MARKET OVERVIEW

In semiconductor technologies, the Global Semiconductor Gas Purifiers market emerges as a crucial player, wielding influence over the quality and efficiency of semiconductor manufacturing processes. This market represents a specialized sector dedicated to the purification of gases employed in semiconductor fabrication, playing a pivotal role in ensuring the integrity of the production environment.

Semiconductor gas purifiers are integral components in the semiconductor manufacturing ecosystem, designed to maintain the purity of gases essential for various fabrication processes. They operate on the principle of removing impurities, moisture, and unwanted particles from the gases, thereby safeguarding the precision and reliability of semiconductor manufacturing.

One of the primary functions of these gas purifiers is to enhance the quality of gases used in critical semiconductor processes such as chemical vapor deposition (CVD) and etching. In CVD, where thin films are deposited onto semiconductor wafers, the purity of the precursor gases is paramount for achieving precise and defect-free layers. Semiconductor gas purifiers play a vital role in eliminating contaminants that could compromise the integrity of these processes.

Moreover, in etching, where material is selectively removed from semiconductor wafers to create intricate patterns, the purity of the etching gases is equally crucial. The Global Semiconductor Gas Purifiers market addresses this necessity by providing advanced purification solutions that contribute to the production of high-performance semiconductor devices.

The semiconductor industry's relentless pursuit of innovation and performance improvement underscores the significance of the Global Semiconductor Gas Purifiers market. As semiconductor technologies continue to advance, demanding higher levels of precision and reliability, the role of gas purifiers becomes even more critical. The market responds to these evolving demands by consistently developing and delivering cutting-edge purification technologies.

In addition to their role in ensuring the quality of semiconductor manufacturing processes, these gas purifiers contribute to the overall efficiency and cost-effectiveness of semiconductor production. By minimizing the risk of defects and optimizing process parameters, they contribute to higher yield rates, reduced downtime, and ultimately, enhanced profitability for semiconductor manufacturers.

The Global Semiconductor Gas Purifiers market occupies a specialized niche within the broader semiconductor industry, wielding influence over the quality, precision, and efficiency of semiconductor manufacturing processes. Its role in purifying gases for critical processes such as CVD and etching underscores its significance in maintaining the integrity of semiconductor production. As the semiconductor landscape continues to evolve, the market adapts by innovating purification technologies that meet the ever-increasing demands for precision and reliability in semiconductor fabrication.

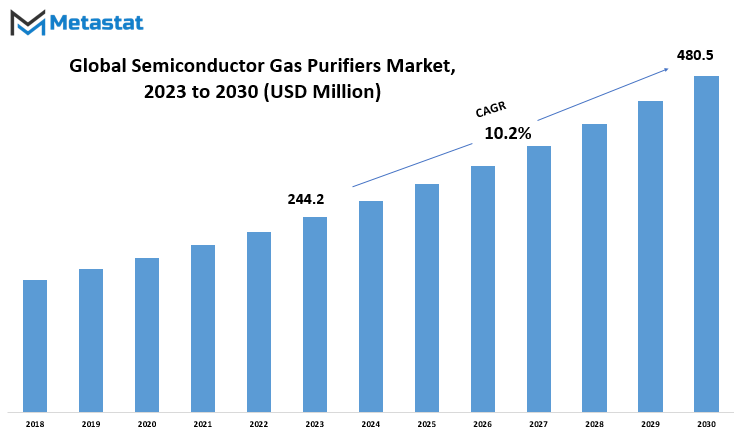

Global Semiconductor Gas Purifiers market is estimated to reach $480.5 Million by 2030; growing at a CAGR of 10.2% from 2023 to 2030.

GROWTH FACTORS

The global Semiconductor Gas Purifiers market experiences various growth factors that play a crucial role in its development. These factors contribute significantly to the market's upward trajectory. On the flip side, certain challenges may impede this growth, posing hurdles for the market. Despite these obstacles, there exist promising opportunities that could propel the market forward in the years to come.

The positive momentum in the Semiconductor Gas Purifiers market can be attributed to key growth factors. These factors serve as catalysts, driving the market towards expansion and success. They act as the driving force, fueling the overall growth and prosperity of the market on a global scale.

However, it's essential to acknowledge that challenges exist in this landscape. Certain factors, yet to be precisely identified, may act as barriers to the market's growth. These challenges pose potential threats, requiring careful consideration and strategic measures to overcome. Despite these obstacles, the Semiconductor Gas Purifiers market remains resilient and adaptive. It can identify and leverage lucrative opportunities that arise. These opportunities, when tapped into effectively, have the potential to steer the market towards prosperity and sustained growth.

The global Semiconductor Gas Purifiers market is a dynamic space with its share of growth drivers and challenges. The market's ability to navigate through obstacles and capitalize on opportunities will ultimately shape its future trajectory. As the industry evolves, stakeholders must remain vigilant, adapting strategies to ensure continued growth and success in the ever-changing market landscape.

