MARKET OVERVIEW

The global prepared flour mixes market is part of the overall food category because it acts as a catalyst in shaping modern consumer dietary habits. It deals in flour-based products premixed with other ingredients to realize ready-to-use solutions in baking and cooking. These products are directed to save efforts and reduce time for both consumers and operators in the foodservice sector and maintain consistent taste and quality across various culinary applications. Convenience foods will increase in the future, while home baking and cooking-which was noted as the top trend-promotes prepared flour mixes' relevance in kitchens worldwide.

The supply chain in the industry ranges from bulk production by large-scale manufacturers to small-scale artisan producers who sell highly specialized niche products. Each of these players will contribute something to the dynamics of this evolving market, which keeps changing with consumer preference and technological advancement. Emergent Trends in the Global Prepared Flour Mixes Market:

Similarly, biodegradable and eco-friendly packaging are some of the innovative types of packaging that will continue to attract the ecologically aware consumer market. Further, technologies in flour mixing and automation also guarantee high levels of production efficiency and homogeneity of products. This will enable manufacturers to scale up their operations without compromising on quality standards. Digital transformation will also play its part in expanding e-commerce platforms and direct-to-consumer sales, further broadening the market's footprint. Consequently, online platforms and social media will be the effective means of marketing, customer engagement, and feedback for further brand loyalty and repeat purchases. Geographically, the marketplace will expand across different regions, bearing their signature of specific cuisine, consumer preference, and regulatory environment. While the trend in North America and Europe will be more toward healthier and organic prepared flour mixes, rapid urbanization and lifestyle changes are fast changing the eating habits in emerging markets across Asia-Pacific and Latin America, pushing up the demand for convenient ready-to-use flour mixes that would fit in with active lifestyles.

It also allows companies operating in the Global Prepared Flour Mixes market to form a view on what regional dynamics and competitive threat concerning targeting might have, which can eventually affect shaping the product offerings, pricing strategy, and marketing approach. The regulatory factors will also add in the future course of action taken up by the Global Prepared Flour Mixes market. This is the point at which various measures on food safety, label requirements, and laws on the issue of imports and exports will have to be complied with in the diverse regions. It is here that manufacturers have to delve into these complexities to make sure their products meet the various regulatory expectations.

In addition, as consumer requirements for transparency are on the increase, companies are more likely to disclose detailed ingredients and sourcing for the sake of trust and credibility. Competition in the Global Prepared Flour Mixes market will be marked by large, established multinational companies and agile, innovative startups. One of the key factors will be differentiation strategies wherein product diversification, branding, and customer engagement remain crucial for gaining a larger market share. Strategic partnerships, mergers, and acquisitions will also be critical in consolidating positions and expanding geographical reach.

Consequentially, in years to come, the Global Prepared Flour Mixes market will continue to evolve on aspects of consumer preference, technology, and geographical dynamics. The market, due to such a path of adaptation to changes, provides a wide portfolio of products to its numerous customers for their very specific needs, ensuring that the market is in a continuous state of growth and relevance within the global food industry.

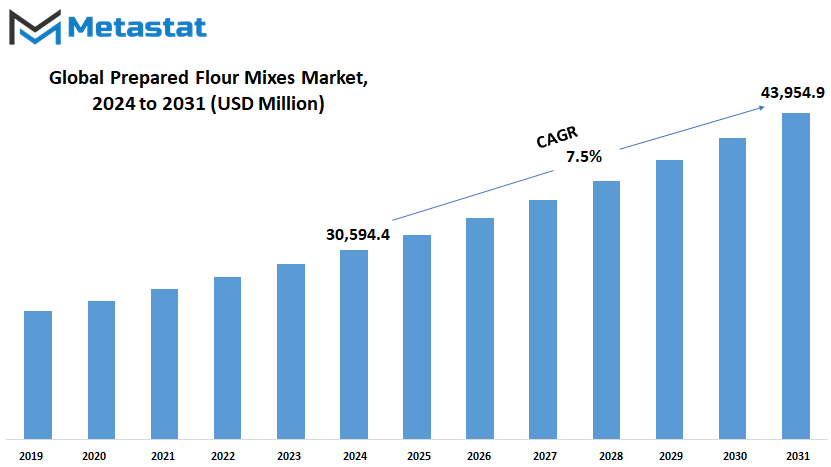

Global Prepared Flour Mixes market is estimated to reach $43,954.9 Million by 2031; growing at a CAGR of 7.5% from 2024 to 2031.

