MARKET OVERVIEW

The global rolling stock market segments the transportation and railway equipment industry and shall remain pivotal in modern mobility infrastructure. This market facilitates all types of rail vehicles, right from locomotives to passenger coaches, freight wagons, and metro systems, with manufacturing, distribution, and technological advancements. As countries consider alternatives to road transport, the global rolling stock market shall become further integrated into strategies addressing the efficient running of goods and commuter mobility.

The global rolling stock market would stretch across regional and national rail networks, connecting key urban centers with industrial hubs and remote areas. This market will facilitate the development of transport corridors, enabling the passage of persons and goods through highly structured rail systems. Rail operators and the government will channel resources toward procurement of durable and efficient rolling stock to meet growing demands for transportation. Both diesel and electric-powered units would continue to run with a gradual shift toward electric traction as sustainability objectives become more focused.

Rolling stock producers will incorporate better safety features, improved passenger comfort, and upgraded digital systems in synchrony with the transition of transport technology. In this vein, the global rolling stock market will juxtapose the legacy fleets undergoing retrofitting from new units with lightweight construction materials and intelligent control systems. The plan will, therefore, allow either approach to accommodate an ongoing impulse for modernization without any interruption of the business of day-to-day operations. Asset management operations will thus be center stage, with operators now planning for longer vehicle lifecycles through predictive maintenance and modular upgrades.

Urban transit authorities will be a considerable actor in determining the global rolling stock market. Metro and light rail demand drives procurement decisions in favor of capacity, energy efficiency, and ease of integration into the existing city infrastructure. Further customization is now witnessed, as rail units will gradually be adapted to local requirements-from climate resilience in the cold climate region to high-speed capabilities in long-haul corridors. Freight logistics operators will also emphasize rolling stock designed specifically with single goods in mind, covering bulk, liquids, and containers, with all being compatible with automated loading systems.

Players in the global rolling stock market will have to meet high standards of quality and thus be integrated into global supply chains that involve specialized components, starting from traction motors, through braking systems, ending up in control software. The rolling stock configuration will, therefore, be significantly affected by standardized design and communication protocols, with interoperability between national railway systems becoming ever important.

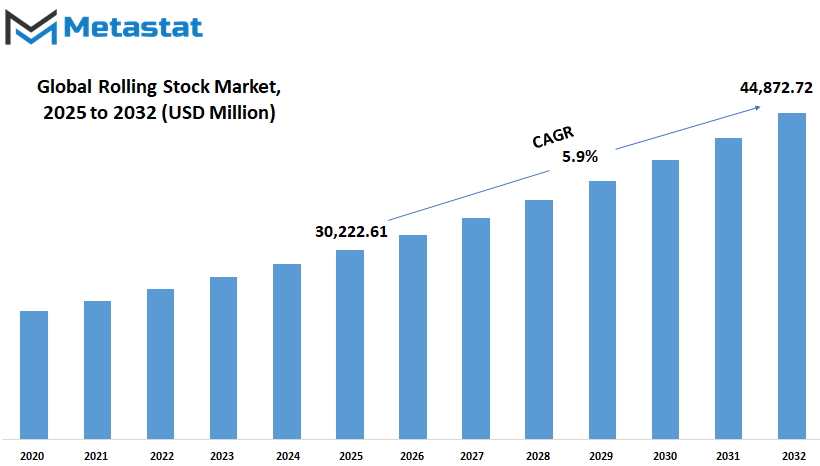

Global rolling stock market is estimated to reach $44,872.72 Million by 2032; growing at a CAGR of 5.9% from 2025 to 2032.

GROWTH FACTORS

The global rolling stock market looks forward to a strong growth path ahead as urbanization continues and more people flock to cities. Urbanization by default brings with it a lot of demand for efficient and sustainable modes of transportation, and rail systems have been proven to be one of the most reliable ways of satisfying such needs. The more individual people who use public transport, the more modern and faster, mostly environment-friendly, train systems make their way into people's consumption patterns. Such a change in consumption behavior will compel governments and private players to invest more in advanced technology on rolling stock.

However, in the same breath, bottlenecks could slow the global rolling stock market from attaining the expected buoyancy. The greatest of these hurdles is the initial high cost for developing and upgrading railway infrastructure and rolling stock. It is not only the cost of the trains but also the cost involved in buildings and maintaining the capacity of the tracks and stations to operate them successfully, as well as control systems which put extra financial burden on developing countries. Besides, regulatory red tape often prevents companies from entering new markets or modernizing their fleets. Different countries often have their own safety and technical standards, which delays the projects and adds cost.

