Global Surgical Stapling Devices Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

Would the growing shift closer to minimally invasive tactics push the global surgical stapling devices market into a brand new section of innovation, or will emerging options project the dominance of conventional systems? As healthcare carriers undertake smarter, more green surgical equipment, should the momentum of virtual integration redefine how those devices are designed and used worldwide? And with rising discussions around protection, precision, and affordability, may unexpected disruptions reshape the destiny path of this market altogether?

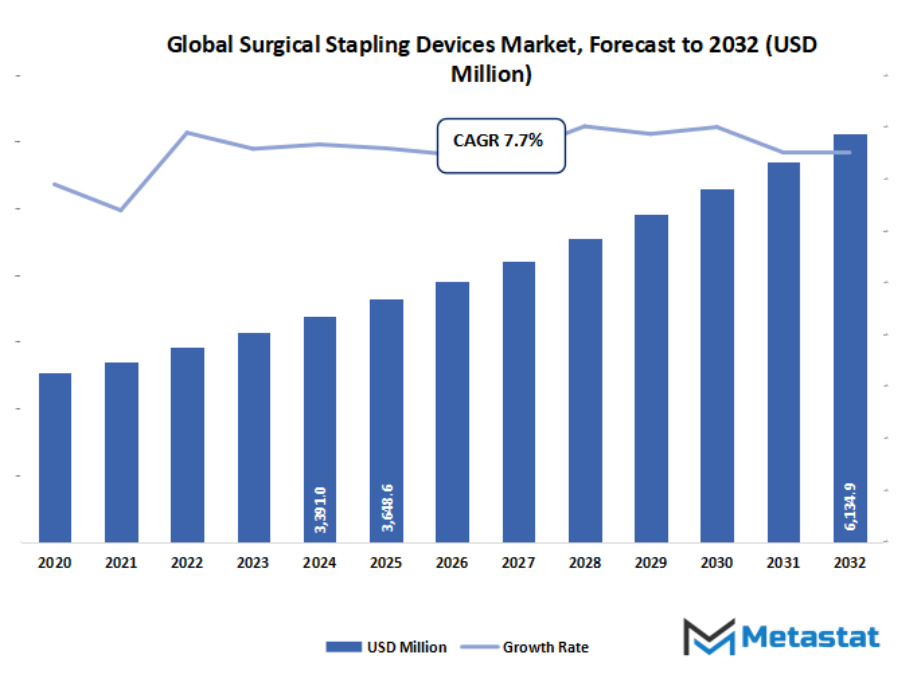

- The global surgical stapling devices market valued at approximately USD 3648.6 million in 2025, growing at a CAGR of around 7.7% through 2032, with potential to exceed USD 6134.9 million.

- Powered Surgical Stapling Device account for nearly 64.9% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising volume of surgeries, especially in oncology and bariatrics., Shift towards minimally invasive procedures requiring specialized staplers.

- Opportunities include Development of smart staplers with tissue feedback and bioabsorbable staples.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

The global surgical stapling devices market will frame a future wherein medical procedures will feel smoother, safer, and much more controlled across its industry. As technology moves on, the conversation will eventually shift away from just mere performance to how these devices could support surgeons in handling complex procedures with greater confidence. What once seemed like a mechanical tool will slowly begin to act as an intelligent assistant, guiding precision in ways that will lessen hesitation inside operation theaters.

Manufacturers will not remain focused only on better materials or faster mechanisms but will investigate small design changes that could improve patient comfort, reduce recovery time, and assist hospitals with managing high caseloads without exhausting resources. With healthcare systems adjusting to growing volumes of Surgery, demand for devices working smoothly under pressure will increase, which will, in turn, drive companies beyond function and toward long-term reliability.

Geographic Dynamics

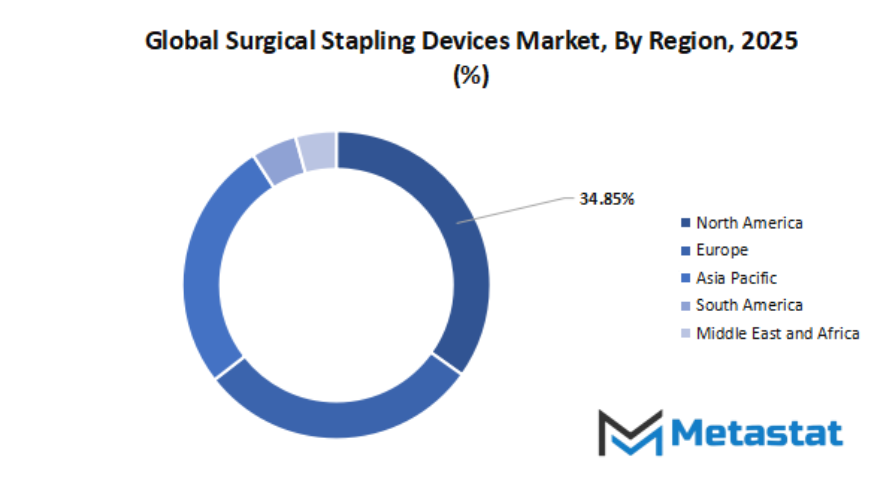

Based on geography, the global surgical stapling devices market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Market Segmentation Analysis

The global surgical stapling devices market is mainly classified based on Product Type, Type, Application, End-user.

