Global Positron Emission Tomography Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

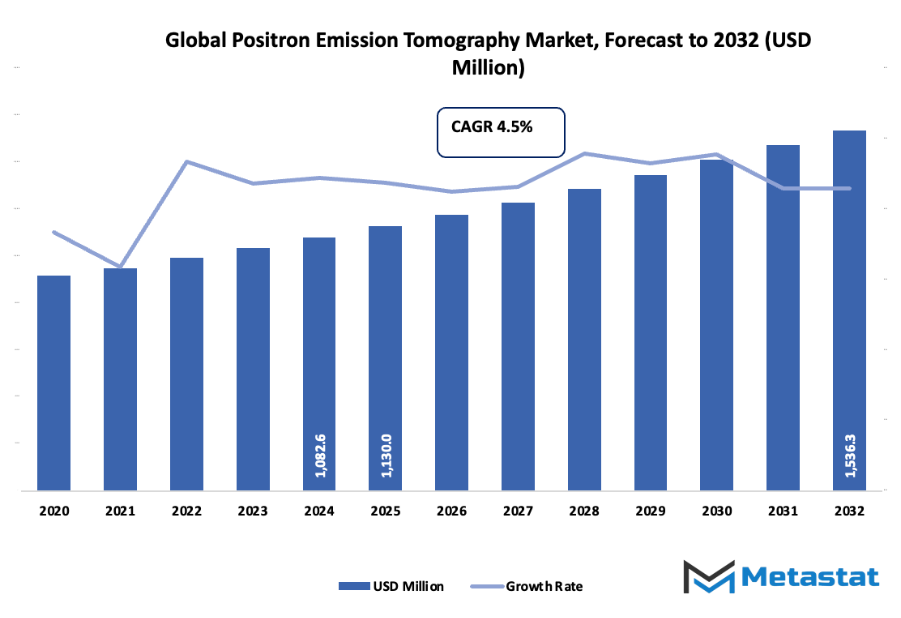

- The global positron emission tomography market valued at approximately USD 1130 million in 2025, growing at a CAGR of around 4.5% through 2032, with potential to exceed USD 1536.3 million.

- Full-Ring PET Scanners account for a market share of 77.5% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising prevalence of chronic diseases driving demand for early diagnosis., Increasing integration of PET with CT and MRI for hybrid imaging solutions.

- Opportunities include: Growing development of AI-enabled PET imaging and next-generation tracers.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

The global positron emission tomography market and its industry will move beyond its current scope as technology, patient expectations, and clinical needs continue to shift. While medical settings are gradually shifting toward tools offering deeper clarity rather than simple detection, this market will extend its influence by turning attention to where diseases will be understood long before symptoms take hold. Future systems will not remain confined to scanning functions but will gradually turn into platforms guiding decisions, shaping treatment pathways, and supporting personalized care in ways that today's user will only begin to imagine.

Manufacturers can be running in the direction of gadget that feels lighter, faster, and more adaptable than whatever used today. Hospitals and diagnostic centres will search for gadgets to match easily into their workflows, which in flip will pressure businesses to design scanners that call for less space, less manual manipulate, and less repeated classes. These changes will quietly reshape how people interact with the imaging tools and make advanced diagnostics among the more approachable steps in a patient's journey.

Market Segmentation Analysis

The global positron emission tomography market is mainly classified based on Product Type, Modality, Radiotracer / Isotope, Application.

By Product Type is further segmented into:

- Full-Ring PET Scanners

The developing utilization of full-ring PET scanners within the global positron emission tomography market is predicted to assist improved photograph clarity and reduced scanning time. Ongoing advancements in detector precision will retain to encourage wider adoption, promoting higher tracking of sicknesses and in advance identification with green system performance and stronger clinical self belief in future settings.