GROWTH FACTORS

The Global Prepared Flour Mixes market has grown massively in recent years owing to an extreme demand for baking solutions that can save both time and effort. Lifestyles turn busier, and more would go with quicker and easier options inside the kitchen. Thus, prepared flour mixes have become a good option for most people because of the simplicity of baking this product in which most ingredients are combined in a single ready-to-use product. These mixes eliminate the need to measure and mix individual components, allowing even novice bakers to achieve consistent results with minimal effort.

The market has been further influenced on the whole by this rise in home baking, particularly during the COVID-19 pandemic. Many people began to bake during increased time at home, either as a way to pass the time or to provide goods for their families. This was only the catalyst that brought on an even greater and unparalleled demand for mixes of prepared flours, as people were increasingly looking for shortcut ways of baking without actually having to start from scratch. Indeed, the convenience factor joins a desire for homemade treats in driving popularity.

This means that the Global Prepared Flour Mixes market has some limiting factors. One is the considerable competition that exists from homemade mixes and other baked goods. Most consumers still prefer homemade mixers, which could be due to many reasons relating to ingredients or flavor. There is also competition from ready-made baked goods that even offer no preparation required; just bake and consume. Yet another threat to the market could be increased health and nutrition awareness among the consumers. The health-conscious consumer may not prefer to use prepared flour mixes due to additives and preservatives present in the product. The fact that the product is perceived to be less healthy compared to homemade may serve to keep a section of consumers away from the product.

This shows that despite challenges, opportunities for growth are available in the Global Prepared Flour Mixes market. Healthier and organic prepared flour mix development can attract the growing segment of health-conscious consumers. The increasing number of people who are in search of products corresponding to their healthy lifestyle will likely widen the circle of consumers for companies offering mixes with natural ingredients and fewer additives. This trend towards healthier options might allow new directions of market growth in the upcoming years. The global prepared flour mixes market, therefore, stands to gain on the back of convenience and the rising home-baking trend. But it has to face stiff competition and health concerns. If such concerns and issues are sorted, then by targeting evolving preferences, the market can hope for further growth in the years to come.