By Product Type is further segmented into:

- Powered Surgical Stapling Device

Future development in the global surgical stapling devices market will widen the adoption of powered systems as healthcare settings pursue steady, consistent precision during procedures. Greater focus on ease of control and dependable movement will support wider adoption, especially with hospitals searching for options that take pressure off surgical teams and support smoother outcomes.

- Manual Surgical Stapling Device

The global surgical stapling devices market will continue to support the use of manual tools as dependable choices for settings that require controlled handling, and which can be provided at a lower cost. Demand will rise in regions working towards better access to basic surgical equipment, encouraging steady use where powered alternatives remain limited or where simpler mechanisms match local needs.

By Type the market is divided into:

- Disposable

The disposable segment in the global surgical stapling devices market will see growth as hospitals move to safer alternatives which limit the risks of cross-contamination. The increasing attention towards infection control standards will strengthen the preference for single-use models, specifically in high-volume centers, expecting stronger compliance requirements and faster procedure turnover in the coming years.

- Re-usable

Reusable products in the global surgical stapling devices market will be relevant in facilities for managing long-term budgets through repeated cycles of sterilization. The growing interest from cost-sensitive regions will continue to support their continued use, and manufacturers are expected to work on improving durability and design features so that they can withstand the strict cleaning schedules without losing performance.

By Application the market is further divided into:

- Gynecology Surgery

Gynecology techniques will make vast contributions to consistent increase in the global surgical stapling devices market due to the fact advanced techniques inspire smoother tissue handling and shortened restoration periods. The extra demand for minimum invasiveness will improve adoption, specifically as health systems prepare for the quantity of surgical operation formed via rising women's health consciousness.

- Urology Surgery

Urology Surgery will contribute to growth in the global surgical stapling devices market due to increasing treatment rates for diseases associated with aging populations. Increasing adoption of laparoscopic techniques will lead to higher adoption of stapling devices designed for small spaces, and will drive manufacturing toward more refined equipment constructed for tiny operational areas.

- General Surgery

General surgical operation will retain to anchor a substantial portion of the global surgical stapling devices market because huge-ranging medical wishes call for dependable closure equipment. An extra emphasis on enhancing velocity and consistency for the duration of approaches will cause higher integration of superior designs, shaping destiny expectancies across numerous surgical departments.

- Others

Other surgical fields will contribute to the momentum of the global surgical stapling devices market, as specialized tactics call for instruments with adaptable structures. Expanding classes of treatment, including bariatric care and thoracic interventions, will inspire product innovation aimed at assisting smoother handling and controlled movement throughout unique anatomical conditions.

By End-user the global surgical stapling devices market is divided as:

- Hospitals

Large hospitals will dominate the global surgical stapling devices market, as ongoing improvements in surgical infrastructure inspire stronger use of mechanized and guide stapling structures. Continuous investment in superior working rooms will assist increase as big medical centers prepare for extra manner counts and rising expectancies for constant outcomes.

- Specialty Clinics

Specialty clinics will help in the continued expansion of the global surgical stapling devices market as focused departments adopt tools suited for narrow treatment areas. The increasing preference for outpatient surgeries will foster further interest in devices offering steady performance and quick preparation, enabling clinics to meet higher patient demand with reliable solutions.

- Others

Other healthcare facilities will add steady participation in the global surgical stapling devices market as smaller centers seek cost-effective closure devices that match up to varied procedure types. Broader access to surgical care in developing regions will spur growth by encouraging the adoption of practical equipment to support improving standards without raising operational strain.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$3648.6 Million |

|

Market Size by 2032 |

$6134.9 Million |

|

Growth Rate from 2025 to 2032 |

7.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Competitive Landscape & Strategic Insights

The landscape of the global surgical stapling devices market includes both long-established international companies and a growing number of regional players. This is a space where experience coalesces with new ideas. These devices have been a reliable part of modern Surgery over the years, with continuous small but meaningful improvements by companies operating in this field to further support safer and faster procedures. As hospitals and clinics continue to seek out tools that contribute to lessened surgical time and improved recovery, the need for reliable stapling solutions will continue to grow, making room for strengthening the presence of both global leaders and emerging names.

