MARKET OVERVIEW

The global salmon market will continue to define the wider seafood industry in terms of sustainability standards, global trade, and continental dietary patterns. As lifestyles change and technology transforms food production, the business of salmon will no longer focus on consumption trends and production levels alone. Rather, it will branch out into wider stories, from ocean conservation through biotechnology incorporation and consumer awareness. The salmon's function, especially in international food systems, will become more multifaceted than supply and demand statistics.

As there is more attention to food security and diet quality, salmon will be more than a commodity protein. Upcoming advances will primarily be focused on traceability technologies when customers will not only want farm-to-table guarantees but also complete transparency about water quality, feed origins, and humane farming methods. This increased sensitivity will reshape the way the market relates to consumers, regulators, and environmental observers. As the world's attention to ecological imprint grows, salmon producers will have to surpass expectations, raising the bar on clean and sustainable aquaculture.

Transcending technological evolution in breeding and disease prevention will also reshape the global salmon market. Genetic science and robotic aquaculture technologies will become the pillars to move beyond traditional biological challenges. These developments won't just impact efficiency but also change the way that areas are investing in aquaculture infrastructure. Nations that were behind in the past in this area could become new players, led by localized production models and specialized breeding techniques designed to accommodate their ecosystems. Simultaneously, innovation in other protein streams could result in hybrid salmon offerings that appeal to both old-school consumers and plant-based markets.

International trade patterns will undergo subtle but strong changes as emerging salmon-exporting countries join the fray. Existing market leaders might be challenged now not best on volume but on ethics, best, and climate footprint. Regional change pacts, price lists, and geopolitics could be crucial in influencing the flow of salmon across borders. But it might not just be about who can sell, however who can offer fee above and past the product itself. Brands that focus on matching their messaging to smooth practices, social obligation, and traceable origins will power the communique forward.

In addition, consumer psychology will fuel surprising transformations. The concept of salmon as a luxury item could change, driven by cultural redefinition and food innovation. Restaurants and food businesses will find themselves testing new forms dried, fermented, raw-infused, and lab-boosted types that capture global fusion and healthy eating trends. These transformations will lead to not only new recipes but new category markets.

The global salmon market in the years ahead will be a mirror to larger social, environmental, and technological currents. It won't only adjust it will dictate. By breaking through conventional boundaries, the business will become the nexus of science, culture, and ethics. As it enters this broader context, its narrative will no longer be marked by tonnage and chart of exports but by innovation, ethics, and effects.

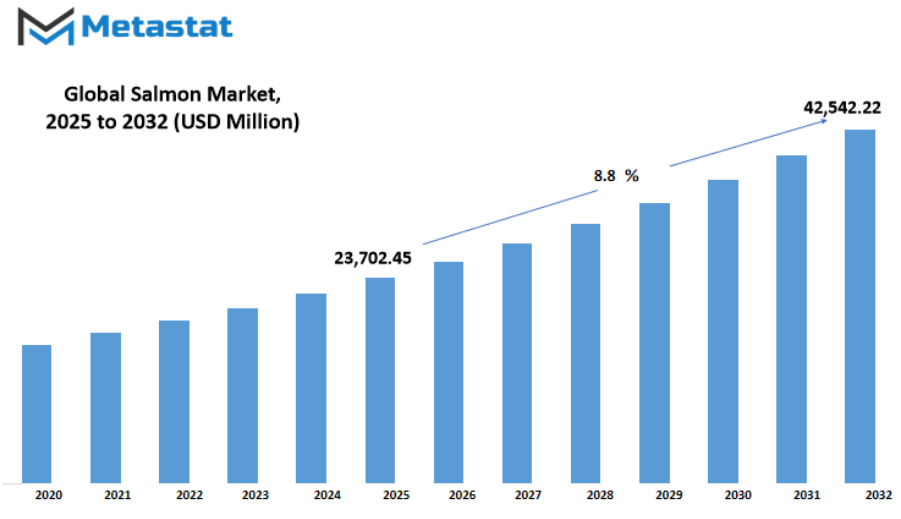

Global salmon market is estimated to reach $42,542.22 Million by 2032; growing at a CAGR of 8.8% from 2025 to 2032.