In the future, on several fronts, many promising opportunities will provide new avenues for the global rolling stock market. The most exciting trend is the electrification of railway networks. Electric trains are much cleaner than diesel-powered models, as they emit less carbon and require reduced operational costs over time. Governments set ambitious targets regarding their carbon footprints across the globe, and inducting rail electrification will fit perfectly into their plans. With this new development will come the demand for new types of rolling stock and innovations in battery-powered and hydrogen fuel cells.

Such would drive manufacturers to invest more and design trains that will promote energy efficiencies while also being lightweight and eco-friendly materials. The existence of automation with real-time monitoring capabilities in trains is likely to make them smart with technological advances. Such developments make the experience of traveling by rail far safer, faster, and more convenient than by cars or planes. Under these circumstances, the global rolling stock market is poised to become an important part of how cities deal with the increasing population in the coming years.

Certainly, challenges would arise during this period; however, the same would have to be countered by the advancements and continual push toward sustainable, efficient transportation. As such, the market would never be static but would continue to evolve toward offering newer solutions into a cleaner and more connected future.

MARKET SEGMENTATION

By Type

The scope of the global rolling stock market will keep transforming the future of transportation across countries as technology and urbanization keep evolving. It deals with all kinds of rail vehicles, such as locomotives, wagons, coaches, rapid transit vehicles, and others. With the rise in demand for sustainable and efficient transportation, rail is becoming an accepted choice for governments and the private sector as a clean and reliable mode of transport. Many problems, such as high fuel prices, traffic jams, and pollution, would find an answer in trains. This encouragement toward rail will intensify as cities search for better ways of transporting people and goods in short and long distances.

When it comes to rolling stock types, each of them has its own mission when it comes to satisfying the needs of growing populations. The locomotive, for instance, provides power to carry loads across long distances. Energy consumption in the locomotives will probably receive more focus than ever, particularly in the newer electric and hybrid types. This agenda will get support from the global push to reduce emissions and move away from fossil fuels. Rapid transit vehicles do much against congestion in urbanized areas, among others. As cities keep sprawling, so will investments in metro systems, trams, and light rail networks. These vehicles are pivotal in forming smart cities, where the movement of people is prioritized for speed and safety.

Freight wagons will continue to be a major force supporting industry. The increased number of trade routes and e-commerce will require wagons to be faster, secure, and easy to track. Coaches will mostly serve the needs of the passenger side and thus upgrade in comfort and aesthetics. Passengers deserve the best of services from seating to access to the internet. Coaches may offer additional personalization that will lure passengers away from alternative modes of transport with even better amenities.

Other rolling stock is also there for some special types of needs—like maintenance or inspection units. With the ever-growing railway network, demand for support vehicles that maintain the proper functioning of the systems is increasing. They may not be as visible as passenger trains or freight wagons but are just as important.

In the future, the global rolling stock market will not just react to developments; it will rather go ahead and determine the way we move. The market retains a robust place in determining what comes next-whether it be advanced trains or smarter transport systems.

By Locomotive Technology

The glimmering horizon that the global rolling stock market is heading towards has many new openings. With increasing transport requirements, therefore, the demand for better, faster, and more efficient trains will continue to rise. Rolling stock, a term that refers to all types of railway vehicles, has played a part in deciding how people and goods move from one place to another. But today, the stress is on technology and new ideas, bringing changes towards how trains will be constructed and, even more important, how they will operate across cities and countries.

Major advances in locomotive technology are expected within a short while. It further categorizes import types of locomotives that offer different services. Conventional locomotives, the backbone of the railway system for several decades, are still of great importance in the field of transport for basic needs, turbocharged locomotives are going to capture the attention as they deliver better power and speed. As cities get better connected, we increasingly require fast input transport, and these speed machines will give such solutions.

Maglev is expected to capture a lot of affection. Maglev, which is short for magnetic levitation, enables trains to glide on top of their tracks using magnetic forces as opposed to friction. Maglev trains can thus go at much faster speeds than conventional trains without making an amount of noise, and without the friction that they incur. Although it would still qualify as advanced today, it could become a more normal option soon as all nations find investments in futuristic transport networks.

Diesel locomotives are still important and will serve areas that do not yet have electrified railway access. These are flexible since they enable service in places where the wiring of electric lines would be too costly or too difficult to construct. But, with continuous emphasis on reduced carbon emissions, diesel technology will most likely turn towards cleaner and more efficient models. Electric locomotives would become more common in cities forming green transport systems. These trains run on electricity and are much quieter and less polluting than traditional fuel-based engines.

