MARKET OVERVIEW

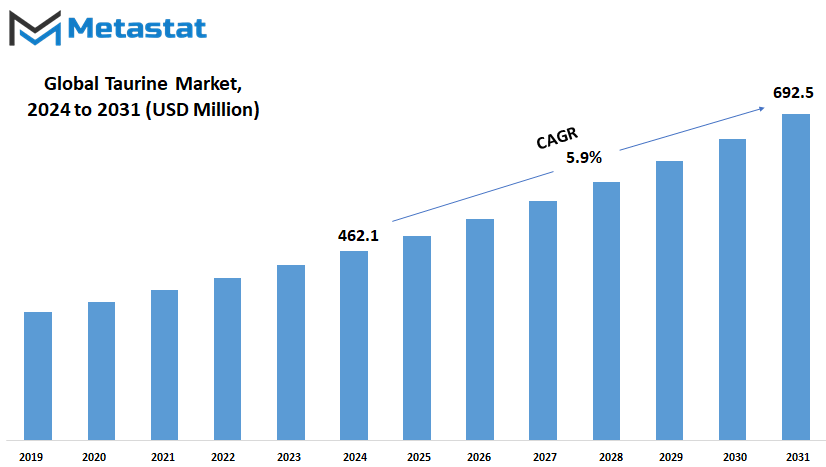

Global Taurine market is estimated to reach $692.5 Million by 2031; growing at a CAGR of 5.9% from 2024 to 2031.

The Global Taurine market is a niche segment of the nutritional supplement and food additive industry, driven by increasing awareness of the multiple benefits of taurine. Contributing to energy metabolism, cognitive health, and athletic performance, taurine has attracted interest in the food and beverage, pharmaceutical, animal feed, and personal care industries. With the significant role of taurine in biological function, usage around the globe is on an increasing rise, with resultant influence upon the range of market space. In consequence, it has been observed that this Global Taurine market becomes a strategic segment for investment for various interested stakeholders interested in developing and applying its therapeutic as well as functional uses.

Applications for which the market of Global Taurine encompasses diverse kinds of activities but are dominantly directed to health and wellness besides veterinary nutrition. Taurine, due to its special characteristics, is an ingredient for energy drinks and supplements in the support of energy and focus, particularly for athletes and sports enthusiasts. It continues to have high demand currently because it has seen a growing trend of consumption in food and beverages targeted for health-conscious consumers. Cellular functionality enables taurine in treatments of conditions such as heart diseases, diabetes, and nervous system diseases as the pharma company expands into bigger areas, allowing the scope of a large market range.

It must be noted that growth regarding taurine can develop new fields of markets opening up the areas which relate to lifestyle awareness by many people through healthy conditions about emerging economy areas where conscious health matters are found at an on-growing interest basis. Increased production capabilities will be developed to satisfy all such demands for Global Taurine market. Sustainability will be an important trend in the manufacturing process that will innovate for taurine. Pharmaceutical-grade taurine will, no doubt, garner a market share Due to its inherent purity, as areas remain focused on the advancement and better therapeutic applications in these regions. As research and development activities go forward, the demand for high-quality taurine is expected to increase with an evolving landscape of product innovation and market expansion.

Taurine is also crucial in animal nutrition, especially in cat and dog food formulations, as it supports essential bodily functions in animals. The pet food industry is, therefore a significant aspect of the Global Taurine market as pet owners prioritize quality nutrition for companion animals. This demand will force animal feed companies to look for taurine as a renewable additive especially with the regulatory bodies beginning to focus more on welfare aspects of animals. Adding taurine to feeds of livestock will also surge because of its health-giving effects to farm animals in that it boosts the productivity and general well-being of the animals, and mostly demanded in high end markets.

Taurine is also used as cosmetic because it hydrates the skin and rejuvenates. This taurine-based formulations are being used by skincare brands to appeal to consumers who look for hydration, resilience, and efficacy in a skincare regimen. As the personal care industry focuses more on ingredients which bring in functionalities, taurine managed to get a place for itself. For the next couple of years ahead, the taurine market worldwide would continue to play its roles in personal care formulation as consumers search for natural yet effective skin care solutions.

The global taurine market, in total, is likely to alter with new applications, research findings, and consumer preferences changing its course. Thus, manufacturers and suppliers in different regions would engage in strategic partnerships; explore new technologies, refine production procedures in order to abide by regulation standards and the expectations of consumers. Thus, the Global Taurine market not only sustains its relevance but also stands out as a flexible and promising market segment that would continue to expand in numerous fields. The more recognition taurine’s functional and therapeutic potential receives, the more expansive the market’s scope is likely to be, with untapped opportunities opening in health, wellness, veterinary care, and beyond.