GROWTH FACTORS

The global salmon market is selecting up steam as more individuals throughout the globe are mastering about the fitness benefits of consuming fish that is wealthy in omega-three fatty acids and protein. Salmon, specially complete salmon, is being placed as a healthy preference that is ideal for the heart, brain, and standard fitness. This increasing emphasis on more healthy diets is prompting both domestic kitchens and restaurant institutions to feature salmon greater frequently to menus. Consequently, consumption is an increasing number of on the upward push, not handiest in installed salmon-ingesting regions but also in rising markets in which fish eating has traditionally been much less large.

To preserve meeting this increased demand, innovation in aquaculture technology is taking center stage. New fish farming technology now allow managed and constant manufacturing of salmon in unique components of the sector, reducing dependence on wild seize and stabilizing the deliver. These technologies have enabled global demand to be fulfilled at some point of the year and preserve the high-quality of the product, even as the purchasers growth in range. Effective farming strategies, blended with better logistics and bloodless chain infrastructure, are bringing salmon to supermarkets, eating places, and online food platforms.

Even amid this forward momentum, a few demanding situations remain threats to the market's enlargement. Environmental problems, like how the waste from salmon farms contaminates surrounding ecosystems, have been troubling sustainability champions. Additionally, disease outbreaks in aquaculture production can result in substantial stock losses and impacts on both supply and price. Another obstacle is price volatility, frequently driven by the impacts of climate change disturbances and variable feed prices. These conditions may render it hard for producers and suppliers to sustain consistent pricing, deterring some purchasers and stretching profit margins.

On the fantastic side, the global salmon market will advantage from changing customer conduct, specifically growing call for comfort meals. There is a growing need for geared up-to-eat and value-introduced salmon products which includes smoked fillets, marinated pieces, and sushi-satisfactory cuts, specially within the city marketplace. Food outlets and foodservice establishments are making their way with the aid of including greater salmon-based totally products, starting new boom possibilities for both suppliers and processors. With accelerated product range and simpler access, salmon is likewise in all likelihood to benefit a good higher position in global diets.

The global salmon market in the next few years will remain a balance between trends in consumption driven by health considerations and demand for sustainable, resilient production systems. If the industry is able to solve the environmental and supply issues, while also capitalizing on consumer demand for convenient meal preparation, then it will find continued growth and shifting demand patterns in both developed and emerging markets.

MARKET SEGMENTATION

By Type

The global salmon market remains stable in its growth, driven by evolving food consumption patterns, rising consciousness of health advantages, and higher demand for protein-based diets. As more consumers take notice of what they consume, salmon has emerged as a choice option owing to its great nutritional content, particularly omega-3 fatty acids. This change in food habit is not only observed in industrialized nations but also picking up pace in developing economies where the level of income is on the rise, and the urban lifestyle is impacting food habits.

Salmon comes mainly in two forms: farmed and wild-captured. Farmed salmon dominates the market, with a cost of $18,529.39 million, particularly because of the truth that it provides confident supply and charge. Fish farms have made it feasible for producers to satisfy growing global call for with out relying entirely on herbal stocks. Cultured salmon is generally perceived as greater handy and economically viable for the typical patron, making it a choice favourite in supermarkets, restaurants, and food service chains. Wild-captured salmon, however, keeps a lesser but vast market proportion, usually demanded for its perceived taste and herbal origin. Nevertheless, troubles which includes seasonal fluctuation, environmental sustainability, and improved fishing regulations persist to steer resources of untamed inventory.

Also influencing client choice are growing enthusiasm for traceability and sustainability. Whilst a few retain to opt for wild-stuck fish because of its natural nature, numerous customers increasingly more accept farmed salmon from green and licensed sources. Technologies employed in aquaculture are becoming better, improving environmental sustainability, fish health, and meals protection. This development has made farm-bred salmon greater appealing to green-aware customers and furnished new avenues for producers to promote responsibly.

The globalization of dishes and cuisines has additionally helped push salmon to extra heights. It's not an unique favorite in nations consisting of Japan or Norway. Salmon is consumed by humans globally in numerous methods from sushi and grilled fillets to ready-to-eat food. This has pressured producers and outlets to innovate through new traces of products, packaging, and geared up-to-cook merchandise which maintain tempo with the anxious lives of current customers.

