risks and ensuring regulatory adherence.

The Global Tax Management market emerges as a critical enabler in the contemporary financial milieu, where businesses grapple with the complexities of global taxation. By offering tailored solutions, both in terms of software and consultancy services, it empowers companies to navigate the intricate web of tax regulations with finesse. As the global economic landscape continues to evolve, the role of the Global Tax Management market is poised to become even more pronounced, shaping the fiscal strategies of businesses in an era where adaptability and precision are paramount.

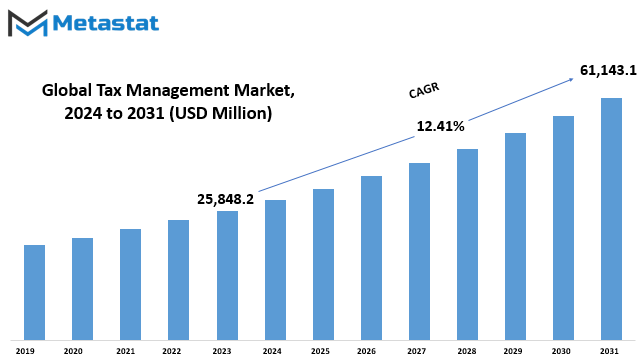

Global Tax Management market is estimated to reach $61,143.1 Million by 2030; growing at a CAGR of 12.41% from 2023 to 2030.

GROWTH FACTORS

The global Tax Management market experiences growth driven by key factors. These factors play a crucial role in shaping the market landscape. However, challenges also exist that could potentially hinder the market's growth trajectory. It's important to consider both sides of the equation to gain a comprehensive understanding.

Growth factors are instrumental in propelling the Tax Management market forward. These catalysts contribute significantly to the positive momentum witnessed in the industry. Understanding and harnessing these factors are pivotal for market participants aiming to navigate the competitive landscape successfully.

On the flip side, challenges pose potential obstacles to the market's growth. It's essential to acknowledge and address these hurdles to ensure sustainable development. Identifying potential pitfalls allows stakeholders to adopt proactive measures, mitigating adverse impacts and fostering resilience in the face of challenges.

Despite challenges, the market holds promise for the future. Opportunities are anticipated to emerge, providing a silver lining amid potential difficulties. Recognizing and capitalizing on these opportunities will be crucial for businesses and investors seeking to capitalize on the Tax Management market's growth potential in the coming years.

The global Tax Management market is influenced by a dynamic interplay of growth factors and challenges. Navigating this landscape requires a balanced approach, acknowledging both the positive drivers and potential hindrances. By doing so, stakeholders can position themselves strategically to not only overcome challenges but also leverage emerging opportunities for sustained success in the ever-evolving market.

MARKET SEGMENTATION

By Type

In today’s dynamic business landscape, the global Tax Management market plays a pivotal role in ensuring financial compliance and efficiency for organizations worldwide. The Software segment, valued at 13744.2 USD Million in 2019, forms a crucial technological backbone for tax-related processes. These software solutions empower businesses to streamline their tax management, providing tools that facilitate accurate calculations, reporting, and compliance. This digital infrastructure proves essential in navigating the complexities of tax regulations and staying abreast of changes in the fiscal landscape.

Complementing the software aspect, the Services segment, valued at 1905.4 USD Million in 2019, offers a human touch to tax management. These services encompass a spectrum of expertise, including consulting, advisory, and support. Professionals in this field bring their experience and insights to assist organizations in navigating the intricacies of tax codes, ensuring compliance, and optimizing financial strategies.

Together, the Software and Services components form a symbiotic relationship within the global Tax Management market. While software provides the technological foundation for efficient tax processes, services bring the human expertise necessary to interpret and implement these solutions effectively. This dual approach reflects the market’s acknowledgment of the importance of both technological tools and human insight in achieving comprehensive tax management solutions.

The global Tax Management market, with its distinct Software and Services segments, stands as a crucial player in the contemporary business landscape. It exemplifies the synergy between technology and human expertise, recognizing that effective tax management requires a harmonious blend of digital solutions and professional insight to navigate the ever-changing terrain of financial regulations.