GROWTH FACTORS

The global taurine market, therefore, offers a promising trend for the coming years ahead. While taurine continues to gain momentum across multi-sectors, its utility in health, wellness, and nutrition is diversifying even further. This demand mainly grows because of the contribution of taurine, associated with increased energy-boosting product and dietary supplement uses, together with functional foods and beverages. Another driver in the market is raised health awareness all over the world, where people look for ingredients with more value additions than mere nutrition. Taurine, therefore, finds massive attractiveness both to manufacturers and consumers as it is an additive to augment cognitive functions and athletic and cardiovascular performance.

Expansion of interest in personal health and fitness is a significant growth factor in the taurine market. With more individuals being keen on keeping an active and healthy lifestyle, interest in this area has also picked up, with taurine commonly being part of energy drinks, sports supplements, and recovery products, thus supporting the fitness-conscious consumer trend. In addition, the vegan and plant-based movement is a positive factor for market growth, as it seeks synthetic or plant-based sources of taurine from manufacturers.

However, despite the good trends, there are several issues that may influence the expansion of the market. For example, the high cost, such as that related to taurine production, may restrain the growth of the market, especially for small-scale manufacturers. In addition, regulations on the use of taurine in food and beverages vary greatly from one country to another, which is challenging for the market expansion in a particular region. In some countries, strict rules and guidelines have been set for the level of taurine allowed in food and beverage products, and this slows its adaptation in most areas.

Going forward, technological innovation in taurine production is likely to generate new opportunities. Innovations in synthesis techniques and extraction processes would reduce the production cost. It would make taurine cheaper and more accessible to manufacturers in different industries. Additionally, as new potential health benefits of taurine are discovered, the medical and pharmaceutical sectors will probably need more of it. This may lead the way to new applications as, for example, it could be used in psychotonic applications, because research on taurine's hypothesized effects with respect to stress-reduction and mood enhancement is now interesting.

Overall, the global taurine market is expected to grow steadily as consumer health-conscious choices drive demand for functional ingredients. With new developments in production and deeper understanding of the benefits that taurine can bring, the market holds significant potential for future expansion. Challenges still exist, but they will be addressed as the industry adapts to consumer needs and regulatory landscapes.

MARKET SEGMENTATION

By Grade

A growth in the taurine global market is expected in the coming years due to a growing requirement in the food, animal feed, and pharmaceutical sectors. Taurine is an amino acid that occurs in the body of humans and animals and is used extensively due to its beneficial properties-supporting cardiovascular health, improving athletic performance, and enhancing cognitive function. The more applications of taurine in various industries show the importance of the ingredient, which is of high value and utility to different markets.

The most significant use of taurine in the food and beverage market is in energy drinks and dietary supplements. Ingredients in this category are highly valued for their potential to boost energy and support muscle recovery, which is expected to spur health-conscious consumers’ demand for supportive physical and mental wellness. Taurine, particularly in the food grade, finds relevance in applications as firms design to supply good quality ingredients that fulfill safety requirements as well as consumer desires for effective and reliable products. Due to the global trend of living healthier lifestyles, food-grade taurine would most probably become one of the essential elements in new products like fortified foods and drinks that offer better health benefits.

Animal feed is an area where taurine demand is increasing. Taurine is necessary for specific species, such as cats and fish, which cannot synthesize it and must obtain this through their diet. Through the feed-grade segment, taurine acts as a vital additive that boosts animal health, thereby developing better growth and overall life. As the animal feed industry grows, especially in developing countries, the application of taurine in livestock and pet food will increase. Innovations in feed formulations will be triggered by growth, and taurine will become an essential nutrient in improving nutrition and productivity in the sector.

Research also uncovers more of its therapeutic potential, making pharmaceutical grade taurine popular. Research studies have shown that taurine may be of therapeutic help to patients suffering from diseases such as cardiovascular diseases, diabetes, and neurological disorders. Therefore, interest is mounting in the addition of taurine in new drugs and supplements for both prevention and symptom management. Pharmaceutical-grade taurine is likely to have a higher investment and innovation rate; thus, the many patients will eventually be treated properly and effectively.

The global taurine market is expected to grow across sectors of food, feed, and pharmaceuticals. With advancing scientific knowledge and thereby consumer interest in taurine’s benefits, the market will continue to grow with new applications, improved formulations, and wider availability. This forward momentum shows a promising future for taurine as a versatile, in-demand ingredient across industries.