In years to come, the market is expected to continue growing, aided by advancements in aquaculture, trade infrastructure, and supply chains. As firms seek to respond to increasing demand while keeping sustainability at bay, farmed salmon will continue to be front runner. Nevertheless, wild-captured salmon will retain its position as a premium and heritage option. Both segments combined will drive the future of an industry that has no indication of slowing down.

By Species

The global salmon market is experiencing constant demand, pushed through clients' preference for protein-wealthy and omega-three-encumbered food merchandise. Because it's far each healthy and has a bland taste, salmon has hooked up itself firmly in the dietary tables of human beings everywhere. Being grilled, smoked, can, or consumed raw in sushi, it has established itself as a fixture in most homes. The market remains on the increase, powered by wild catch and aquaculture production that aims to satisfy increasing consumption demands without excessively straining natural stocks.

It's also one of the species considered in the main categorization of the market. Chinook Salmon, also commonly known as King Salmon, is distinguished by its high oil content and rich flavor. It's a darling in high-end restaurants and premium product offerings. Coho Salmon, or Silver Salmon, is another widespread variety with a lighter flavor and firm texture, which is usually used for grilling and smoking. These varieties are appealing to various segments of the market in terms of providing variety in price and usage in the kitchen.

Pink Salmon is the most widely sold variety because it is produced on a large scale and has a shorter life cycle. It is normally bought in cans and its popularity stems from its affordability. The Red Salmon or Sockeye is heavily pigmented and strong-tasting, hence a favorite among individuals who like stronger flavors and appearances. Its peak demand comes from particular seasons, but its processed and frozen state maintains supply year-round.

Salmo Salar, or Atlantic Salmon, is principally farmed and plays a significant role in servicing the world demand. It's widely utilized in ready-to-consume products, sashimi, and smoked. Because it's constantly available and of uniform quality, it has become the commercial backbone of the salmon industry. At the same time, Silverbrite Salmon, normally called Chum Salmon, is much less oily and generally processed into value-introduced objects such as salmon burgers or as puppy food. While not as upscale as a number of the opposite types, it serves an crucial function in maintaining deliver open for the duration of diverse monetary strata.

Having so many exceptional salmon species way that the market can continue to be agile, accommodating a massive variety of various tastes and charge factors. Each range has its benefits, starting from Chinook's premium enchantment to Pink's ubiquity. With the worldwide food trend toward healthier and more sustainable options, demand for various species of salmon is expected to keep increasing with the help of innovations in husbandry techniques and enhanced logistics to get fresh and frozen products to consumers all over the world.

By End Product Type

There is a possibility of significant increase in the forecast period from 2025 to 2032 in the global salmon market. Salmon has emerged as a favorite source of protein for individuals in search of a healthy and delicious option, especially with an increase in health awareness of the benefits of omega -3 fatty acids. Consumer awareness about the consumption they consume is another driver of development in the global salmon market, in association with nutritious as well as their demand for consistent food. This change in taste is creating strong demand in both developing and developed countries, not only by restaurants but also by domestic kitchen more sought fishes.

On the basis of end product type, the market has been segmented into fresh, frozen, canned, and others. Fresh salmon remains to draw quality-conscious and health-conscious consumers who place a premium on quality and flavor. It's particularly sought after in areas where there is easy availability of stable cold chains that keep it fresh from sea to shelf. Frozen salmon, however, is increasingly becoming popular because of its extended shelf life as well as convenience. It enables consumers to accumulate purchases without fear of spoilage. Canned salmon is an affordable one that is particularly preferred in areas where access to frozen or fresh types is scarce. It provides a longer-term storage solution and continues to be a favourite in most homes. The "others" segment consists of smoked, cured, and processed salmon products catering to niche segments but also growing consistently, particularly in high-end snack and ready-to-eat categories.