By Application

In the vast arena of the global tax management market, its various applications play a pivotal role in shaping its dynamics. This market is segmented based on applications, specifically into indirect tax and direct tax.

Indirect tax, within this context, refers to taxes imposed on goods and services rather than on income or profits. It encompasses a broad spectrum of taxes, such as value-added tax (VAT) and goods and services tax (GST). These taxes are usually passed on to the end consumer through the pricing of goods and services.

On the other hand, direct tax involves the taxation of individuals and businesses on their income and profits. This category includes taxes like income tax and corporate tax, where the tax liability is directly levied on the income earned by individuals or entities.

These applications are significant in their distinct nature and impact on businesses and individuals. Indirect tax, by virtue of being embedded in the cost of goods and services, influences consumer behavior and purchasing decisions. Businesses must navigate the complexities of indirect tax structures to ensure compliance and competitive pricing strategies.

In contrast, direct tax has a more direct impact on personal and corporate financial landscapes. Individuals are obliged to report their income and pay taxes accordingly, while companies must navigate a web of regulations to fulfill their tax obligations. The interplay between direct tax and economic activities is intricate, shaping investment decisions and financial planning.

Understanding the nuances of these tax applications is crucial for stakeholders in the global tax management market. Businesses, policymakers, and individuals alike must adapt to the evolving landscape of tax regulations, ensuring compliance and navigating the challenges posed by both indirect and direct taxes. The effectiveness of tax management strategies ultimately hinges on a comprehensive grasp of these application-specific dynamics within the broader global tax management market.

By Organization Size

In the expansive landscape of the global Tax Management market, we find segmentation based on the size of organizations. Within this market, organizations are categorized according to their size, acknowledging the distinct needs and approaches that vary between SMEs and Large Enterprises. This categorization provides a nuanced perspective on how different entities navigate the complex landscape of tax management.

Small and Medium-sized Enterprises, often abbreviated as SMEs, represent a significant portion of businesses globally. These enterprises, characterized by their relatively moderate scale, face distinct challenges and opportunities in managing their taxes. Their operational dynamics and financial structures often differ from larger counterparts, influencing their tax management strategies.

On the other hand, Large Enterprises, encompassing organizations with substantial scale and resources, operate in a different echelon. The challenges they encounter in tax management may be influenced by the intricacies of their extensive operations and financial frameworks. Large Enterprises often grapple with complex tax structures, compliance requirements, and global considerations, necessitating a tailored approach to tax management.

Understanding the differentiation based on organization size is crucial for stakeholders in the Tax Management market. It enables providers of tax management solutions to tailor their offerings to meet the specific needs of SMEs and Large Enterprises alike. This market segmentation recognizes the diversity in the business landscape, acknowledging that a one-size-fits-all approach is inadequate in addressing the varied tax management requirements across different organizational sizes.

The global Tax Management market, when viewed through the lens of organization size, reveals a nuanced landscape with distinct considerations for Small and Medium-sized Enterprises as well as Large Enterprises. This segmentation serves as a practical framework for stakeholders to navigate the diverse challenges and opportunities inherent in the dynamic field of tax management.

By Industry Vertical

Effective communication is paramount in conveying ideas and information. When revising a document, it is crucial to ensure that the content flows smoothly without the use of complex language. By simplifying the text, the writer can engage the reader more effectively.