By Form

The global taurine market is expected to grow steadily over the coming years; its importance will increase as more applications and product forms continue to develop. Taurine is an amino acid-like compound whose potential health benefits and diverse applications have made it increasingly valuable across industries. As both consumers and manufacturers become more health-conscious, a significant rise in taurine’s role in dietary supplement and functional beverages has emerged. Also, with increasing research that establishes its health benefits and well-being for the body, demand is likely to increase even further.

Taurine market can be broadly segmented into three: tablet form, liquid-based serums, and other forms. Tablets had been a favorite since they have been very convenient in terms of consumption. Tablets are especially used much in dietary supplements, specially with the quantified measurement is a need for these end-users of dietary supplements, in this case, people desirous of measurable, or even measurable intake levels when consuming dietary supplements. It follows that such a usage type is bound to mirror these overall trends even when consumed by the markets of other places of the world.

The growing trend, on the other hand, is liquid-based serum. Serums became trendy because they get absorbed quite rapidly, making it perfect for those who require fast effects. Most companies of energy drinks and manufacturers of functional beverages included taurine-based liquids in their products as the latter was known as a cognitive enhancer and energizer. Faster-acting supplements and innovation in the beverage market are expected to fuel the demand for liquid taurine preparations.

Apart from its tablets and serums, taurine is also available in powdered additives and custom formulations to be added to animal feed and personal care products. Its veterinary and skincare applications are slowly opening up new markets for the less familiar forms of taurine. Each of these will meet the specific demand of its respective industry-from supplementing animal health to enriching skincare products. With increased interest in the versatility of taurine, applications will increase even more with the growing exploration of companies on new methods of integrating it in a wide array of industries.

Technological development and research may also contribute to increasing the use of taurine in the future. The demand for natural ingredients and performance-enhancing additives is expected to remain high and push taurine into an increased number of products. Now at the threshold of major expansion, new benefits that could potentially unfold as being developed and validated mark the future of the international market for taurine. This likely growth aligns with a growing level of consumer awareness of the trend and manufacturers who are willing to innovate in response to demands as they evolve. Taurine will be applied in the form of tablets, serums, and other applications as the global health-conscious population changes its preferences.

By End-use

The global market of taurine will surely experience significant growth over the next few years as it turns out to be the one organic compound which would progressively become more and more required in various industries. Though primarily obtained from animals, taurine can be synthesized synthetically too and has gained immense interest, mainly because of the several applications it serves in wide biological processes. Its important role in many biological activities encompasses supporting cardiovascular function, enhanced athletic performance, and improving general well-being. All these benefits are driving further demand for taurine in various industries, primarily dietary supplements, food and beverages, animal feed, and pharmaceuticals. All these factors will likely propel its market.

In the dietary supplement segment, taurine is gaining popularity because of the health benefits attributed to it, such as better energy and concentration and its role as an antioxidant. As more individuals include dietary supplements in the pursuit of health, taurine will probably find its way into these products. More consumers are now interested in healthy fitness and active lifestyles, with taurine widely added to pre- and post-workout formulas, further increasing demand. The trend will probably continue as the world focuses on health, with more and more turning to supplements that contribute to bodily and mental well-being.

Taurine is the most added ingredient in energy drinks and fortified foods in the food and beverage industry. With consumers preferring functional foods and beverages that go beyond basic nutrition, taurine is one of the most sought-after ingredients by health-conscious consumers. Manufacturers of energy drinks rely on taurine for the upgrading of their products. Given these beverages’ continued popularity with the masses, particularly young adults, it is expected that the taurine market for this category will also blossom.

Another significant application of taurine is in animal feed. It is included in most pet foods, mainly for cats, as they require it as an essential nutrient. With increasing pet ownership, along with growing concern for the nutritional value of the pet food consumed, demand from animal feed, especially enriched taurine, is expected to increase.

Applications of taurine are increasing in the pharmaceutical arena, and various research studies have brought to light many potential therapeutic uses. Most health conditions can be treated, and its antioxidants and anti-inflammatory properties add it to the list of medicinal uses. Further scientific expertise in taurine could make it a very important commodity in pharmaceutical products.