MARKET SEGMENTATION

By Type

In the vast landscape of the global market for Semiconductor Gas Purifiers, the types available play a pivotal role in meeting diverse industry needs. Breaking down this market, we find two main segments that cater to distinct requirements: Point of Use Gas Purifiers and Bulk Gas Purifiers.

The Point of Use Gas Purifiers, a key player in this market, held a value of 123.2 USD Million in the year 2022. This segment is designed to address specific points in the manufacturing process where gas purification is crucial. It serves as a targeted solution, ensuring that gases used in specific applications meet the required purity standards. This strategic approach enhances efficiency by focusing on the exact junctures where gas quality is paramount.

On the other side of the spectrum, we have the Bulk Gas Purifier segment, which recorded a value of 94 USD Million in 2022. This category takes a broader approach, purifying gases on a larger scale before they are distributed to various points in the manufacturing process. Bulk Gas Purifiers are instrumental in maintaining a consistent and high level of purity throughout the entire system, catering to industries where uniform gas quality is imperative.

Both segments play distinctive roles in the semiconductor industry, addressing the specific needs of different stages in the manufacturing process. The Point of Use Gas Purifiers offer precision at critical points, while the Bulk Gas Purifiers provide a comprehensive solution, ensuring purity across the board. As the semiconductor industry continues to advance, the importance of these purifiers becomes even more apparent, contributing significantly to the overall quality and reliability of semiconductor products.

