MARKET OVERVIEW

The Saudi Arabia Bottled Water market stands as a significant component within the country's broader beverage industry landscape. With its unique geographical and climatic conditions, Saudi Arabia has witnessed a burgeoning demand for bottled water over the years, driven by various factors including lifestyle changes, urbanization, and growing awareness of health and hydration.

In recent times, the Saudi Arabia Bottled Water market has experienced notable shifts in consumer preferences and market dynamics. With an increasing focus on health and wellness, consumers are seeking purified and mineral-enriched water options, driving the demand for premium bottled water products. Additionally, factors such as convenience, hygiene concerns, and the absence of reliable tap water in certain regions further contribute to the market's growth.

One of the distinguishing features of the Saudi Arabia Bottled Water market is the presence of both domestic and international players. While international brands have a strong foothold in the market, domestic brands have been gaining momentum, capitalizing on their understanding of local preferences and distribution networks. This competitive landscape fosters innovation and product differentiation, with companies introducing new flavors, packaging formats, and functional benefits to cater to diverse consumer needs.

Moreover, the regulatory environment plays a crucial role in shaping the Saudi Arabia Bottled Water market. Strict quality standards and regulations ensure the safety and purity of bottled water products, instilling consumer confidence and driving compliance across the industry. These regulations also govern labeling requirements, pricing policies, and advertising practices, contributing to a transparent and regulated market ecosystem.

In terms of distribution, the Saudi Arabia Bottled Water market encompasses a diverse network ranging from supermarkets and hypermarkets to convenience stores, pharmacies, and online channels. This multi-channel approach allows brands to reach consumers across various touchpoints, ensuring widespread availability and accessibility.

Despite the market's resilience, it is not immune to challenges. Fluctuations in raw material prices, logistics constraints, and environmental concerns surrounding plastic usage pose significant hurdles for industry players. Moreover, the economic landscape, including factors such as disposable income levels and consumer spending patterns, influences the market's growth trajectory.

Looking ahead, the Saudi Arabia Bottled Water market is poised for continued expansion, fueled by evolving consumer preferences, infrastructure developments, and strategic initiatives by industry stakeholders. As the demand for safe and convenient hydration solutions persists, the market is expected to witness further innovation, consolidation, and market segmentation, shaping the future of the beverage industry in the Kingdom.

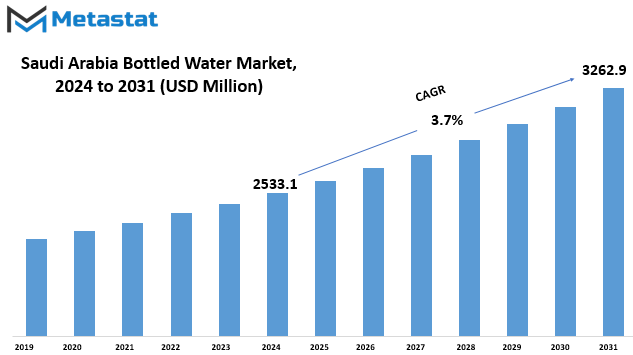

Saudi Arabia Bottled Water market is estimated to reach $3262.9 Million by 2031; growing at a CAGR of 3.7% from 2024 to 2031.

GROWTH FACTORS

In the Saudi Arabia bottled water market, several factors drive its growth. Firstly, the high temperatures and arid climates prevalent in the region increase the demand for hydration solutions. With scorching heat being a common occurrence, people naturally seek ways to stay hydrated, and bottled water serves as a convenient and accessible option.

There is a growing trend of health awareness among consumers. Many individuals are becoming more conscious of their health and are opting for bottled water over sugary drinks. This shift in consumer preferences towards healthier alternatives further boosts the demand for bottled water in the market.

However, despite the growth drivers, there are also challenges that the market faces. One significant restraint is the environmental concerns associated with plastic usage. The reliance on plastic bottles for packaging raises issues related to waste management and pollution. As awareness about environmental sustainability grows, consumers and regulatory bodies are increasingly scrutinizing the use of plastics in packaging.

Additionally, regulatory challenges and stringent quality standards pose another restraint to the bottled water market in Saudi Arabia. Compliance with regulations and ensuring the quality and safety of bottled water products require investments in infrastructure and adherence to strict protocols, which can be challenging for companies operating in the market.

Nevertheless, amidst these challenges, there are opportunities for growth and expansion. One such opportunity lies in the rising demand for premium and functional bottled water products. Consumers are increasingly willing to pay a premium for water that offers additional benefits, such as enhanced flavors, added vitamins, or specific health benefits. This trend towards premiumization presents significant market expansion opportunities for companies willing to innovate and cater to evolving consumer preferences.

The Saudi Arabia bottled water market is influenced by various drivers, restraints, and opportunities. While factors like high temperatures and health awareness drive market growth, challenges such as environmental concerns and regulatory hurdles need to be addressed. However, with the rising demand for premium and functional bottled water, there is ample opportunity for companies to thrive and expand their presence in the market.

