MARKET OVERVIEW

The Projectors and Smart Projectors Market has emerged as a dynamic force, shaping the way we perceive and interact with visual content. A projector, in its essence, is a device that takes digital or analog data and projects it onto a screen or other flat surfaces, providing a larger-than-life visual experience. This market, characterized by innovation and adaptability, has grown beyond conventional uses, finding its significance in diverse fields.

The importance of projectors lies in their ability to amplify and share information compellingly. In educational settings, projectors serve as indispensable tools, transforming traditional classrooms into interactive spaces where concepts come to life. Through vivid visuals and dynamic presentations, educators can engage students and facilitate a deeper understanding of complex subjects. This not only enhances the learning experience but also fosters a more interactive and collaborative educational environment.

Beyond education, projectors play a pivotal role in corporate boardrooms, enabling impactful presentations and fostering effective communication. Businesses utilize projectors to showcase data, graphs, and multimedia content during meetings and conferences, enhancing the overall effectiveness of their communication strategies. The ability to project large, high-quality images makes projectors valuable assets in professional settings, where visual impact is often synonymous with success.

The evolution of projectors into smart projectors marks a significant milestone in this market. Smart projectors go beyond the traditional role of projecting images; they integrate advanced technologies to enhance functionality and connectivity. These intelligent devices often come equipped with features such as wireless connectivity, interactive touch capabilities, and compatibility with various devices and platforms. This convergence of projection technology with smart features has opened up new possibilities in sectors like entertainment, gaming, and collaborative workspaces.

In the entertainment industry, smart projectors have redefined home theaters, offering a cinematic experience in the comfort of one's living room. With features like built-in streaming services, voice control, and connectivity to smart home ecosystems, these projectors bring a new level of convenience and immersion to home entertainment systems. Additionally, the gaming community has embraced smart projectors for their ability to deliver a more immersive gaming experience, complete with vibrant visuals and responsive interactivity.

Collaborative workspaces have also witnessed a transformation with the integration of smart projectors. These devices facilitate seamless communication and idea sharing in meetings and brainstorming sessions. The interactive capabilities allow users to annotate directly on the projected content, fostering a collaborative environment where ideas can be refined in real-time.

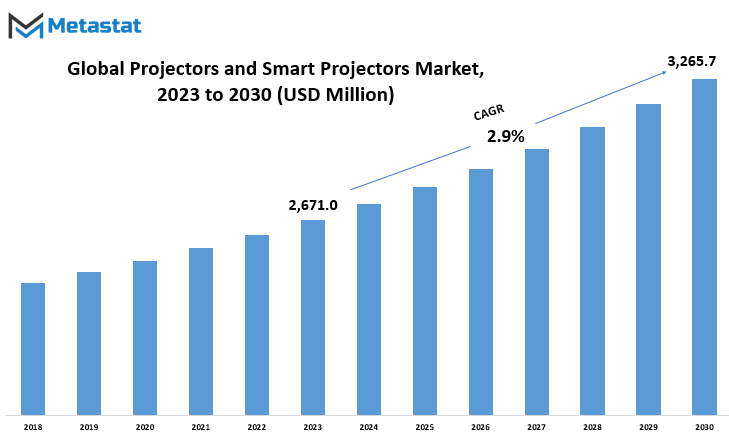

Global Projectors and Smart Projectors market is estimated to reach $3,265.7 Million by 2030; growing at a CAGR of 2.9% from 2023 to 2030.

GROWTH FACTORS

The Projectors and Smart Projectors Market is experiencing a surge in demand, driven by the increasing need for digital projection technology across diverse sectors. This upswing in demand is particularly notable in business, education, and entertainment applications. The landscape of projectors has evolved significantly, with technological advancements playing a pivotal role in shaping their trajectory.

Technological strides, notably the integration of 4K resolution and wireless connectivity, stand out as key catalysts propelling market growth. These innovations enhance the quality and convenience of projection experiences, meeting the rising expectations of users in various domains.

However, amid the promising ascent of projectors, challenges loom on the horizon. The high cost associated with smart projectors compared to their traditional counterparts emerges as a potential impediment. This financial barrier may hinder widespread adoption, particularly in markets where budget considerations play a crucial role in decision-making.