By Application

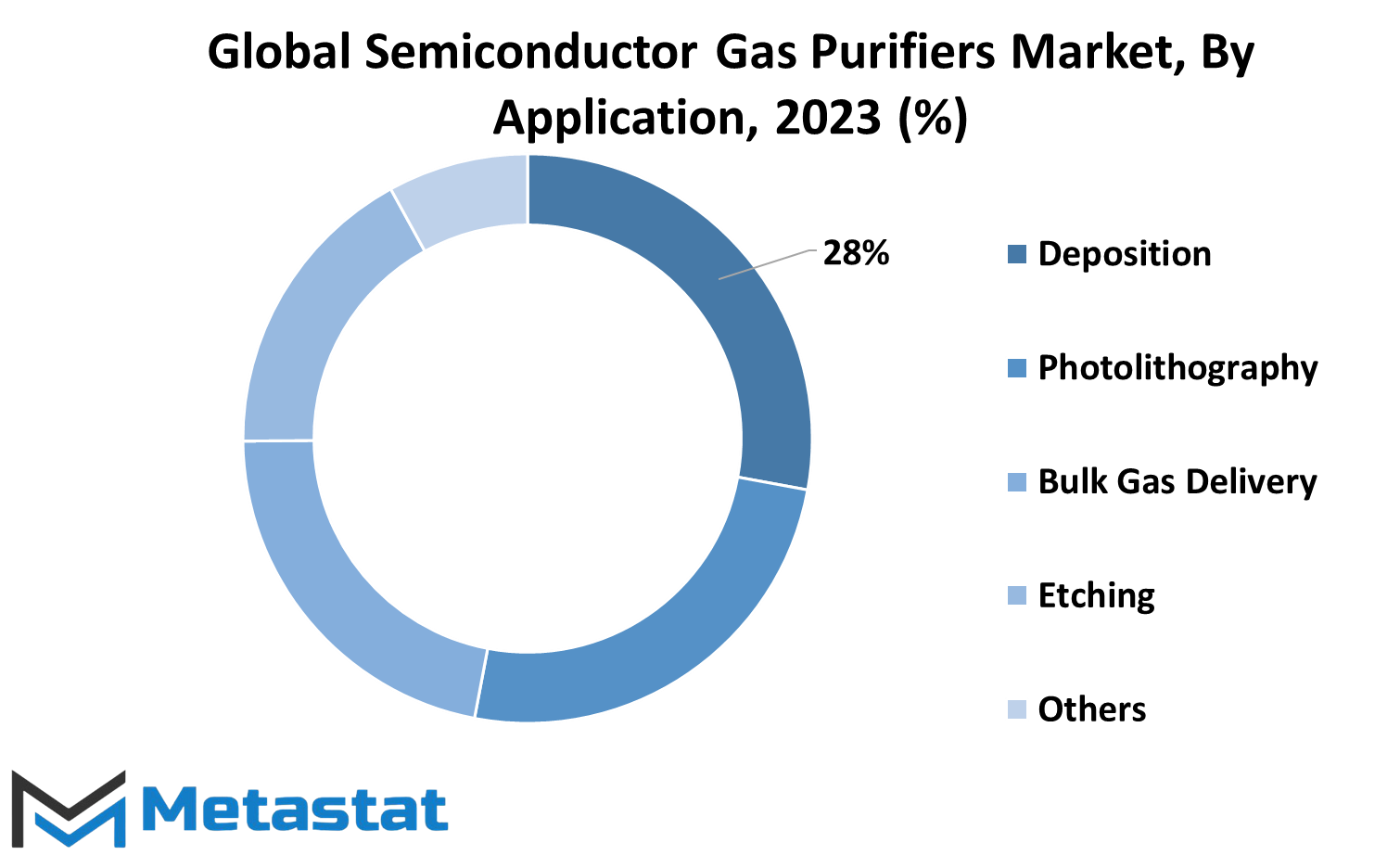

The global semiconductor gas purifiers market caters to various applications, each contributing to its overall dynamics. One pivotal segment is Deposition, which accounted for a substantial value of 60.4 USD Million in 2022. This application involves the process of adding a layer of material onto a substrate, playing a crucial role in semiconductor manufacturing. Another significant facet is Photolithography, valued at 54.6 USD Million in 2022. Photolithography is a key element in the semiconductor production process, employing light to transfer a geometric pattern from a photomask to a light-sensitive chemical, facilitating precise circuitry creation.

Bulk Gas Delivery stands as a prominent category, registering a value of 47.5 USD Million in 2022. In semiconductor fabrication, Bulk Gas Delivery ensures the efficient transportation of gases required for various processes, underscoring its indispensable role. Etching is another crucial application, with a value of 37.3 USD Million in 2022. This process involves selectively removing material from a substrate, contributing significantly to the creation of intricate patterns in semiconductor manufacturing.

The market also encompasses an Others category, valued at 17.4 USD Million in 2022. While not explicitly detailed, this segment likely includes a range of miscellaneous applications within the semiconductor industry.

The global semiconductor gas purifiers market unfolds across these diverse applications, each playing a distinct role in the intricate web of semiconductor manufacturing. From the precise layering of materials to the strategic removal of substances, these applications collectively drive the market's growth and underline the vital role of semiconductor gas purifiers in modern technology.

REGIONAL ANALYSIS

The North American region holds a significant stake in the Semiconductor Gas Purifiers market. With advanced technological infrastructure and a robust semiconductor industry, the demand for gas purifiers is notably high. The region's commitment to innovation and research contributes to the constant growth of the market.

Moving across the Atlantic, Europe stands as another crucial player in the Semiconductor Gas Purifiers market. European countries have a well-established semiconductor sector, driving the need for efficient gas purifiers. Stringent environmental regulations also play a role in adopting these purifiers, ensuring compliance with emissions standards.

In the Asia-Pacific region, the Semiconductor Gas Purifiers market experiences dynamic growth. This surge is attributed to the flourishing semiconductor manufacturing activities in countries like China, Japan, and South Korea. The region's economic prowess and continuous industrial development fuel the demand for gas purifiers as an essential component of semiconductor production.

Each of these regions contributes uniquely to the global market landscape. North America, with its technological prowess, Europe with its stringent regulations, and Asia-Pacific with its booming semiconductor industry, collectively shape the trajectory of the Semiconductor Gas Purifiers market on a global scale. This regional segmentation provides insights into the diverse factors influencing market dynamics across different parts of the world.

COMPETITIVE PLAYERS

The global market for Semiconductor Gas Purifiers features significant players driving the competition. Among these key contributors are companies like Entegris, Inc. and Pall Corporation. Entegris, Inc. stands out as one of the prominent players in the Semiconductor Gas Purifiers sector. Their role in this industry revolves around providing solutions that contribute to the efficiency and reliability of semiconductor manufacturing processes. With a focus on innovation, Entegris aims to address the evolving needs of the market.

Another noteworthy participant is Pall Corporation, recognized for its impact on the Semiconductor Gas Purifiers market. Pall Corporation is dedicated to delivering advanced filtration and purification technologies. Their contributions play a crucial role in maintaining the purity of gases involved in semiconductor production, ensuring the high-quality standards required by the industry.

These competitive players, such as Entegris, Inc. and Pall Corporation, are instrumental in shaping the landscape of the Semiconductor Gas Purifiers market. Their commitment to innovation and reliability reinforces their positions in the industry, contributing to the overall growth and development of semiconductor manufacturing processes.

Semiconductor Gas Purifiers Market Key Segments:

By Type

- Point of Use Gas Purifiers

- Bulk Gas Purifier

By Application

- Deposition

- Photolithography

- Bulk Gas Delivery

- Etching

- Others

Key Global Semiconductor Gas Purifiers Industry Players

- Entegris, Inc.

- Pall Corporation

- Nippon Sanso Holdings Corporation

- Applied Energy Systems, Inc.

- Air Water Mechatronics Inc.

- NuPure Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383