MARKET OVERVIEW

Somatostatin analogues are the synthetic formulations of the naturally occurring hormone, somatostatin, in order to control certain medical conditions related to excess hormone secretion. These analogues then become major drugs in curing conditions such as acromegaly, neuroendocrine tumors, and certain forms of gastrointestinal disorders. The analogues work essentially as hormones inhibitors and stabilize hormone secretion, which helps overcome the effects of symptoms caused by an imbalance in hormone secretion.

Somatostatin analogues reduce the levels of hormones in the case of acromegaly, the condition that is related to a state of excessive production of growth hormone; therefore the abnormal tissue growth is retarded. It not only stops the manifestations physically but it also minimizes the complications from joint pains, diabetes complications, and heart diseases. The analogues attack the root cause of the disorder thus providing a more pragmatic solution to managing the disease where necessary invasive procedures are reduced or eradicated.

Somatostatin analogs form the mainstay of treatment for neuroendocrine tumors. Neuroendocrine tumors arise from cells that produce hormones, which could lead to various symptoms based on their location and activity. The drugs work by reducing the secretion of hormones, which in turn is associated with symptoms such as flushing, diarrhea, and abdominal pain. These drugs do improve the quality of life by alleviating symptoms; in some patients, it might even decrease tumor growth.

Somatostatin analogues are vital in the management of gastrointestinal disorders, specifically in treating carcinoid syndrome and refractory diarrhea. This is due to the suppression of an overproduction of substances, which would otherwise disturb normal processes in the digestive system; therefore, the treatment might be very effective in terms of comfort and stabilization for such difficult symptoms. Because this treatment is targeted, the relief benefits the patient without other unwanted systemic effects.

The development and application of somatostatin analogs reflect the developing aspect of medical science. These permit a more individualized approach toward such conditions where only few earlier options were available for this condition. As somatostatin analogues representing the action of endogenously produced somatostatin, these substances offer an approach toward hormone-related disorders using a controlled manner of doing so. This gives entry ways to better outcomes and superior well-being. Often, such analogues prevent complications and have a better prognosis. Summarizing, somatostatin analogues are very important tools in the modern practice of medicine, effectively managing acromegaly, neuroendocrine tumors, and gastrointestinal disorders. Their targeted action brings patients much relief, underlining the role of innovative approaches in complex health challenges treatment.

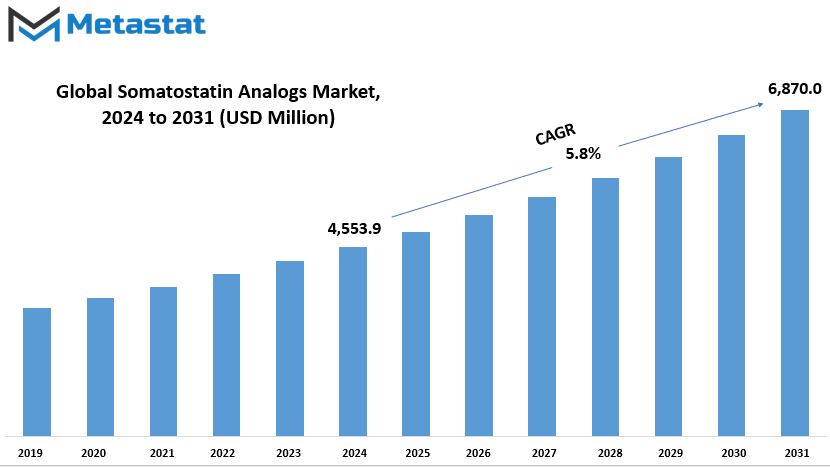

Global Somatostatin Analogs market is estimated to reach $6,870.0 Million by 2031; growing at a CAGR of 5.8% from 2024 to 2031.

MARKET DYNAMICS

Neuroendocrine tumors and disorders associated with hormones are some of the growing conditions that drive the market forward. There is a rising incidence of such conditions, which in turn raises the demand for such treatments. In addition to this, there is increasing adoption of targeted therapies in managing chronic diseases. Targeted therapies are those therapies that are precise to ensure the best possible patient outcome. By focusing on specific biological targets, they decrease unnecessary side effects, which is why they are increasingly becoming acceptable to healthcare professionals and patients.