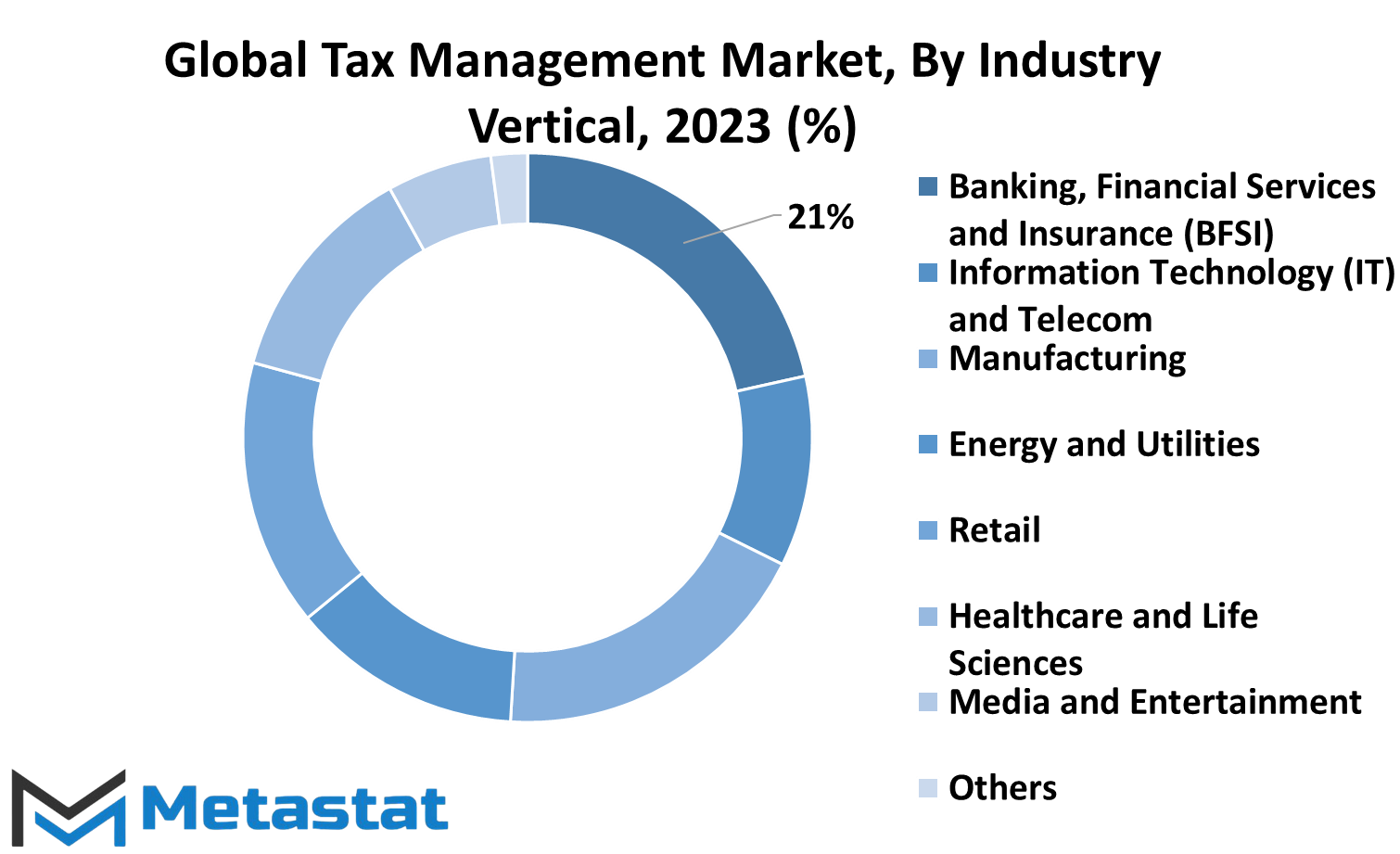

One area that often benefits from revision is the description of the global Tax Management market. When categorizing the market by Industry Vertical, it is commonly segmented into sectors such as Banking, Financial Services and Insurance (BFSI), Information Technology (IT) and Telecom, Manufacturing, Energy and Utilities, Retail, Healthcare and Life Sciences, Media and Entertainment, and Others. This categorization allows for a clearer understanding of the market’s scope and target audience.

Reducing repetition is another key aspect of refining a document. Repeating information can dilute the impact of the message. Therefore, careful consideration should be given to identifying and eliminating redundant phrases or concepts. This ensures that the document remains concise and focused, preventing the reader from becoming overwhelmed with unnecessary details.

In addition, the use of overly formal language should be avoided. Document writing is most effective when it adopts a conversational tone that resonates with the intended audience. By doing so, the writer establishes a connection with the reader, making the content more accessible and relatable.

Maintaining the original meaning of the text is paramount during the revision process. Substituting words or phrases should not alter the intended message. Instead, it should enhance clarity and understanding. For instance, replacing complex terminology with simpler alternatives aids in conveying information without sacrificing comprehension.

Attention should be given to the preservation of markdown formatting. Headers, bullets, and checkboxes serve as organizational tools, contributing to the document’s structure. Any modifications made during the revision process should respect these elements to ensure the document’s overall coherence.

