MARKET OVERVIEW

The Switzerland logistic market within the broader transport and supply chain sector will remain one of Europe's best-planned and tech-savvy logistics systems. Based on geographical position, streamlined infrastructure, and seamless global connectivity, Swiss culture of logistics is characterized by precision, reliability, and alignment with the global geography of trade. Despite being landlocked, the nation serves as a vital bridge between north-south goods movement in Europe with transport corridors stretching beyond regional borders. The Switzerland Logistic market will continue to depend on multimodal transport networks where road, rail, and air freight are interconnected to cut delays and maximize transit time.

Its dense highway and rail network, along with properly mechanized cargo terminals, enables freight transporters to implement just-in-time delivery patterns with least dislocation. The big cities of Zurich, Geneva, and Basel will continue to be vital nodes, connecting national distribution with global commerce. Basel, being very close to Germany and France, will keep strengthening its role as a logistics center for chemical and pharmaceutical shipments. Swiss logistics providers will increasingly tailor their services to serve the needs of industry sectors that are sensitive to gentle handling and just-in-time delivery. Some of these industries, such as life sciences, precision instruments, and high-value consumer products, are heavily ingrained in the Swiss economy and rely on effective supply chain performance.

As a consequence, Switzerland Logistic market companies will invest in value-added warehousing, refrigerated chain, and electronic traceability systems to ensure shipment integrity at every stage of transport. Switzerland customs procedures will remain conducive to the free flow of goods, even though Switzerland is outside the European Union. Close cooperation with EU trading partners, aided by bilateral arrangements and standardized documentation procedures, minimizes the risk of bottlenecks. Such a climate enables Swiss logistics providers to provide transit services that are swift but legally appropriate to international regulations.

The market will gain from its capacity to transport with the least administrative friction across borders. The Switzerland Logistic market will also focus on sustainability, aided by national policy and corporate responsibility. Freight haulers will be set to increase the use of low-emission trucks and trigger road-to-rail modal shifts wherever possible. Spend on electric delivery vehicle fleets and optimization software will help reduce the carbon footprint of freight activity in the nation. With growing demand for green operations, logistics companies will look for ways to comply with Switzerland's tough green regulations. The utilization of data intelligence and automation will gain more traction in the Switzerland Logistic market. Advanced technologies will make it possible to transition to more responsive and adaptable supply chain systems from robots in warehouses to predictive maintenance of delivery fleets. Logistics planning will largely rely on real-time analytics in an effort to predict delays, reroute shipments, and ensure service levels across different scenarios. Over the next couple of years, the Switzerland Logistics industry will also be transforming itself into a technology-savvy and eco-friendly segment of the supply chain business, weighing function with precision along with adaptability demanded by global trade.

Switzerland logistic market is estimated to reach $76.8 Billion by 2032; growing at a CAGR of 1.8% from 2025 to 2032.

GROWTH FACTORS

The Switzerland logistic market is expected to grow steadily in the coming years, depending on a variety of influential factors that will dictate the future transportation, storage, and delivery services. With more and more businesses depending on seamless and timely flow of goods, the need for efficient logistic solutions in Switzerland will increase. The country's strong infrastructure and geographical location at the center of Europe are reasons behind this. Its railroad and road infrastructure is well developed, enabling it to more comfortably connect various regions and even neighboring nations. This advantage not only improves intra-domestic logistics but also boosts Switzerland's role in cross-border trade. Among the major reasons the market has expanded is the consistent expansion of e-commerce.

Online retailing has changed the way products are sold and distributed, with fast and effective logistic services becoming more important than ever. Consumers want faster delivery, and businesses are attempting to respond. Technology is helping the logistics, as well. The use of automation, traceability systems, and smart inventory management software are improving the treatment, storage, and transport of goods. These improvements save time and cost, always the priority concerns of service providers and consumers. At the same time, initiatives to reduce carbon emissions are driving change in logistics operations management. Environmentally friendly transport options, like electric cars and route optimization, are being adopted to advance environmental goals.