However, some factors may slow this growth. The high cost of the treatment is a significant limitation, especially in low-income areas where access to advanced healthcare is already limited. Many patients in such areas cannot afford necessary therapies, which limits their reach and effectiveness. Side effects that may occur with chronic therapy, such as gastrointestinal issues, present another challenge in this area. Such adverse effects can prevent patients from continuing their treatments, directly affecting the growth potential of this market.

Despite these challenges, promising market opportunities exist in the future. The expansion of new conditions for which these treatments might be applied will surely create the momentum needed. Ongoing research on methods for applying these treatments opens them to more extensive applications and consequently high demand. Another area is a significant interest in the extended release formulations. Extended-release formulation aims to offer convenient patient treatment schedules. Reduced frequencies of dosing could bring about improved compliance altogether.

In the coming years, these opportunities could significantly shape the market’s trajectory. As more advancements are made, and as affordability and accessibility improve, the impact of targeted therapies in managing complex health conditions could expand even further. While the obstacles cannot be ignored, the potential for growth remains strong, especially with ongoing investments in research and development. It is the balance that defines the evolution of the current market in terms of resolving all existing challenges and also achieving new opportunities. For sure, the industry needs innovative patient-centric solutions; its way out of hurdles makes such big strides in improving outcomes on health.

MARKET SEGMENTATION

By Type

The Octreotide segment accounted for a significant share in the Somatostatin Analogs Market in 2019, with a valuation of 1,705.1 USD million. This accounted for 51.7% of the market share during that year, underlining its prominence in this area. The segment is expected to grow steadily in the years to come, at a compound annual growth rate (CAGR) of 5.7% from 2020 to 2026. By the end of this period, its value is projected to reach 2,671.2 USD million. The market also holds other segments like Lanreotide, Pasireotide, Somatostatin, and others; each of these has something unique to offer to the market dynamics. Lanreotide has been another important constituent; it has been used as a treatment in similar ailments, while Pasireotide has provided specific applications to expand the spectrum of intervention. The scientific work through which these analogs of Somatostatin has been developed remains foundational in this market.

The divisions represent various uses and administration paths, thus meeting different needs in the medical field. Octreotide's supremacy in this market is majorly due to its acceptance among many and its efficiency in treating acromegaly, neuroendocrine tumors, and complications of gastrointestinal disorders. The steady demand for Octreotide speaks to the continued dependence on its established capabilities.

Lanreotide and Pasireotide have also become popular, although their contributions are still relatively much smaller compared to Octreotide. These analogues serve as alternatives, especially for those who need specific formulations or whose condition responds better to other treatment plans. Medical research and technological progress have allowed the creation and improvement of these treatments to provide healthcare professionals with a variety of instruments to tackle complex health issues.

As the market is growing, these segments combined prove the role of innovation in the pharmaceutical sector. With growing awareness about these drugs and their advantages along with improved healthcare infrastructure, this market seems to grow. Focus on patient outcomes along with unmet medical needs will ensure that these drugs are going to remain as a part of the new age medicine to fulfill current as well as future requirements.

Maintaining an equilibrium between accessibility, efficacy, and continuous research, Somatostatin Analogs Market, led by Octreotide, is poised to make meaningful contributions to global health.

By Formulation Type

Segmented by type of formulation, which includes injectable, oral, and depot injection; each offers specific advantages tailored to specific needs and preferences. Injectable formulations are among the most used types, since it rapidly and effectively places drugs directly into the bloodstream for faster and rapid action by active ingredients for applications that need a rapid outcome. Injectables are the first choice in emergency conditions or for patients where oral intake may not be possible by healthcare providers.

Oral preparations are the most commonly administered drugs as they are most convenient for drug administration. These are generally available as tablets, capsules, or liquids, which can easily be kept and administered. Patients prefer oral medication since it can be administered by themselves without the help of a healthcare professional. Moreover, oral formulations are cheaper in general, thus more accessible to a larger population. However, this method is slower in producing results compared to injectables because the drug has to pass through the digestive system before being absorbed into the bloodstream.

