Global Pharmaceutical Desiccants Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global pharmaceutical desiccants market will transcend its traditional borders as innovation, sustainability, and precision manufacturing continue to redefine the industry. This market, closely linked to the pharmaceutical industry's drive for maintaining product integrity, will start to see an increased role that extends beyond the role of mere moisture absorption. As technology and materials science continue to evolve, desiccants will not be considered passive protectants but as intelligent solutions that can react to environmental stimuli and provide extended shelf lives to sensitive drug products.

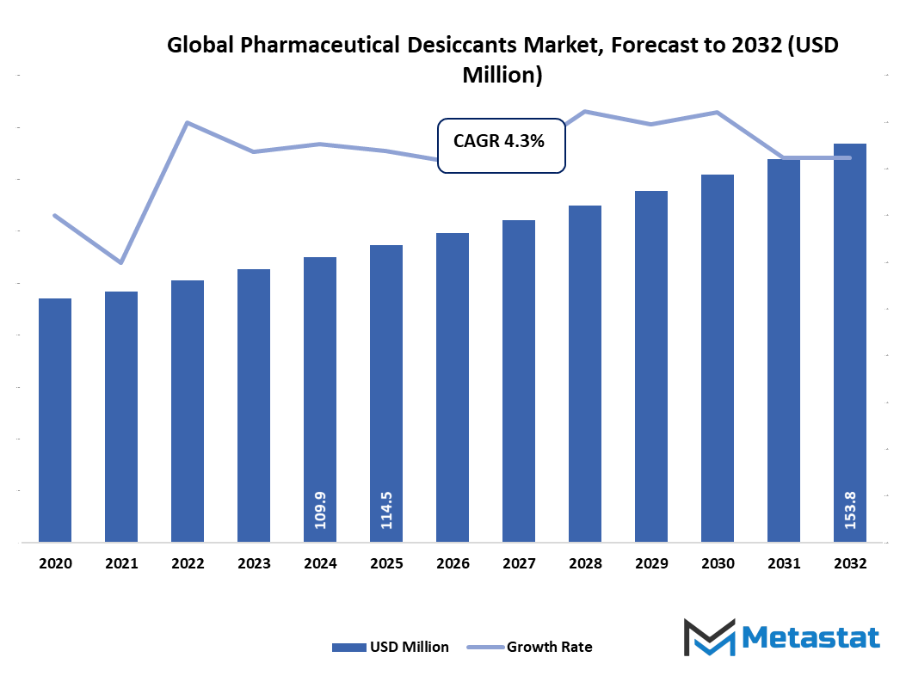

- Global pharmaceutical desiccants market valued at approximately USD 114.5 million in 2025, growing at a CAGR of around 4.3% through 2032, with potential to exceed USD 153.8 million.

- Silica Gel account for nearly 39.7% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising demand for moisture-sensitive oral solid and biologic drugs., Growth in pharmaceutical packaging innovations and compliance needs.

- Opportunities include Development of eco-friendly and smart desiccant packaging solutions for sustainable pharma applications.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

What impact will the increasing use of environmentally friendly packaging have on the need for desiccants in the pharmaceutical sector? Is it possible that improvements in moisture control technology could make conventional desiccant methods obsolete and change the way product safety is ensured in the pharmaceutical industry? Furthermore, as international regulatory systems become more stringent, will producers have the capacity to mix compliance with innovation so as to retain their position in the market?

Pharmaceutical companies will, in the future, collaborate with material engineers to develop dynamic desiccants that will interface with packaging systems in a more intelligent manner. These next-generation materials will not only provide protection for product stability but also facilitate green packaging efforts to enable the industry to ensure both quality and environmental stewardship. In addition to protection, desiccants will be engineered to report and signal humidity levels, providing pharmaceutical companies with real-time information on storage conditions—a leap that will greatly improve supply chain visibility.

Market Segmentation Analysis

The global pharmaceutical desiccants market is mainly classified based on Type, End-use.

By Type is further segmented into:

- Silica Gel

Silica Gel will remain a dominant player in the global pharmaceutical desiccants market with its superior moisture adsorption capacity. Its applications will grow with the growth of medicine packaging humidity control demand. As formulations for drugs become more sensitive, Silica Gel's role will be crucial in sustaining product stability.

- Activated

Activated desiccants will become increasingly significant in the global pharmaceutical desiccants market because industries will be shifting towards better shelf-life protection for medicinal products. The high adsorption rate and fine pore structure will make this material increasingly popular for drugs that are temperature-sensitive and high potency, promoting long-term product integrity.