MARKET SEGMENTATION

By Product

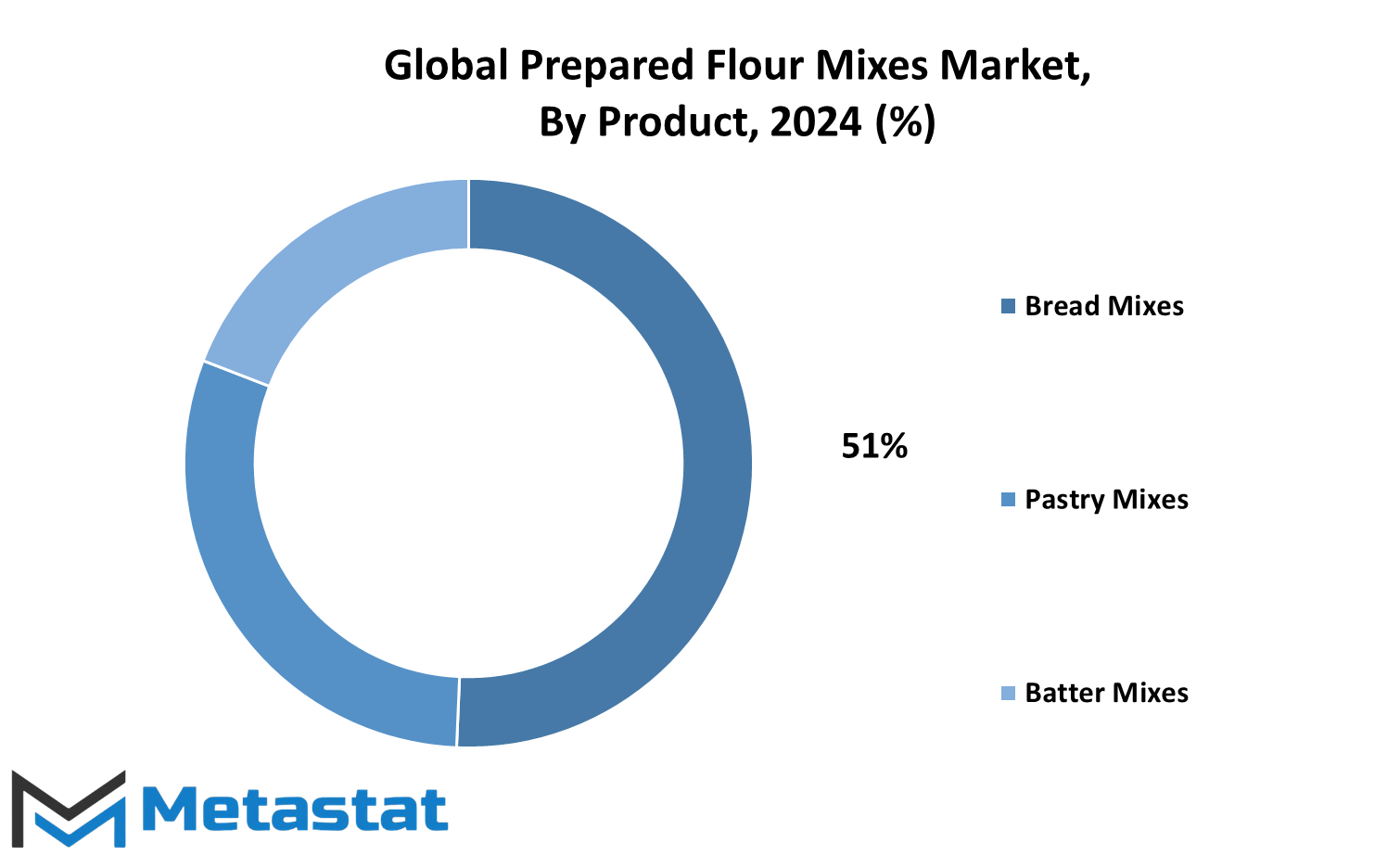

The change in needs and preferences of modern consumers across the world has fostered changing ways in the Global Prepared Flour Mixes market. Among home bakers and foodservice professionals, one of the most trending trends is prepared flour mixes, because it ensures convenience, uniformity, and timesaving. These products include various items that involve bread mix, pastry mix, and batter mix, which all exist to satisfy different cooking requirements. Since people will continue seeking the easiest ways to use without compromising on quality, the demand for these mixes is likely to see a rise.

Bread mix is a key segment within the prepared flour mixes market. As bread remains a staple food in many cultures, the demand for easy-to-prepare bread mixes is strong. These mixes are not restricted to white or whole wheat bread but extend to multigrain, gluten-free, and artisan varieties among other specialty breads. Increased health and wellness awareness is driving demand for healthier bread options, with mixes under development to capitalize on this market trend. The convenience of such mixes let the customers enjoy freshly baked bread at home with minimal effort, hence acting as a significant factor in the growth of this market.

