MARKET OVERVIEW

The changing landscapes in emerging trends and evolving consumer behaviours will shape the future of the DIY Home Improvement Retailing market and its industry in South Africa over the next couple of years. The sector will further continue its development and will probably reflect significant shifts due to changes in lifestyles, technological advances, and consumer involvement in home improvements.

Very soon, the digital channels of South Africa's DIY Home Improvement Retailing will have full scope for various ways of enhancing customer experience. Online retailing would be more integrated with digital platforms hosting a long portfolio of products with recommendations from the platform itself based on consumer preference. E-commerce would afford not just broader access to diversified product categories, but convenience and flexibility for the consumers. This digital engagement will also be complemented by the trend of emerging mobile technologies wherein customers smoothly browse, compare, and buy the product on their smartphones and tabs.

Furthermore, there will be a greater diffusion of smart home technologies that would unfold the demand for integrated home-improvement products in digital systems. This will raise demand for energy-efficient appliances, smart lighting, and home automation systems as consumers try to provide extra comfort to their living areas, build on their securities, and make life sustainable. Sentiment towards smart home solutions will continue to influence product portfolios of retailers in the South Africa DIY Home Improvement Retailing market, where inventories are required to change by retailers in order to satisfy these demands.

It is also going to further face an increased drive towards greener and more sustainable businesses. Customers, too, are going to be more sensitive towards the environment. This means demands for products that have sustainable material in them will go up, along with energy-efficient products. For retailers, this means having a product lineup in line with all such environmental concerns, offering solutions which make lives greener and reduce waste. This too drives one of the big drivers in innovative product categories and product development.

Aside from that, the DIY Home Improvement Retailing market in South Africa will also be characterized by increasing interest in customized and bespoke solutions. As customers become more participatory in processes of home improvement, they are going to seek out unique and personalized products that say something about themselves. Consequently, the retailers too have to provide a suite of options that can be personalized or tailor-made services that would cater to these changing tastes. Due to such increasing personalization, the demand will spur further development of more market niches and specialized product lines within the industry.

This would ensure that fierce competition, both at the entry level and the expansion of product offering from existing retailers, occurs. Firms would be at each other's throat regarding matters to do with quality, innovation, and customer service in ensuring they gain and retain market share. Such competition would ensure that continuous improvement and innovation take place within the South Africa DIY Home Improvement Retailing market, therefore assuring consumers access to high-quality and diverse product selections.

The trends of technological advancement, changed consumer preference, and a knack for greener solutions will shape the South Africa market of DIY Home Improvement Retailing. It's about time retailers outpaced such trends through innovative strategies besides reworking their offerings to appeal to the changing needs of consumers. New opportunities and challenges are opening up, making the retail and customer landscapes dynamic and ever-changing.

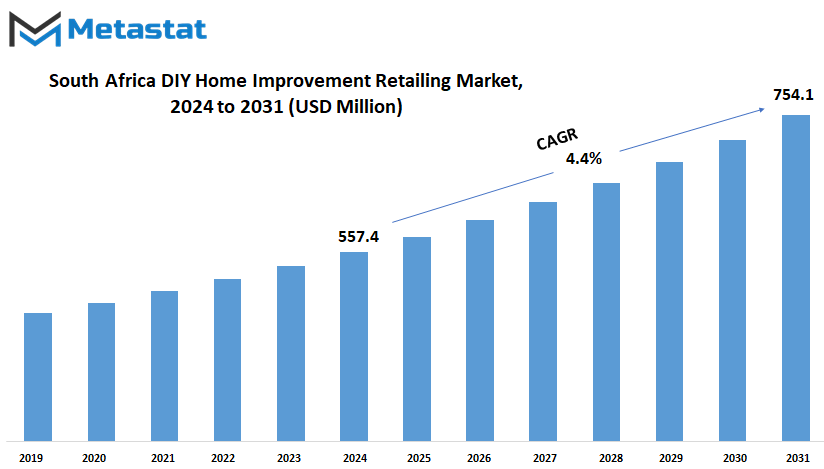

South Africa DIY Home Improvement Retailing market is estimated to reach $754.1 Million by 2031; growing at a CAGR of 4.4% from 2024 to 2031.