The global taurine market is expected to increase significantly in the future as the applications are broad, and consumers are interested in these products in many sectors. Focusing on health, performance, and well-being, taurine will probably be an important constituent of many products around the globe.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$462.1 Million |

|

Market Size by 2031 |

$692.5 Million |

|

Growth Rate from 2024 to 2031 |

5.9% |

|

Base Year |

2022 |

|

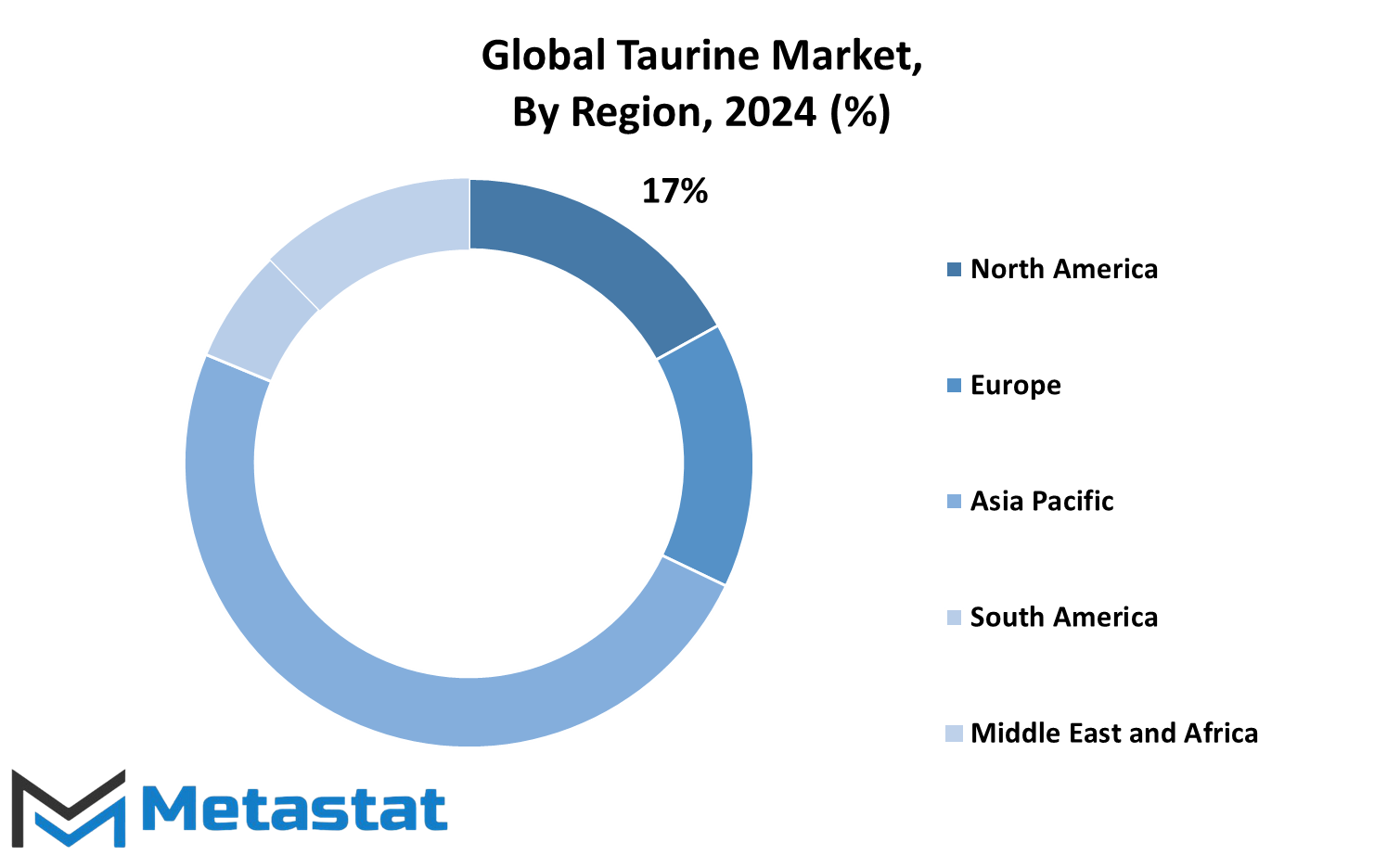

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global taurine market, segmented by region, consists of various factors in the North American, European, Asia-Pacific, South America, and Middle East & African regions. Each region portrays different dynamics that affect production, consumption, and its market trends. For example, demand for taurine is relatively high in the United States, Canada, and Mexico. Applications for taurine range from energy drinks, to pet food, and more so, in the nutritional supplements industry, with its uses expected to increase due to more health-conscious consumers embracing wellness. Further, North American well-established infrastructure supports production as well as distribution and supports reliable supply chain in taurine which also makes more accessible for manufacturers and end-users as well.