These green programs not only benefit the planet but also attract customers and investors who care about sustainability. Eventually, this shift towards cleaner logistics will be the standard and not the norm, determining the way businesses compete and do business. Nevertheless, there are also certain hurdles that could hamper growth. Exorbitant labour and land costs can discourage new market entrants or established players to grow. Furthermore, excessive regulation on transport and emissions can inhibit the capacity of firms to act in a timely manner. These difficulties must be addressed sensitively in a way that does not stifle advancement. However, new opportunities still arise. Advances in digital technology and the further use of data analytics can help businesses to improve understanding of trends and consumer patterns. This can be used to plan more effectively and execute more successfully. While the Switzerland logistics market keeps evolving, a blend of strong infrastructure, advanced technology, and sustainability will shape its future direction.

MARKET SEGMENTATION

By Type

The Switzerland logistic market is gradually transforming into a more integrated and streamlined network as technology continues to impact the movement and storage of goods. Famous for its robust infrastructure and European location, the nation is poised to become increasingly vital in cross-border commerce and advanced supply chains. As companies require faster delivery, easier customs procedures, and improved monitoring, the Swiss logistic market is answering with continuous improvements that portend a bright future. Within the next few years, Switzerland's logistics sector will be inclined to see freight transport gravitate toward cleaner, more automated methods.

As the increased adoption of electric cars and intelligent route optimization tools, the sector looks to shorten delivery time and environmental footprints. This shift will not only reduce emissions but also save companies time and money. As companies become more environmentally conscious, freight companies in Switzerland will also do so, providing green solutions without sacrificing speed or reliability. Warehousing and storage are also being transformed by new tools. Future Swiss warehouses will be smarter, employing sensors, robots, and software to monitor inventory and minimize mistakes.

These new technologies will lead to more orderly and responsive storage, with greater speed in goods handling and minimized waste. As e-commerce is on the ascendance, there will be higher demand for this kind of storage, prompting investors to invest even more in automation systems and real-time monitoring. Such developments will enhance productivity and labor safety and pave a safer working environment for firms as well as employees. Distribution services will become more integrated and precise, fueled by improved communication among suppliers, warehouses, and delivery partners. Inventory management will also improve, as digital solutions will enable companies to have just the right amount of inventory without overloading their warehouses.

This equilibrium will minimize waste and enhance service quality, resulting in greater customer trust and fewer delays. Customs brokerage will be a major factor in accelerating global shipments. With software that can rapidly scan regulations and complete forms, customs procedures will be significantly faster. This will be significant for businesses that ship goods across borders frequently, as it will reduce costs and prevent delays. At the same time, the courier, express, and parcel industry will concentrate on same-day or next-day delivery, employing local hubs and enhanced tracking to satisfy customer demands. Switzerland's logistics market is gearing up for a future where speed, sustainability, and intelligent systems complement each other to enable global trade and local demand.

By Freight Transportation Mode

The Switzerland logistic market will remain a central pillar in sustaining both its domestic economy and global trade. With its strategic position in the heart of Europe and robust infrastructure, Switzerland has always had an effective and well-organized logistic system. In the future, how goods are transported across and outside its borders will continue to evolve, influenced by increasing digitalization, sustainability, and evolving customer expectations. Each mode of transportation—by road, rail, air, and sea—has its own niche in the big picture, and they all play their roles in different ways to enable the country to deal with freight efficiently and on time. Road transport is likely to remain one of the most popular modes of transportation of freight in and around Switzerland.

It is a flexible and point-to-point service that allows quick access to several destinations, hence suitable for domestic and border trade delivery. In the coming times, road freight is going to be cleaner and more efficient because of electric-powered vehicles and advanced traffic management. Autonomous trucks can also play their part in streamlining deliveries in the future to save time and reduce costs along with highway safety. Rail transport, however, is becoming popular because it has less impact on the environment.

