Global Silicone Coating Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global silicone coating market as it evolved from a small segment of the chemical industry to being a major player in material innovation. The first steps were taken in the mid-20th century when silicone-based materials were tested for their durability and resistance to extreme environments. First, the aerospace and electronics industries were the only ones to benefit from silicone coatings as during the time other coatings could not raise high temperatures and moisture. Soon, through research and improved production, silicone coatings could be used in various industries, besides aerospace and electronics, like automotive, construction, textile, and energy.

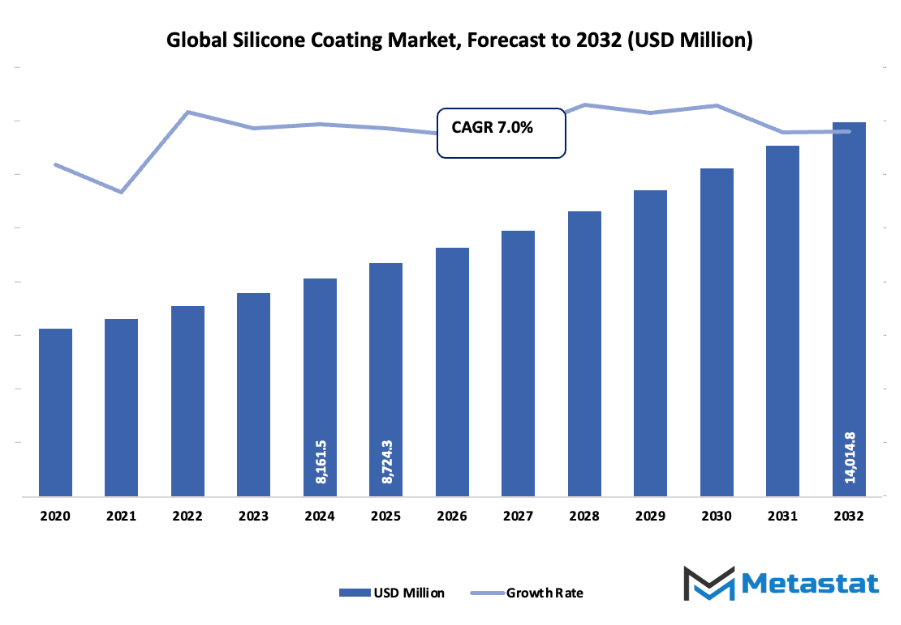

- Global silicone coating market valued at approximately USD 8724.3 million in 2025, growing at a CAGR of around 7.0% through 2032, with potential to exceed USD 14014.8 million.

- Silicone Additives account for nearly 32.2% market share, driving innovation and expanding applications through intense research.

- Key trends driving growth: Increasing demand for energy-efficient and weather-resistant roofing solutions, Growing use of silicone coatings in automotive and electronic applications

- Opportunities include: Development of eco-friendly, water-based silicone coatings for sustainable applications

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

In the 1980s, industrial usage became widespread as companies understood that silicone would lengthen the life of even the most heavily used surfaces. Thus, the market rise then was a reflection of an increasing concern over durability, energy efficiency, and safety. Silicone coatings became the “hidden” benefits to urban infrastructure and industrial manufacturing, which were getting harsher over time and challenged by conventional material properties. The environment awareness took off in the 1990s which was another major turning point. As a response to the issues related to environmental and safety regulations, the manufacturers started to change their products and to use less volatile organic compounds while at the same time keeping the old performance standards.

The task of mapping professional demand went on into the next century, through digital revolution and globalization. The building of the data centers, the renewable energy sites, and the high-performance vehicles projected the challenges for coating technologies. Silicone coatings came out with a solution through a combination of nanotechnology and hybrid formulations that improved weather resistance, adhesion, and flexibility.

Market Segments

The global silicone coating market is mainly classified based on Composition Type, Technology, Application.

By Composition Type is further segmented into:

- Silicone Additives: Silicone additives improve coating performance by enhancing surface smoothness, durability, and resistance to environmental factors. They are often used in small quantities but have a strong impact on the overall quality of coatings. Their ability to improve spreadability and reduce foam formation increases the lifespan and appearance of coated surfaces.

- Silicone Polymers: Silicone polymers play a vital role in providing elasticity and protection to coated materials. They help coatings withstand harsh weather conditions and mechanical stress. Their chemical stability ensures that coatings remain effective over time, maintaining both function and appearance without degradation. These properties make them widely used in various industries.

- 100% Silicone: 100% silicone coatings are known for their excellent waterproofing and weather-resistant properties. They form a strong and flexible layer that protects surfaces from moisture and UV damage. Such coatings are preferred in applications where long-lasting performance and minimal maintenance are required, especially in outdoor and high-temperature environments.

- Silicone Water Repellents: Silicone water repellents are used to protect surfaces from water absorption and staining. They allow materials to breathe while preventing moisture penetration, which helps reduce damage caused by mold and cracking. These coatings are commonly used on concrete, masonry, and other porous surfaces to enhance durability and lifespan.