- Partial-Ring PET Scanners

Partial-ring PET scanners in the global positron emission tomography market will gain attention for flexible installation needs, lower system cost, and easier workflow adaptation. Advancements in compact designs support wider accessibility, thus enabling health facilities to increase diagnostic capabilities without intensive infrastructure burdens while still upholding strong performance levels.

By Modality the market is divided into:

- Stand-Alone PET

Stand-alone PET systems in the global positron emission tomography market will continue serving facilities focused on metabolic imaging, offering steady functionality. Future upgrades in processing speed and sensitivity of the detector will raise the value of these units, enabling hospitals to strengthen diagnostic capability without complex hybrid platforms.

- PET/CT

PET/CT will continue to dominate in the global positron emission tomography market owing to strong acceptance in cancer care centers. Ongoing work on higher-resolution CT and faster reconstruction methods to support more accurate treatment planning will give medical teams better clarity into the monitoring of variations in diseases over time.

- PET/MRI

Coupling with MRI, PET/MRI will further extend globally in the field of positron emission tomography by offering comprehensive metabolic and soft tissue imaging. Advancement in the future will decrease scan time, further facilitate broad-based clinical applications, and extend to research settings where advanced mapping of complex disease pathways will better inform targeted care strategies.

By Radiotracer / Isotope the market is further divided into:

- F-Fluorodeoxyglucose (F-FDG)

F-FDG will continue to be the most used tracer within the global positron emission tomography market, as it sustains regular cancer studies. Ongoing efforts toward improving manufacturing efficiency, coupled with diversified supply chains, will enable healthcare institutions to address increasing diagnostic needs and thus optimize patient scheduling and regional access in a more predictable manner.

- Ga-Based Tracers (DOTATATE, PSMA)

Ga-based tracers will see strong growth in the global positron emission tomography market as targeted imaging gains wider acceptance in tumor assessment. Further refinement of generator systems and labeling methods will support reliable access, enabling specialists to detect specific disease markers that guide personalized treatment pathways.

- Rb & N-Ammonia (Cardiac)

Cardiac tracers of Rb and N-ammonia will support the growing interest in functional heart evaluations in the global positron emission tomography market. Better production methods and a rise in demand for accurate perfusion assessment encourage larger installations; thus, enabling hospitals to build stronger cardiac diagnostic programs with dependable scanning results.

- Cu & Zirconium - Immuno-PET

Cu and zirconium tracers will define the next phase of targeted imaging in the global positron emission tomography market. These tracers will, in turn, enable mapping immune activity with heightened clarity, aiding research and clinical monitoring as newer biological therapies advance, strengthening precision-guided diagnostic solutions.

By Application the global positron emission tomography market is divided as:

- Oncology

Oncology will continue to guide most usage within the global positron emission tomography market, with a shift toward earlier detection and closer treatment tracking in cancer management. Improved sensitivity of scanners and diversity of tracers will facilitate more confident evaluation to aid healthcare centers in designing better treatment pathways for rapidly changing disease patterns.

- Cardiology

Cardiology use within the global positron emission tomography market will grow because metabolic heart imaging will be increasingly important in the understanding of complex cardiac conditions. Improved resolution and faster workflow designs would help clinicians assess perfusion, thus supporting decisions that require accurate insight into subtle changes in heart function.

- Neurology

Within the global PET market, neurology applications are going to grow with increasing interest in mapping brain disorders. Better tracers and improved systems will further facilitate the process of early detection of neurological decline, thus helping in providing valuable guidance towards long-term care planning, research studies, and clinical monitoring as the understanding of the diseases continues to evolve.