Switzerland already possesses a robust rail system, and future development will make it even more attractive to companies seeking secure and environmentally friendly means. Trains are ideal for heavy and bulk commodities that have to cover long distances without the urgency of air transport. Improved automated loading systems and enhanced links with other modes of transport will probably enhance the speed and coordination of rail transport. Air transport is most renowned for speed and access to distant markets. While it is not the most prevalent method within Switzerland's logistic system, it is necessary for high-value or time-critical products.

With technology advancing and demand for speedy delivery on the rise, more efficient aircraft and streamlined customs procedures will define the use of air transport in the next few years. Sea transport, although less utilized because Switzerland is landlocked, continues to have a role through ports in adjacent countries. Overseas goods coming into Switzerland are frequently imported via these gateways. Future improvements in cleaner ships and improved port facilities will enable this aspect of the logistic process to remain in line with other contemporary modes of transport.

The Switzerland logistic market will most probably experience growth through sound planning, strategic investment, and long-term focus, strengthening each component of the system and connecting them more strongly.

By Application

Switzerland has been prominently known for its efficient transport infrastructure and strong international connections, both of which provide a good platform for its logistics sector. With the altering global needs and the advent of new technologies, the Swiss logistic industry is transforming into an integrated and responsive framework. This industry serves a wide variety of industries, each with its own growing demand and custom-made needs that continue to revolutionize the transportation, warehousing, and handling of commodities. With more emphasis on digital and green solutions, Swiss logistics is on the threshold of a new era of expansion based on speed and accuracy but also long-term impact. Production will most likely go on relying heavily on logistics capabilities that are able to support just-in-time delivery and flexible supply chain.

While greater automation in production becomes widespread, logistics suppliers will need to maintain the same, with even greater integrated coordination between distribution hubs and factories. Retail and online retailing will require faster delivery capabilities, though, especially as consumer expectations shift towards same-day or next-day shipping. This pressure will demand logistics networks that are responsive as well as efficient, especially in less densely populated regions. Accuracy and safety will continue to be the watchwords in the healthcare and pharmaceutical sectors. Temperature-controlled storage and real-time tracking will grow, especially as sensitive products become more widespread. Food and beverage logistics will also change, with more concern for freshness and less waste, likely through smarter packaging and local sourcing habits.

These developments will depend on how effective logistics networks are in dealing with complex scheduling and safe transporting in the process. The auto sector will need logistics that can accommodate large parts and whole cars as well as be nimble enough to deal with bespoke orders and electric vehicle components. Technology and electronics, however, will require quicker response times and safe transportation due to the fragile nature of the majority of products. Chemicals and hazardous materials will still require high levels of safety, and future upgrades may be directed toward risk forecasting and safer routing.

Farm farming and forestry will keep depending a lot on the availability of transportation that is efficient, dependable, and punctual, especially with increasing sustainable options. Logistics systems in here are designed to aid large as well as small producers such that crops will end up being delivered to marketplaces in good conditions. Every one of these fields of use assists in building the Switzerland logistic market so that it progresses wiser, cleaner, and more precisely for the future times.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$67.9 billion |