By Technology the market is divided into:

- Solvent-based: Solvent-based silicone coatings provide excellent adhesion and smooth finish. They dry quickly and perform well in humid environments. Although they may contain volatile organic compounds, their strong protective qualities make them suitable for industrial and automotive uses where long-term durability is essential.

- Solventless: Solventless silicone coatings are gaining popularity due to low emissions and environmental benefits. They provide excellent mechanical strength and resistance to chemicals without using harmful solvents. This technology reduces waste and improves efficiency, making it ideal for industries focusing on sustainability and safety.

- Water-based: Water-based silicone coatings are preferred for being environmentally friendly and easy to apply. They offer strong adhesion, UV protection, and flexibility while reducing harmful emissions. Their growing use in construction and consumer goods sectors reflects the increasing shift toward eco-friendly and safer coating solutions.

- Powder-based: Powder-based silicone coatings are durable and efficient, requiring no solvents during application. They provide excellent resistance to scratches, corrosion, and chemicals. The powder form reduces waste and allows precise application, making them cost-effective and environmentally responsible choices for industrial uses.

By Application the market is further divided into:

- Construction: In the construction sector, silicone coatings are widely used to protect buildings from moisture, heat, and weather damage. They improve energy efficiency by reflecting sunlight and reducing surface temperature. Their long-lasting protection makes them valuable for roofing, walls, and exterior structures.

- Automotive & Transportation: Silicone coatings in automotive and transportation help enhance vehicle durability and appearance. They provide protection against corrosion, UV exposure, and extreme temperatures. These coatings also improve gloss and resistance to abrasion, making them suitable for both interior and exterior automotive applications.

- Consumer Goods: Silicone coatings are used in consumer goods to enhance product life and performance. Their heat resistance, flexibility, and non-stick qualities make them ideal for cookware, electronics, and personal care items. The coatings also improve aesthetic appeal and ensure longer usability.

- Industrial: In industrial applications, silicone coatings are valued for protecting equipment from chemical and thermal damage. They offer insulation and corrosion resistance, which extends machinery life and reduces maintenance costs. These coatings support reliable performance even in demanding industrial environments.

- Paper & Film Release: Silicone coatings in paper and film release applications prevent sticking and provide smooth surface separation. They are essential in label production, tapes, and packaging materials. Their efficiency in ensuring clean release and maintaining product quality supports widespread use in packaging industries.

- Marine: In marine applications, silicone coatings protect surfaces from saltwater corrosion and fouling. They help reduce drag and improve fuel efficiency for vessels. Their long-lasting resistance to harsh marine conditions makes them crucial for ship maintenance and performance.

- Others: Other applications of silicone coatings include textiles, electronics, and energy sectors. They provide insulation, heat resistance, and surface protection across various products. Their versatility and adaptability drive ongoing demand in specialized industries where performance and durability are essential.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$8724.3 Million |

|

Market Size by 2032 |

$14014.8 Million |

|

Growth Rate from 2025 to 2032 |

7.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

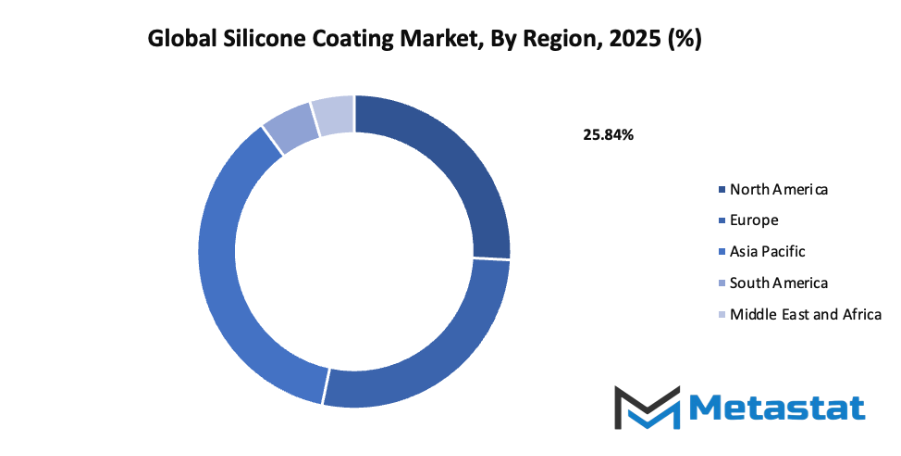

By Region:

- Based on geography, the global silicone coating market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing demand for energy-efficient and weather-resistant roofing solutions: The global silicone coating market is experiencing steady expansion due to rising interest in roofing materials that enhance durability and energy efficiency. Silicone coatings are known for their excellent resistance to extreme temperatures and UV radiation, which helps in reducing energy consumption. The growing focus on sustainable construction and cost-effective maintenance has encouraged wider use of silicone coatings in both residential and commercial roofing projects. These coatings also extend the lifespan of roofs, reducing replacement costs and promoting long-term savings for building owners.