MARKET SEGMENTATION

By Type

The Saudi Arabian bottled water market is a dynamic industry with various types catering to different consumer preferences. In 2023, the market was segmented into Still Water, Sparkling Water, and Functional Water.

Still Water, the first segment, held a considerable value of 1725.6 USD Million in 2023. This type of bottled water is characterized by its lack of carbonation, providing consumers with a refreshing and pure hydration option.

The Sparkling Water segment boasted a value of 484.2 USD Million in 2023. Unlike Still Water, Sparkling Water contains carbon dioxide gas, resulting in effervescence upon opening. Many consumers enjoy the fizzy sensation and slightly acidic taste of Sparkling Water as an alternative to sugary carbonated beverages.

The Functional Water segment, valued at 233.6 USD Million in 2023, caters to consumers seeking additional health benefits beyond basic hydration. Functional waters may contain added vitamins, minerals, electrolytes, or other supplements intended to enhance overall well-being or address specific health concerns.

Overall, the Saudi Arabian bottled water market offers a diverse array of options to meet the varying tastes and needs of consumers. From pure and still hydration to bubbly and flavored alternatives, the market continues to evolve to satisfy consumer demand for convenient and healthier beverage choices.

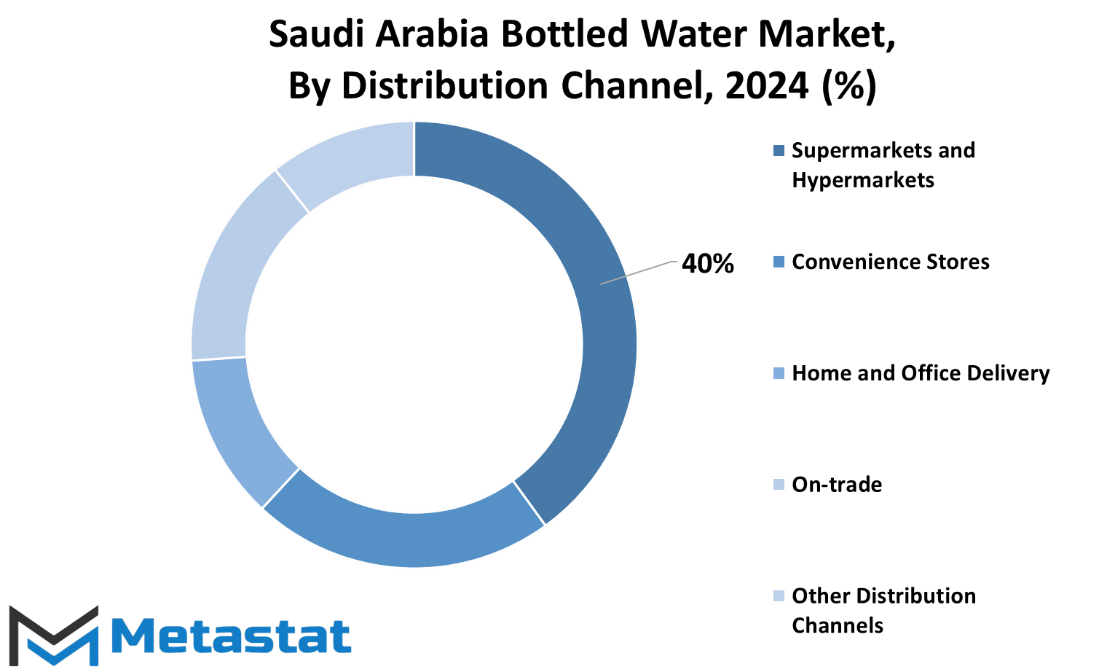

By Distribution Channel

The Saudi Arabian bottled water market is segmented by distribution channels, including supermarkets and hypermarkets, convenience stores, home and office delivery, on-trade, and other distribution channels. These segments represent the various channels through which bottled water reaches consumers in the country.

Supermarkets and hypermarkets are large retail outlets that offer a wide range of products, including bottled water. These stores attract a large number of customers due to their convenience and the variety of options available.

Convenience stores are smaller retail establishments that are typically located in residential areas or along busy streets. They cater to customers who are looking for quick and easy access to everyday items, including bottled water.

Home and office delivery services provide a convenient option for consumers who prefer to have bottled water delivered directly to their homes or workplaces. This service is particularly popular among busy individuals and businesses looking to stock up on supplies without having to visit a store.

On-trade refers to establishments such as restaurants, cafes, and hotels where bottled water is served to customers as part of their dining or hospitality experience. These establishments often purchase bottled water in bulk to meet the demands of their customers.

Other distribution channels encompass various other avenues through which bottled water is distributed in the Saudi Arabian market. This may include specialty stores, online retailers, vending machines, and direct sales channels.

Each distribution channel plays a vital role in ensuring that bottled water is readily available to consumers across the country. Supermarkets and hypermarkets offer a one-stop shopping experience, convenience stores cater to on-the-go customers, home and office delivery services provide added convenience, and on-trade establishments serve bottled water as part of their offerings. Other distribution channels further expand the reach of bottled water to meet the diverse needs and preferences of consumers.