|

Market Size by 2032 |

$76.8 Billion |

|

Growth Rate from 2025 to 2032 |

1.8% |

|

Base Year |

2024 |

|

Regions Covered |

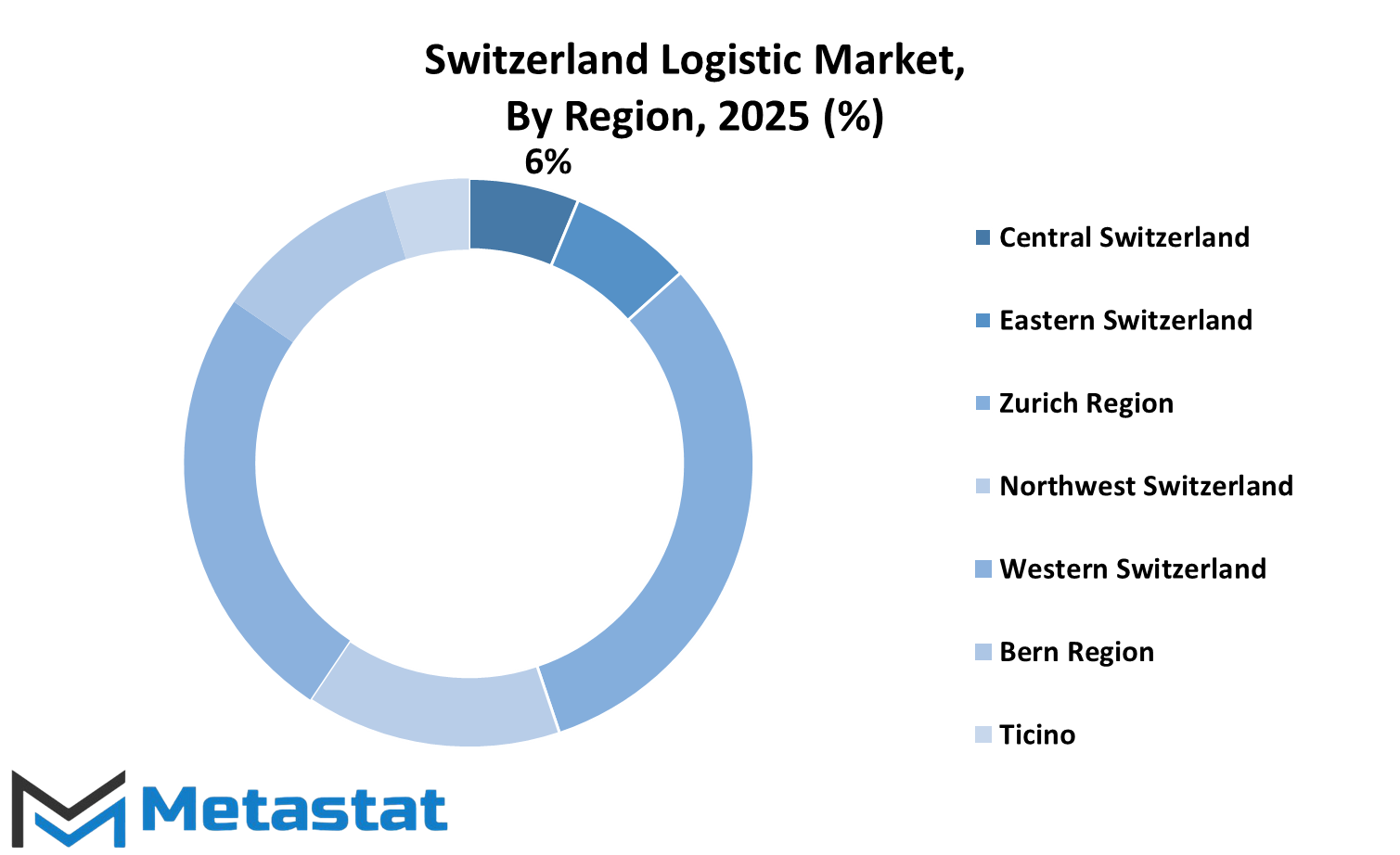

Central Switzerland, Eastern Switzerland, Zurich Region, Northwest Switzerland, Western Switzerland, Bern Region, Ticino |

By Region

The Switzerland logistic market is quietly transforming into one of the more responsive and efficient systems in Europe. While the country is famous for its order and precision, its transportation and storage systems are transforming in practical as well as visionary terms. With its unique geography and stable economy, the Swiss logistic market is not only catering to current trade and supply chain needs but also preparing for future needs. From advanced road and railway infrastructure to more intelligent warehousing and delivery regulations, everything is being maximized to meet growing business and consumer expectations. There is a development in every area of Switzerland.

Central Switzerland is strengthening transport links to increase the connectivity of rural areas to larger economic centers. Eastern Switzerland is putting growing focus on eco-friendly logistics to find solutions to reduce emissions with efficiency. The Zurich Region, generally considered the nation's financial heartbeat, is also a logistics hub, with activities being quicker and more reactive as it invests in technology and employee training. Northwest Switzerland is capitalizing on its proximity to borders as a primary selling point for cross-border goods movement and trade. Western Switzerland is finding success with the coordination of air, road, and rail systems to flow more smoothly and reduce delays. Logistic business in the Bern Region is becoming more structured, with stronger digital tracking systems benefiting companies through greater control over their supply chain.