- Growing use of silicone coatings in automotive and electronic applications: The global silicone coating market is gaining traction with the increased use of silicone-based coatings in automotive and electronic sectors. These coatings provide superior protection against moisture, heat, and corrosion, ensuring longer component life and improved performance. In vehicles, silicone coatings are used for exterior protection and heat insulation, while in electronics, they serve as effective insulating materials that prevent short circuits and damage from humidity. With continuous advancements in technology and manufacturing, the demand for silicone coatings across these industries continues to strengthen globally.

Challenges and Opportunities

- High production and application costs compared to conventional coatings: The global silicone coating market faces challenges due to its relatively high production and application costs. Silicone coatings require specialized raw materials and manufacturing processes, making them more expensive than traditional coatings. This cost factor limits adoption in price-sensitive markets and small-scale industries. Additionally, the application process often demands trained professionals and specific equipment, further increasing expenses. Despite their superior performance and durability, the higher overall cost can discourage potential users, slowing market penetration in certain regions.

- Environmental concerns related to solvent-based silicone coatings: Another major challenge for the global silicone coating market is the environmental impact of solvent-based coatings. These products release volatile organic compounds (VOCs) that contribute to air pollution and pose health risks. Increasing regulatory restrictions on VOC emissions have put pressure on manufacturers to find cleaner alternatives. This concern has led to a shift in focus toward developing low-VOC or solvent-free silicone coatings. While the transition requires investment in research and reformulation, it opens the path for more sustainable and compliant products in the future.

Opportunities

- Development of eco-friendly, water-based silicone coatings for sustainable applications: The global silicone coating market holds strong growth potential through the development of eco-friendly, water-based silicone coatings. These alternatives offer the same durability and weather resistance as solvent-based options but with significantly reduced environmental impact. Water-based coatings eliminate harmful emissions and are safer to produce and apply. Their increasing use aligns with global sustainability goals and rising consumer preference for green materials. Continuous innovation in water-based technology is expected to improve performance standards further, positioning these coatings as the preferred choice for sustainable construction and industrial applications worldwide.

Competitive Landscape & Strategic Insights

The global silicone coating market operates within a highly competitive landscape marked by the presence of both long-established international corporations and ambitious regional players. Each company continuously strives to strengthen its position through innovation, sustainability, and technological advancements. The leading participants such as Wacker Chemie AG, Momentive Performance Materials Inc., Dow Corning Corporation, Shin-Etsu Chemical Co., Ltd., KCC Silicone, Evonik Industries AG, Elkem Silicones, Carboline Company, OMG Borchers GmbH, Sika AG, ACC Silicones Ltd., MAPEI SpA, BASF SE, and BYK-Chemie GmbH, collectively influence the market’s direction through ongoing research and expansion of production capabilities.

Future growth within this competitive landscape will rely on how efficiently each company adapts to the changing needs of end-users and global sustainability trends. The demand for eco-friendly and durable coatings is driving firms to focus more on developing low-emission formulations and advanced performance materials. Technological progress in material science is also expected to transform production methods, making them more cost-effective and environmentally conscious. In the coming years, the market will likely witness collaborations, mergers, and acquisitions designed to combine expertise and enhance innovation capacity.

Strategic insights for the next phase of industry development point toward automation, digital monitoring, and AI-assisted manufacturing as major enablers of efficiency. Such advancements will allow faster production cycles, better quality control, and reduced operational costs. Moreover, global regulatory standards emphasizing environmental protection and product safety will push companies to invest in cleaner manufacturing processes. The firms that respond quickly to these standards will gain stronger market credibility and customer trust.

Market size is forecast to rise from USD 8724.3 million in 2025 to over USD 14014.8 million by 2032. Silicone Coating will maintain dominance but face growing competition from emerging formats.

From a futuristic perspective, the competitive landscape will shift toward greater specialization, with each participant aiming to serve niche applications through tailored silicone solutions. As industries like construction, automotive, and electronics continue to expand, silicone coatings will play an increasingly vital role in ensuring product durability, heat resistance, and surface protection. This transformation will open new growth paths while encouraging continuous improvement in product performance.

Report Coverage

This research report categorizes the global silicone coating market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global silicone coating market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global silicone coating market.

Silicone Coating Market Key Segments:

By Composition Type

- Silicone Additives

- Silicone Polymers

- 100% Silicone

- Silicone Water Repellents

By Technology

- Solvent-based

- Solventless

- Water-based

- Powder-based

By Application

- Construction

- Automotive & Transportation

- Consumer Goods

- Industrial

- Paper & Film Release

- Marine

- Others

Key Global Silicone Coating Industry Players

- Wacker Chemie AG

- Momentive Performance Materials Inc.

- Dow Corning Corporation

- Shin-Etsu Chemical Co., Ltd.

- KCC Silicone

- Evonik Industries AG

- Elkem Silicones

- Carboline Company

- OMG Borchers GmbH

- Sika AG

- Momentive Performance Materials Inc.

- ACC Silicones Ltd.

- MAPEI SpA

- BASF SE

- BYK-Chemie GmbH

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252