A number of well-known companies have built their position through constant product development and strong links with healthcare providers. Names like Medtronic, 3M Healthcare, BioPro, Inc., Johnson & Johnson Services, Inc., ConMed Corporation, BD, B. Braun SE, Smith + Nephew, and Stryker are some of the greater diagnosed names, every with their personal approaches to design and innovation. With a protracted history in clinical era, these businesses understand exactly what surgeons need and what sufferers count on, which lets in them to introduce tools to be able to guide smoother operations.

Besides those leaders, some of specialised companies hold to play an increasing number of large role in centered enhancements. Frankenman International Ltd., Intuitive Surgical Operations, Inc., CareFusion Corporation, Cardica, Inc., Ethicon US., LLC, Covidien, Ethicon Inc., and Golden Stapler Surgical are some of the companies bringing new power into the market. Their paintings often centres on making devices extra user-friendly, greater specific, or higher suitable for minimally invasive strategies, which will stay crucial as surgical practices shift towards methods that reduce discomfort and shorten medical institution stays.

Entry of groups like Afimilk Ltd., Iteris, Inc., DeLaval, Heliospectra AB, Lely Group, Kubota Corporation, Valmont Industries, Taranis, Yara International, and PrecisionHawk-normally related to agricultural technology-demonstrates how go-enterprise understanding every so often fuels new pathways of growth. Their information in sensors, automation, and records-driven systems suggests how scientific equipment may advantage from technology used in different sectors. While their direct involvement in surgical stapling gadgets isn't always widespread, their presence in related markets demonstrates how thoughts can traverse industries to permit further enhancements.

Combined, these players are defining a competitive landscape that will keep growing as healthcare systems search for reliable solutions supporting improved surgical outcomes. With famous names and up-and-coming contributors focusing on safety and efficiency in their tool development, the global surgical stapling devices market will progress at a moderate rate based on practical advancements and a much clearer understanding of the day-to-day needs of medical teams.

Market Risks & Opportunities

Restraints & Challenges:

High cost of gadgets and consumable staple cartridges

The excessive device and staple cartridge expenses will keep hosing down wider diffusion into smaller hospitals and coffee-finances clinical facilities. Many facilities are looking for out cost-saving options, but steady overall performance standards will restriction lower-fee options. These surroundings will make it tough for brand new consumers who intend to develop their surgical services with superior stapling systems.

Risk of complications such as leaks, bleeding, or strictures

The hazard of leaks, bleeding, or strictures will hold to undertaking adoption. Surgeons will be depending on training and device precision to avoid unwanted outcomes. Even with development made in design, such events are pushing producers to reinforce safety steps and recognition on equipment that aid purifier tissue managing throughout various tactics.

Opportunities:

Development of clever staplers that provide tissue comments and installation bioabsorbable staples

In the destiny, clever staplers will provide instantaneous tissue feedback and support more secure closure. Bioabsorbable staples will allow purifier restoration and reduce comply with-up techniques. All these advancements in generation might honestly attract strong hobby from hospitals seeking shorter remains and smoother recovery consequences, hence promising an area for new product strains.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 3648.6 million in 2025 to over USD 6134.9 million by 2032. Surgical Stapling Devices will maintain dominance but face growing competition from emerging formats.

Future trends will also foster collaborations between engineering teams, medical professionals, and digital innovators. Such partnerships will shape how novel devices are tested, validated, and brought into practice. Hospitals will increasingly require tools that perform not only well but also integrate into larger systems, enabling training programs, performance tracking, and safety protocols. In this larger picture, the market will represent more than a collection of products. It acts as a bridge between surgical tradition and the type of guided precision that modern medicine will progressively need. As the global surgical stapling devices market moves ahead, it will usher in conversations about how small shifts in design and function may reshape patient outcomes for years to come, turning an industry where thoughtful innovation will really matter.

Report Coverage

This research report categorizes the global surgical stapling devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global surgical stapling devices market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global surgical stapling devices market.

Surgical Stapling Devices Market Key Segments:

By Product Type

- Powered Surgical Stapling Device

- Manual Surgical Stapling Device

By Type

- Disposable

- Re-usable

By Application

- Gynecology Surgery

- Urology Surgery

- General Surgery

- Others

By End-user

- Hospitals

- Specialty Clinics

- Others

Key Global Surgical Stapling Devices Industry Players

- Medtronic

- 3M Healthcare

- BioPro, Inc.

- Johnson & Johnson Services, Inc

- ConMed Corporation

- BD

- B. Braun SE

- Smith + Nephew

- Frankenman International Ltd.

- Intuitive Surgical Operations, Inc.

- Stryker

- CareFusion Corporation

- Cardica, Inc.

- Ethicon US., LLC

- Covidien

- Golden Stapler surgical

- Intuitive Surgical

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383