Electro-diesel locomotives are another key category contributing to trains; it's made up of electric and diesel powers combined. These energies make them nice for networks having electrified and non-electrified tracks. Flexibility is going to be unmatchable as they switch between those two sources. Not only will there be categories of locomotives fulfilling requirements as they emerge, for instance, bespoke high-speed freight trains or new forms of urban transport, but also several other categories would gain importance. To conclude, the global rolling stock market future appears to be bright with the momentum of technology and demand pushing it ahead.

By Component

In the forthcoming years, yet again, the global rolling stock market is poised for continued steady growth as transportation needs continuously change and expand around the globe. All vehicles operating on railway tracks, that is, locomotives, coaches, and wagons, are known as rolling stock. This plays a key part in shaping modern transportation systems. Meanwhile, the focus on clean energy, faster travel, and higher comfort will spur tremendous technological innovations pertaining to the rolling stock design and functioning.

By component, the market can be segmented into several significant parts, each exerting an influence on the operational possibilities and performance of the trains. One such part would be pantographs for collecting overhead lines. In future times, pantographs will become even more important by increasing the efficiency of train travel over less uninterrupted distances. Also, the axle and wheelset are very important, employing advanced technologies and materials to keep them light and strong, and improving the safety and speed of trains without stressing the tracks increasingly.

Another vital component to be affected by these changes is the traction motor. With the growing popularity of electric trains, the traction motor design will head towards developing high power with low energy consumption. This development will, in turn, favor the sustainable environment with the trains having a very low carbon footprint. Other than that, the auxiliary power system will get upgrades as well. These systems provide energy for onboard services like lighting, heating, and other applications and will emphasize efficiency in their upcoming design so that nothing is wasted.

Air conditioning systems will advance since passengers expect greater comfort even under brutally hot conditions. With regard to upgrading passenger information systems in tandem, this next generation will make real-time announcements as well as offer more personalized travel information that facilitates better travel decisions while ensuring a smooth journey. Brakes will continue to follow, where smarter braking systems safer will be built to react faster and wear less.

Gearboxes for transferring power from the engine to the wheels are going to be nearing a redesign to make them stronger and efficient. Last on the list of updates are parts often taken for granted: innovations found in all things related to the railways, from seating to lighting to door mechanisms, suffice for safety, comfort, and overall passenger satisfaction.

Not only will the global rolling stock market satisfy today, but it will also anticipate the needs of future generations. As cities expand and the connections between them become predominant, rolling stock will stand as the backbone of safe, clean, and efficient transportation.

By End-Users

Global Rolling Stock’s shape is probably the future of transportation in many forms. It will keep being a significant part in how well goods, people travel from one point to another. The expansion of cities and their need for better connectivity will always have reflected changes in the market toward advanced and more efficient systems. Innovation will actually pull the speed in the development of trains as faster and safer as well as greener. It will do so, by innovation not only for an everyday traffic but also for the environment, given that all countries are trying strenuously to cut carbon emissions and build sustainable infrastructure into the fabric of modern life.

Based on end-user, the global rolling stock market is divided into passenger and freight transportation segments. Passenger transportation involves the movement of people from one city to another or within a city. However, as more individuals rely heavily on public transportation, there will be an increased penetration of demand for better speed, comfort, and consistency in trains. In addition, the public and private sector will spend on projects for improving high-speed rail networks and urban transit systems. This will not just cater to existing demands but will also be ready for cities to manage population growth in the future.

Freight transportation on the other hand deals with moving goods over long distances. The need for lean and efficient supply chains will increase with the increasing growth of online shopping and the boom in on-demand delivery options. The global rolling stock market has already planned innovations regarding newer freight trains that would be designed for higher speeds, greater loads, and energy efficiency. Railway will still remain among the most reliable methods for transporting heavy goods, as they are considered most cost-effective and environmentally friendly compared to roads.

Technology is going to play a major part in determining the future of both these sections. Intelligent trains equipped with automated control systems, predictive maintenance, and real-time monitoring will be the norm. Operational smoothness, shorter waiting time, and reduced operating costs will all be achieved through these developments. Nations across the globe would strive to enhance their railway networks to remain competitive and meet the rising demands for efficient transport options.

And in the coming years, the global rolling stock market is going to become a part of the global transition for cleaner, smarter, and more connected transportation. It will be linked with economic growth, job creation, and a better travel experience for millions. As the world advances, so will those trains: reaching not only a destination, but reaching it in a way that benefits society and the planet as well.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$30,222.61 million |

|

Market Size by 2032 |

$44,872.72 Million |

|

Growth Rate from 2025 to 2032 |

5.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

With the rapid progression in the spheres of transportation, technology, and urban growth, the global rolling stock market will have a substantial role in future traveling. Rolling stock actually represents the aggregate of vehicles moving across a railway, both powered and unpowered, from locomotives to passenger coaches and freight wagons. The market has not only been influenced by advances in railway systems but also by increasing demands for safer, faster, and more sustainable modes of travel across countries and continents.