GROWTH FACTORS

Over the past couple of years, the South Africa DIY Home Improvement Retailing market hasrought with it a lot of potential for growth on the basis of several key factors that drive it. Of many other factors that act as a catalyst in bringing growth to this industry, the greatest push factor has been the continuous incline in the demand from consumers to have personal and inexpensive home improvements. Due to more and more people in South Africa coming into the picture to develop their homes, the demand for DIY products and solutions has radically increased. This trend will be highly influenced by the increasing awareness related to home maintenance and personalization, encouraging home owners to go for self-made projects rather than fully depending on professional services.

Other factors that contributed to the growth of the market include increased disposable incomes of households in South Africa. As the disposable incomes of people increase, they are very likely to invest in renovating homes. Financial flexibility will provide the consumer with the ability to try more types of DIY products and tools, boosting the market. Besides, the development of technologies, the growth of online shopping availability, and increasing accessibility to DIY products and resources fuel further market development.

However, there are still certain factors that could impede the development of the South Africa DIY Home Improvement Retailing market. In this regard, changing economic conditions could curtail spending ability due to such fluctuations, thereby reducing the amount that could be budgeted for home improvement. Economic contraction or instability may result in reduced spending on non-essential items, which might include DIY supplies. Thirdly, a disruption to the supply chain or an increase in the raw material cost could have the effect on the market, impacts that may be translated into the availability of the product and the price at which it is available.

Despite all these odds, there are also some positive prospects that could take place with regard to the South Africa DIY Home Improvement Retailing market. The process of urbanization is increasing, and this is very likely to have an effect on the demand for home improvement products since these people will either be moving into new homes being built or renovating existing ones. Besides, the increasing interest in greener lifestyles and products opens a window of opportunity for creative retailer offerings targeted at environmentally sensitive consumers. These emerging trends have a good chance of unfolding new growth and investment opportunities as the market evolves.

Although there are some factors that might hinder the South Africa DIY Home Improvement Retailing market, it is supposed to look pretty good. Increased interest by consumers, rising disposable incomes, and continuous improvement in technologies create a sound basis for future growth. If the right strategies will be followed, coupled with adaptability, then the market will be able to exploit all the new opportunities and further expand in the ensuing years.

MARKET SEGMENTATION

BY Product Type

As consumer tastes and economic conditions are changing, the competition among the key players in South Africa DIY Home Improvement Retailing market is anticipated to be more intense as the sector progresses. Builders, Leroy Merlin SA, Cashbuild Limited, Mica Hardware, Timbercity, Makro SA, Chamberlains Hardware, Brights Hardware, BUCO Hardware, and Mercury Build It are some leading names moving this market forward.

Builders present a diverse portfolio of products and services that address nearly all home improvement needs and are also well-settled players with full presence across South Africa. A huge network of stores, coupled with supply chain management, forms the backbone of competitive advantage for the company. Another key player in the market is Leroy Merlin SA, part of the global chain of Leroy Merlin, which is well-known for its various product offerings and innovative store layouts. With the international experience that this brand carries, it brings fresh eyes into the South African market.

Cashbuild Limited retains its appeal due to the broad reach and concentration on affordable solutions. Mica Hardware boasts personalized service with an extensive product offering to please a wide range of customers, from the DIY enthusiast to the professional contractor. Timbercity has specialized in timber and related products, thereby meeting the needs of the niche market.

Makro SA is an established retailing giant with a wide assortment of home improvement goods under its roof. The large-scale operation with bulk purchasing power ensures economic advantages. Chamberlains Hardware and Brights Hardware also play their critical roles by providing specialized products and offering products at competitive prices, with strong regional presence to serve the local market demands effectively.