Countries in Europe such as the UK, Germany, France and Italy are experiencing growth in its demand slowly but steadily in taurine. Strict regulation in Europe and focus on health standards ensure that products containing taurine offer a high level of safety and quality, which meets the health-conscious consumer and provides credibility to markets. Demand for new supplements, functional beverages, and regions embracing clean labeling and transparency regarding product ingredients also should drive use of taurine.

The Asia-Pacific region is going to be a hotbed of the taurine market, with major markets from China, India, Japan, and South Korea. Such growth can be attributed to a combination of rising disposable incomes, expanding urbanization, and a growing interest in health and wellness. China and Japan demand the highest amount of energy drinks and dietary supplements where taurine's benefits are well recognized. The region is also marked by manufacturing capacity, wherein China plays an important role in taurine production. The middle class and awareness about the product of the Asia-Pacific region in terms of fitness and wellness products are making the market surge ahead.

In South America, especially in Brazil and Argentina, the taurine market has been in the emerging stage for long and promises stability as consumers gain more awareness about dietary supplements. The long-run prospects for taurine will be supported by better economic development and gradual moving toward healthier lifestyles in the regions. In the Middle East & Africa, the market scope is expanding with the momentum of countries like the GCC nations, Egypt, and South Africa. As these places are investing in infrastructure as well as healthcare, using taurine in dietary supplements and functional beverages would find its way into mass consumption.

Overall, each region presents different opportunities that will contribute to the dynamic landscape of the global taurine market. As demand for health-related products grows across the globe, taurine is expected to find greater application in supplements, beverages, and pet food in all these diverse geographical markets.

COMPETITIVE PLAYERS

Global Taurine market has been witnessing the robust growth for the last several years and will continue throughout the forecast period, majorly due to the increasing health-consciousness through advantages of taurine, and the wide scope of the application range. An amino acid abundantly occurring in energy drinks, dietary supplements, animal foodstuff, and baby formulas, taurine is useful for enhancing the health and well-being of the heart, brain, and athletics. The demand for taurine is on the rise with shifting consumer preferences toward functional foods and beverages and the expanding health and wellness industry. Increasingly, companies are now investing heavily in research and development to find innovative ways of incorporating taurine into more products, thereby improving its bioavailability and effectiveness for consumers.

A strong inclination to competition of the contestants is seen looking forward toward the future of the global taurine market in order to preserve their ground: Qianjiang Yongan Pharmaceutical Co., Ltd.; Grand Pharma (China) Co., Ltd.; Jiangyin Huachang Food Additive Co., Ltd.; Molekula Group. They have been investing in production capacity and supply chain optimization. This is trying to capture the rapidly growing global market for taurine. The entry of new players like Avanscure LifeSciences Pvt. Ltd, Honjo Chemical Corporation, and Kyowa Hakko Bio is into the scene each one having a differentiated approach to the market as well as products and thus enlivening the industry scenario.

More and more companies are even coming up with synthetic and vegan-friendly taurine alternatives due to the increased rise in plant-based diets, preference for natural and sustainable ingredients, and so on. Innovation in production will surely lead to more sustainable ways of taurine production. These trends focus more on green and ethical sourcing, especially nowadays; most companies are focusing the practice to meet the environment. This is a critical fact to be played within competition in the future market.

Another trend in the Global Taurine market is integration of advanced technologies, artificial intelligence, and data analytics to understand consumer behavior more effectively and optimize production. For example, predictive analytics can help companies predict a shift in the market, which can help them prepare their strategies accordingly. As a result, they would be able to respond swiftly to changing demands and preferences. Emerging technologies are bound to play a crucial role in shaping the industry with better product development, quality control, and distribution efficiency.

Established firms and new entrants into the Global Taurine market will need to innovate and be sustainable. Health awareness combined with the development of production and commitment to environmentally friendly practices is likely to drive this market forward in the coming years, as taurine is positioned as a major ingredient in consumer products across the board.

Taurine Market Key Segments:

By Grade

- Food Grade

- Feed Grade

- Pharmaceuticals Grade

By Form

- Tablets

- Liquid Based Serum

- Other

By End-use

- Dietary Supplements

- Food and Beverages

- Animal Feed

- Pharmaceuticals

- Others

Key Global Taurine Industry Players

- Qianjiang Yongan Pharmaceutical Co., Ltd.

- Grand Pharma (China) Co., Ltd.

- Jiangyin Huachang Food Additive Co. Ltd.

- Molekula Group

- Avanscure LifeSciences Pvt. Ltd.

- Honjo Chemical Corporation

- Kyowa Hakko Bio

- Advance Inorganics

- Mitsui Chemicals Group

- BOC Sciences

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383