Another major sector is the pastry mix, which is also in great demand and is growing. As more and more people become involved with baking at home for special occasions and holidays, there is tremendous demand for the availability of a pastry mix for making all types of baked products. These pastry mixes have simplified baking, and even people with very little experience in baking are able to bake. The varied nature of pastry mixers also enables consumers to try out different flavors and textures, thus coming out with numerous product types ranging from pies to croissants. This segment is thus envisaged to continue growing as more people explore the joys of home baking. Batter mixes, mainly for pancakes and waffles, among other breakfast foods, also gained in popularity. There is strong interest in quick and easy breakfast solutions, particularly for busy families and individuals. These batter mixes make for an easy way to get a hot, satisfying meal with no need to have numerous ingredients or complicated recipes. As the pace of life accelerates, so does the demand for these time-saving products.

By Application

The global Prepared Flour Mixes market is poised to accredit appreciable growth over the coming years. As the lifestyle of consumers is gradually changing, the demand for convenience has been at an all-time high, and prepared flour mixes find their place in households and industries. These mixes are a viable alternative to save time by individuals and enterprises with no sacrifice of quality in baked items.

Conveniently, mixes of prepared flour are available in household inventory for baking a variety of products with ease and convenience. Because today more people desire quick, easy meals, these mixes fulfill the need for quick, easy baking at home. The novice baker, by using mixes, can easily duplicate the same results every time so more will be able to enjoy freshly baked products at home. Also, with more and more people being conscious about health, the market is likely to see a spur in demand for mixes that address special dietary requirements, such as gluten-free or low-sugar options. Bakery shops, too, have benefitted from the Global Prepared Flour Mixes market. These outlets need quality inputs to come up with their products, and prepared flour mixes provide a reliable answer for the same.

By using these mixes, the baker can achieve the same effect on their products every time, creating the same taste and texture a consumer expects over and over again. Consistency like this is key to having repeat business and ensuring a competitive advantage. Furthermore, with the evolution of customer preference for more artisanal and premium baked goods, demand for high-end, customized flour mixes will likely increase to meet such demand. Another important sector that has adopted the Global Prepared Flour Mixes market is the food processing industry. In the production lines of food processing, the presence of prepared flour mixes helps producers produce large-scale output of baked products. This efficiency factor makes the application of prepared flour mixes essential, particularly with the increasing demand for processed foods on a global scale. Prepared flour mixes also give flexibility to the food processor to make everything from bread to cakes, and from snacks to desserts, that can meet various tastes of consumers.

The Global Prepared Flour Mixes market is poised for continued growth into the future, with the industry adapting to increasingly demanding consumers and changing technologies. New formulations, innovative ingredients additions will keep the market productive and in turn offer even further opportunities for household, bakery shop, and food processing use. This is a continually growing and developing market that is going to play a big role in the future of the global food landscape: convenience and quality solutions for many applications.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$30,594.4 million |

|

Market Size by 2031 |

$43,954.9 Million |

|

Growth Rate from 2024 to 2031 |

7.5% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The regional landscape of the Global Prepared Flour Mixes market is heterogeneous and spreading, with each region presenting various sets of opportunities and challenges. It includes North America: The United States, Canada, Mexico, etc. In North America, one of the most important markets, prepared flour mixes are mainly required due to the fast pace of their lives, which dictates a trend toward convenient foods. The healthier trend to eat is also trending in product innovation, where the companies are focusing on gluten-free, organic, and high protein options. Established food industry infrastructure in the region supports the steady growth of the market in North America, along with increasingly diverse consumer preferences.

Another huge market is that of Europe: the UK, Germany, France, Italy, and many others. Key drivers are the region's rich tradition of food along with the growing interest of people in baking at home. European consumers increasingly seek prepared flour mixes that adhere to health-conscious choices, such as whole grain and additive-free products. The regulatory environment of the region plays another important part in the market of Europe, as it requires high standards on food safety and quality. This emphasis on quality is pushing companies to develop more refined and healthier product options to cater to discerning consumers.