What makes BUCO Hardware and Mercury Build It stand out is attention to the quality of materials availed to customers and customer-oriented services. The players are gearing up for the future by introducing a wider variety of products and offering better customer experiences. Considering that the South African market of Do-It-Yourself Home Improvement Retailing will keep on expanding for the foreseeable future, key players are likely to refine strategies in an attempt to meet the emerging trends and challenges. They will have to become more tuned in to the consumer preference, technology, and economic variables to stay well ahead of the market. It is only because of the ability of these companies to innovate and meet the changing needs of the consumers in South Africa that their future and competitive positions would be shaped in the next couple of years.

By Consumer Type

The DIY Home Improvement Retailing market of South Africa remains one of the dynamic sectors, with a number of distinctive categories of consumers likely to shape up its future course. The market, in its current growth phase, requires an understanding of the various consumer types and how these would influence retail trends.

The main category is that of homeowners in the context of the DIY home improvement market. They invest in their houses to serve more purposes or to look more beautiful for unique reasons. Home owners tend to spend more on mega projects or those that take time to complete, for they are set on improving their homes. The demand from home buyers will increase with the growth of the real estate market in South Africa, appreciating quality and durability in purchases.

Renters, however, tend to take a different approach when it comes to DIY projects. Their investments would probably be more temporary or removable improvements that can be done easily and taken back upon moving out. The nature of this group calls for practical and adaptable products that allow the renters to upgrade their living space without permanent changes. As more rental markets grow in South Africa, demand for flexible and easy-to-install solutions for home improvement is likely to increase.

The other big chunk involves professionals, such as contractors and builders. They usually buy these products in bulk and ensure that whatever they get is of high quality and meets the set standards in the industry. Their purchasing habits will, therefore, be influenced by their desire to complete projects efficiently and ensure high standards. Due to the fact that the construction industry in South Africa is on the rise, activity from this group is also bound to increase. Again, their demand for the product would revolve around dependability in providing them with what they need professionally.

DIYers are committed to home improvement and view projects as a means to express their hands-on approach. This group is driven by the creativity of working independently from challenges in home improvement. Therefore, they are usually in search of innovative kinds of tools and materials that can help them give special results. Increased digital platforms with instructional content will continue to empower this segment further with their resources and inspiration toward successful DIY projects.

Driving the trends for the South Africa DIY Home Improvement Retailing market will be diverse for various types of consumers-homeowners focusing on long-term improvements, renters requesting adaptable solutions, professionals demanding qualitative materials, and amateur DIY enthusiasts driving demand in offering innovative tooling. Since these trends are in continuous evolution, the market is responding through permanent adaptation, offering customized solutions to meet the diverse needs of its consumers.

By Application

The South Africa DIY Home Improvement Retailing market is entering a period of rapid evolution, reflecting wider trends in consumer behavior and economic conditions. As more and more South Africans have become eager to make their homes even more attractive, the market for DIY home improvement products has concurrently grown. This market is steadily growing, impelled as it is by an increasing interest in personalization of home environments along with the necessary desire to keep costs as low as possible.

Among the various market sectors, home renovation may be included as one of the most influential determinant factors that increase demand. Most homeowners seeking an upgrade invest in various materials and tools to renovate their homes. This is influenced by either a modern look one would intend to achieve or increased functionality. As the economic conditions continue to improve and disposable incomes continue to rise, many more people are likely to undergo renovation projects, further propelling the growth of the market.

The home repair and maintenance segment also significantly contributes to the growth of the do-it-yourself market, since regular maintenance ensures that the value of property does not deteriorate, and encourages South Africans to be more hands-on and thus manage minor repairs. This is supported by the availability of a wide range of products designed for easy use by non-professionals. With the focus on home maintenance, the demand for 'do-it-yourself' products would continue to prevail as the homeowners would like to rectify the defects themselves instead of relying wholly on professional services.

Outdoor and landscaping projects also make a great deal of difference in DIY home improvement. As people continue to spend more time in their homes, investing in outdoor areas has become one of the most pleasurable ways to develop space that is both enjoyable to relax in and entertain others. This includes everything from garden design to patio enhancements. Such a focus on the outdoors points to wider lifestyle changes and an increasing interest in tailor-made, functional outdoor areas.