Additionally, the limited availability of compatible content for smart projectors poses another hurdle. The disparity between the advanced capabilities of smart projectors and the content optimized for them may restrain their full potential, affecting their market penetration.

Despite these challenges, the horizon holds promise for the Projectors and Smart Projectors Market. The advent of virtual and augmented reality technologies opens new vistas for projectors, enabling immersive experiences beyond conventional applications. This transformative potential creates lucrative opportunities for the market, paving the way for dynamic and engaging use cases in the years to come.

MARKET SEGMENTATION

By Type

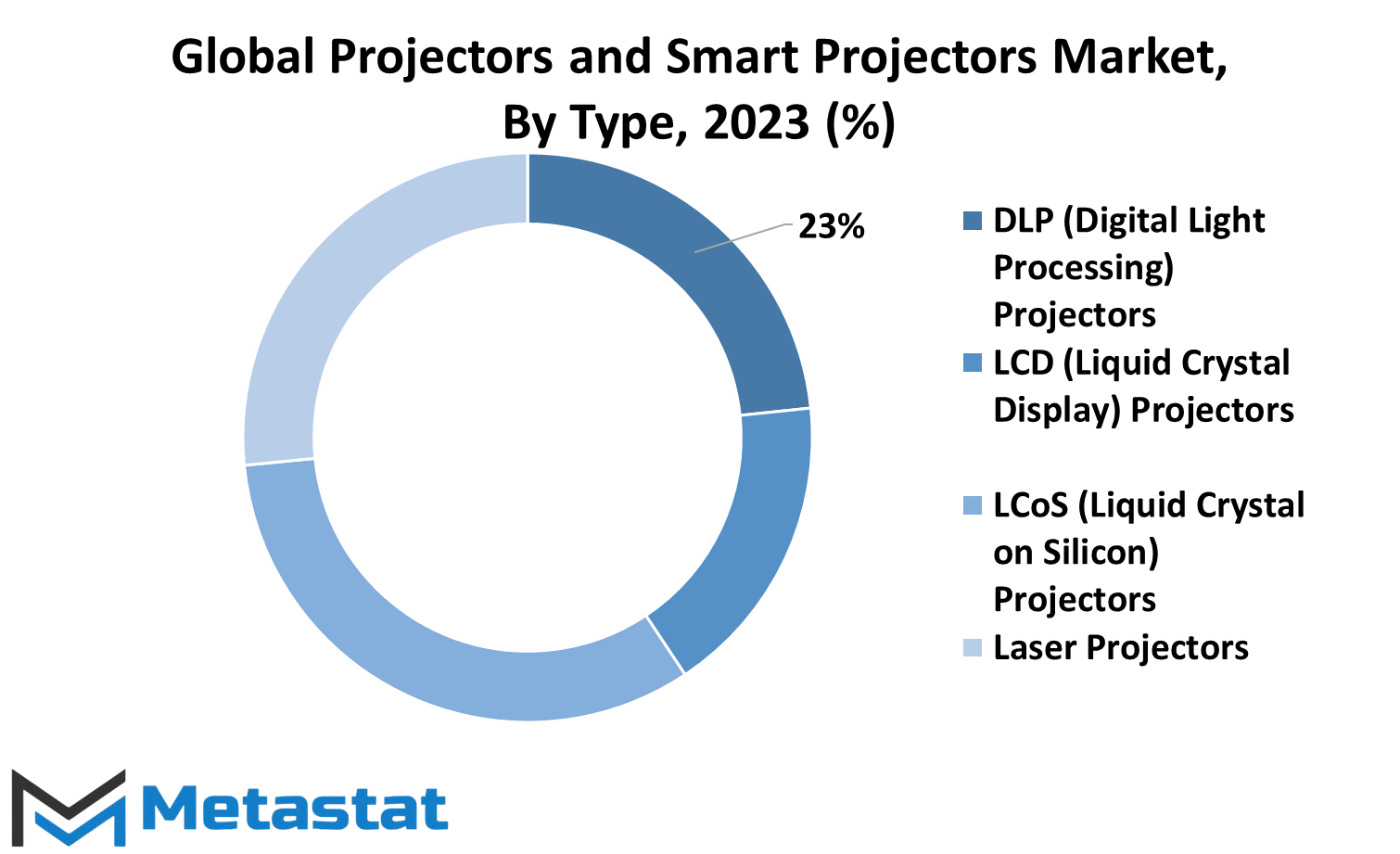

The global market for projectors, including smart projectors, exhibits a diverse landscape, with various types catering to distinct technological preferences. The segmentation of this market provides insight into the preferences and trends that shape the industry. Among these, the DLP (Digital Light Processing) Projectors stand out, contributing significantly to the market with a valuation of 392.2 USD Million in 2022.

DLP Projectors utilize digital micromirror devices to create images, offering a dynamic and responsive visual experience. Their widespread use is indicative of the demand for high-quality display solutions in the contemporary market. A close contender in terms of market value is the LCD (Liquid Crystal Display) Projectors segment, valued at 300.4 USD Million in 2022. LCD Projectors operate on the principle of manipulating liquid crystals to produce images, providing a reliable and widely adopted technology.

Another noteworthy category in the projector market is the LCoS (Liquid Crystal on Silicon) Projectors segment, valued at 559.6 USD Million in 2022. LCoS technology combines liquid crystals and silicon to deliver high-resolution images with enhanced clarity. This segment's significant valuation underscores the growing preference for advanced projection technologies that offer superior visual experiences.

The Laser Projectors segment, with a valuation of 446 USD Million in 2022, represents a technological leap in projector evolution. Laser projectors leverage laser light sources for image projection, resulting in improved brightness and color accuracy. This segment's noteworthy market value reflects the recognition of laser technology as a formidable player in the projector domain.

Complementing these advanced technologies is the LED Projectors category, contributing to the market's vibrancy. While specific valuation data for LED projectors is not provided in the given information, their inclusion signifies the continuing relevance of LED technology in the broader projector market.