The revision of a document involves enhancing clarity and readability. This can be achieved by simplifying language, eliminating repetition, adopting a conversational tone, preserving the original meaning, and respecting markdown formatting. By adhering to these principles, a writer can effectively convey their message to the audience, promoting better understanding and engagement.

REGIONAL ANALYSIS

In the context of global tax management, the market is segmented based on geographical regions, including North America, Europe, and Asia-Pacific. This division allows us to analyze and understand the dynamics of tax management within distinct global regions.

The global tax management market includes various strategies and tools aimed at efficiently handling taxation processes. These strategies play a crucial role in ensuring compliance with tax regulations and optimizing financial operations for businesses worldwide.

Within North America, Europe, and Asia-Pacific, businesses navigate the complexities of tax management to meet regulatory requirements specific to each region. This regional differentiation influences the strategies adopted by enterprises, considering the unique tax landscapes they encounter.

North America, being a significant player in the global economic landscape, witnesses diverse tax challenges that companies must address. Europe, with its varied tax systems across countries, presents a distinct set of considerations for effective tax management. Meanwhile, Asia-Pacific, with its rapidly growing economies, requires businesses to adapt to evolving tax regulations for sustained success.

Understanding the nuances of tax management in each geographical segment is imperative for businesses aiming to operate seamlessly in a globalized economy. It involves staying abreast of region-specific tax laws, compliance standards, and market trends to tailor effective tax strategies accordingly.

The global tax management market's geographical segmentation into North America, Europe, and Asia-Pacific reflects the need for businesses to navigate diverse tax landscapes. This approach allows enterprises to implement targeted strategies, ensuring compliance and efficiency in their financial operations across different regions.

COMPETITIVE PLAYERS

The global market for Tax Management sees active participation from various key players who contribute significantly to the industry's dynamics. Among these players are well-known names such as Avalara, ADP, Intuit, Thomson Reuters, Wolters Kluwer, Blucora, H&R Block, SAP, Sovos, Vertex, Canopy Tax, DAVO Technologies, Defmacro Software, Drake Software, Sailotech, Taxback International, TaxJar, TaxSlayer, and Xero.

These entities play a crucial role in shaping the landscape of Tax Management, each bringing its unique strengths and offerings to the table. Avalara, for instance, is recognized for its expertise in cloud-based tax compliance solutions, while ADP specializes in providing comprehensive payroll services. Intuit is known for its user-friendly accounting and tax software, and Thomson Reuters is a key player in providing tax and accounting solutions globally.

Wolters Kluwer, Blucora, and H&R Block contribute to the market with their diverse range of tax and financial services, catering to the needs of businesses and individuals alike. SAP, a global software giant, extends its influence into the Tax Management sector with integrated solutions. Sovos focuses on tax compliance and reporting software, and Vertex is a notable player in tax technology, offering solutions for various industries.

Canopy Tax, DAVO Technologies, Defmacro Software, and Drake Software are among the innovative contributors, each specializing in different aspects of tax management software. Sailotech, Taxback International, TaxJar, and TaxSlayer also bring their unique perspectives and solutions to the competitive landscape. Xero, with its emphasis on cloud-based accounting, is another player making its mark in the Tax Management market.

The interplay between these competitive players creates a dynamic environment where innovation, efficiency, and client-focused solutions drive the industry forward. As businesses and individuals navigate the complexities of taxation, the diverse offerings from these key players play a vital role in shaping the present and future of the Tax Management market.

Tax Management Market Key Segments:

By Type

- Software

- Services

By Application

- Indirect Tax

- Direct Tax

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- Banking, Financial Services and Insurance (BFSI)

- Information Technology (IT) and Telecom

- Manufacturing

- Energy and Utilities

- Retail

- Healthcare and Life Sciences

- Media and Entertainment

- Others

Global Tax Management Industry Players

- Avalara

- ADP

- Intuit

- Thomson Reuters

- Wolters Kluwer

- Blucora

- H&R Block

- SAP

- Sovos

- Vertex

- Canopy Tax

- DAVO Technologies

- Defmacro Software

- Drake Software

- Sailotech

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252