Ticino, situated nearer to southern European countries, is focusing on smoother transit flows and the development of its warehouse and cargo center network. All these areas are not only fulfilling current logistic needs but also looking ahead to future developments in how goods will be moved. In the future, the Swiss logistic market will depend more and more on digital platforms, automation, and renewable energy. Increasingly, there is demand for short-distance delivery by electric cars and more advanced route planning software that saves time and fuel. With evolving global demands and increasing customer expectations, Switzerland is developing a system that can be adaptable without compromising the precision it's renowned for.

Through additional regional resilience or creative new concepts, the industry is moving toward a more flexible and sustainable future. This innovative approach, in addition to the country's already established strengths, positions the Switzerland logistic market as a model that others might follow.

COMPETITIVE PLAYERS

The Switzerland logistic market is experiencing a quiet revolution. The reason behind this revolution is the need for faster deliveries, better tracking systems, and growing customer expectations. The demand for efficiency, combined with pressure from foreign trade, has led logistics companies to rethink the way they operate. Switzerland, with its stable infrastructure and location in central Europe, provides a good base for these changes. With its strongly integrated road and rail network, the country has enjoyed an advantage for some time, but the focus now is on leveraging historical strengths combined with technological gains. There are several large players in this industry that are setting the tone for the industry and how logistics will play out in the near future.

These are Swiss Post Ltd, Kuehne + Nagel International AG, DSV A/S, Logistos AG, Planzer Holding AG, DHL Group, Rhenus Logistics, Nunner Logistics BV, CEVA Logistics, and United Parcel Service of America, Inc. Every company is up to something different. Some are making investments in automation so they can boost the speed of sorting and handling. Others are creating digital platforms where customers can make bookings using their phones. These are not just steps about staying in line these are steps about moving ahead. In the coming years, the Swiss logistic market will come to rely more and more on information and artificial intelligence to predict traffic flow, weather disturbances, and customer patterns. This will allow companies to make decisions sooner and more accurately.

Warehouse buildings may have more and more robots doing routine work, reducing the possibility of human error and speeding up processes. Delivery routes can be real-time optimized to minimize the consumption of fuel and emissions. The shift to electric vehicles and other green technology is also set to pick up as the awareness for environmental issues grows. Of significance is the manner in which this market is being made more competitive. With all these industry titans, the firms cannot afford to move in slow motion. They will need to continually improve not only to expand, but just to maintain their position.

Collaborations between businesses, joint ventures with technology startups, and investments in sustainable operations will be the new order of the day. Logistics in Switzerland in the future will no longer be all about getting stuff from here to there it'll be about getting it there smarter, faster, and in a way that is respectful of individuals and the planet. The competition is fierce, but it's also what moves the market ahead.

Switzerland Logistic Market Key Segments:

By Type

- Freight Transportation

- Warehousing & Storage

- Distribution Services

- Inventory Management

- Customs Brokerage

- Courier, Express, and Parcel (CEP)

By Freight Transportation Mode

- Road Transport

- Rail Transport

- Air Transport

- Sea Transport

By Application

- Manufacturing

- Retail and E-commerce

- Pharmaceuticals and Healthcare

- Food and Beverage

- Automotive

- Electronics and Technology

- Chemical and Hazardous Goods

- Agriculture and Forestry

- Others

By Region

- Central Switzerland

- Eastern Switzerland

- Zurich Region

- Northwest Switzerland

- Western Switzerland

- Bern Region

- Ticino

Key Switzerland Logistic Industry Players

- Swiss Post Ltd

- Kuehne + Nagel International AG

- DSV A/S

- Logistos AG

- Planzer Holding AG

- DHL Group (Deutsche Post AG)

- Rhenus Logistics

- Nunner Logistics BV

- CEVA Logistics

- United Parcel Service of America, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252