The Asia-Pacific region is expected to exhibit the highest growth in this sector, inclusive of India, China, Japan, South Korea, and others. The growing middle class is leading to changed eating habits more and more, with increasing urbanization and higher disposable incomes. The consumer today favors convenient, effortless-to-make food products because of their rising inclination towards convenience. Prepared flour mixes have thus become popular. The Western diet is highly influential, especially in the case of the urban population and its effects are causing a rise in demand for more varieties of flour mixes. However, regional tastes and preferences are still important in that companies develop products that can meet the taste and dietary requirements of the local populations. South America, including Brazil, Argentina, among others, is recording incremental but definite growth in the Prepared Flour Mixes category. Economic dynamics in the region, influenced by traditional cuisines, determine demand. Exposure to international food trends is increasing, and with it, a curiosity towards various baking mixes, encouraging further expansion in the market.

The Middle East & Africa, with GCC Countries, Egypt, South Africa, and others, is a developing market where economic growth is presumed to be one of the drivers, along with changing consumer lifestyles. The inclination of people toward Western-style diets increases in this region, which furthers interest in prepared flour mixes. In conclusion, it can be said that each region, in its capacity, contributes to the total global growth of the Prepared Flour Mixes market. It is driven by localized consumer preference, economic conditions, and evolving food trends. Companies will likely focus more on regional customization and product innovation amidst persistently growing demand for Prepared Flour Mixes in this market.

COMPETITIVE PLAYERS

The Global Prepared Flour Mixes market is dynamic, with leading players employing innovative strategies coupled with various manufacturing techniques to set the pace for the industry. Main players in the sector include ADM, AB Mauri, and Allied Pinnacle Pty. Ltd., which are central to the growth and development of the market. Companies are engaged in meeting the prevailing demand for prepared flour mixes, together with future trends and requirements.

The obvious change in consumers' demands about eating-for instance, demands for healthier and more 'convenient' foods-mean that the food industry is always outlining a different trend in their lines of product. For example, there is an emerging trend of mixes intended for special diets such as gluten-free and low-sugar diets. This is influenced by the growing awareness on the part of consumers about the health and wellness implications of their eating.

Technological advancement also encourages creativity in the marketplace. Companies like AngelYeast and Bakels Group are thus using technologically advanced methods to enhance the quality of their products and increase the shelf life of these products. This helps achieve better consumer satisfaction and gives them a relative advantage over other companies in the market. Sustainability is another important area of concentration for such companies. While global concern is on the rise regarding environmental impact, so are the adoptions of eco-friendly best practices at the business levels in various stages of production.

The competitive scenario of Prepared Flour Mixes marketplace is strategic collaborative agreements and partnerships. Companies such as Griffith and Interflour Group Pte. Ltd. are collaborating with local players/suppliers and distributors to extend their business in emerging economies. This not only supports cost reduction but also guarantees continuous supply of raw materials that becomes extremely important to maintain the quality of the products.

Companies like Nisshin Seifun Group Inc. and PURATOS have entered new markets both in Asia and Africa, which, in a geographical expansion context, bear growth potential in view of rapid urbanization and changes in food consumption styles. It is vital that the emergence of such companies with a strong position in the marketplace will provide them with wider perspectives in the long term.

The prospects for the Global Prepared Flour Mixes market look pretty bright, with leading companies such as Showa Sangyo, Yihai Kerry, and Rich Products Corp. keeping innovating and finding ways around changing market conditions. Competition among these players will grow further and help the segment grow more both in product offerings and its methods of production. This would be such a developing trend in the market that it would continuously favor the consumer in the assembly of various high-value products, healthy and convenient.

Prepared Flour Mixes Market Key Segments:

By Product

- Bread Mix

- Pastry Mix

- Batter Mix

By Application

- Household

- Bakery Shop

- Food Processing Industry

- Other Application

Key Global Prepared Flour Mixes Industry Players

- ADM

- AB Mauri

- Allied Pinnacle Pty. Ltd.

- AngelYeast

- Bakels Group

- Griffith

- Interflour Group Pte. Ltd.

- IREKS

- Kerry

- Lesaffre

- Nisshin Seifun Group Inc.

- Nitto-fuji International Vietnam Co., Ltd.

- Prima Flour

- PURATOS

- Rich Products Corp.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252