Increased e-trade and home transport alternatives have also contributed notably in the direction of improving income throughout all the sorts of products. Shoppers are greater open to ingesting numerous sorts of salmon when they are able to read on-line critiques, examine fees, and obtain it delivered to their front door. That convenience is reworking the way humans buy seafood, with the frozen and canned forms reaping the most important advantages. Further, innovations consisting of pre-seasoned, pre-cut, and convenient-to-cook varieties are similarly commencing up salmon to the mass client.

Environmental concerns, although, may have a role to play in influencing the route of the market. With growing issues concerning overfishing and sustainability, the arena will probable must rely increasingly on aquaculture and sustainable sourcing practices. Governments and meals certification government will intervene with extended guidelines, which could have an effect on production ranges, pricing, and client self assurance. Companies that invest early in transparency and environmentally pleasant operations are likely to stay beforehand of the curve.

Looking to the future, the global salmon market could be fueled by using adjustments in way of life, urbanization, and continued call for protein ingredients. The pass toward healthful consuming isn't most effective a fashion it is turning into an expectation. From 2025 to 2032, all product bureaucracy fresh, frozen, canned, and other agencies will retain to set up themselves in families throughout the globe based totally on regional tastes, technology, and changing purchasing conduct.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$23,702.45 million |

|

Market Size by 2032 |

$42,542.22 Million |

|

Growth Rate from 2025 to 2032 |

8.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

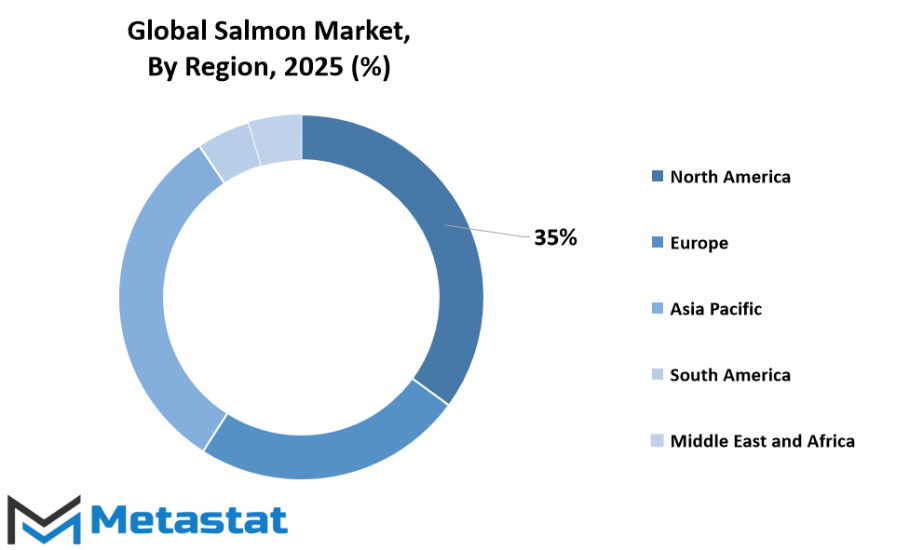

The global salmon market shows an thrilling aggregate of demand and increase driven by neighborhood consuming styles, manufacturing facilities, and exporting techniques. In North America, salmon maintains its sturdy role, particularly inside the United States where clients are health-orientated and price its excessive protein and omega-three scores. Canada is a primary manufacturer and exporter of salmon farming, with cold, pristine waters offering conditions for huge-scale aquaculture. Mexico, even as now not as paramount in phrases of production, is experiencing growing call for for salmon as food trends pass closer to more healthy seafood alternatives. This complete region enjoys state-of-the-art logistics and infrastructure, allowing powerful deliver chains from producers to cease-clients.

Europe is every other massive inside the global salmon market, with international locations together with Norway (typically part of Rest of Europe), the UK, and Scotland being main manufacturers. In Germany, France, and Italy markets, salmon isn't simplest a favorite dinner table fare however additionally a featured aspect in severa gourmand meals. The local affinity for clean and excellent seafood reinforces the consistent expansion of this market. Strong regulatory structures in the European Union additionally make contributions to guaranteeing meals protection, sustainability, and traceability, improving consumer confidence and making sure market balance.