The global projector market showcases a dynamic interplay of diverse technologies, each with its unique strengths and applications. The popularity of DLP, LCD, LCoS, laser, and LED projectors reflects the varied preferences of consumers seeking efficient and high-performance visual display solutions. As technology continues to advance, the projector market is poised to evolve further, providing users with an ever-expanding array of options to meet their specific needs and preferences.

By Application

In the global projector market, the segmentation based on application plays a pivotal role in understanding the diverse utility of these devices. The market, in essence, is categorized into several key applications, each catering to specific needs and environments.

Education stands out as a significant sector where projectors find extensive use. In classrooms and lecture halls across the globe, these devices facilitate visual learning, enhancing the educational experience. The interactive nature of projectors aids in conveying complex concepts, making lessons more engaging and comprehensible.

Moving into the corporate and business realm, projectors prove indispensable for presentations and meetings. They serve as a visual aid, helping professionals communicate ideas, data, and strategies effectively. The versatility of projectors in this context contributes to seamless collaboration and decision-making processes within the business landscape.

Transitioning to a more leisurely domain, home theater enthusiasts have embraced projectors for an immersive cinematic experience. The projection of movies, sports events, and gaming on large screens transforms ordinary living spaces into private entertainment hubs. The demand for projectors in the home theater segment reflects a growing preference for a personalized and cinematic viewing environment.

Large venues and events constitute another significant application area for projectors. Whether it's a concert, conference, or sporting event, these devices project content on expansive screens, ensuring visibility for large audiences. The dynamic nature of these gatherings requires projectors that deliver high-quality visuals, making them an integral part of such occasions.

The healthcare sector is not left untouched by the projector's utility. In this context, projectors aid medical professionals in presentations, training sessions, and even surgical procedures. The visual representation of medical information contributes to a clearer understanding and effective communication within the healthcare community.

The catch-all category of Others has various niche applications where projectors find utility. This includes areas like museums, art installations, and any context where visual representation plays a crucial role. The segmentation of the global projector market by application underscores the adaptability and widespread use of these devices across diverse sectors. From education to healthcare and beyond, projectors continue to evolve as versatile tools, meeting the visual communication needs of various environments.