Depot injections are a formulation option that is specifically tailored to release medication over a longer duration. These formulations are administered into the body where the drug is released over a long period of time. Depot injections are particularly helpful to patients who need consistent medication levels but cannot take it daily. It is often used in the treatment of chronic conditions, thereby making it a reliable and convenient solution for both the patient and the healthcare provider. Depot injections reduce the dosing interval, thereby contributing to increased adherence to treatment schemes and, ultimately, positive outcomes.

By Route of Administration

Medical products and treatments form a well-categorized market regarding method of administration that provides clarity of thought towards how patients' treatment can be made easily delivered to them. Because the subcategories according to the type of treatment -subcutaneous, intramuscular, intravenous and oral provide a differentiated usage according to the form or type of the desired therapy. Such therapy types, considering nature of disease, need or demand in the given treatment of patients, work precisely to perform their designed intended functions.

Subcutaneous injection refers to the injection of drugs under the skin, usually in the fatty tissue. This is one of the most common routes for drugs that need to be absorbed slowly over a period of time, such as insulin for diabetes or some vaccines. It is less invasive than other routes of injection and therefore commonly used in home care for patients who are managing chronic conditions. Subcutaneous injections are relatively easy to administer and do not require much training; therefore, they are very popular in both clinical and personal care settings.

In the intramuscular injection, medicine is directly given into a muscle. This is the reason it is usually recommended for drugs that have to be absorbed in large quantities in the bloodstream but cannot be given via the oral route. Examples are flu shots and some antibiotics. Large volumes of drugs can be administered intramuscularly as compared to subcutaneous injections; thus, it is suitable for treatments requiring high doses.

Intravenous administration, or IV, is one of the fastest ways to administer drugs directly into the bloodstream. It is mainly used in hospitals and emergency conditions where a quick effect is needed. Intravenous administration is helpful for severe infection, dehydration, or for pain management during surgery. It requires professional skills and sterile equipment, hence, is mostly used in clinical settings and provides instant results.

The most common and convenient method is oral administration. It is orally administered and ingested into the mouth. That category falls under pills, capsules, and liquids. Oral routes are favored where the treatment doesn't need quick action or is stable to pass through the digestive system. Oral medication is very easy to produce, transport, and store; therefore, it is easily accessible and not expensive for most conditions.

Every route of administration has different strengths and weaknesses, and some are suited to particular situations and the patient's needs than others. Understanding these modes assures effective delivery, contributing towards better patient care and better treatment outcomes.

By End-User

Somatostatin analogs, the synthetic version of the naturally occurring hormone, are slowly being marketed worldwide. Such analogues are extremely critical in dealing with acromegaly, neuroendocrine tumors, and most disorders of the gastrointestinal system. They have hugely assisted in regulating excessive hormone secretion, thereby affording the patient an excellent relief as well as quality life.

The most important factor driving the growth of this market is the growing incidence of hormonal disorders and neuroendocrine tumors across the world. The more people get to know about these diseases, the more they look for effective treatments. More recent advances in medical technology also led to more efficient delivery methods that make these medications easier to administer and enhance patient adherence to prescribed regimens.

This end-users market the somatostatin analogs is divided into hospitals, specialty clinics, ambulatory surgical centers, and home care settings. For such treatments, patients prefer hospitals most because they feel that such advanced diagnostic and treatment facilities are available there. This would provide focused care specialty clinics, so the patients could be targeted according to the rarity of the disease. Ambulatory surgical centers now form a setting for minimal invasive procedures that can be combined with postoperative care settings and include the use of somatostatin analogs. For homecare settings, they also increased because more patients seek convenience and comfort in managing chronic conditions at their homes, especially with long-acting formulations.

This market expansion is also supported by continuous research and new formulations being developed to improve efficacy and minimize side effects. Companies are working on increasing access by making the treatment cost less expensive, thereby increasing access for a larger population of patients.

Though there is a promising outlook, rigid regulatory requirements and the high price of these drugs are likely to limit the growth of this market to some extent. However, alliances between pharmaceutical companies and healthcare providers, and the government's efforts toward strengthening healthcare infrastructure, will definitely counterbalance these challenges to a large extent.