- Carbonclay Desiccant

Carbonclay Desiccant will witness increased usage in the global pharmaceutical desiccants market because of its eco-friendly and sustainable characteristics. As the industry slowly moves toward biodegradable materials and reusable products, Carbonclay will catch the eye for balancing moisture while being in compliance with environmental packaging norms.

- Molecular Sieves

Molecular Sieves will be indispensable in the global pharmaceutical desiccants market due to the fact that they selectively adsorb water molecules. Their use will increase in regulated drug packaging and sophisticated pharmaceutical storage systems where exact moisture control will be required for product effectiveness.

By End-use the market is divided into:

- Tablets

The global Pharmaceutical Desiccants market will experience increasing usage of desiccants in tablet packaging to protect products from humidity and degradation. As demand for solid-dose drugs rises, desiccant integration in blister packs and bottles will ensure longer shelf life and quality preservation during storage and transport.

- API’s

The global global pharmaceutical desiccants market will significantly grow in the API packaging segment. Desiccant consumption is going be a necessity for the maintenance of chemical stability and for the prevention of contamination in the formulation, especially as complex molecules and biologics have to be controlled in the environment for the therapeutic effects to be consistent.

- Capsules

Capsules will be one of the main consumers in the global pharmaceutical desiccants market. The hygroscopic nature of gelatin-based and plant-based capsules will definitely require desiccant systems to be dry in order to provide the correct dosage and to prevent clumping or softening during storage for a long period of time.

- Nutraceutical Product Packaging

The packaging of Nutraceutical Products is going to be a major factor in the global pharmaceutical desiccants market as a result of the consumer knowledge of the quality of the supplements that is increasing. The heavy focus on vitamins that are sensitive to moisture and on herbal remedies will be the reason for the safe, and non-toxic desiccant use that is going to be the most suitable to freshness and to the extension of shelf stability.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$114.5 Million |

|

Market Size by 2032 |

$153.8 Million |

|

Growth Rate from 2025 to 2032 |

4.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

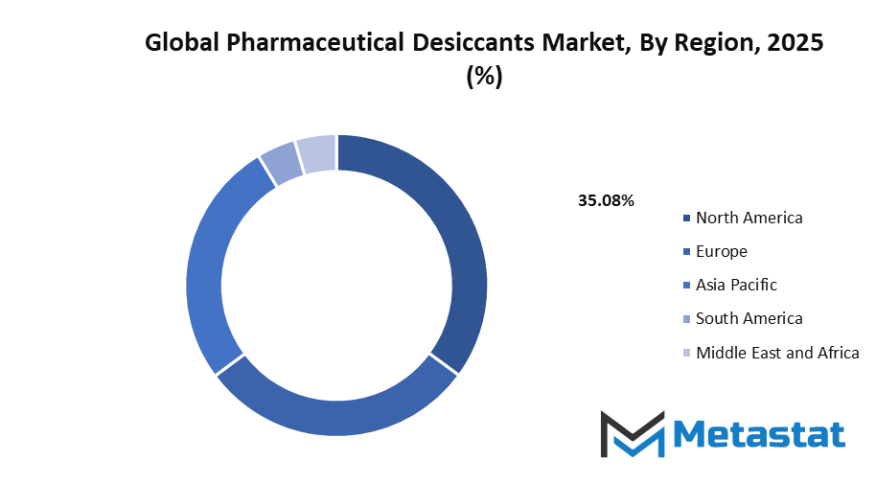

Geographic Dynamics

Based on geography, the global pharmaceutical desiccants market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Competitive Landscape & Strategic Insights

The global pharmaceutical desiccants market comprises long-established major players complemented by numerous regional companies which are progressively gaining market share and bringing innovation and competition to the industry. In line with the increasing demand for moisture control in the pharmaceutical sector, these companies are coming up with improved and more efficient solutions that, at the same time, guarantee drug stability and shelf life. Desiccants are used in a wide range of pharmaceutical products, from tablets and capsules to diagnostic test kits, in order to protect the products from moisture and thus ensure their quality and efficacy. The trend towards product integrity and patient safety has contributed to the rise of desiccants as the indispensable elements in modern pharmaceutical packaging.

Some of the leading players in this market are E. I. Du Pont De Nemours and Company, Filtration Group Corporation, Sanner GmbH, Clariant Global, CSP Technologies Inc., Capitol Scientific Inc., Desiccare Inc., W. R. Grace & Company, Desican Inc., Oker Chemie GmbH, Airnov Healthcare Packaging, Sorbent Systems, Flow Dry Technology Inc., and Wisesorbent Technology. To a large extent these players have solidified their positions through the ongoing quality improvement of products, deepening distribution networks, and heavy investments in R&D. They are also among the leading ones to have adopted green manufacturing processes and improved materials that are both eco-friendly and safer to end-users.