The global rolling stock market has proven to have a geographical characteristic because each region has its own issues and opportunities. North America, with its countries like the U.S. and Canada, along with Mexico, will put a lot of attention into modernization efforts, especially for existing infrastructures. The region would probably therefore invest more towards energy-efficient and technologically-advanced trains, which reduce environmental impact as well as provide better services, since adequate networks are already in place. Europe, including major countries such as the UK, Germany, France, and Italy, will likely continue improving its cross-border rail services, but which as we have seen are already known for their green technology orientation would include in that rolling stock smarter and quieter trains with less emissions.

Strong demand for passenger and freight trains will also be found in the Asia-Pacific region, including emerging economies such as India, China, Japan, and South Korea. These countries are developing and adding cities with new railways connecting urban to rural areas, thereby requiring a large number of cars with the most modern safety systems and comfortable interiors. Increasing the capacity will be a goal, but with high-speed rail, the other will be to reduce travel times.

The global rolling stock market will surely see growth from both South America and the Middle East and Africa, which are still at different levels of rail development across the two regions. Countries like Brazil, Argentina, Egypt, and South Africa have been developing and strengthening their public transport systems while improving cargo networks. Investments possibly in rolling stock in these areas aim to replace older equipment, reduce travel costs and increase trade.

As the world becomes more connected, this would instead reflect how people and goods move through the global rolling stock market while casting upon the ideal for smarter and more sustainable transportation future-ready generations.

COMPETITIVE PLAYERS

The global rolling stock market has a lot to do with transportation through connecting cities, countries, and people in increasingly efficient ways. The trains and the railway systems of tomorrow will not just deal with transporting goods and passengers but will symbolize the priorities of changing times such as cleaner energy, smarter technologies, and speed. The factors that push towards providing better public transport and sustainable shipping solutions will, in the time to come, fairly give a decent and permanent standing for the global rolling stock market in the world economy.

Many companies are now pushing boundaries to make sure they stay ahead. Industry heavyweights such as Alstom Transport, CAF, CRRC Corporation Limited, and Hitachi Rail Limited have heavily invested in innovative designs and technologies. These players are keeping one eye on today and the other on tomorrow's market requirements. On the other hand, companies like Siemens Mobility and Stadler Rail AG are developing trains capable of covering greater distances while still being environmentally friendly, whereas Hyundai Rotem Company and Kawasaki Railcar Manufacturing Co., Ltd. concentrate on railcar construction that permits a safe, fast, and comfortable ride.

This brutal competition is there in the global rolling stock market because these companies are always trying to outdo one another. On the one hand, lighter, stronger freight wagons from Trinity Rail and The Greenbrier Co. are under continuous design development for reduced transport cost. On the other hand, Talgo trains appear to be poised for a revolution in city travel soon with lightweight and high-speed capabilities. With advancement on fuelsaving and low-maintenance engines GE Transportation and Electro-Motive Diesel (EMD) are working on locomotive technology.

Into the future, it will not be business as usual for the global rolling stock market. As environmental and travel pattern challenges come up, the named companies would need to be adaptable and inventive in their responses. It is expected that railways will usher said innovations into automation, smart maintenance using sensors, and fully battery-powered trains. The key players will keep racing to bring innovations to life that offer fast and clean ways to travel. The future will go beyond this toward setting the pace and those who can mix innovations with reliability will shape what will be said next in the global rolling stock market.

Rolling Stock Market Key Segments:

By Type

- Locomotives

- Rapid Transit

- Wagon

- Coaches

- Others

By Locomotive Technology

- Conventional Locomotive

- Turbocharge Locomotive

- Maglev

- Diesel Locomotive

- Electric Locomotive

- Electro-diesel Locomotive

- Others

By Component

- Pantographs

- Axle

- Wheelset

- Traction Motor

- Auxiliary Power System

- Air Conditioning System

- Passenger Information System

- Brakes

- Gearboxes

- Others

By End-Users

- Passenger Transportation

- Freight Transportation

Key Global Rolling Stock Industry Players

- Alstom Transport

- CAF, Construcciones y Auxiliar de Ferrocarriles, S.A.

- CRRC Corporation Limited

- Electro-Motive Diesel (EMD)

- GE Transportation

- Hitachi Rail Limited

- Hyundai Rotem Company

- Kawasaki Railcar Manufacturing Co., Ltd.

- Siemens Mobility

- Stadler Rail AG

- Talgo

- The Greenbrier Co.

- Trinity Rail

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252