- Inflammation & Others

Inflammation and other indications within the global positron emission tomography market will increase due to the fact that new tracers emerging will allow for better tracking of immune responses across a wide array of medical conditions. Greater research activity will continue to point out new ways in diagnosis, enabling the healthcare teams to observe the changes that come about in diseases, which require detailed functional information.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1130 Million |

|

Market Size by 2032 |

$1536.3 Million |

|

Growth Rate from 2025 to 2032 |

4.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

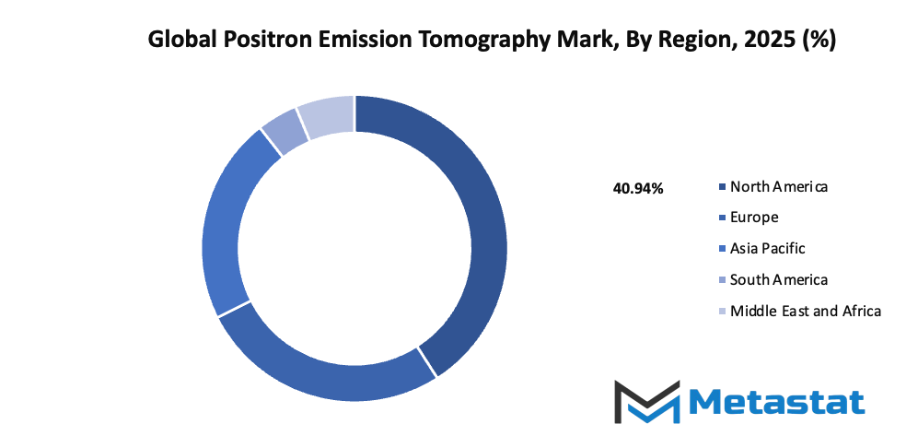

By Region:

- Based on geography, the global positron emission tomography market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Market Dynamics

Growth Drivers:

- The increasing incidence of continual sicknesses is fostering call for for early prognosis.

The developing reputation of lengthy-time period ailments will hold to push healthcare structures to reinforce their diagnostic pathways, and the global positron emission tomography market will progress as scientific groups turn to in advance detection strategies. This change will encourage wider use of PET scans, enabling hospitals to pick out diffused changes inside the body with stepped forward precision and guide well timed treatment selections.

- Increasing integration of PET with CT and MRI for hybrid imaging solutions.

The future of diagnostic care will take shape with better coordination among imaging technologies, and with the recognition of hybrid structures, the increase of the global positron emission tomography market will surge in advance. By merging PET with CT or MRI, clinicians are able to seize metabolic and structural info in only one session, hence making affected person assessment clearer and enhancing clinical efficiency across diverse scientific settings.

Restraints & Challenges:

- High cost of PET scanners and limited isotope availability.

High investment requirements will remain a factor in limiting adoption, and the global positron emission tomography market is expected to exert pressure since many hospitals in various regions consider financial constraints. Short supplies of crucial isotopes will further complicate things, as health centers will have to plan their imaging programs with caution and seek collaborations with production facilities as a way of ensuring service availability.

- Stringent regulatory requirements for radiopharmaceuticals.

Manufacturing cycles will be shaped by demands for strict quality checks, and the global positron emission tomography market will find manufacturers following detailed approval pathways. This units rules that gradual down the creation of new tracers, however it helps preserve patient safety, urging businesses to invest in compliant manufacturing setups and improved monitoring structures.

Opportunities:

- Growth in improvement of AI-enabled PET imaging and subsequent-era tracers.

Future tendencies might be impacted through technological advancement, and the global positron emission tomography market will pass closer to structures supported via records-driven gear. Image interpretation could be quicker with the assist of AI-guided analysis, whilst emerging tracers will screen biological activity more sincerely, opening new pathways closer to targeted prognosis and personalized therapy planning.

Competitive Landscape & Strategic Insights

The global positron emission tomography market will continue to be within the spotlight as enterprise leaders and new entrants pass towards superior imaging answers. The dynamics inside the marketplace will reveal how well-hooked up businesses uphold high standards, at the same time as smaller factions deliver up new thoughts to similarly solidify consistent development. Each one of the players will aim at firming stability, and this combination of strengths will lead the way in how the market shall proceed. Interest in correct imaging has been on the rise due to improvement in technology and advanced tools being assimilated into healthcare, thus ensuring a conducive environment for sustained innovation.