Market competition has become a lively battlefield with local producers coming up with cheaper and region-specific solutions. New entrants are generally more nimble and quicker to react to market changes, especially in developing economies where the pharmaceutical sector is booming at a very fast rate. They are facilitating the affordability of desiccant technologies as global leaders continue to set the bar for high-quality and innovative products. The industry will benefit from the international and local players' concerted efforts to raise efficiency levels and widen the range of products in the near future.

One of the industry's main gears to keep turning is technological progress. Companies are abandoning traditional silica gel or clay-based desiccants in favor of building advanced materials that can even detect certain moisture levels and offer extra protection to sensitive pharmaceutical products. On the other hand, digital technologies are opening ways for producers to oversee not only the performance of their products but also supply chains in a much more efficient manner. These technologies will make the use of desiccants more precise and reliable in various pharma sectors.

In the future, the global pharmaceutical desiccants market will keep changing as medical requirements grow and regulations on drug quality tighten. The partnership between traditionals and newcomers will be a key driver of innovation and affordability. As more firms put investments in research and sustainability, the market will not only provide the means to protect pharmaceutical products but also enhance a safer and more efficient healthcare system globally.

Market Risks & Opportunities

Restraints & Challenges:

Specialized desiccant materials and integration systems being too expensive: The influence of the advanced materials and integrated systems, which are of a premium nature, will be felt for a long time in the global pharmaceutical desiccants market expansion. Processes requiring precision-based manufacturing, the observance of very strict regulations, and the use of innovative technologies will all lead to higher prices, thus preventing smaller companies from going for these solutions. Therefore, there will be a difference between big pharmaceutical companies that have access to premium desiccant technology and small firms that are unable to support it and thus will facilitate limited accessibility and scalability in the market for the next few years.

Limited usage due to price sensitivity of low-cost generic drug packaging: The generic drug companies, which are the main actors in the global pharmaceutical desiccants market, will be the source of resistance against the implementation of desiccants under strict pricing constraints. Since producing cost-effectiveness will remain the most important issue among these manufacturers, high-end desiccants will hardly be used in order to keep costs at the existing level. This conflict of quality control and cost containment will delay market growth in areas where consumers are very price-conscious, such as those predominantly with generic drugs making up the pharmaceutical output.

Opportunities:

Development of sustainable and environmentally friendly smart desiccant packaging for pharma applications: Sustainability trends will lead the global pharmaceutical desiccants market to adopt environmentally friendly and smart packaging solutions. Companies will be willing to introduce biodegradable products and digital monitoring devices that are friendly to the environment while still providing moisture control. As sustainability becomes the most important issue in the pharmaceutical industry, eco-friendly and data-driven desiccant solutions will open new possibilities for global adoption in a way that is compatible with product safety and environmental stewardship.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 114.5 million in 2025 to over USD 153.8 million by 2032. Pharmaceutical Desiccants will maintain dominance but face growing competition from emerging formats.

The global pharmaceutical desiccants market will also benefit from opportunities in personalized medicine and biologics, where control of moisture will become ever more essential to product safety and efficacy. With standards for compliance increasingly stringent around the globe, companies will invest in high-performance desiccant products that comply globally while aligning with green chemistry. In the coming years, this market will expand its reach into digital integration, with intelligent packaging and sensor-activated desiccants leading the way in drug conservation and data precision. Beyond its classic role as protection, the market will become a prime driver of innovation, sustainability, and pharmaceutical dependability globally.

Report Coverage

This research report categorizes the global pharmaceutical desiccants market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global pharmaceutical desiccants market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global pharmaceutical desiccants market.

Pharmaceutical Desiccants Market Key Segments:

By Type

- Silica Gel

- Activated

- Carbonclay Desiccant

- Molecular Sieves

By End-use

- Tablets

- API’s

- Capsules

- Nutraceutical Product Packaging

Key Global Pharmaceutical Desiccants Industry Players

- E. I. Du Pont De Nemours and Company

- Filtration Group Corporation

- Sanner GmbH

- Clariant Global

- CSP Technologies Inc.

- Capitol Scientific Inc

- Desiccare Inc

- W. R. Grace & Company

- Desican Inc

- Oker Chemie GmbH

- Airnov Healthcare Packaging

- Sorbent Systems

- Flow Dry Technology, Inc.

- Wisesorbent Technology

- Desican Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252