REGIONAL ANALYSIS

The global Projectors and Smart Projectors market unfolds across diverse regions, with North America and Europe standing as prominent geographical domains. These regions not only represent substantial market shares but also encapsulate unique dynamics that shape the trajectory of the projector industry.

North America, a powerhouse in technological advancements, serves as a focal point for projector innovations and smart technologies. The market in this region thrives on the high demand for cutting-edge projection solutions, driven by various sectors ranging from education to business presentations. The tech-savvy consumer base in North America further fuels the adoption of smart projectors, integrating intelligence into the projection experience.

In parallel, Europe contributes significantly to the global Projectors and Smart Projectors market, bringing its own blend of demands and preferences. The European market is characterized by a diverse array of applications, spanning from home entertainment to corporate use. The demand for projectors with smart capabilities is on the rise, reflecting the region's inclination towards seamless and interconnected technologies.

The driving forces in North America and Europe stem from the increasing need for advanced visual solutions across industries. Both regions showcase a penchant for high-quality displays in educational institutions, corporate settings, and entertainment arenas, propelling the demand for projectors that go beyond traditional capabilities. Smart projectors, with their integrated features and connectivity options, align with the evolving needs of users in these regions.

However, while North America and Europe share commonalities in their reliance on advanced technologies, the market landscapes are not homogenous. Each region responds to market dynamics influenced by factors such as cultural preferences, economic conditions, and regulatory environments. Consequently, the projector market in North America exhibits distinct patterns, preferences, and challenges compared to its European counterpart.

As these regions continue to play pivotal roles in shaping the global Projectors and Smart Projectors market, the industry witnesses a dynamic interplay between technological innovation and regional nuances. The relentless pursuit of enhanced visual experiences, coupled with the integration of smart features, marks a shared trajectory across North America and Europe. Yet, the market's responsiveness to local demands and the distinctive flavor each region imparts to the industry underscore the richness and diversity within the global projector landscape.

COMPETITIVE PLAYERS

In the expansive landscape of the Projectors and Smart Projectors Market, notable players contribute to its vibrancy, shaping the dynamics of this technological domain. Among the key entities driving innovation and market presence, Acer Inc. and Barco NV emerge as prominent figures.

Acer Inc., a stalwart in the technology sector, brings its expertise to the realm of projectors, contributing to the market's diversity. Recognized for delivering reliable and cutting-edge solutions, Acer Inc. stands as a testament to the intersection of technology and visual experiences. Its presence in the Projectors and Smart Projectors Market underscores a commitment to providing users with quality display solutions for various applications.

Barco NV, another significant player in this dynamic market, brings its own set of strengths and capabilities. Renowned for its prowess in visualization and collaboration technology, Barco NV extends its influence on the projector domain. With a focus on innovation and customer-centric solutions, Barco NV adds a layer of sophistication to the market, catering to the evolving needs of users seeking smart and advanced projection systems.

Together, these key players exemplify the competitive landscape of the Projectors and Smart Projectors Market, showcasing not only technological proficiency but also a commitment to enhancing visual experiences. As the market continues to evolve, the contributions of Acer Inc. and Barco NV play a pivotal role in shaping the trajectory of projector technologies, providing users with a diverse range of options that blend functionality, innovation, and user-centric design.

Projectors and Smart Projectors Market Key Segments:

By Type

- DLP (Digital Light Processing) Projectors

- LCD (Liquid Crystal Display) Projectors

- LCoS (Liquid Crystal on Silicon) Projectors

- Laser Projectors

- LED Projectors

By Application

- Education

- Corporate and Business

- Home Theater

- Large Venue and Events

- Healthcare

- Others

Key Global Projectors and Smart Projectors Industry Players

- Acer Inc.

- Barco NV

- BenQ Corporation

- Boxlight Corporation

- Canon Inc.

- Christie Digital Systems

- Dell Inc.

- Delta Electronics, Inc.

- Digital Projection Limited

- Seiko Epson Corporation

- Hitachi Ltd.

- InFocus Corporation

- LG Electronics Inc.

- Nebula

- Optoma Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252