The Saudi Arabian bottled water market is segmented by distribution channels to ensure widespread availability and accessibility to consumers. Each channel serves a specific purpose and caters to different consumer demographics, contributing to the overall growth and success of the bottled water industry in the country.

By End Use

The bottled water market in Saudi Arabia is segmented based on its end use, specifically into two categories: households and retail, commercial. This division allows for a clearer understanding of how bottled water is utilized in the country.

In Saudi Arabia, bottled water serves various purposes, with households being a significant consumer group. Families often rely on bottled water for drinking and cooking purposes due to concerns about the quality and safety of tap water. Additionally, households may choose bottled water for its convenience and portability, especially when traveling or engaging in outdoor activities.

On the other hand, the retail and commercial sector also plays a crucial role in driving the bottled water market. Retail establishments such as supermarkets, convenience stores, and gas stations are key distribution channels for bottled water, catering to the needs of consumers on the go. These outlets offer a wide range of bottled water brands and varieties, catering to different preferences and requirements.

Furthermore, the commercial sector encompasses various businesses and institutions that require bottled water for their operations. This includes hotels, restaurants, cafes, offices, educational institutions, and healthcare facilities. In these settings, bottled water is not only consumed by staff and patrons but also used in food and beverage preparation, sanitation, and other applications.

Overall, the division of the Saudi Arabia bottled water market by end use into households and retail, commercial segments provides valuable insights into consumer behavior and consumption patterns. Understanding the distinct needs and preferences of each segment enables industry players to tailor their marketing strategies, product offerings, and distribution channels accordingly.

Moreover, this segmentation allows for targeted approaches in addressing specific challenges and opportunities within each segment. For instance, while households may prioritize factors such as taste, purity, and packaging size, retail and commercial establishments may focus more on factors like price competitiveness, brand visibility, and supply chain efficiency.

The segmentation of the Saudi Arabia bottled water market by end use into households and retail, commercial segments enhance our understanding of consumer dynamics and market dynamics. By recognizing the unique needs and preferences of each segment, industry stakeholders can develop strategies to better serve their target audience and capitalize on growth opportunities in the market.

COMPETITIVE PLAYERS

The bottled water market in Saudi Arabia is bustling with activity, driven by various players striving to meet the demands of consumers. Among these key players are Hana Water-Hana Food Industries Co. and Aloyoun Water Factory Inc.

Hana Water-Hana Food Industries Co. is one of the prominent players in the Saudi Arabian bottled water industry. Known for its commitment to quality and innovation, the company has established itself as a leader in providing refreshing bottled water to consumers across the region. With a focus on meeting consumer preferences and ensuring product excellence, Hana Water-Hana Food Industries Co. has carved a niche for itself in the competitive market landscape.

Similarly, Aloyoun Water Factory Inc. is another significant player in the Saudi Arabian bottled water market. Renowned for its dedication to sustainability and environmental responsibility, the company has garnered a loyal customer base. By leveraging advanced technologies and adhering to stringent quality standards, Aloyoun Water Factory Inc. has emerged as a formidable competitor in the industry.

These competitive players constantly strive to differentiate themselves through various strategies. From product innovation and quality enhancement to marketing initiatives and distribution networks, each player seeks to gain a competitive edge in the market. Additionally, factors such as pricing strategies, brand positioning, and customer service also play a crucial role in determining the success of these players in the bottled water industry.

In this dynamic market environment, competition among key players is intense. As consumer preferences evolve and market dynamics shift, companies must adapt and innovate to stay ahead of the curve. By continuously monitoring market trends and consumer behavior, competitive players can identify opportunities for growth and development.

Moreover, partnerships and collaborations with other industry stakeholders also play a significant role in shaping the competitive landscape of the bottled water market in Saudi Arabia. Whether it's forming strategic alliances with distributors or engaging in joint ventures with suppliers, these collaborative efforts enable players to leverage their strengths and resources more effectively.

The bottled water market in Saudi Arabia is characterized by the presence of competitive players such as Hana Water-Hana Food Industries Co. and Aloyoun Water Factory Inc. These companies are committed to delivering high-quality products and meeting consumer needs through innovation and strategic initiatives. As competition intensifies and market dynamics continue to evolve, these players must remain agile and proactive to maintain their competitive position in the industry.

Saudi Arabia Bottled Water Market Key Segments:

By Type

- Still Water

- Sparkling Water

- Functional Water

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Home and Office Delivery

- On-trade

- Other Distribution Channels

By End Use

- Households and Retail

- Commercial

Key Saudi Arabia Bottled Water Industry Players

- Hana Water-Hana Food Industries Co.

- Aloyoun Water Factory Inc

- Agthia Group PJSC

- Maeen Water

- Health Water Bottling Co Ltd (Nova Water)

- PepsiCo Inc

- Al Qassim Health Water

- Nestlé (Nestlé Pure Life)

- Oy Nord Water LTD

- Almar Water Solutions

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252