Asia-Pacific is the various maximum hastily increasing markets for salmon. Japan and South Korea have traditionally included salmon into nearby diets, even as extra current consumer markets in China and India are demonstrating mounting call for as a result of the growing prominence of global diets and the upward push of disposable earning. China has particularly become a significant importer of salmon, particularly in fresh and chilled form. India is only at the nascent stage of embracing salmon as a staple, thanks to price and availability, though cities have started the process. With continued investment in cold chain facilities and evolving food culture, the region will continue to expand.

In South America, Brazil and Argentina are spearheading the salmon consumption growth. Although this area is not renowned for big-scale salmon culture, foreign products do make their way into urban demand. Domestic consumers are increasingly concerned about health, and salmon is becoming a premium but affordable protein to consume. Chile, although not included in this segmentation, should be mentioned due to high production volumes of salmon in the country, which drives trade throughout the Americas. This region's expansion can continue at a steady pace as awareness and accessibility increase.

Middle East & Africa has been witnessing increasing interest in salmon, especially in urban areas of GCC countries, Egypt, and South Africa. Demand is influenced by the integration of increased incomes, enhanced access to global foods, and rising awareness of nutritional value. While these markets base most of their activity on imports from areas where little is locally produced, the salmon market is picking up as retail networks extend and middle-class populations grow. There is potential in this region, particularly as infrastructure builds to facilitate cold storage and sea-to-table transportation of seafood.

COMPETITIVE PLAYERS

The global salmon market has consistently received more interest due to the increasing demand, fueled by consumers interested in healthier protein sources and a higher interest in seafood-based diets. Salmon, due to its rich flavor and nutrient content, particularly omega-3 fatty acids, has emerged as a household staple, restaurant favorite, and pre-packaged food commodity globally. This increased demand has prompted producers to expand business and find environmentally sustainable ways of production and distribution in order to meet shifting patterns of consumption.

Aquaculture has been significantly responsible for fulfilling global demand for salmon over the last few years. Because wild salmon stocks are under pressure from the environment as well as overfishing, farmed salmon has become a viable alternative. This change has spurred innovation in farming technologies, from cleaner feed to improved water management technologies, with the aim of minimizing environmental impact while increasing production. Norway, Chile, Scotland, and Canada have emerged as leading production nations, with a number of key players that have spearheaded the revolution to modernize salmon farming.

Nordlaks, SalMar ASA, Mowi ASA, and Bakkafrost have been at the forefront of shaping the future of salmon production. These companies, joined by others like Cermaq Group ASA, Lerøy Seafood Group ASA, and Grieg Seafood, still invest in infrastructure and sustainable processes to provide regular supply and quality. In Chile, Blumar SA and Salmones Camanchaca stand out as significant contributors, producing for both domestic and global markets. Nova Sea and Atlantic Sapphire, on the other hand, are testing land-based and environmentally friendly structures to remedy issues attached to conventional sea farming.

On the retail and distribution front, companies such as Ideal Foods Ltd and BluGlacier are narrowing the distance between the consumer and producer. They concentrate on creating wider global markets, particularly into territories where salmon remains a premium product. Their efforts facilitate getting salmon, fresh, frozen, or processed, onto supermarket shelves and restaurant plates with little disruption. These companies often act as a crucial link in maintaining the balance between supply and demand.

In the future, the global salmon market will experience steady growth as culinary tastes around the world turn more towards healthier and more sustainable food options. Producers and suppliers will have to be prepared for environmental challenges like climate change, changing trade policies, and tougher environmental standards. But with the industry already having major players dominating farming and distribution, the future of the global salmon market looks bright and responsive to the needs of consumers tomorrow.

Salmon Market Key Segments:

By Type

- Farmed

- Wild Captured

By Species

- Chinook Salmon

- Coho Salmon

- Pink Salmon

- Red Salmon

- Salmo Salar

- Silverbrite Salmon

By End product type

- Fresh

- Frozen

- Canned

- Others

Key Global Salmon Industry Players

- Nordlaks

- SalMar ASA

- Blumar SA

- Salmones Camanchaca

- Nova Sea

- Bakkafrost

- Mowi ASA

- Cermaq Group ASA

- Grieg Seafood

- Lerøy Seafood Group ASA

- Atlantic Sapphire

- Ideal Foods Ltd

- BluGlacier

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252