Both home décor and interior design hold equal importance in shaping the market of DIY. Unique décor items that can be made by consumers as per their preference are what most people get attracted to, and they are even willing to invest in products that help them show their personal style. It ranges from furniture and lighting to paint and accessories. This demand is expected to increase with constantly changing trends and preferences of designs.

However, the growth of the South Africa DIY Home Improvement Retailing market looks very promising for the future. The combination of economic improvement, growing consumer confidence, and increasing demand for personalized home environments is expected to boost the market. With every sector contributing significantly-renovation, repair, and maintenance, outdoor and landscaping projects, and home décor and interior design-the outlook seems appealing and vibrant.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$557.4 million |

|

Market Size by 2031 |

$754.1 Million |

|

Growth Rate from 2024 to 2031 |

4.4% |

|

Base Year |

2022 |

COMPETITIVE PLAYERS

The marketplace for South Africa DIY Home Improvement Retailing is one of dynamism, with an assortment of key players that determine the future of the industry. Companies like Builders, Leroy Merlin SA, Cashbuild Limited, Mica Hardware, Timbercity, Makro SA, Chamberlains Hardware, Brights Hardware, BUCO Hardware, and Mercury Build It are some of the significant retailers within this sector. Market leaders in this category not only compete at the retail level but also at the pace-setting level in innovations and the struggle to meet ever-changing consumer needs.

Builders hold a prominent position in the DIY market of South Africa because of its comprehensive home improvement products and services. Builders is also one of the largest retail chains in South Africa and changes according to the changing consumer preference and market demand. Since it can offer a wide array of items from materials used in building to home dcor items, it remains in front.

Besides this, the international touch was brought into the South African marketplace by another major player known as Leroy Merlin SA. This company, based in France, has introduced international trends and standards in the country that no doubt influenced local practices and consumers' expectations. The company adds to the diversity in the South African market through its unique products and services, meeting both the taste for traditional and contemporary excellence.

Cashbuild Limited is one that clearly stands out by being affordable and accessible. Cashbuild Limited allows the realization of affordable solutions for home improvement to meet the needs of the budget-conscious consumer in such a way that the wide range of customers can gain access to quality products for their projects without having to overspend.

Mica Hardware serves with personalized service and a touch of local expertise. An independently owned store network allows for a tailored approach to customers' needs, thus cementing its place in the DIY market. The local touch supplements the broad product offering, connecting well into the community.

Timber city specializes in selling timbers and products allied to it, finding a niche in the DIY segment. Its focus is on quality timbers and building materials for professionals and do-it-yourselfers who want to reinforce its market position.

Business Model: Makro SA operates on a large format retailing business model offering products to individual and business clients, further and broadly exposing and offering its range to support the company's positioning among leaders in the DIY home improvement segment.

Chamberlains Hardware and Brights Hardware have specialized services and products available in the market to meet specific needs; their quality and customer service allow them to stay competitive.

Other key players, like BUCO Hardware and Mercury Build, also make valuable contributions to the industry. Since they are equally committed to high-quality products and services, they help the market demands move along in stride with its growth.

The market for DIY home improvement retailing in South Africa consists of a number of different players, each of whom contributes in a very varied way to the development of the industry. Their continuous innovation and adaptation will contribute to the future trend and consumptive preference in the DIY sector.

South Africa DIY Home Improvement Retailing Market Key Segments:

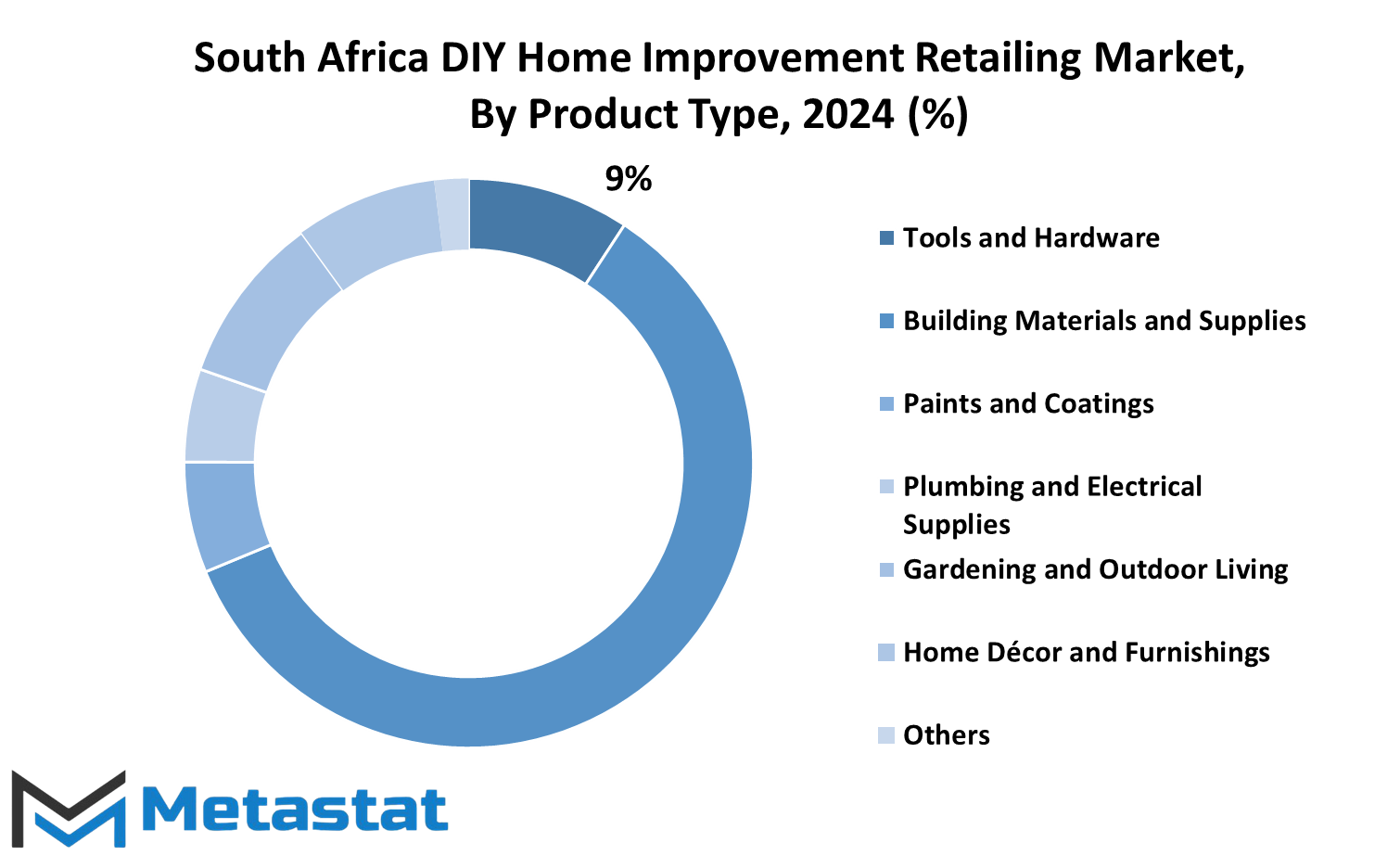

By Product Type

- Tools and Hardware

- Building Materials and Supplies

- Paints and Coatings

- Plumbing and Electrical Supplies

- Gardening and Outdoor Living

- Home Décor and Furnishings

- Others

By Consumer Type

- Homeowners

- Renters

- Professionals

- DIY Enthusiasts

By Application

- Home Renovation

- Home Repair and Maintenance

- Outdoor and Landscaping Projects

- Home Décor and Interior Design

Key South Africa DIY Home Improvement Retailing Industry Players

- Builders

- Leroy Merlin SA

- Cashbuild Limited

- Mica Hardware

- Timbercity

- Makro SA

- Chamberlains Hardware

- Brights Hardware

- BUCO Hardware

- Mercury Build It

- Powafix (Pty) Ltd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383