In brief, the global somatostatin analog market would grow strongly in the forthcoming years with an increase in medical needs, better treatment options becoming available, and increased utilization across various healthcare settings. So long as the trend of progress continues along with support from policies, the potential of the market is regarded to benefit hundreds of thousands of patients.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$4,553.9 million |

|

Market Size by 2031 |

$6,870.0 Million |

|

Growth Rate from 2024 to 2031 |

5.8% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL SEGEMENTATION

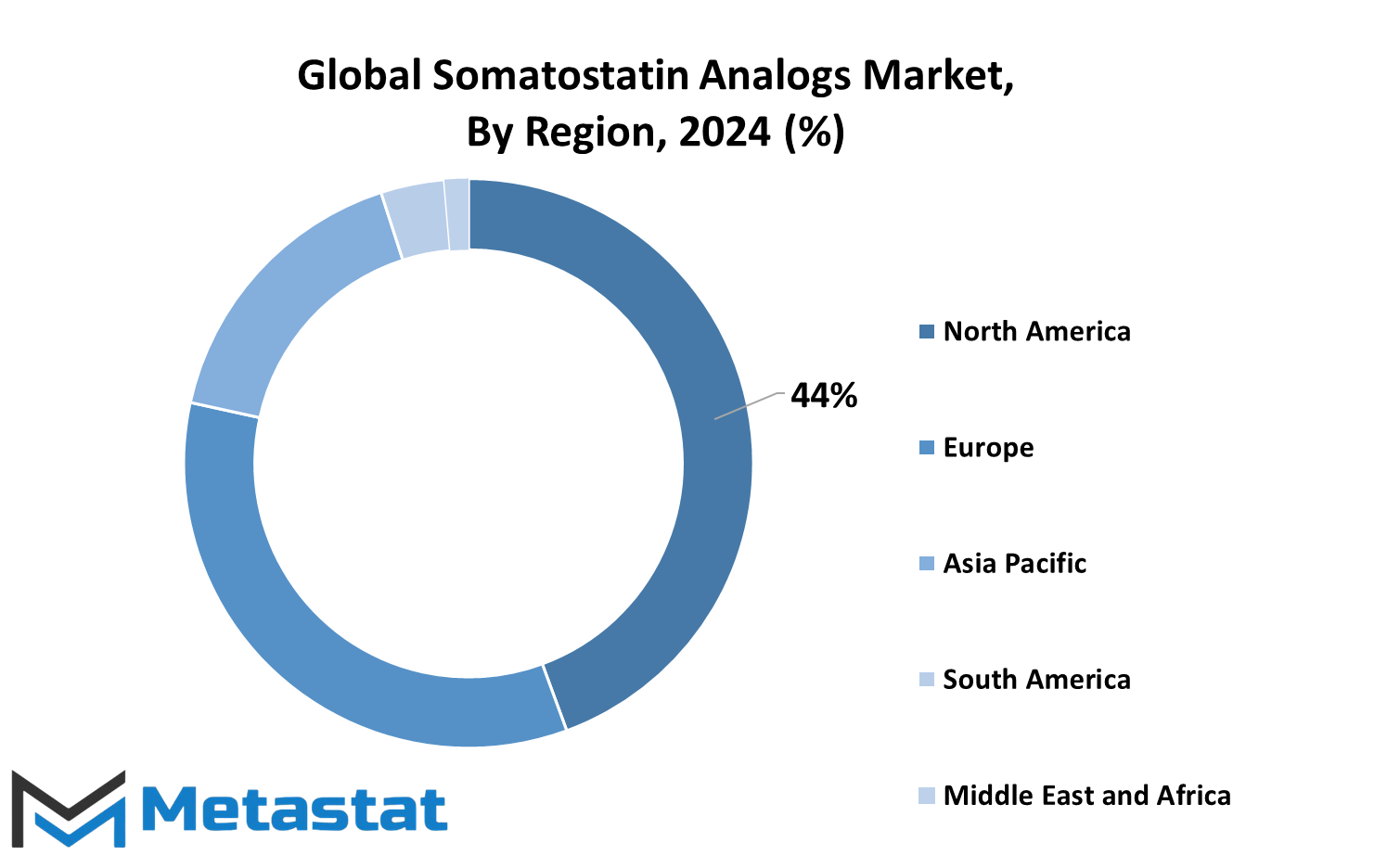

The global Somatostatin Analogs market has been analyzed according to the geographical distribution that is spread across five significant regions of North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each of these regions further divides into specific countries in order to provide an appropriate understanding of the reach of the market and the prospects.