The global positron emission tomography market will also gain momentum as different companies focus on refining existing tools while introducing fresh methods that help specialists detect conditions earlier and manage treatments with more confidence. Collaboration of research groups, industry manufacturers, and medical facilities will help widen the use of PET systems for better access to modern scanning technology. Steady improvement in image clarity, energy efficiency, and patient comfort will shape future demand and help expand the reach of advanced imaging setups.

The global positron emission tomography market will see further movement as large manufacturers and regional developers work toward meeting rising expectations from hospitals and diagnostic centers. Some of the companies involved in this industry include GE HealthCare, Siemens Healthineers AG, Koninklijke Philips NV, Canon Medical Systems Corp, United Imaging Healthcare Co Ltd, Mediso Ltd, CMR Naviscan Corporation, Bruker Corporation, Positron Corporation, Spectrum Dynamics Medical Ltd, Agfa HealthCare NV, Segami Corporation, SOFIE Biosciences, Inc, Eckert & Ziegler Strlzg AG, Neusoft Medical Systems Co Ltd, Hitachi Ltd, and Hyperfine, Inc., which will continue to influence the pace in this industry with their product upgrades and technology expansion. Their combined presence will introduce more variety, foster a healthy competitive atmosphere, and ensure balanced progress in these global markets.

The global positron emission tomography market will move into a phase where wider acceptance of advanced imaging tools assists in enhancing diagnosis quality. As more healthcare vendors understand the advantages accruing from early and accurate evaluation, call for for PET structures is persevering with to upward push. Growing collaboration among providers, software developers, and studies companies will help smoother integration of scanning systems. This regular shift will assist strengthen global get entry to to green imaging answers, thus allowing the market to progress at a stable and meaningful tempo.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 1130 million in 2025 to over USD 1536.3 million by 2032. Positron Emission Tomography will maintain dominance but face growing competition from emerging formats.

Software will also, at some time, play an equally important role in enabling clinicians to analyze data with refined precision. Improved image quality and smoother processing mean that health teams will increasingly depend on insights that will bring into view early signals, which are often missed. In this direction, research also stands to benefit by enabling scientists to study more clearly how diseases develop at their earliest stage. Beyond clinical use, the global positron emission tomography market will also open new discussions on accessibility, training, and affordability. As this technology spreads in its adoption, the industry will be encouraged to build systems that are easier to maintain and operate to ensure that advanced imaging does not remain confined to major centres only. This will redefine how disease understanding, patient care, and medical progress will unfold in the years to come.

Report Coverage

This research report categorizes the Positron Emission Tomography market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Positron Emission Tomography market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Positron Emission Tomography market.

Positron Emission Tomography Market Key Segments:

By Product Type

- Full-Ring PET Scanners

- Partial-Ring PET Scanners

By Modality

- Stand-Alone PET

- PET/CT

- PET/MRI

By Radiotracer / Isotope

- F-Fluorodeoxyglucose (F-FDG)

- Ga-Based Tracers (DOTATATE, PSMA)

- Rb & N-Ammonia (Cardiac)

- Cu & Zirconium- Immuno-PET

By Application

- Oncology

- Cardiology

- Neurology

- Inflammation & Others

Key Global Positron Emission Tomography Industry Players

- GE HealthCare

- Siemens Healthineers AG

- Koninklijke Philips NV

- Canon Medical Systems Corp

- United Imaging Healthcare Co Ltd

- Mediso Ltd

- CMR Naviscan Corporation

- Bruker Corporation

- Positron Corporation

- Spectrum Dynamics Medical Ltd

- Agfa HealthCare NV

- Segami Corporation

- SOFIE Biosciences, Inc

- Eckert & Ziegler Strlzg AG

- Neusoft Medical Systems Co Ltd

- Hitachi Ltd

- Hyperfine, Inc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383