In North America, the market is segmented into the United States, Canada, and Mexico. This region plays a significant role because of advanced healthcare infrastructure, growing awareness of endocrine disorders, and the availability of innovative treatments. Similarly, Europe includes key countries such as the United Kingdom, Germany, France, Italy, and the Rest of Europe. The well-established pharmaceutical industries and strong research activities drive the market in these nations.

Asia-Pacific is another key region that is further segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific. Growth in this region is promising owing to its large population, increasing healthcare expenditure, and growing prevalence of chronic diseases. Rapid urbanization and betterment in the healthcare infrastructure are also helping in demand for Somatostatin Analogs.

South America consists of Brazil, Argentina, and the Rest of South America. The market in this region is expanding with increased awareness of hormonal disorders and the treatment available. Improvement in access to medical facilities in the region and healthcare reforms underway are factors that further the region's chances in enhancing market opportunities.

Lastly, the Middle East & Africa is divided into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa. Although this region experiences such challenges as limited healthcare access in some areas, it faces such opportunities as growing health care modernization and chronic diseases burden.

This geographic analysis reveals the various factors that influence growth and development in the Somatostatin Analogs market. Each region has distinct opportunities and challenges, molded by factors such as healthcare policy, economic development, and population health trends. Understanding these regional dynamics is the best way for the stakeholders of the market to align their strategies with regional requirements and maximize their output at a global level.

COMPETITIVE LANDSCAPE

The Somatostatin Analogs industry has grown strongly due to its essential functions and applications in disease treatment, such as hormone-related disorders and certain types of tumors. This field attracted various major companies that continue to develop new products for the continuously increasing demand for effective treatments. Major players in this market include Novartis International AG, Ipsen Pharma, Sun Pharmaceutical Industries Ltd, Eli Lilly and Company, Chiesi, Peptron, Inc., CRINETICS PHARMACEUTICALS, Ferring Pharmaceuticals, Camurus AB, and Pfizer Inc.

Somatostatin analogues are artificial peptides designed to mimic the natural somatostatin hormone that acts on various physiological processes. The major application of such analogues is in managing conditions such as acromegaly, neuroendocrine tumors, and others involving hypersecretion. Their efficacy in mitigating symptoms and improving patients' quality of life makes them the cornerstone in the treatment of these diseases. Moreover, the continuous advancement of the field is working toward making better drug delivery systems with a longer duration of action, which could also be of great help for better adherence and outcomes by patients.

The companies discussed above play a significant role in innovating and advancing access to these drugs. For example, Novartis International AG has created several products that are known to be effective. Ipsen Pharma and Pfizer Inc. have also contributed a lot by developing high-quality treatments that fill the gaps of unmet medical needs. Each of these companies concentrates on research and development in order to come up with solutions that not only control symptoms but also deal with the root causes of the diseases.

Besides the therapeutic values, the industry of Somatostatin Analogs also contributes to the economy of the world by creating employment opportunities and promoting teamwork among healthcare providers, researchers, and pharmaceutical companies. The efforts of these key players are not only advancing medical science but also enhancing the lives of many people across the globe.

With the continuous evolution of the sector, the commitment of the companies to innovation and patients ensures that the future would be bright for the lives of those suffering from hormonal disorders and other treatable conditions with somatostatin analogs. The relentless work of these companies towards addressing the challenges in healthcare reflects dedication towards making a tangible difference in the lives of its users.

Somatostatin Analogs Market Key Segments:

By Type

- Octreotide

- Lanreotide

- Pasireotide

- Somatostatin

- Other

By Formulation Type

- Injectable

- Oral

- Depot Injection

By Route of Administration

- Subcutaneous

- Intramuscular

- Intravenous

- Oral

By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Homecare Settings

Key Global Somatostatin Analogs Industry Players

- Novartis International AG

- Ipsen Pharma

- Sun Pharmaceutical Industries Ltd

- Eli Lilly and Company

- Chiesi

- Peptron, Inc

- CRINETICS PHARMACEUTICALS

- Ferring Pharmaceuticals

- Camurus AB

- Pfizer Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252